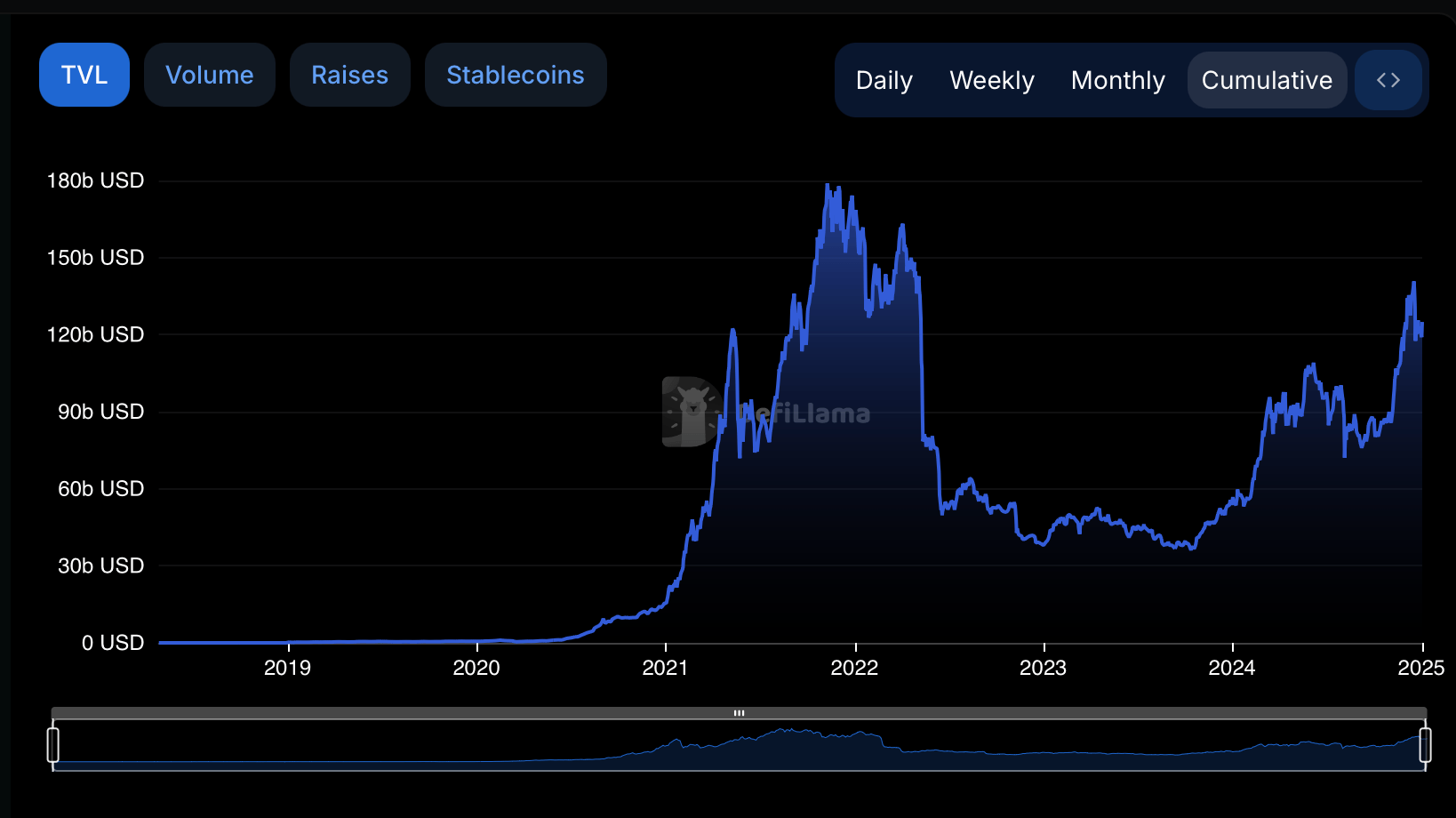

Yr-end information reveals an thrilling enhance within the whole worth captured in decentralized finance (defi), which is up 133.8% over the previous yr. December capped off this thrilling development with a flurry of exercise, as defi and onchain protocols generated greater than $1.5 billion in whole income over the previous 30 days, as reported by Defillama.

The overall worth of Defi will enhance by greater than 130% by 2024

Defillama, a number one analytics hub and information collector for the defi sector, revealed that stablecoin issuers topped the income charts over the previous 30 days, raking in $664.12 million. This replace was shared by Defillama on January 2, 2025, as the corporate famous:

Defi and onchain protocols have amassed a complete of over $1.5 billion in income over the previous 30 days. Of this, greater than 80% went to Stablecoin Issuers, Chains, Dexes, Telegram Bots and Launchpads. Stablecoin Issuers alone accounted for 43.7% of income.

