2023 has been robust for cryptocurrency costs and the general state of the market. But it surely additionally noticed the beginning of many tales and catalysts for a lot of cryptocurrency initiatives and ecosystems, with a few of them seeing explosive, sudden will increase in complete worth (TVL) and others rising extra organically.

One factor is true: capital, analysis and growth (along with the exhausting work) are being poured into new applied sciences and options that might carry a wave of enhancements to decentralized finance (DeFi). This text explores these applied sciences and a number of the finest performing cryptocurrency protocols and tales.

zkEVM

The zkEVM ecosystem has just lately develop into a scorching subject within the crypto group, particularly within the Ethereum ecosystem. Combining zero-knowledge proofs (ZKP) and EVM may benefit Ethereum by way of scalability, throughput, composability, and knowledge replication.

But it surely wasn’t till 2022 that zkEVMs have been actively developed, and that is nonetheless the case now greater than ever, with increasingly builders and protocols becoming a member of the story.

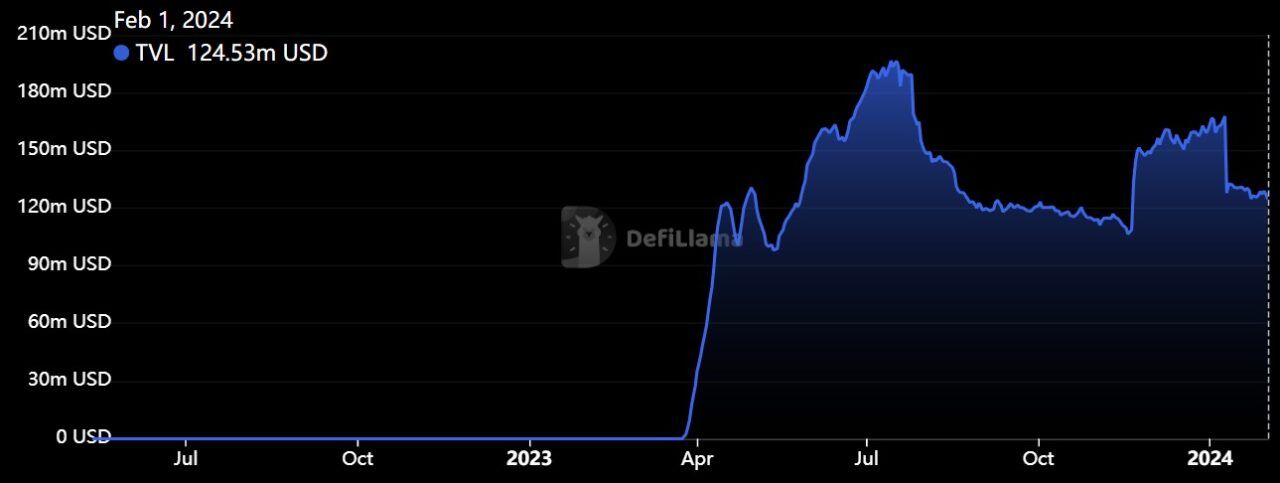

The TVL wave of zkSync Period, at present the quickest rising zkEVM. Supply: DeFiLlama

What’s zkEVM?

As we talked about, zkEVM refers to protocols that use zero-knowledge proofs and are EVM appropriate on the similar time. Utilizing ZKPs (within the type of zero-knowledge rollups), these protocols can execute good contracts with extra privateness as a result of they don’t reveal the information and phrases inside these contracts. These are the primary advantages of zkEVM initiatives: privateness, safety, scalability and composability.

EVM compatibility relies on the venture; particular protocols can extremely replicate the EVM to allow interoperability, however might not be capable to generate ZK proofs sooner. In the meantime, different initiatives might need decrease EVM compatibility however sooner pilot technology.

That additionally means, as Vitalik Buterin defined, that there’s a trade-off between EVM compatibility and efficiency.

Among the hottest zkEVM rollups launching this 12 months:

- zkSync period: $120 million TVL, excessive efficiency, decrease compatibility.

- Linea: $60 million TVL, reasonable compatibility and efficiency

- Polygon zkEVM: $19 million TVL, reasonable compatibility and efficiency

Actual World Belongings – RWAs

Actual World Belongings (RWA), because the title suggests, refers to tangible and intangible property that may be tokenized utilizing blockchain know-how. In different phrases, RWA protocols carry the off-chain property on-chain, unlocking an untapped potential of latest income and sources for DeFi.

