Zerbor/iStock by way of Getty Photographs

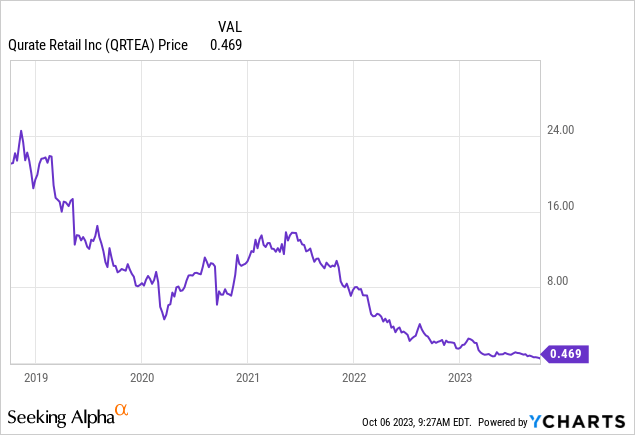

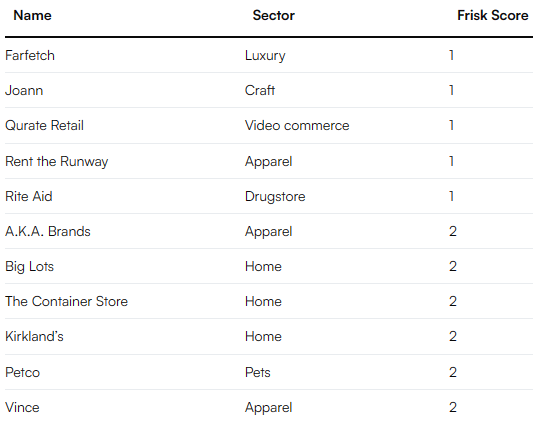

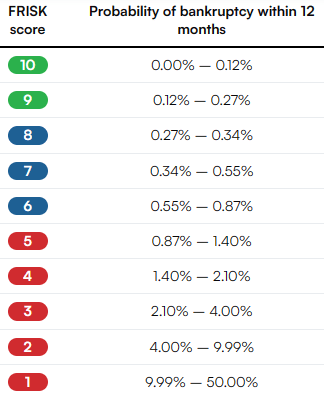

Qurate Retail (NASDAQ:QRTEA) (QRTEB) (NASDAQ:QRTEP) made the listing of outlets probably to file for chapter over the subsequent 12 months, with a 9.99%-50% chance, which additional depressed the value of QRTEA widespread inventory and QRTEP 8.0% most well-liked inventory this week. Whereas I agree that there’s a excessive chance of a submitting for Ch.11, I made a particularly dangerous commerce and purchased a number of the 8% most well-liked inventory at costs under $20 per share. Moreover protecting the first purpose why I purchased QRTEP, this text will cowl some necessary points associated to particular sections of the U.S. Chapter Code impacting Qurate, however this text will not be supposed to be an entire protection of the corporate.

Threat of Chapter Inside Twelve Months

There was an article earlier this week on the web site Retail Drive that listed 11 retailers prone to submitting for chapter throughout the subsequent 12 months based mostly on metrics by Credit score Threat Monitor, which used FRISK scores. The truth is that there have been no actual surprises on this listing.

www.retaildive.com

www.retaildive.com

Why I Purchased Most popular Inventory

The first purpose why I purchased the popular inventory was the yield in comparison with the chance of a chapter submitting over time. I take into account it a rational, however extraordinarily dangerous commerce.

First, some objects must be clarified. The popular shares would not have a par worth of $100. These asserting it’s buying and selling at some low cost to par are incorrect. The precise par worth per share is $0.01. The “liquidation value is $100”. There may be additionally confusion by some buyers pondering that the dividend relies on a typical $25 par worth, which is what number of most well-liked shares are issued. The 8.0% dividend, which is paid quarterly, relies on $100. These usually are not perpetual most well-liked shares. There’s a necessary redemption at $100, plus any unpaid dividends, on March 15, 2031, until they’ve already been redeemed. This can be a enormous concern. Due to this redemption requirement, the popular inventory is reported within the legal responsibility space of the steadiness sheet as an alternative of the customary shareholder space.