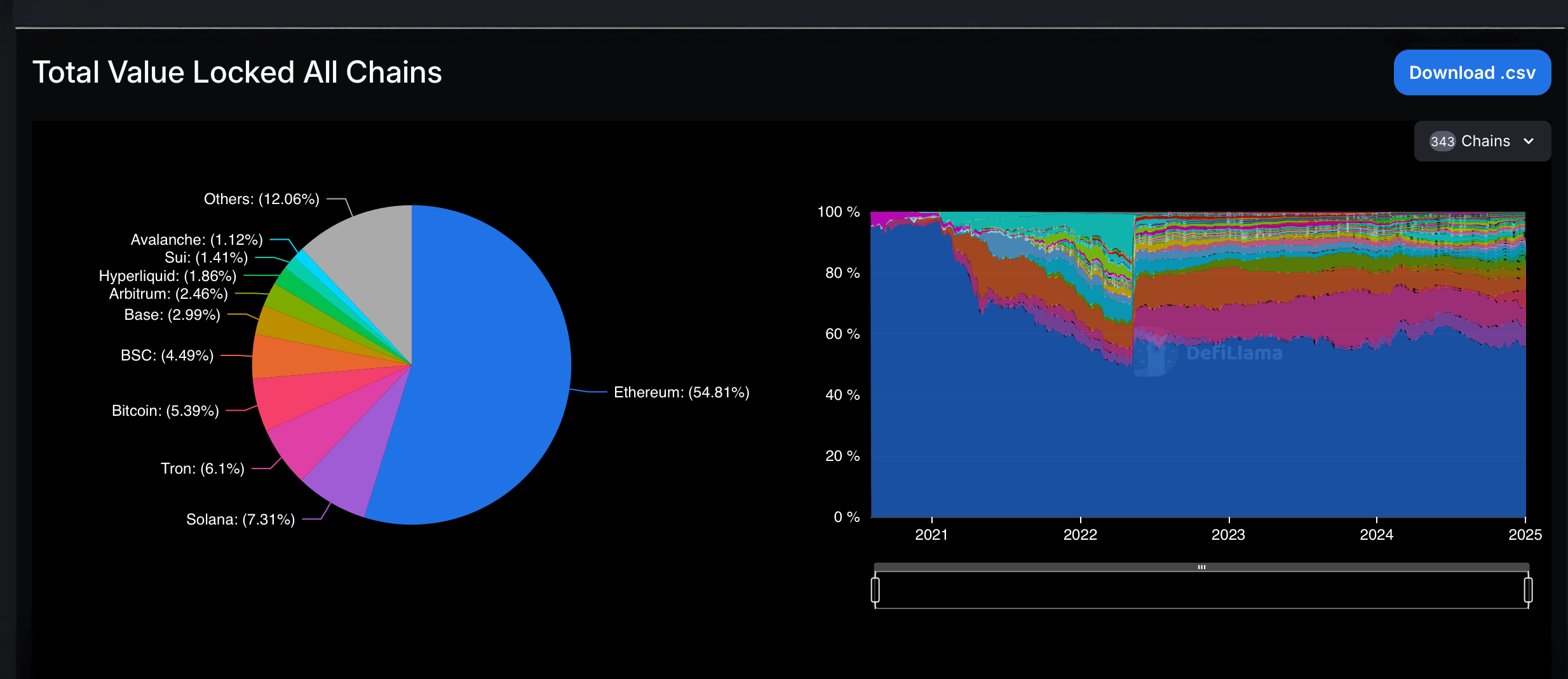

Defi noticed dynamic growth in 2024, with whole worth locked (TVL) rising 133.8% from $53.369 billion to a hefty $124.773 billion. Within the first week of January 2024, liquid strike chief Lido had a TVL of roughly $21.33 billion. Quick ahead to right this moment, January 2, 2025, and that determine has risen to $33.573 billion. Alongside this development in TVL, there was a notable realignment of key defi protocols.

On the time, TVL’s heavyweight champions have been Lido, Makerdao (now renamed Sky), Aave, Justlend and Uniswap. As of January 2025, the leaders are Lido, Aave, Eigenlayer, Ether.fi and Binance’s Staked Ether protocol.

Sky, as soon as second, has now fallen to tenth place. As of right this moment, in 2025, Ethereum holds a dominant 54.82% of the TVL in defi, whereas Solana holds 7.34% and Tron 6.09%. Bitcoin is in fourth place, securing 4.5% and a worth of $6.669 billion.

As 2025 begins, the decentralized finance panorama will not be solely celebrating a exceptional yr of development in 2024, but in addition positioning itself for future improvements. With TVL hovering and earnings reaching new heights in December, defi continues to evolve, reshaping monetary ecosystems worldwide.

This dynamic shift indicators a maturing market, poised to welcome broader adoption and deeper integration throughout industries within the coming years.