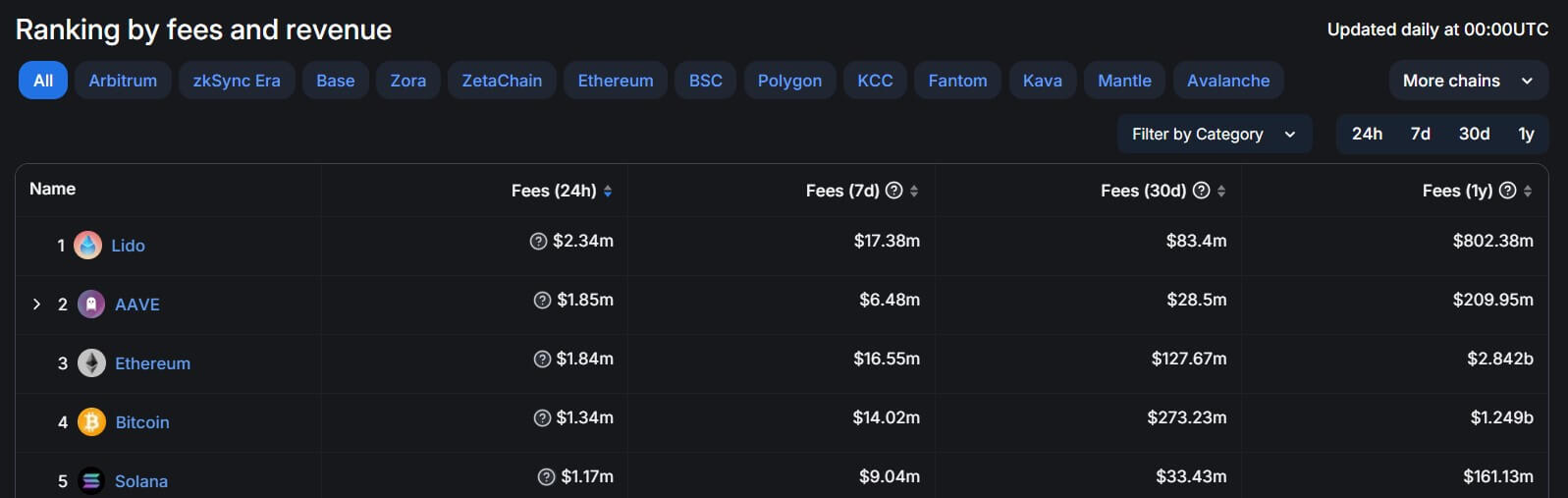

Decentralized finance initiatives Lido and Aave generated extra charges up to now 24 hours than prime blockchain networks corresponding to Bitcoin, Ethereum and Solana.

In keeping with DeFillama knowledge, Lido earned $2.34 million through the interval, whereas Aave earned $1.85 million. Ethereum, Bitcoin, and Solana, alternatively, have raked in $1.84 million, $1.34 million, and $1.17 million in charges, respectively.

Market observers defined that the rise in charges displays the willingness of crypto customers to have interaction with these platforms by conventional blockchain networks.

Why do individuals use Aave?

The Financial institution for Worldwide Settlement (BIS) defined that crypto buyers are utilizing DeFi lending swimming pools like Aave to earn returns.

BIS said:

“This impact is especially robust for retail customers and is bolstered by the ‘low-for-long’ rate of interest atmosphere in superior economies.”

Given its substantial adoption, Aave Labs, the entity behind the DeFi lending platform, lately unveiled a 2030 strategic roadmap that introduces a number of key initiatives, together with the launch of Aave V4, a brand new visible identification, and expanded DeFi functionalities.

In the meantime, Marc Zeller, founding father of the Aave Chan Initiative, lately prompt that the protocol is gearing as much as make a payment change to encourage engagement and funding in its ecosystem.

This function basically permits platforms to activate or deactivate sure person charges. Within the case of Aave, this might result in the redistribution of charges ensuing from transactions to platform contributors, particularly Aave holders and stakers.

Information from DeFiLlama reveals that Aave is the biggest lending protocol, with greater than $10 billion in escrow belongings.

The dominance of Lido

Lido is a decentralized autonomous group (DAO) that gives a liquid staking resolution for numerous proof-of-stake blockchain networks, corresponding to Ethereum.

The protocol permits customers to pool and stake their belongings on these blockchain networks to earn as much as 3% APR rewards. Lido accounts for about 28.5% of Ethereum stakes, making it the biggest DeFi protocol. In keeping with knowledge from DeFillama, its complete worth is roughly $28 billion.

In the meantime, Lido’s market dominance is underneath heavy competitors from the brand new revival idea led by EigenLayer.