Brandon Bell/Getty Photographs Information

Funding Thesis

I imagine Dell Applied sciences (NYSE:DELL) inventory is a purchase. They’ve grown within the tech sector, notably in PCs and servers. A DCF evaluation suggests an 11% annual return on Dell’s inventory over the subsequent 5 years. They’re concerned in tech areas like cloud providers, edge computing, synthetic intelligence, and cybersecurity. Dell’s deal with shareholders is evident by way of its dividends and buybacks. With a rising Complete Addressable Market and their monitor file, I see Dell as a stable funding possibility.

Firm Overview

Dell Applied sciences is a world tech firm providing services and products from private computer systems to information storage and cloud options. The corporate used a direct-to-consumer mannequin, avoiding conventional retail channels. This strategy helped Dell handle stock prices and set aggressive costs. Over time, Dell expanded its choices to incorporate information middle and cloud providers for each shoppers and companies. The 2016 acquisition of EMC enhanced its place within the IT infrastructure market. Nevertheless, Dell faces competitors from firms like HP Inc. (HPQ), Lenovo Group Restricted (OTCPK:LNVGY), Apple Inc. (AAPL), and Cisco Methods, Inc. (CSCO). In my view, whereas these opponents current challenges in areas from PC gross sales to enterprise options, Dell’s historical past suggests they’ve the aptitude to adapt and compete successfully.

Dell’s TAM Alternative

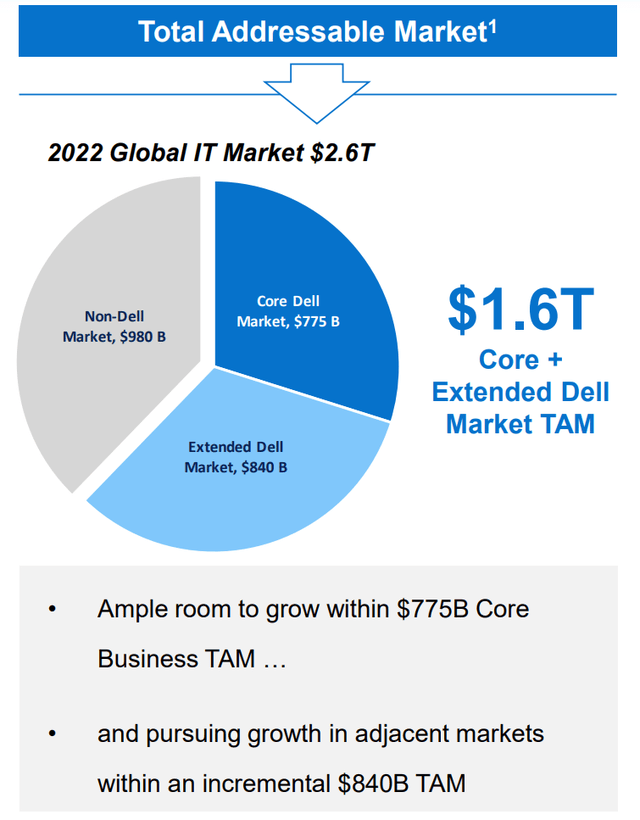

In my view, Dell Applied sciences has a promising outlook based mostly on its complete addressable market (TAM). Dell’s core TAM is already at $775 billion, indicating a stable base for its current operations. However what catches my consideration is Dell’s potential to faucet into adjoining markets, which provide a further TAM of $840 billion. These markets embody areas like cloud providers, edge computing, synthetic intelligence, and cybersecurity. Cloud providers meet the demand for scalable IT options and distant information entry. Edge computing, influenced by IoT gadgets, gives fast information processing important for real-time duties. Synthetic Intelligence (AI) supplies automation, information evaluation, and tailor-made experiences, with its function rising with information quantity. Cybersecurity is essential as a consequence of rising digital threats, guaranteeing information and asset safety. Collectively, these areas spotlight present digital requirements and are more likely to be central to tech progress sooner or later. Given Dell’s positioning and capabilities within the tech trade, it is anticipated that the corporate will profit considerably from these tendencies over time.

