HD: How Trump’s pro-crypto stance is likely to be fueling Bitcoin’s surge

HD: Bitcoin breaks $67,000 barrier as market sentiment shifts

- BTC has climbed to the $67,000 worth place.

- Lengthy positions are actually dominating the market with present worth strikes.

In latest weeks, Bitcoin [BTC], alongside the broader cryptocurrency market, has seen a notable enchancment in repute and sentiment.

This constructive shift was mirrored in a number of key indicators, significantly within the dynamics of BTC’s lengthy and quick positions and up to date worth tendencies.

Bitcoin strikes into the $67,000 zone

AMBCrypto’s evaluation of Bitcoin’s each day time-frame chart confirmed a constructive momentum over the past 24 hours.

BTC closed the buying and selling session on the twenty fifth of July with a modest enhance of lower than 1%, bringing its worth to round $65,795.

Since then, the value has continued its upward trajectory, rising to over $67,000 after an approximate 2% enhance.

The $63,000 worth stage has been established as a confirmed assist space, bolstered by its quick transferring common (yellow line).

This assist stage indicated a robust purchaser presence at and above this worth level, stopping additional declines and sustaining upward strain.

Supply: TradingView

The Relative Energy Index (RSI) prompt that Bitcoin was in a bullish pattern at press time.

An RSI worth of round 60 indicated that the market was neither overbought nor oversold, supporting a secure continuation of the present uptrend.