In contrast to non-payment of curiosity on debt, non-payment of the popular inventory dividends doesn’t drive Qurate Retail out of business. The dividends accumulate if unpaid. If unpaid after a “30-day remedy interval, the dividend fee will improve by 1.50% each year of the liquidation value till cured, plus an extra 0.25% commencing on the dividend cost date instantly following such nonpayment and for every subsequent dividend interval thereafter till such nonpayment is cured, as much as a most dividend fee of 11.00% each year of the liquidation value”. There are additionally some extra board of director objects that would kick in.

Some buyers use yield-to-maturity when assigning a yield to QRTEP as a result of it has a redemption requirement. I take a considerably completely different method as a result of the yield-to-maturity assumes that the $2.00 quarterly dividend is reinvested on the yield-to-maturity rate of interest, which on this case is extraordinarily unlikely. Utilizing the newest QRTEP value of $19.58 and the $8.00 annual dividend, the present yield is 40.9%. Treating the redemption issue as successfully a zero-coupon bond implies an annual rate of interest of just about 25% solely for the redemption characteristic. These utilizing yield-to-maturity would get an annual rate of interest of just about 48%.

The anticipated subsequent dividend determination day is in mid-November. There might be main inventory value strikes based mostly on that call by the board, which I could commerce on.

Part 548 Potential Influence

There are a variety of sections within the U.S. Chapter Code that would have a big impression on Qurate Retail and too typically buyers both ignore them or are unfamiliar with them.

First, I often learn statements that they may promote Cornerstone Manufacturers – CBI to boost money to assist paydown debt. Since they already bought Zulily earlier this yr might sound logical. The truth is that the clock is ticking. There might be worries of section 548 points by a possible purchaser – truly typically by a purchaser’s banker. If Qurate “obtained lower than a fairly equal worth”, filed for Ch.11 chapter inside two years of the shut of the asset sale, and is finally decided by the chapter court docket to be bancrupt or turned bancrupt due to the sale on the date of the asset sale, there’s a threat {that a} creditor would possibly file a movement to void that sale transaction throughout a Ch.11 course of. (Notice: do not be shocked by the title of part 548. It comprises a lot of completely different objects below the identical part title. I believe this part ought to be divided into a number of separate sections.)

If they’re planning on promoting CBI or different belongings, they should act shortly, for my part, earlier than they’re prone to being thought of “bancrupt”. (Notice: I’m not asserting that they really are bancrupt. I’m stating that they is likely to be “thought of” bancrupt by some social gathering in future litigation.) Bear in mind it’s as much as the chapter choose to make the ultimate determination concerning insolvency. There isn’t a absolute definition. Some judges make very quirky choices, for my part. Some readers would possibly keep in mind when Choose Drain decided that the worth of the 2lien noteholder’s collateral was “$0.00” in the course of the Sears Holdings chapter course of. Traders and a few readers had been shocked/appalled. There are various metrics to have a look at equivalent to losses, inventory costs, web short-term liquidity, and plenty of different metrics to find out insolvency. Even when Qurate will not be bancrupt, if there may be even the chance that there might be part 548 points some bankers is likely to be reluctant to finance a purchase order.

Due to part 548, firms cannot actually have “fireplace gross sales” to boost wanted money to remain out of chapter, which then generally leads to them truly submitting for chapter. I’ve written a lot of In search of Alpha articles on this concern for some distressed firms that finally filed for chapter or are at present on the point of submitting for chapter partially due to this concern.

As an alternative of shopping for a desired asset from a distressed firm, a possible purchaser would possibly wait till they’ll purchase that very same asset throughout a Ch.11 course of “free and clear” of any claims and generally cheaper. They might additionally not have to fret about part 548.

Potential Vendor Points

Typically the impression of sure sections of the U.S. Chapter Code on merchandise distributors forces retailers out of business. These sections, nonetheless, do not have as a lot impression on different distressed firms, equivalent to power firms as a result of they do not purchase/promote merchandise.

