Bjoern Wylezich/iStock Editorial through Getty Photos

Funding Thesis

Diana Delivery Inc. (NYSE:DSX) presents a fancy funding case that requires a nuanced analysis. On the one hand, the corporate’s strong money place of $197.6 million supplies a monetary cushion, backed by a web debt of $671.9 million, which is balanced in opposition to this robust money reserve. The sale of its “Boston” vessel for $18 million and the acquisition of recent technologically superior vessels for $92 million point out strategic asset administration aimed toward long-term development. With a fleet utilization price of 99.6% and a workforce of 1,024 staff, operational effectivity seems to be a robust swimsuit. Refinancing current loans extends debt maturity to 2025, including monetary stability.

Nonetheless, there are crimson flags. A 71% YoY decline in web revenue and a 9.6% discount in Time Constitution Revenues, regardless of a rise in fleet measurement from 35 to 41 vessels, increase questions on profitability and operational efficacy. Working bills have surged, and liquidity is impacted with a YoY decline in working revenue from $40.4 million to $19.5 million.

Baltic Indices and IMF projections counsel headwinds for the dry bulk service trade, and gradual financial development forecasts for the U.S. and China add exterior dangers. Given these multifaceted elements, the funding technique leans in the direction of a ‘Maintain’ advice, appropriate for a conservative investor with a long-term view.

Overview

In Q2 2023, Diana Delivery Inc. noticed a major drop in its monetary numbers in comparison with the earlier 12 months. The corporate introduced a dividend payout of $0.15 per share, demonstrating its dedication to rewarding shareholders. This payout is backed by a stable money place of $197.6 million, providing a monetary cushion for operations and potential investments. The monetary well being is additional emphasised by the corporate’s web debt of $671.9 million, which could seem to be a big quantity however is well-balanced in opposition to the robust money place.

The corporate introduced the sale of its “Boston” vessel for a stable $18 million. This is not nearly eliminating an asset; it is about fast liquidity. With $18 million money in hand, the corporate can allocate this capital to different strategic areas to maximise returns. For example, Diana Delivery has already dedicated to investing in new expertise by shopping for two 81,200 DWT methanol twin gasoline new-building Kamsarmax dry bulk vessels for $46 million every, totaling a considerable funding of $92 million. These new vessels are anticipated by the second half of 2027 and the primary half of 2028. That is pivotal as a result of these new vessels are outfitted with superior methanol twin gasoline expertise, which aligns with the transport trade’s transfer towards sustainability and will give Diana Delivery an edge in future regulatory eventualities.

Moreover these acquisitions, Diana Delivery has additionally strategically entered into a number of time constitution contracts which can be going to herald a gradual money circulate. These constitution contracts have gross charges ranging between $11,250 and $14,250 per day. Once you add it up, these charters are anticipated to generate no less than $8.91 million in gross income. It is a essential income stream, particularly when you think about that they’ve prolonged a few of their current constitution contracts, just like the one with Reachy Delivery, thereby making certain that their vessels will not be sitting idle and can proceed to generate income. That is notably essential as a result of idle ships can change into a monetary drain.

When it comes to trade outlook, the worldwide transport enterprise is leaning extra in the direction of sustainable options. Diana Delivery’s funding in superior gasoline expertise places it in a good place each for regulatory approvals and for long-term sustainable operations. The $92 million dedication to new vessels isn’t just an expenditure; it is a long-term funding aimed toward positioning the corporate for sustainable development in an trade that is changing into more and more eco-conscious. However investments like these aren’t with out dangers. There’s market volatility that may have an effect on transport charges and long-term contracts. After which there are future environmental rules that the corporate might want to adjust to.

One standout metric is the corporate’s fleet utilization price of 99.6%. It is a very important signal of operational effectivity. The corporate is almost utilizing its total fleet to generate income, which is rare in an trade plagued with inefficiencies. This excessive utilization price additionally units the corporate above trade averages, making it a robust participant in a difficult atmosphere. The workforce behind this excessive utilization price is powerful, with 1,024 staff making certain easy operations.

The corporate has refinanced its current loans and secured new time period loans from Danish Ship Finance and Nordea Financial institution. Refinancing is a strategic transfer right here; it isn’t nearly swapping out previous debt for brand new. It improves the corporate’s monetary flexibility, permitting it to adapt to a unstable market. Importantly, the corporate has no debt maturing till the top of 2025, providing a secure monetary future and making it a horny long-term funding.

The corporate acquired the DSI Drammen vessel for $27.9 million, indicating a proactive strategy to increasing its revenue-generating belongings. It is also diversifying via joint ventures, just like the one for an Ultramax vessel, broadening its operational scope and income streams.

