Alexandros Michailidis

Introduction

Deutsche Telekom (OTCQX:DTEGY) is among the firms I’ve persistently been recommending right here on Looking for Alpha. Not for its unbelievable development, spectacular margins, or high-end applied sciences – the corporate has none of these issues as a frontrunner within the very mature telecommunications {industry}. Going into this text, it’s good to know to not count on flashy financials. It’s a boring enterprise.

We’re not speaking in regards to the likes of Nvidia (NVDA), Palantir (PLTR), or Microsoft (MSFT) right here, however crucially, we don’t need to with a view to discover “Alpha” available in the market. It is rather simple to thoroughly deal with the much-discussed and top-rated shares available in the market that current an thrilling and compelling story and for which a premium must be paid – a premium for the promise of unbelievable development. But, within the meantime, it’s usually the defensive and boring firms that may ship market-beating returns.

No, with Deutsche Telekom, we’re specializing in one thing utterly completely different. Whereas the corporate’s income will not be projected to develop at unbelievable charges – somewhat low-single digits – it’s nonetheless a really attractive funding alternative at the moment and one which has outperformed the market on many events during the last couple of years. Not due to its development however due to the significance of its merchandise, glorious execution, main market positions, and defensive nature.

I final lined the corporate in August and upgraded shares to a powerful purchase, pushed by a powerful efficiency within the first half of the yr and a ten% drop within the share worth as an overreaction to rumors of Amazon (AMZN) doubtlessly coming into the sector, providing a terrific shopping for alternative. In fact, this comes on prime of an already bullish thesis. Final outing, I wrote the next:

Positioned as a worldwide chief within the telecommunications sector, this firm holds the excellence of being the biggest in Europe and a distinguished participant on the worldwide stage. What really captures my enthusiasm is its in depth footprint spanning each Europe and the USA. With strategic possession of over 50% in T-Cellular US, Inc. (TMUS), Deutsche Telekom has strategically established its presence throughout each continents. Working throughout varied telecommunications segments, together with cellular subscriptions, fixed-network strains, and wi-fi networks, this {industry} large showcases a sturdy aggressive benefit. This benefit ensures income stability and predictability and empowers it to thrive throughout difficult durations.

Although, Deutsche Telekom’s attraction as an funding goes past its stability, aggressive benefit, and important product choices. The corporate’s spectacular EPS development outlook is underpinned by the expectation of serious margin growth within the years forward. Moreover, its proactive debt discount efforts have strengthened its monetary place. In the present day, in my eyes, Deutsche Telekom stands out as some of the strongly positioned telecom firms globally, poised for substantial and enduring development.

The shares have since outperformed the market with returns of over 10% towards the SP500’s decline of two%. On this article, I’ll check out the corporate’s Q3 efficiency and alter my projections and expectations accordingly. Nevertheless, I can already let you know at this level that my long-term bullish thesis laid out above has not modified. The corporate continues to point out operational excellence, leading to monetary development and elevated shareholder returns. Whereas this firm will get far much less investor consideration than its American friends, Verizon (VZ) and AT&T (T), it presents a much more compelling funding alternative at the moment.

On that observe, let’s dive into the Q3 outcomes.

Deutsche Telekom delivered respectable development on all metrics in Q3

Deutsche Telekom launched its Q3 earnings earlier this week on November 9 and confirmed why it deserves extra investor consideration. The corporate is firing on all cylinders on each side of the Atlantic and appears to be untouched by every thing that’s occurring around the globe, together with excessive inflation ranges, rising rates of interest, and lowering client spending energy.

The corporate reported natural income development of 0.7% to €27.6 billion. This was a slowdown in development from the yr’s first half and resulted in 3.3% natural development for the primary 9 months. Moreover, revenues general in Q3 have been down 4.9% YoY because of decrease gadget revenues and foreign money headwinds. Nevertheless, this has little to do with the actual underlying efficiency, so I like to recommend traders deal with the natural development ranges.

Trying on the completely different working areas, we are able to see that T-Cellular US, wherein Deutsche Telekom now holds a 52.1% stake and which accounts for the corporate’s US operations, continues to carry out strongly, simply outpacing any of its US friends.