Lengthy positions dominate Bitcoin’s market

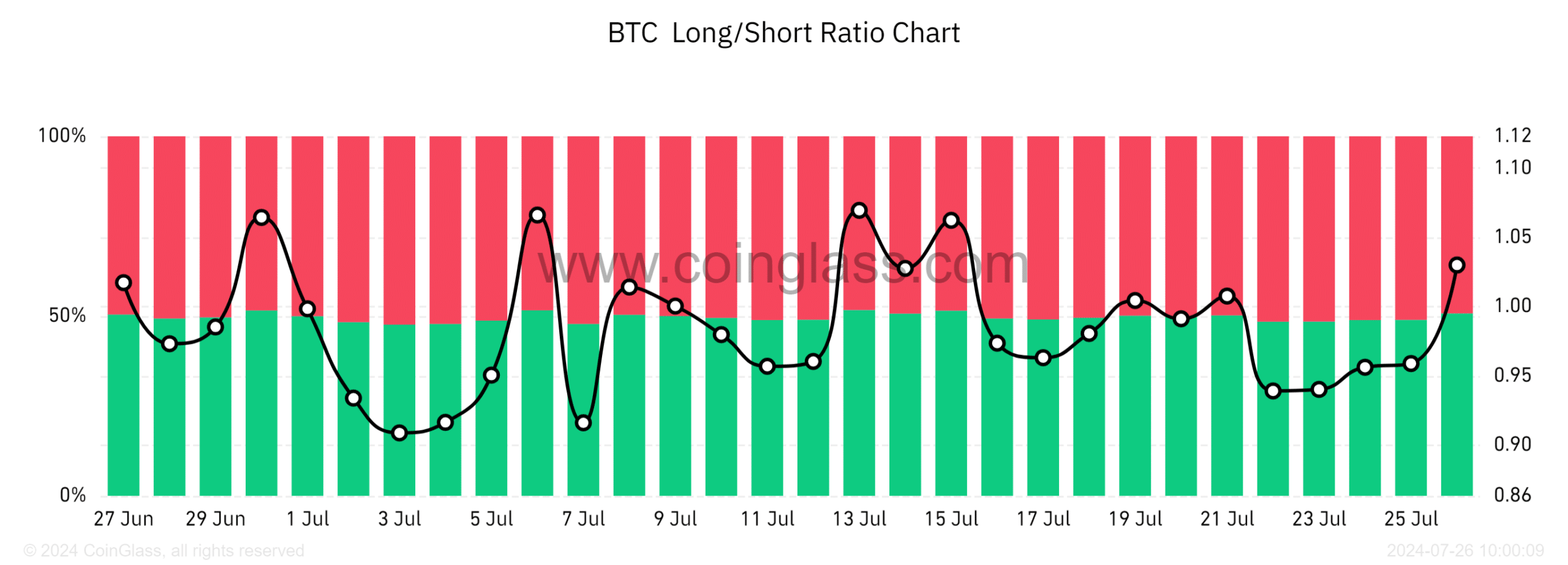

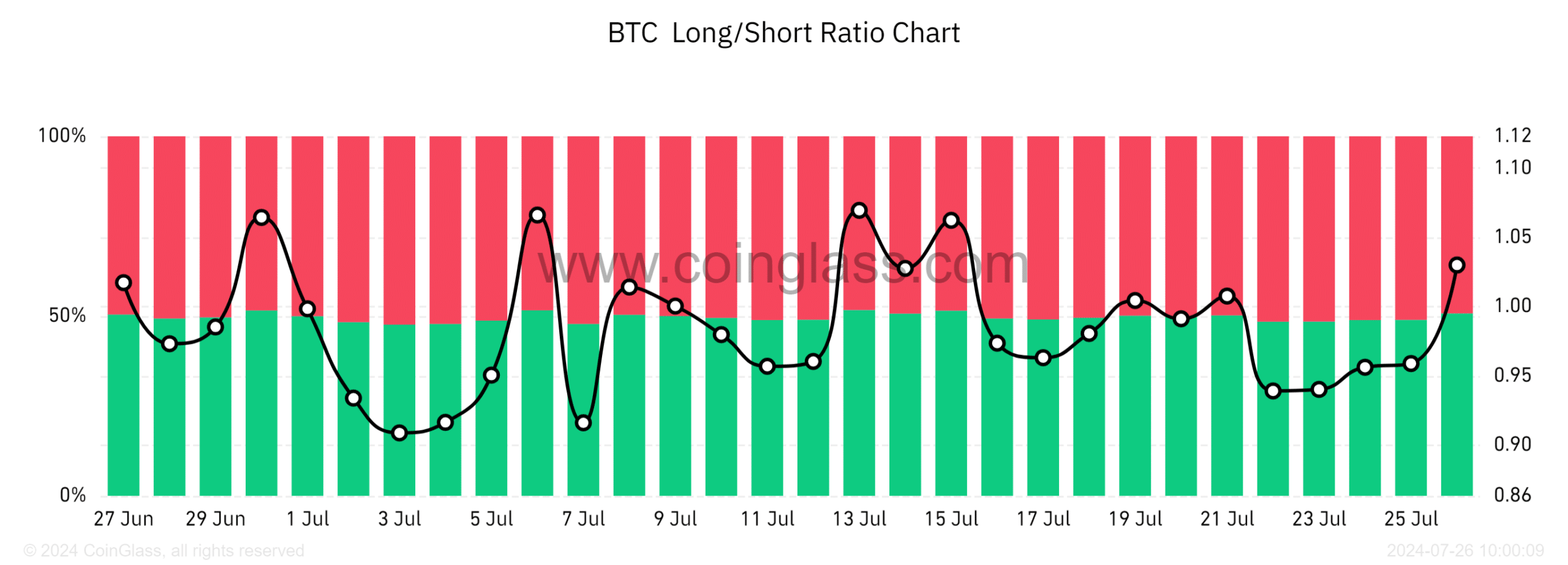

The latest Bitcoin worth pattern has provoked combined reactions amongst merchants, mirrored within the dynamics of lengthy and quick positions.

Regardless of the latest uptick in Bitcoin’s worth, the Long/Short Ratio Chart confirmed a notable quantity in brief positions. This meant that many merchants have been betting on a possible decline in Bitcoin’s worth.

Nevertheless, at press time, there was a shift, with lengthy positions barely outweighing shorts at 50.7%, in comparison with 49.2% for shorts.

This slight dominance of lengthy positions indicated that extra merchants have been optimistic about BTC’s future worth enhance. Nevertheless, the margin was slender, highlighting a considerably divided sentiment inside the market.

Supply: Coinglass

The Funding Price on the time of writing, located above zero, additional supported this optimistic outlook.

A constructive Funding Price sometimes signifies that lengthy place holders are paying shorts, which frequently happens in markets the place the overall expectation is for costs to rise.

The Trump impact?

Weeks in the past, there was a reported assassination try on Donald Trump, a candidate in america presidential race. Following this occasion, the value of Bitcoin skilled a surge.

This constructive worth motion might be partly attributed to perceptions of Trump as a pro-cryptocurrency determine.

His elevated visibility and perceived endorsement of the crypto sector following the assassination try seemingly bolstered investor confidence.

As Trump is scheduled to talk at a cryptocurrency conference on the twenty seventh of July, BTC has continued to exhibit constructive worth tendencies.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

The anticipation surrounding his look on the occasion could also be contributing to bullish sentiment within the cryptocurrency markets.

Individuals are speculating on potential constructive endorsements or supportive statements that might additional legitimize or promote the adoption of digital currencies.