Dell 2023 Investor Presentation

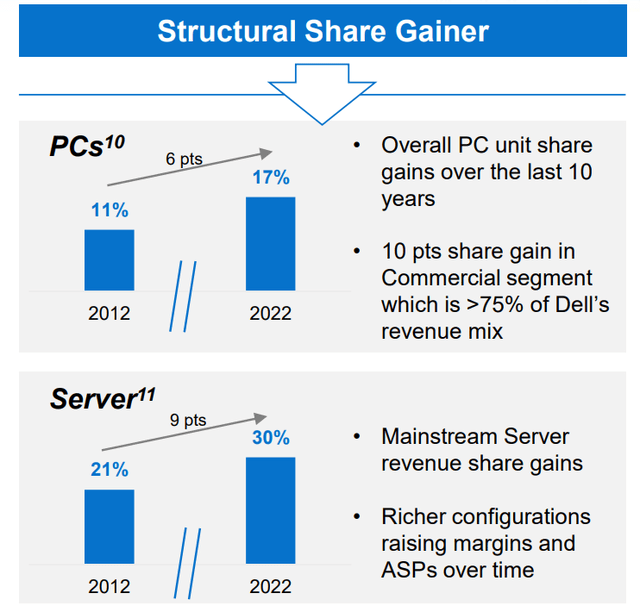

Moreover, over the past 10 years, Dell’s achievements in its core segments are evident. Their total PC market share elevated by 6 factors, transferring from 11% to 17%. Equally, their server market share noticed a big achieve of 9 factors, rising from 21% to 30%. These tendencies underscore Dell’s power and aggressive positioning in these essential areas.

Dell 2023 Investor Presentation

Dell’s Market Dominance and Future Market Share Good points

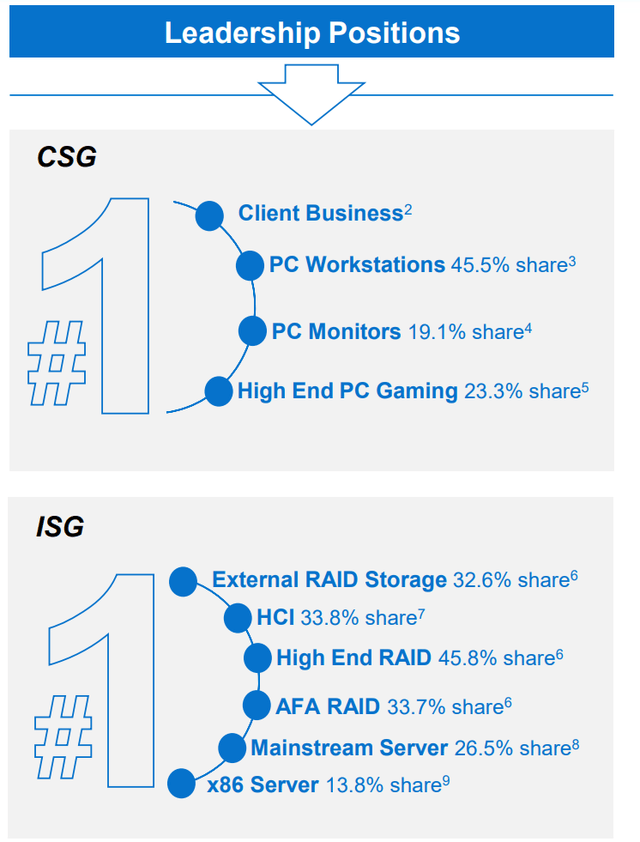

In my view, Dell Applied sciences is a key participant within the tech trade. Their skill to adapt highlights their power in a altering market. Two important segments drive their success: the Consumer Options Group (CSG) and the Infrastructure Options Group (ISG). The CSG focuses on merchandise like desktops and laptops and has a big 45.5% market share in PC workstations. On the opposite aspect, the ISG targets enterprise wants, providing storage, servers, and networking. Notably, Dell has a 25%+ market share in most ISG merchandise, besides the x86 Server. This reveals their constant efficiency within the enterprise sector. Given their strategy to client and enterprise segments and their deal with innovation, I believe Dell is well-placed to capitalize on future alternatives in tech.