Nonetheless, market indicators just like the Baltic Indices and IMF projections counsel a difficult atmosphere for dry bulk carriers, impacting the long-term sustainability of the corporate. Moreover, gradual financial development forecasts for the U.S. and China, main gamers in transport, may negatively impression the corporate. Despite the fact that Diana Delivery has secured 80% of its 2023 income and 31% for 2024, the difficult market circumstances make long-term funding within the firm dangerous.

To sum all of it up, the corporate’s deal with excessive fleet utilization, strategic refinancing, and a robust workforce makes it a secure guess for long-term funding, albeit not completely devoid of market dangers.

Income Evaluation

Writer evaluation

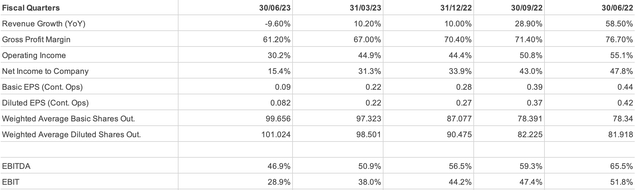

In Q2 2023, the corporate’s Web Earnings decreased to $10.364 million from $35.606 million in Q2 2022, marking a 71% decline. This development can also be mirrored in a six-month view, the place the Web Earnings fell from $61.649 million to $33.077 million. Alongside this, Time Constitution Revenues, the core income stream, noticed a 9.6% discount, dropping from $74.522 million to $67.379 million, regardless of the variety of vessels within the fleet rising from 35 to 41 over the identical interval. The corporate skilled a quarter-over-quarter (QoQ) decline of 9.59%, implying a discount in chartering actions and a fall in charges charged. For the half-year comparability, revenues remained comparatively secure, falling solely by a marginal 0.31%, indicating some resiliency on this income stream over an extended interval.

Voyage Bills, the prices incurred throughout a ship’s voyage, elevated by 438.06% QoQ and 1,010.71% HY. These numbers may outcome from resuming halted voyages and embarking on new ones, indicating a major ramp-up in actions.

One other worrying sign is the rise in Vessel Working Bills by 23% from $18.4 million to $22.6 million in the identical interval. These constant will increase may level to larger upkeep prices.

The most important crimson flag, nonetheless, comes from the Web Earnings metrics. The corporate’s web revenue plummeted by 70.89% QoQ and 46.35% HY. This important decline and the surge in working bills increase critical considerations concerning the firm’s present profitability and future monetary stability. These elements have had a unfavorable impression on the EPS, dropping it from $0.44 to $0.09, making the inventory much less interesting to particular person traders.

The sharp drop in web revenue and improve in operational prices do carry into query the standard of earnings and the potential for one-time occasions or manipulations.

Projecting ahead, if these declining developments proceed, the corporate may face a Web Earnings of round $5 million and Time Constitution Revenues near $60 million by Q2 2024. Given these indicators, the fast focus needs to be intently monitoring Web Earnings and Time Constitution Revenues in upcoming quarterly stories.

The corporate’s energy lies within the comparatively secure half-year revenues, whereas the weaknesses and threats are predominantly from growing operational prices and plummeting web revenue. Based mostly on the accessible information, the funding advice is to ‘HOLD’ the inventory.

Stability Sheet Evaluation

Beginning with liquidity, the corporate has a strong Present Ratio of 4.83, calculated by dividing its present belongings of $215,314k by its present liabilities of $44,561k. This excessive ratio means the corporate has ample short-term belongings to satisfy its fast obligations, making it financially secure within the quick run.

Nonetheless, once we take a look at solvency via the Debt to Fairness Ratio, which is 1.38, issues change into a bit regarding. This ratio is derived by dividing the corporate’s complete debt of $671,934k by its complete stockholders’ fairness of $487,388k. Given these figures, it is prudent to foretell that if present developments proceed, the corporate may face additional declines in fastened belongings and will increase in long-term debt, which can result in utilizing its money reserves to service these rising liabilities.

Stockholders’ fairness has remained virtually static, from $487.3 in 2022 million to $487.38 million in 2023, suggesting neither important dilution of shares nor a recent influx of capital. This static fairness place may sign that Diana Delivery shouldn’t be producing sufficient retained earnings, limiting its inside funding choices and probably pushing it in the direction of extra debt financing in the long term.

The money and money equivalents have elevated from $143.9 million on the finish of 2022 to $197.6 million as of June 2023, boosting liquidity. It hints at constructive money circulate technology, most likely from its core enterprise actions. Nonetheless, there’s a rise in long-term debt from $663.4 million to $671.9 million, and a lower in fastened belongings from $996.7 million to $958.6 million. These shifts point out that the corporate is taking over extra debt with out investing in its development or belongings, elevating questions on its long-term monetary technique.