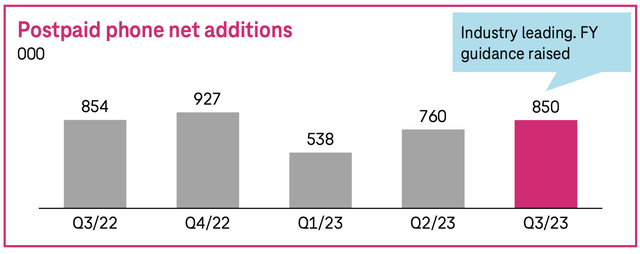

T-Cellular added a staggering and industry-leading 850,000 postpaid cellphone prospects in Q3. These ranges of internet provides reported by T-Cellular US utterly blow opponents like AT&T and Verizon out of the water. For instance, AT&T reported postpaid cellphone internet provides of 468,000, not even near the degrees reported by T-Cellular. Verizon reported even much less, illustrating that T-Cellular continues to win market share and outpace the competitors by way of development, fueled by its 5G management, confirmed by all assessments.

US section Q3 information (Deutsche Telekom)

The corporate additionally continued to see good success in high-speed Web with nearly 560,000 internet provides, bringing complete subscribers to 4.2 million. Churn additionally got here in on the lowest-ever stage at simply 0.87%.

Consequently, service revenues elevated by 3.6%, pushed by a postpaid service income development of 6.4%. However, T-Cellular revenues declined YoY by 8.7% attributable to decrease gear revenues, pushed by a weakening in client spending. Nevertheless, as defined earlier than, this can be a short-term impact and doesn’t impression the corporate’s operations. T-Cellular nonetheless accounts for 64% of Deutsche Telekom’s internet gross sales.

Deutsche Telekom not solely noticed robust underlying development within the US but in addition continues to achieve share in Europe, pushed by a powerful growth of its operations. The corporate now gives FTTH to fifteen.6 million European properties, up 3.4 million YoY. This, mixed with robust postpaid cellular net-adds, allowed the corporate so as to add 1.4 million subscribers in Q3, driving ex-US income up 2.6%.

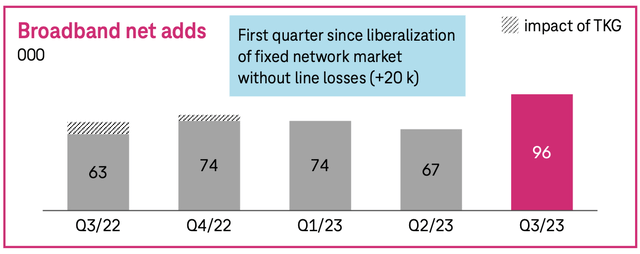

In Germany, the corporate’s largest European market, it reported natural income development of two.1%, pushed by service development of two.4%. In Germany, it added a really spectacular 900,000 branded postpaid cellphone prospects and grew natural broadband subscribers by 5% or 96,000.

Germany section Q3 information (Deutsche Telekom)

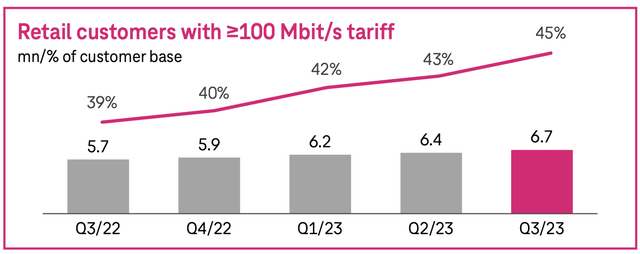

All metrics noticed very robust development developments, with TV internet provides sitting on the highest stage in 5 quarters and buyer web speeds nonetheless rising persistently, with 45% now utilizing web speeds of over 100 Mbit. That is essential as these higher-speed contracts are value extra to Deutsche Telekom, including extra income with out having so as to add prospects.

Germany section Q3 information (Deutsche Telekom)

Information utilization is an identical metric indicating contract worth, which has additionally been trending upward. In Q3, information utilization elevated 32% YoY, indicating increased contract values. Additionally, churn decreased from 1% final yr to 0.9% in Q3.

Lastly, in the remainder of Europe, Deutsche Telekom additionally noticed robust underlying development with energy throughout the board. Cellular contract internet provides have been 223,000, broadband internet provides 76,000, and TV internet provides have been 52,000, far increased than we noticed in earlier quarters.

