Decentralized operations account for many of the block area on L2 chains. Almost all rollup platforms grew in 2024, getting the most important enhance from DEX buying and selling and lending. Different actions take up lower than 5% of the block area on some chains.

DeFi and L2 chains proved to be a superb slot in 2024, as DEX buying and selling and lending turned the principle drivers of exercise on these networks. The crypto panorama in 2024 additionally included stablecoins that served as the principle supply of liquidity on L2.

Mantle reserves over 57% of block area for DeFi actions. Base has the second largest share of DeFi exercise, primarily associated to the creation of meme tokens and the launch of small-scale liquidity pairs. Greater than 43% of the area in Base’s chain is occupied by a majority of these L2 transfers.

DeFi additionally underlines the necessity for worth transfers from Ethereum, which led to a web influx of $1 billion into giant L2 ecosystems.

After the previous few weeks of market restoration, the worth of DeFi throughout all chains as soon as once more surpassed $103 billion. Ethereum nonetheless has the biggest share with nearly $60 billion. L2 chains compete with Solana, TRON and BSC for a share of the enterprise. Nevertheless, Ethereum’s dominance is the principle driver of liquidity and site visitors to the present number of L2s.

The opposite driving drive behind L2’s success is the apps themselves, particularly Uniswap and Aave, which have proven their capacity to draw retailers and worth.

Most L2 chains stay fragmented

Of the L2 chains, Polygon stays essentially the most used for cross-chain actions. Polygon was a pioneer and maintains shut ties to Ethereum, by extra liquid bridges.

Polygon additionally carries bridges with connections to a number of different chains, locking as much as $63 million in money. Bridging will not be a heavy-traffic exercise as most bridged or wrapped property stay within the new chain. The bridge again to the unique chain can also be typically difficult or restricted.

Arbitrum stays the busiest L2 chain by way of bridging. Whereas Arbitrum leads the pack on this class, on-chain knowledge reveals that solely about 819 wallets are bridging property per week. Every single day, underneath 150 bridge wallets are lively and shifting under 400 ETH.

Optimism, Zora and Scroll are additionally amongst chains with roughly 10% in bridging actions. Nevertheless, L2s don’t fulfill Vitalik Buterin’s imaginative and prescient as a result of they don’t seem to be solely appropriate with Ethereum, but in addition with one another.

Questions stay in regards to the acceptable use of L2 chains

In 2024, L2s have been all about fast progress, excessive transaction volumes, and worth inflows. In some use circumstances, L2s have efficiently scaled Ethereum and moved site visitors to a less expensive, quicker tier.

L2 chains additionally turned to enterprise fashions to draw the eye of enterprise capital backers or produce a viable signal for short-term market success.

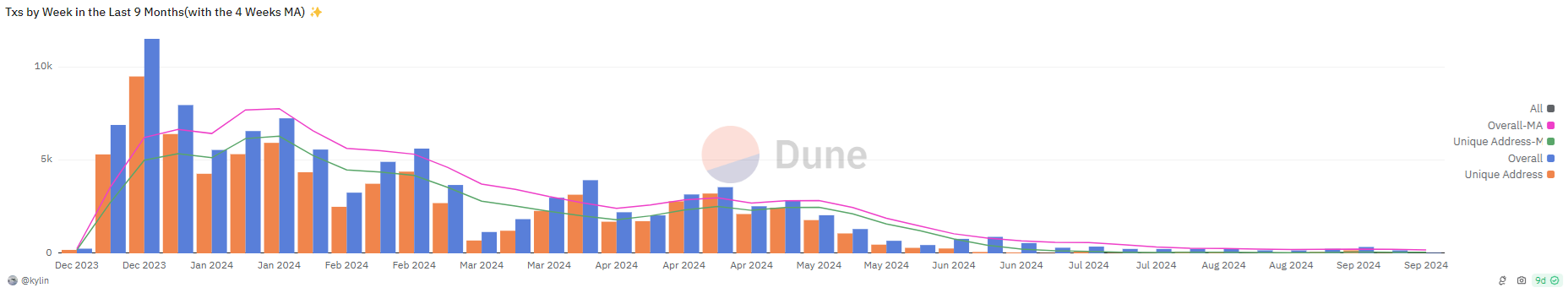

One of many greatest issues for L2 chains is the fast decline in volumes shortly after launch. The airdrop incentive mannequin typically drives builders to flock to early-stage L2 even throughout the testnet interval.

ZKSync transactions slowed down after airdrop incentives ended. | Supply: Dune Analytics

Shortly after the launch of the principle community, these customers are already flocking to new chains, rising the variety of transactions at their new vacation spot. All actions are targeted on one objective: receiving a larger share of airdrops. After just a few months, site visitors on new L2 chains slows right down to zero.

L2 chains might have fat-fee apps and liquidity hubs to thank for his or her survival and for sustaining exercise ranges, which collectively present passive returns or buying and selling. Even with early incentives, this meant that the primary technology of large-scale L2 platforms managed to outlive and develop their liquidity and consumer base.

L2 as a narrative confirmed indicators of overhyping, however present chains are internet hosting actual exercise, with a doubtlessly bullish impact for Ethereum.

L2 chains additionally supply their very own distinct focus and tradition, typically defining the commonest forms of apps. Chains like Linea host outrageous SocialFi exercise, making this a staple. The chain can also be the principle host for NFT exercise. Arbitrum is commonly chosen for gaming, whereas Base is the go-to chain for fast DEX exercise and a launch pad for meme cash.

L2s stay very lively, however haven’t but reached the bounds of the Ethereum blocks. Most chains managed to strike a stability and make a web revenue even after paying all of the L1 charges for utilizing Ethereum. Taiko stays the one main L2 working on one loss because of the high-frequency interactions with Ethereum blocks.

Cryptopolitan reporting by Hristina Vasileva.