After an unprecedented surge in decentralized currencies (dex) and perpetuals volumes final month, these decentralized finance (defi) platforms have witnessed a buying and selling quantity of $52.81 billion within the first 4 days of January 2025.

Uniswap and Hyperliquid will dominate Defi buying and selling volumes in 2025

The brand new 12 months is off to a promising begin, as the online value of the crypto economic system has soared above final week’s numbers and now stands at $3.51 trillion. Whereas centralized exchanges took the lead final month to finish the 12 months on a constructive observe, decentralized trade platforms (dex) additionally noticed a big enhance in quantity. In accordance with information from Defillama, December 2024 proved to be the height for each dex buying and selling quantity and decentralized perpetuals volumes.

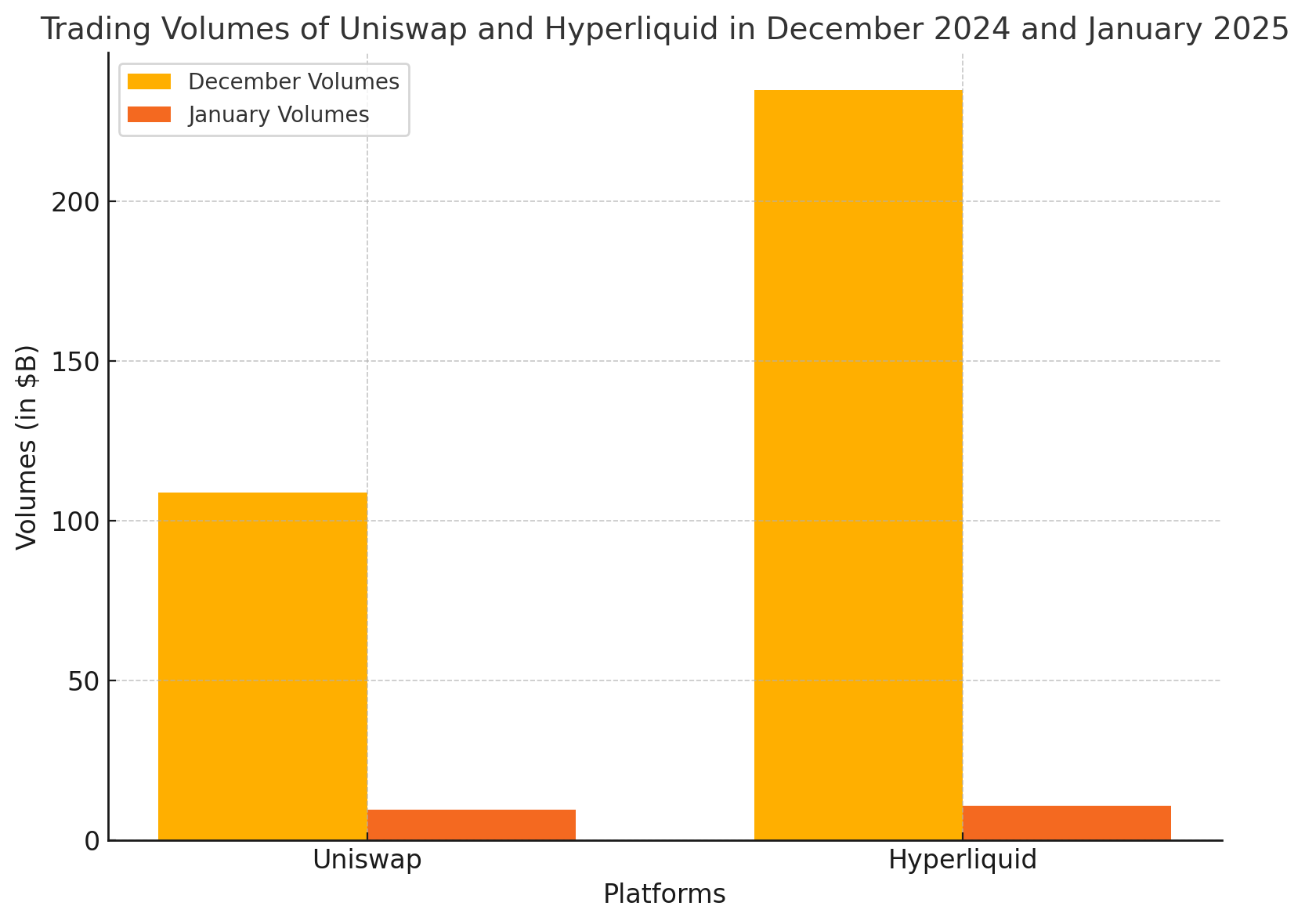

Dex buying and selling quantity rose to $322.25 billion in December, with Uniswap claiming the lion’s share, amassing greater than $109 billion. Uniswap, a dex for cryptocurrency spot buying and selling, operates on an Automated Market Maker (AMM) mannequin and makes use of liquidity swimming pools for easy token swaps. Decentralized perpetuals protocols raised $369.4 billion, in keeping with Defillama figures. Hyperliquid spearheaded this house, valued at a whopping $235 billion final month.

Not like typical dex platforms like Uniswap, Hyperliquid is a strong decentralized perpetuals platform by itself layer one (L1) blockchain, outfitted with an onchain order ebook for superior perpetual (perps) futures buying and selling, characterised by low latency and excessive transit. {and professional} instruments. Each Uniswap and Hyperliquid dominated $52.81 billion in quantity over the previous 4 days, with Uniswap securing $9.48 billion and Hyperliquid securing $10.75 billion.

Uniswap consists of Raydium, and the Solana-based protocol has raised $8.61 billion to this point within the first days of January 2025. Like Uniswap, this dex makes use of an AMM, however integrates with Solana’s quick, cost-effective infrastructure, permitting for quick transactions and important liquidity. Equally, the second largest decentralized offender trade, Jupiter, can be constructed on the Solana blockchain for a similar advantages. Jupiter perpetual trade deviates from conventional decentralized perpetual platforms like Hyperliquid by its LP-to-trader mannequin.

As an alternative of utilizing order books, Jupiter depends on the JLP pool, the place liquidity suppliers act as counterparties to trades, facilitating zero slippage and deep liquidity by oracle integration. Statistics present that Jupiter has recorded a complete buying and selling quantity of roughly $2.45 billion over the previous 4 days. Different main protocols for perpetrators embody Synfutures, Apex Protocol, Satori Finance, Bluefin, Drift, GMX and JOJO. In accordance with Defillama statistics, 109 decentralized offender platforms have collectively seen a complete buying and selling quantity of $6.611 billion within the final 24 hours.

On the dex entrance, moreover Uniswap and Raydium, notable dexes embody Pancakeswap, Aerodrome, Lifinity, Orca, Curve Finance, Cetus, Pump.enjoyable, and Dexalot. These decentralized exchanges skilled a complete buying and selling quantity of $11.464 billion up to now day. The explosive progress in defi buying and selling volumes in latest months marks a transformative shift within the crypto markets, highlighting innovation and adoption on decentralized platforms. As members start to redefine buying and selling dynamics, the problem now’s to take care of this momentum into 2025. To this point, volumes have remained excessive.