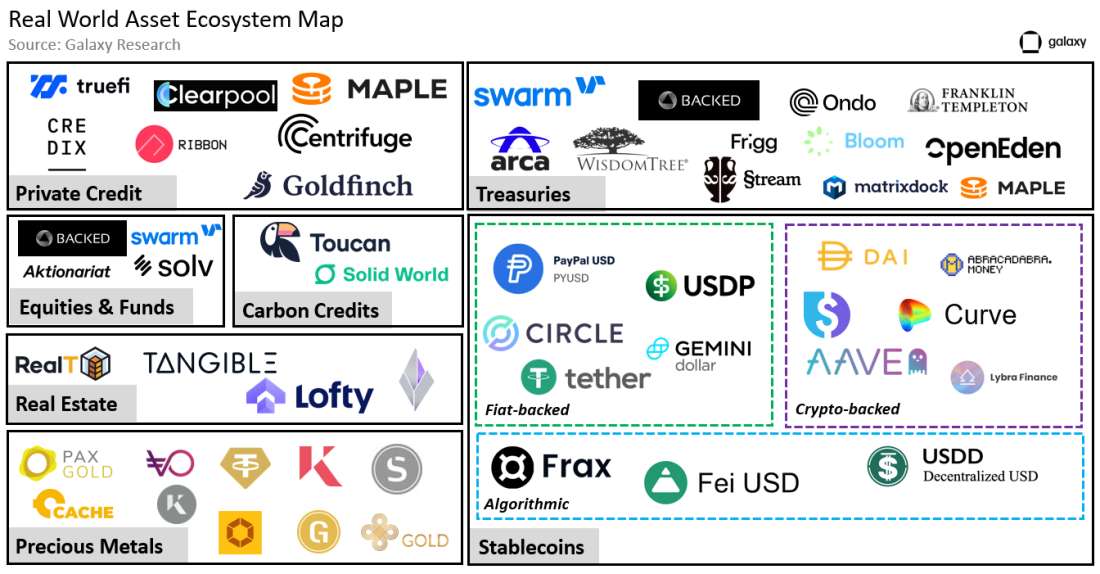

There are various forms of RWA protocols, from on-chain lenders to debt markets, lending, commodities and actual property.

Supply: Galaxy Digital

RWAs have surpassed the common DeFi APY by 2023, which is at present round 3%. Moreover, risk-weighted property make up roughly 6.3% of DeFi’s complete TVL, in line with DefiLlama. RWA protocols and repair suppliers have grown organically, in contrast to most tales which have had explosive ups and downs.

RWAs have many professionals and cons. Let’s begin with the advantages:

- RWAs might develop into a brand new supply of liquidity for the DeFi ecosystem, unlocking untapped income for the house.

- Mass institutional adoption

- Decrease barrier to entry for various markets, particularly actual property

- Quicker service and commerce in objects with out intermediaries

The disadvantages/challenges of risk-weighted property

Regulation will strongly affect the success of risk-weighted property. For RWAs to entry giant markets akin to credit score, actual property or lending, they want giant quantities of liquidity, and the obvious approach to channel that is by way of giant establishments.

This raises numerous questions:

- Is it now not DeFi if we’d like the assistance of TradFi establishments?

- Do risk-weighted property work higher for establishments and personal corporations?

- Retention interval: Do customers personal the token, however not the asset itself? If that’s the case, can regulators take management of such help, or can monetary establishments or businesses refuse repayments within the case of loans and on-chain credit, for instance?

SocialFi: Tokenizing Affect

SocialFi is without doubt one of the hottest tendencies in crypto, kicking off with protocols like pal.tech and Stars Enviornment, at present market leaders.

In SocialFi (or SoFi), you may affect enterprise as content material creators monetize their followers and social media engagement. Income is generated by way of cryptocurrencies and the digital id is an NFT. This could possibly be thought-about a brand new model of Web3 that clusters social media, crypto, NFTs and content material creation.

SocialFi has many advantages for customers, together with the next diploma of privateness, new monetization strategies, the power of creators to higher work together with customers, and the discount of censorship and knowledge management by centralized events.