Now, projecting into the long run, if the prevailing development of incrementally rising belongings and money owed continues, Diana Delivery may face each liquidity and solvency points. It urgently wants to enhance its profitability and curtail its burgeoning debt to keep away from future monetary instability.

Free Money Stream Evaluation

Writer evaluation

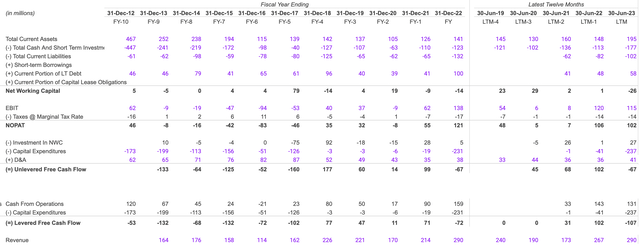

On the working entrance, money from operations surged from $33M in 2021 to $143M in 2022, indicating strong development in gross sales and operational effectivity. Nonetheless, this dropped barely to $131M in 2023, signaling potential stagnation. When it comes to investing, the corporate elevated its capital expenditures from -$1M in 2021 to -$237M in 2023, which suggests aggressive funding in long-term belongings but additionally locks up a major amount of money. On the financing facet, short-term money owed, together with the present portion of long-term debt, rose steadily from $41M in 2021 to $58M in 2023. This escalating debt can pose a danger if not lined by operational money circulate, which already exhibits indicators of slowing down.

The Unlevered Free Money Stream plummeted from $68M in 2021 to a unfavorable $67M in 2023, primarily as a consequence of elevated capital expenditures. This may very well be a calculated danger if these investments generate larger returns sooner or later. However as of now, it is a warning signal. Levered Free Money Stream additionally swung into the unfavorable at -$107M in 2023, indicating doable liquidity points. Coupled with growing money owed, the corporate may have to safe extra financing or enhance its operational effectivity to keep away from liquidity points.

EBIT rose from $8M in 2021 to $120M in 2022, demonstrating strong operational well being, though it dipped to $115M in 2023. NOPAT grew from $7M in 2021 to $106M in 2022 however barely decreased to $102M in 2023, suggesting a robust core enterprise. In the meantime, income has been constantly rising from $173M in 2021 to $290M in 2023, displaying robust market demand. Nonetheless, Web Working Capital dropped to a unfavorable $26M in 2023, a crimson flag indicating the corporate could wrestle to satisfy its short-term liabilities, thus questioning the standard of its earnings.

The one-year forecast suggests these money flows may rebound, however that is contingent on the ROI generated by these new capital investments, which must be intently monitored. Attributable to these elements, the fast funding advice is to carry, whereas conserving an in depth eye on ROI from capital expenditures and the NOPAT figures.

Money Conversion Cycle

Writer evaluation

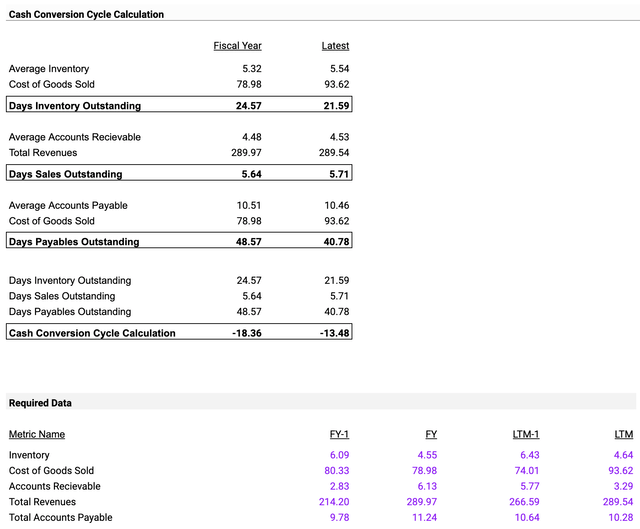

Between December 2022 and June 2023, the corporate noticed an 18.6% rise in its Value of Items Bought (COGS) from $78.98M to $93.62M, with out a matching improve in income, which stayed almost flat at round $289.5M. This raises a crimson flag about doubtlessly growing operational prices and shrinking revenue margins. Common stock and accounts receivable additionally elevated by 4.1% and 1.1%, respectively, hinting at potential liquidity points.