The corporate additionally continues outperforming its expectations with stable buyer and monetary development. In Q3, natural income development in Europe was 3.7% YoY.

General, Q3 was one other very respectable quarter for Deutsche Telekom, with market share features and robust subscriber development throughout the board, solidifying the corporate’s future income potential. Whereas it faces weak {hardware} gross sales, service revenues appear unhurt by inflation and a weak client, as development is seen in all metrics. Underlying this firm is displaying no weak spot in any respect.

Deutsche Telekom is quickly bettering margins, driving unbelievable FCF development

Transferring to the underside line, there may be additionally lots to be optimistic about, as the corporate’s money flows are bettering quickly. The adjusted core EBITDA grew by 6.8% organically within the first 9 months and eight.9% within the third quarter, which is admittedly spectacular for a corporation like Deutsche Telekom.

This introduced the group’s EBITDA to €10.5 billion in Q3. Progress was pushed largely by bettering profitability within the US, which noticed EBITDA develop 7.4% in Q3. In the meantime, natural EBITDA development in Germany was 3%, rising for the 28th consecutive quarter. The European section grew EBITDA by 3.3% regardless of vital inflationary pressures and value inflation, together with increased salaries and vitality prices. This makes this efficiency much more exceptional.

Nevertheless, EPS was down 4.2% in Q3 and down 14% for the primary 9 months, however this is because of a troublesome comparability to final yr because of one-off advantages in 2022. Excluding one-offs, EPS was up YoY.

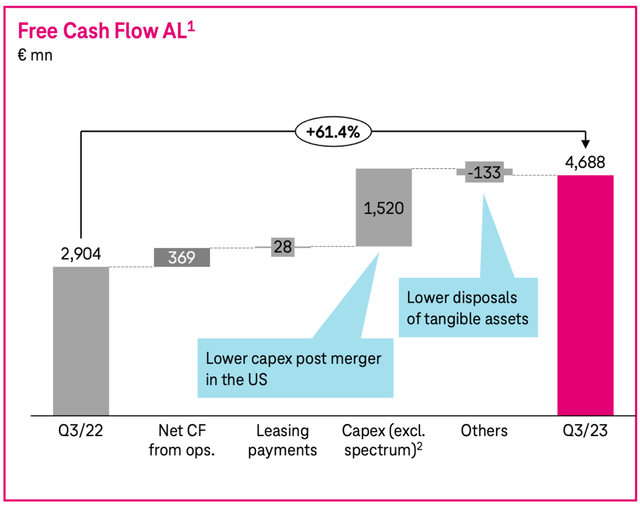

Moreover, FCF grew 60% YoY in Q3, pushed by decrease Capex for T-Cellular associated to the dash integration. Capex is anticipated to maintain lowering over the following few years, driving vital FCF development.

YoY FCF development (Deutsche Telekom)

This staggering enchancment in FCF has helped Deutsche Telekom meaningfully enhance its monetary place, decreasing the debt place by 11.5% during the last 12 months from €109.5 billion to €97 billion, of which 75% is on account of T-Cellular. With FCF anticipated to develop quickly, we are able to safely assume the corporate will hold deleveraging the steadiness sheet. Internet debt leverage at the moment nonetheless stands at 2.4x. Whereas its debt place continues to be vital, it is much better than that of its US friends, with AT&T and Verizon holding internet debt positions of $128.7 billion and $154.4 billion, respectively. On the similar time, Deutsche Telekom additionally has a far, much better FCF development outlook. The distinction in monetary well being is, subsequently, vital.

Along with bettering monetary well being, the rising FCF additionally helps considerably increased shareholder returns within the type of a rising dividend and a repurchase program of as much as €2 billion to start out in 2024.

Deutsche Telekom plans to extend the dividend by 10% to €0.70 per share, bringing the yield to roughly 3.3% and the payout ratio to a really conservative 41% primarily based on FY23 EPS. With EPS projected to develop within the double digits within the medium time period, I count on Deutsche Telekom to continue to grow the dividend at an identical price, providing respectable dividend development to traders mixed with a stable yield.

Nevertheless, regardless of this improved shareholder returns outlook, that is additionally the one level the place Deutsche Telekom loses to its friends who pay a dividend of over 7% on seemingly sustainable payout ratios.

