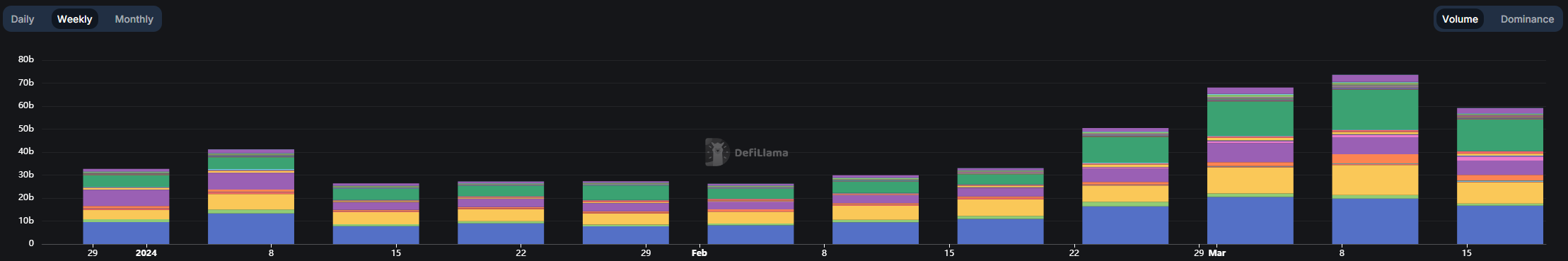

In line with DefiLlama’s, the weekly buying and selling quantity of the decentralized exchanges (DEX) has fallen by 24.5% over the previous seven days. facts. Among the many high 10 blockchains by quantity traded, Polygon’s 40% decline was the worst, intently adopted by Avalanche’s 39.5% decline.

Even the favourite meme coin chain Solana didn’t escape the drop in weekly buying and selling volumes, with a big drop of 20%. Base, however, rose greater than 64% over the identical interval, pushed by its personal ‘meme coin mania’. Starknet additionally noticed optimistic weekly variation, with 28% extra exercise in its DEXes.

Tristan Frizza, founding father of the decentralized platform Zeta Markets, identified that this detrimental motion in buying and selling volumes could possibly be associated to final week’s value drop.

“Usually, such market pullbacks disproportionately impression memecoins and altcoins, finally resulting in a big discount in buying and selling exercise for these kinds of cryptos. This phenomenon could be seen as widespread market habits, the place traders start to withdraw from extra speculative belongings, leading to diminished buying and selling volumes for these cash,” Frizza explains.

Moreover, this transfer could possibly be a wholesome adjustment to the market euphoria, because the weekly buying and selling quantity of $73.6 billion seen from March 9 to fifteen was the best weekly quantity ever recorded on the chain.