On the similar time, Days Stock Excellent dropped from 24.57 to 21.59 days, signaling quicker stock turnover. Conversely, Days Gross sales Excellent (DSO) edged up from 5.64 to five.71 days, whereas Days Payables Excellent (DPO) decreased from 48.57 to 40.78 days, which means the corporate is paying its suppliers extra rapidly. These adjustments led to a Money Conversion Cycle (CCC) shift from -18.36 days to -13.48 days, pointing to much less effectivity in changing sources into money.

Given these metrics, the fast focus needs to be on the rising COGS and the much less environment friendly money conversion cycle. If these developments persist, the corporate may face profitability challenges.

Shareholder Yield

Writer evaluation

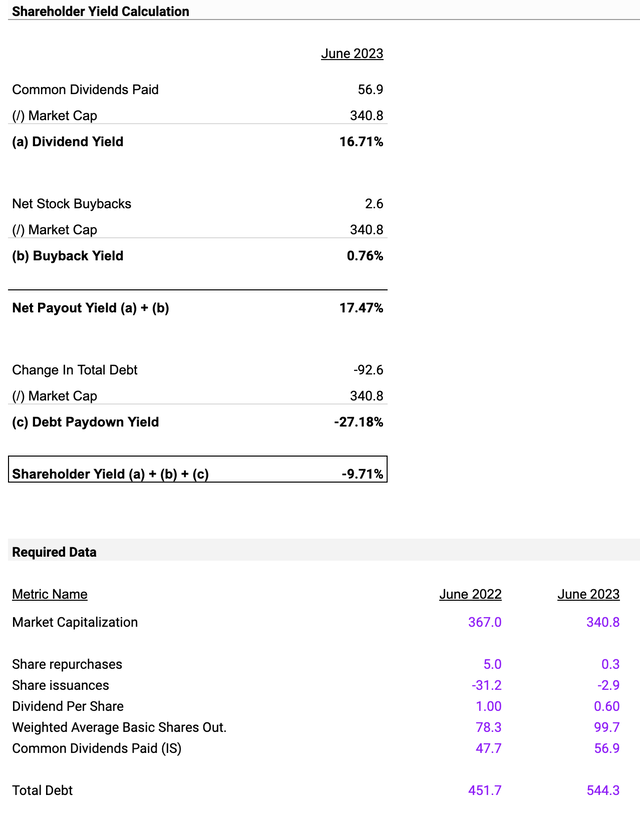

The corporate has a excessive Dividend Yield of 16.71%, calculated from its Frequent Dividends of $56.9M and a Market Cap of $340.8M, which may very well be a constructive signal of investor confidence and a crimson flag if unsustainable. Its Buyback Yield stands at 0.76%, primarily based on Web Inventory Buybacks of $2.6M, indicating that share buybacks aren’t aggressive. Including these, the Web Payout Yield is 17.47%, which is worrying as the corporate would not have robust money flows to assist it. Concurrently, the Debt Paydown Yield is -27.18%, displaying the corporate decreased its Complete Debt by $92.6M, marking an aggressive stance on debt discount.

In consequence, the general Shareholder Yield is unfavorable at -9.71%, suggesting a lower in shareholder worth. Given these metrics, fast consideration is required to scrutinize the excessive Dividend Yield and unfavorable Shareholder Yield. If the development of debt discount continues whereas sustaining a excessive Dividend Yield, the corporate may face liquidity points.

When it comes to funding, the most effective course proper now could be to ‘Maintain’ whereas monitoring these important monetary metrics and the corporate’s methods behind them.

Valuation

I do an EV/EBITDA comparable valuation evaluation for Diana Delivery.

Benchmark Firms:

Writer evaluation

The businesses chosen for benchmarking embody Euroseas Ltd. (ESEA), Protected Bulkers, Inc. (SB), Seanergy Maritime Holdings Corp. (SHIP), Eagle Bulk Delivery Inc. (EGLE), and Star Bulk Carriers Corp. (SBLK). These firms function throughout the similar trade as Diana Delivery Inc. and exhibit comparable enterprise fashions, thereby making the comparability related and credible.