Outlook & Valuation – Is Deutsche Telekom a Purchase, Promote, or Maintain?

Again in September, T-Cellular US already upgraded its outlook following a powerful first 9 months of the yr. Earlier this week, Deutsche Telekom handed on this steering enhance and likewise raised the FY23 outlook for the third time this yr.

Deutsche Telekom has raised each its EBITDA and FCF steering by €0.1 billion, bringing the anticipated FY23 EBITDA to €41.1 billion and FY23 FCF to €16.1 billion. In the meantime, the ex-US enterprise efficiency expectation stays unchanged, and the corporate continues to count on over €1.60 in EPS for the complete yr. We will safely assume that these expectations are nonetheless conservative, and the corporate will ship one other outperformance when it experiences FY23 outcomes early subsequent yr.

Following a powerful Q3 with spectacular underlying development and an upgraded FY24 outlook, I now count on the next monetary outcomes by way of FY26. Regardless of the robust efficiency, I’ve needed to decrease my income and EPS projection for this yr, largely as a result of impression of FX headwinds.

Monetary projections (By creator)

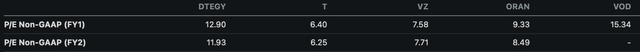

Primarily based on these up to date projections, shares are actually buying and selling at a ahead earnings a number of of 12.75x. This implies shares are buying and selling at fairly a premium over its US friends however a reduction to its most necessary European peer, Vodafone (OTCPK:VODAF). Nevertheless, this premium over its US friends is absolutely justified, at the same time as these provide a superior dividend yield.

valuation comparability (Looking for Alpha)

For one, Deutsche Telekom is in higher monetary well being, as mentioned earlier than, as it’s quickly decreasing its debt and is much better diversified with robust market positions in each the US and Europe. The corporate has been quickly gaining wi-fi and wired web subscribers, simply outpacing the web provides reported by Verizon and AT&T.

Consequently, Deutsche Telekom additionally has a far superior development outlook. Trying on the present Wall Avenue consensus, AT&T is projected to develop income at a CAGR of solely barely over 1% over the following 4 years. Verizon is analogous, with a CAGR projected between 1.5% and a couple of%. In the meantime, Deutsche Telekom is anticipated (by each Wall Avenue analysts and me) to develop income at 2x the CAGR of its friends at 3% to 4%.

Taking a look at EPS development, the distinction is night time and day, with traders being fortunate if Verizon grows its EPS at a CAGR of above 1% and AT&T not trying a lot better at roughly 2%. In the meantime, Deutsche Telekom is poised to develop EPS and FCF at a mighty CAGR of over 10%, much better than any of its friends. Additionally, bear in mind these firms have an identical market cap.

So, sure, traders on the lookout for a excessive yield will most probably be higher off with both Verizon or AT&T. Nonetheless, these on the lookout for an organization in the identical defensive {industry} (making it exceptionally proof against inflation and financial downturns, providing stability), with bettering monetary well being, a stable and rising dividend, and far quicker income and earnings development ought to deal with Deutsche Telekom, which nonetheless has some room for a number of growth as development expectations are realized.

On the similar time, sure, Verizon and AT&T are buying and selling at a far decrease a number of of seven.5x and 6.5x, respectively, however I might completely not be keen to pay rather more for a corporation rising its prime and backside line at a CAGR of 1-2%. Even when their multiples would develop to 8x and 7x, this is able to nonetheless give traders not more than a complete return of 10-11% yearly for both of the 2 by way of 2026.

Don’t be seduced by a excessive yield. Trying on the complete return potential for Deutsche Telekom primarily based on a good a number of of 13x, I calculate complete returns exceeding 12% yearly, with rather more monetary stability, room for upside, dividend development, and higher long-term monetary development. This makes Deutsche Telekom a superior funding to its much-discussed American friends at the moment.

Lastly, primarily based on a 13x a number of and my FY24 EPS, I keep my worth goal of €25 per share, leaving a major upside of 17%. I reaffirm my Robust Purchase ranking with Deutsche Telekom shares nonetheless trying very enticing and poised for stable returns within the medium to long run.

Editor’s Observe: This text discusses a number of securities that don’t commerce on a significant U.S. alternate. Please pay attention to the dangers related to these shares.