Nonetheless, SocialFi rapidly took off after pal.tech grew to become Base’s flagship product. Quickly after, forks and new apps emerged in varied ecosystems, most notably AVAX’s Stars Enviornment, which was hacked for $3 million. The hack reminded crypto customers that new, experimental applied sciences may be harmful, and that exponential progress in such a short while body can appeal to many malicious actors.

Important SocialFi protocols:

- pal.tech: $40 TVL, market chief with over 72,000 energetic every day wallets

- StarsArena: $3 million (just lately recovered), with over 25,000 energetic every day wallets

Liquid strike derivatives (LSD)

Liquid Staking Derivatives (LSD) have been in all probability essentially the most hyped story of 2023, particularly within the first quarter. LSD are tokenized variations of locked tokens in deposit contracts or whereas being staked. This permits customers to make use of their tokenized ETH (or different tokens) with out having to stake the precise funds.

On the time of writing, the overall worth of liquid staking is roughly $33.8 billion, and Lido is at present the market chief with $21 billion in TVL, dominating the market.

LSD at present accounts for about 20% of the overall worth of DeFi. The success of this ecosystem may be traced again to the Shanghai Replace, when Ethereum moved to a Proof-of-Stake consensus algorithm, locking up a big quantity of ETH till the Shapella improve, which induced a liquidity disaster for ETH-based corporations . initiatives and trigger the strikers to doubtlessly undergo losses because of market situations.

- The answer? Create a tokenized model of those staked property, akin to Coinbase’s Wrapped Staked ETH, after which use it for varied DeFi actions.

The principle advantages of LSD could possibly be restricted to the best way these protocols rework deployed property into extra versatile and dynamic return devices. Principally, customers obtain a tokenized model of their property, like a receipt, which permits further yield alternatives in DeFi.

Telegram buying and selling bots

Telegram crypto buying and selling bots grew to become fashionable in 2023 as they supply an automatic system for buying and selling on decentralized exchanges, permitting customers to commerce and execute operations extra effectively and rapidly.

Customers don’t want a pc to hook up with their pockets to commerce tokens on a decentralized trade (DEX); as an alternative, they’ll merely copy the token’s deal with and paste it into the bot’s chat to purchase/promote it. This makes the buying and selling course of considerably sooner than on a DEX’s authentic web site. Nonetheless, it does not finish there as buying and selling bots provide options akin to stop-loss, take-profit orders, MEV and anti-back safety measures, liquidity sniping and extra.

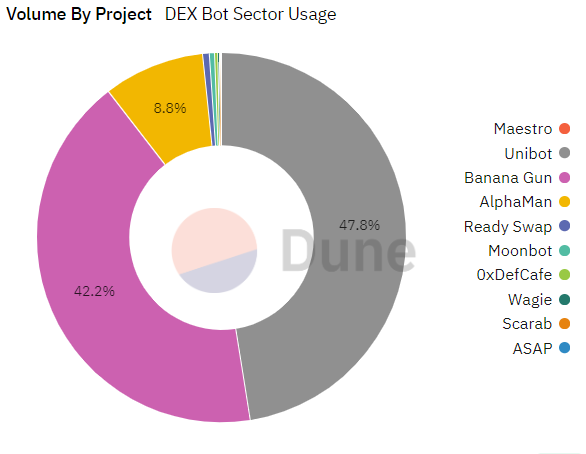

Banana Gun, Maestro and Unibot are the preferred buying and selling bots in the intervening time. Unibot by itself can course of transactions 6 instances sooner than Uniswap’s personal web site.

This ecosystem of buying and selling bots has a complete of roughly 124,000 distinctive customers who’ve traded greater than $740 million. It’s value noting that no buying and selling bot can assure buying and selling success and customers’ investments are in danger.

Remaining ideas

The tales talked about right here revolve round essentially the most talked about subjects, tendencies, and protocols this 12 months, however there are a couple of different tales which are shaping and gaining momentum at their very own tempo.

- Chinese language tokens: This 12 months, Hong Kong allowed retail buyers to put money into digital property, which has led to a worth enhance for Chinese language cash akin to NEO, BitDAO’s BIT, VeChain’s VET and extra.

- Decentralized stablecoins: These stablecoins are managed by a decentralized group as an alternative of 1 central physique like Tether or Circle. Subsequently, a centralized occasion can not tamper with the provision of the forex or fake that they’ve property to again the forex when in actuality they don’t. T.