Dell 2023 Investor Presentation

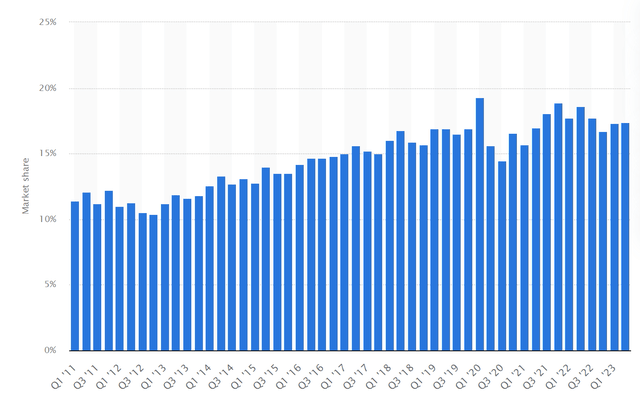

In my view, Dell Applied sciences’ progress within the private laptop (PC) market over the previous decade is noteworthy as seen within the graph below. Ranging from Q1 2011, once they held a unit cargo share of 11.4% worldwide, their constant growth to 17.4% by Q2 2023 speaks volumes about their strategic prowess. This year-on-year progress, to me, showcases Dell’s resilience and adaptableness, particularly in such a aggressive panorama. Furthermore, the rising demand in areas like cloud providers, edge computing, synthetic intelligence, and cybersecurity suggests a promising horizon for Dell. Their energetic engagement in these sectors, in my opinion, displays a proactive and forward-thinking strategy. Contemplating these dynamics and the prevailing market tendencies, I imagine that Dell is on a path to additional success, with a robust potential to reinforce its market share within the coming 5 years.

Statista

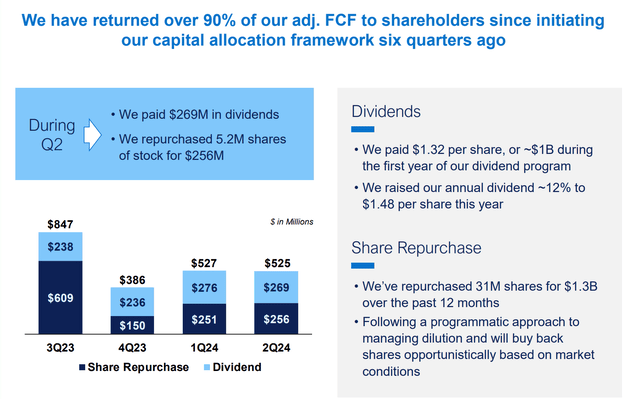

Dell’s Shareholder-Centric Technique

In my opinion, Dell Applied sciences’ capital allocation technique clearly displays its dedication to shareholders. The administration staff emphasizes returning capital, highlighting their shareholder-centric mindset. They’ve dedicated to allocating 90% of the adjusted free money movement again to shareholders, cut up between a dividend program and share buybacks. The dividend program, launched in 2023, returned $1 billion in its first yr. I imagine this dividend has room to develop, particularly with Dell’s expectation of a extra secure free money movement from 2024 onwards. Apart from, the corporate has directed $1.3 billion towards share buybacks. The administration’s inclination to extend buyback depth, particularly once they see the share worth as probably undervalued, additional signifies their proactive strategy. Given the present valuation which shall be elaborated on later on this article, it’s probably an efficient approach of allocating free money movement which shall be optimistic for EPS progress over the subsequent 5 years. General, Dell’s technique appears targeted on enhancing shareholder returns.

Dell 2023 Investor Presentation

Monetary Evaluation

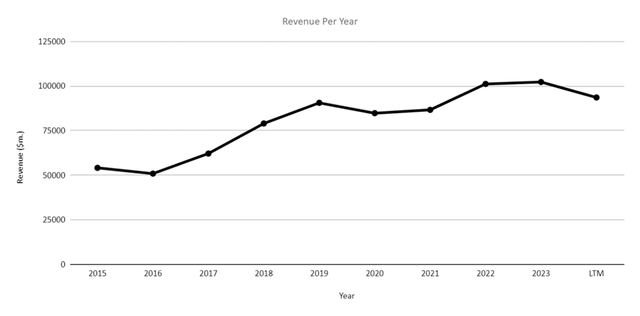

In my evaluation, from 2018 to 2023, Dell has demonstrated secure monetary outcomes. The corporate has achieved a Compound Annual Development Fee (CAGR) for income of roughly 3.5%, with its income escalating from $79,040.00 million in 2018 to $93,616.00 million within the final 12 months. This progress in income is complemented by the enterprise reaching profitability when it comes to Earnings Per Share (EPS), which has superior from -$3.71 in 2018 to $2.58 within the final 12 months, showcasing the corporate’s effectivity in changing income into revenue by bettering margins and scale.

