In November, the decentralized finance sector (DeFi) share of the cryptocurrency market rose 18% in comparison with the earlier month.

November additionally went inexperienced for non-fungible tokens (NFTs). Based on the newest report from Binance Analysis, buying and selling volumes have just lately elevated by 200%.

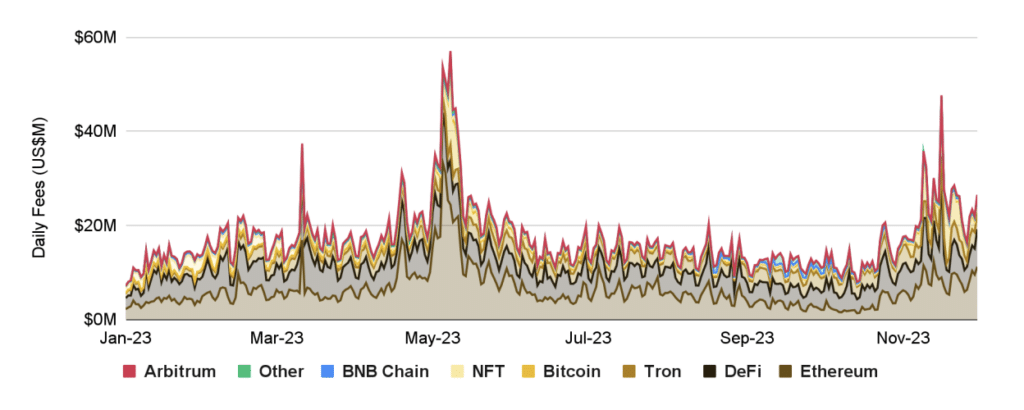

Analysts famous that charges remained regular from 3.8% to 4.1% all year long. Nonetheless, in November it began to overgrow. Through the month, the DeFi sector’s inventory rose 18% to shut at 4.44%. The primary drivers of serious progress had been THORChain, PancakeSwap, Uniswap and Synthetix.

Moreover, worth locked (TVL) in DeFi protocols has elevated 25% because the begin of 2023, with a 14% improve in November alone. All year long, this determine was $45 to $50 billion. Given the newest dynamics, we are able to count on a breach of the $50 billion mark.

You may additionally like: Altcoin Market on Brink of Parabolic Development, Analyst Predicts

The dominant blockchain within the DeFi area stays Ethereum (ETH), accounting for over 56% of the full TVL. In second place is Tron (TRX), with a 16% share, and in third place is BNB Chain (BNB) with a 6% share.

Supply: Binance analysis

The most important class this 12 months was liquid staking, which amounted to $27 billion. Nearly the whole quantity declared got here from the Lido Finance protocol – $20 billion. Analysts famous that the Shanghai replace enabled progress.

Together with the sharp rise within the BTC worth in current weeks, there has additionally been a pointy rise in the whole cryptocurrency market. So if in the beginning of November the market capitalization of the crypto market was solely $1.28 trillion, by the top of final month it was already $1.43 trillion. Moreover, the market capitalization of the cryptocurrency sector surpassed $1.6 trillion in December.

You may additionally like: Tether’s market cap reaches a brand new milestone of $90 billion