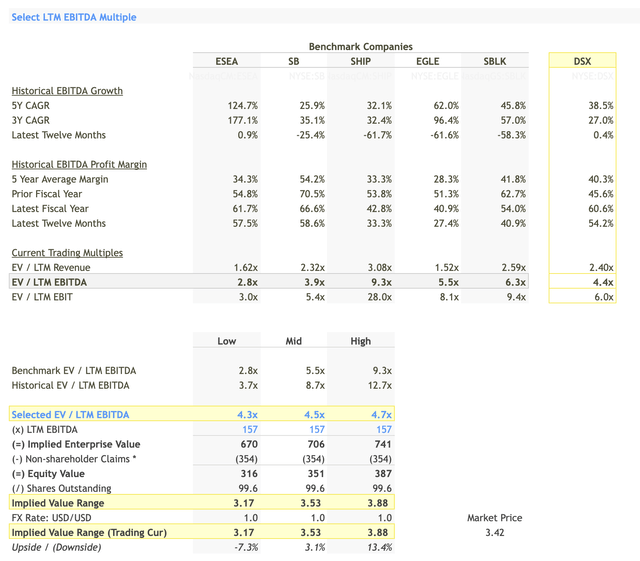

Choose LTM EBITDA A number of:

Writer evaluation

The LTM (Final Twelve Months) EBITDA multiples for the benchmark firms vary from a low of two.8x (ESEA) to a excessive of 9.3x (SHIP). Diana Delivery Inc. itself has an LTM EBITDA a number of of 4.4x. The chosen LTM EBITDA a number of vary for Diana Delivery is 4.3x to 4.7x, which is throughout the trade vary and displays its 0.4% LTM EBITDA development and 54.2% LTM EBITDA margin. These numbers substantiate that Diana Delivery is reasonably positioned by way of profitability and development in comparison with its friends.

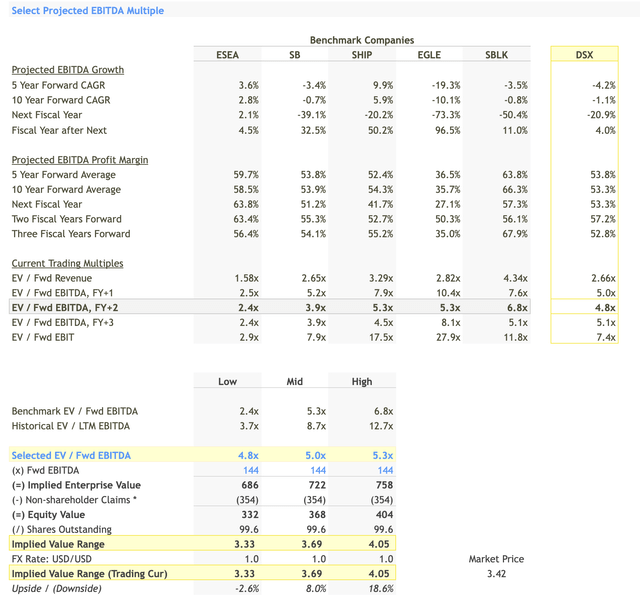

Choose Projected EBITDA A number of:

Writer evaluation

The projected EBITDA multiples for the benchmark firms within the subsequent fiscal 12 months (FY+1) vary from 2.5x (ESEA) to 10.4x (EGLE). The chosen projected EBITDA a number of for Diana Delivery is between 4.8x and 5.3x. That is in line with its projected EBITDA development price of -20.9% for the subsequent fiscal 12 months and a margin of 53.3%. These forward-looking multiples point out that whereas Diana Delivery could expertise a contraction in EBITDA development, it’s more likely to keep a comparatively secure EBITDA margin, justifying the chosen a number of vary.

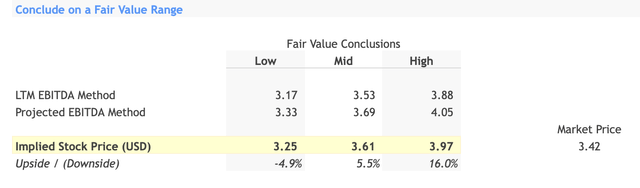

Truthful Worth Vary:

Writer evaluation

Based mostly on the LTM EBITDA technique, the implied inventory worth vary is between $3.17 and $3.88. In accordance with the projected EBITDA technique, the implied inventory worth is between $3.33 and $4.05. Combining these two strategies supplies a complete honest worth vary for Diana Delivery from $3.25 to $3.97. This vary is derived by averaging the low, mid, and excessive values from each LTM and projected EBITDA strategies.

Funding Determination:

The present market value of Diana Delivery’s inventory is $3.42. The honest worth vary suggests an implied inventory value between $3.25 and $3.97. The draw back danger is about -4.9%, and the upside potential is roughly 16.0%.

Given this vary and the present market value, the funding advice for Diana Delivery is a ‘Maintain’. The corporate exhibits reasonable EBITDA development and profitability in comparison with its friends but additionally faces forward-looking contraction in EBITDA.

This combined outlook validates a ‘Maintain’ place, because the inventory is pretty valued with restricted draw back and reasonable upside potential. Subsequently, on the present market value, the inventory neither provides a considerable low cost neither is it overly costly, making ‘Maintain’ essentially the most prudent advice.