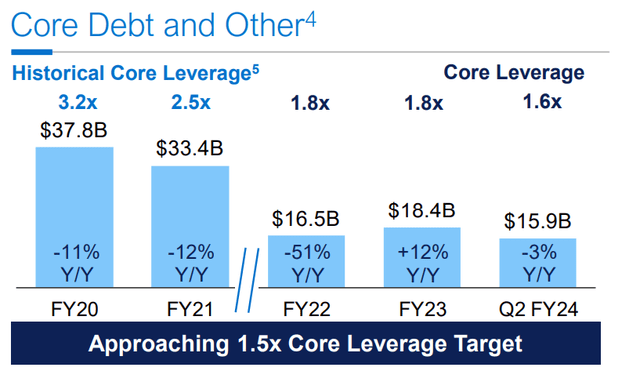

Writer

By way of liquidity, the most recent quarterly figures point out money and money equivalents amounting to $8,364.00 million. The full debt is recorded at $15,952.00, which appears sustainable on condition that the enterprise can repay all debt in lower than three years’ value of free money movement. I imagine that Dell’s administration has been prudent in managing debt, the place over time they’ve lowered the enterprise’ core leverage from 3.2x in 2020 all the way down to 1.8x in 2023, with ambitions of lowering the core leverage all the way down to 1.5x.

Dell 2023 Investor Presentation

Within the brief time period, I anticipate Dell to recuperate to their normalised ranges of free money movement of between $5 billion to $6 billion over the subsequent yr, so long as no critical macro-economic headwinds are confronted. In the long term, I anticipate Dell to develop at roughly 5% per yr based mostly on a rising TAM and anticipated market share positive aspects, pushed partly by cloud providers, edge computing, synthetic intelligence, and cybersecurity.

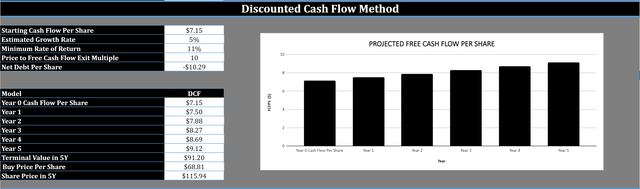

Valuation

I imagine {that a} correct valuation ought to contain contrasting the market capitalization with the elemental features of the underlying enterprise, together with potential earnings. A reduced money movement evaluation is a technique I usually make use of for such evaluations. As of the most recent quarter, the current TTM Money movement per Share for Dell is $7.15. Contemplating the explanation for progress beforehand mentioned, I foresee Dell’s Money movement per Share experiencing a modest annual progress fee of 5% within the coming 5 years. With this progress projection, the anticipated Money movement per Share for Dell in 5 years is $9.12.

By making use of an exit a number of of 10, derived from what’s estimated to be a conservative exit a number of given the anticipated progress fee and Dell’s historic P/E ratio, the projected inventory worth goal in 5 years is estimated to be $115.94. Therefore, buying Dell shares on the current share worth of $67.00 would result in an anticipated Compound Annual Development Fee of 11% over the next 5 years.

Writer

Subsequently, if you’re glad with an 11% annual return over the subsequent 5 years, then you could wish to take into account this inventory as a possible purchase.

Conclusion

In my view, Dell Applied sciences has navigated effectively within the tech sector, particularly in PCs and servers. Their progress is clear, and so they’re positioned in key tech areas. I worth Dell’s deal with shareholders by way of dividends and buybacks. A DCF evaluation suggests a possible 11% annual return on Dell’s inventory over the subsequent 5 years. With a rising Complete Addressable Market and certain market share positive aspects from areas like cloud providers, edge computing, synthetic intelligence, and cybersecurity, I imagine Dell presents alternative for buyers.

Editor’s Word: This text discusses a number of securities that don’t commerce on a serious U.S. trade. Please pay attention to the dangers related to these shares.