Beginning with the problem that surprises many buyers and that’s part 547 Preference Payment Rule and section 550. An organization in chapter can attempt to get funds returned from distributors who had been paid inside 90 days (one yr for insiders) of a chapter submitting date. That’s right. Even when a vendor was paid and thought they had been “fortunate” that they didn’t get burned by the retailer submitting for chapter, might be required to return “property transferred” (which is money paid). I’m going to make use of a part of the identical demand letter (Sears docket 8959) despatched to a vendor in the course of the Sears Holdings chapter course of that I utilized in my Mattress Bathtub & Past (previously BBBYQ) article:

Plaintiffs search to keep away from and recuperate from Defendant, or from another individual or entity for whose profit the transfers had been made, all preferential transfers of property that occurred in the course of the ninety (90) day interval previous to the graduation of the chapter case of the Debtors pursuant to sections 547 and 550 of chapter 11 of title 11 of america Code (the “Chapter Code”). Topic to proof, Plaintiffs additionally search to keep away from and recuperate from Defendant or another individual or entity for whose profit transfers had been made pursuant to sections 548 and 550 of the Chapter Code any transfers which will have been fraudulent conveyances.

Many distributors earlier this yr didn’t need to cope with BBBY even when they had been pay as you go earlier than cargo as a result of they anxious that they may get certainly one of these compensation demand letters if BBBY finally filed for chapter. That is partially why their cabinets had been so empty. Of their Ch.11 plan (BBBY docket 1712) BBBY talked about they had been contemplating utilizing the Desire Cost Rule to recuperate some money paid to distributors. At this level it’s unclear if any compensation demand letters have been despatched but by the plan administrator.

One other main concern merchandise distributors fear about when coping with distressed retailers is being thought of simply “basic unsecured claims” below a Ch.11 chapter plan, which frequently means little or no restoration as a result of they’re in a low precedence class. To keep away from this concern some distributors require important deposits or C.O.D. when coping with distressed distributors. (They nonetheless must fear about part 547 and 550 points.) This typically places extra monetary stress on the retailer as a result of they’ve to make use of more money to hold their inventories.

There are exceptions. Some distributors get labeled as “crucial distributors” and are paid in the course of the Ch.11 chapter course of and would not have to attend till the plan turns into efficient. This idea is definitely based mostly on case legislation and since there’s a threat of litigation, the variety of distributors thought of crucial distributors by the court docket is normally pretty restricted. One other exception are these distributors whose merchandise was constructively obtained by the retailer inside 20 days previous to the chapter submitting. These distributors have part

503(b)(9) precedence claims and are close to the very prime of cost precedence order below a chapter plan.

I assume readers can see the issue right here. A vendor whose items had been obtained 21 days or extra earlier than the chapter submitting typically get no or little restoration, however a vendor whose items had been obtained throughout the 20 day window typically get full or near full restoration. (There may be additionally a unique part for many who cope with the corporate in the course of the chapter course of, however that’s past the scope of this text.)

Sooner or later sooner or later, I fear that Qurate Retail’s distributors would possibly turn out to be extra reluctant to cope with them due to numerous sections of the chapter code. Qurate has “deep pocket” folks related to the corporate, however so did Sears Holdings – Eddie Lampert – and so did Revlon – Ron Perelman. As a result of over the past six years so many retailers have gone bankrupt that always resulted in little or no restoration for distributors, I fear that distributors and the seller’s bankers would possibly turn out to be stricter when coping with Qurate Retail. This may put extra stress on their money place and improve the necessity to borrow more money.

Conclusion

I’m not now, and I by no means have been a fan of Qurate Retail, however the threat/reward for his or her 8% most well-liked inventory looks like a rational commerce under $20. I’m not anticipating to carry QRTEP for the long-term and I could promote when the dividend determination is introduced in mid-November -either way- paying dividend or not paying dividend.

The truth is the U.S. Chapter Code will be very harsh particularly for retailers. Sure sections make it extra possible a distressed retailer, equivalent to Qurate Retail, information for chapter. At this level I’m score QRTEA widespread inventory impartial/maintain and placing the corporate on my watch listing for a possible future downgrade. I fee QRTEP a purchase under $20 per share.

Editor’s Notice: This text covers a number of microcap shares. Please pay attention to the dangers related to these shares.