Decentralized Finance (DeFi) is on the forefront of a monetary revolution, making a paradigm the place good contracts and decentralized functions change conventional monetary intermediaries. However innovation comes with scrutiny, and these entities are actually dealing with a brand new wave of regulatory scrutiny in the USA.

The US regulatory surroundings, marked by a sequence of actions by the Commodity Futures Buying and selling Fee (CFTC) and the Securities and Change Fee (SEC), emphasizes a stringent stance that pushes DeFi entities in direction of compliance and operational transparency

Has DeFi change into unlawful within the US?

Web3 authorized strategist Jose Bencomo likened the present regulatory surroundings within the US to “traversing a area filled with landmines.” The CFTC’s latest actions towards DeFi entities similar to Opyn, ZeroEx, and Deridex underscore a tricky stance on regulatory compliance and operational transparency.

These actions and the shortage of clear pointers pose a risk to innovation. They may additionally deter new entrants into this rising sector, signaling a extra aggressive regulatory method. Moreover, the SEC has warned of extra authorized motion towards centralized exchanges and DeFi platforms, underscoring the seriousness of compliance.

“The latest regulatory actions point out seemingly consolidation within the trade as smaller protocols battle with compliance, however might additionally pave the way in which for a extra mature, compliant DeFi ecosystem. The long-term reverberations stay obscured, however the substantial influence so far is simple, creating a sturdy dialogue that can seemingly proceed for the foreseeable future,” Bencomo informed BeInCrypto.

Amid this hostile regulatory surroundings, DeFi and Web3 corporations are being urged to ascertain roots outdoors the US. Like Coinbase, Ripple and different corporations, they need to faucet worldwide markets as U.S. rules evolve to outlive.

Learn extra: Prime 5 DeFi Lending Platforms

Bencomo additionally beneficial that DeFi protocols be aligned with US compliance requirements, just like these of conventional monetary entities. That’s the reason we concentrate on anti-money laundering (AML) and Know Your Buyer (KYC) rules.

This place, complemented by limiting US residents’ entry to their platforms, might present a prudent buffer towards potential monetary setbacks ensuing from non-compliance.

“Establishing a sturdy compliance blueprint is crucial, significantly detailing the steps in direction of regulatory registration and buyer identification. The subsequent step entails the precise rollout of this plan, together with establishing KYC and AML frameworks, deploying transaction monitoring mechanisms and appointing a compliance custodian. Periodically reviewing and fine-tuning these compliance protocols, in sync with regulatory updates, is important to sustaining compliance integrity,” Bencomo stated.

Crypto regulation at work

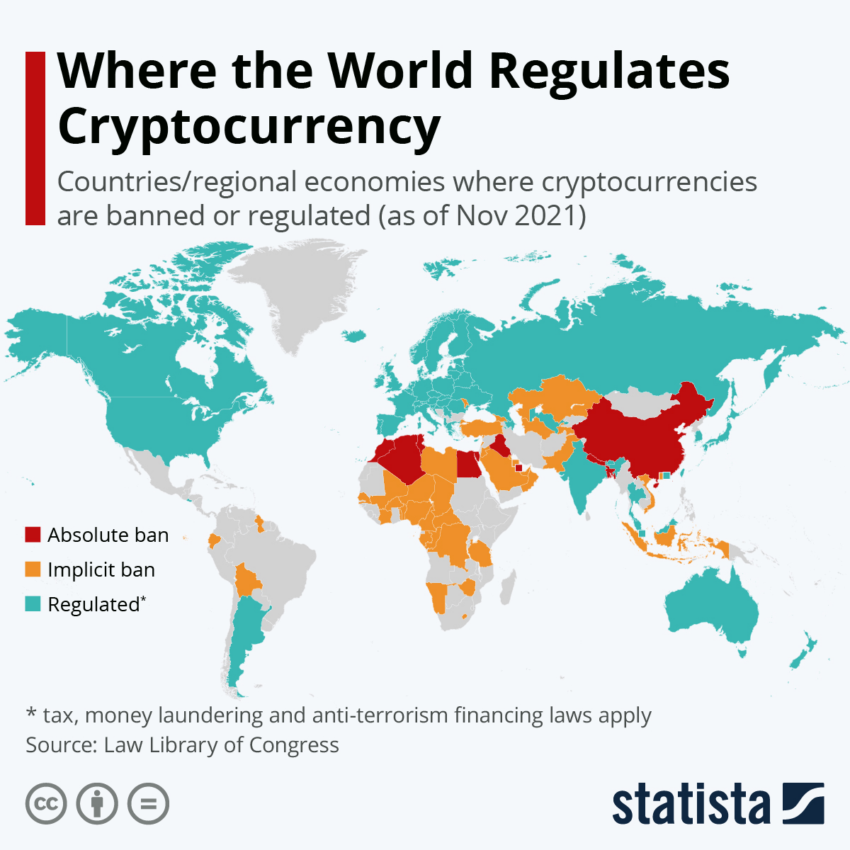

On a worldwide degree, the regulatory surroundings in direction of DeFi within the US stands in stark distinction to the extra progressive attitudes in areas such because the EU, Singapore and the UK. There, regulators are creating regulatory frameworks to advertise DeFi improvements.

In distinction to the US’s cautious method, these areas are selling the expansion of DeFi via regulatory sandboxes and frameworks for crypto belongings. Such a distinction underlines the necessity for the US to adapt to altering paradigms to stay globally aggressive.

“US regulators can achieve useful insights from the balanced regulatory approaches being carried out globally. Key classes embody selling an enabling surroundings for innovation and guaranteeing shopper and investor safety. Organising regulatory sandboxes that allow a managed surroundings for testing new DeFi merchandise offers regulators with a greater understanding of the know-how and its implications. Moreover, a collaborative method, by working with DeFi entities within the regulatory course of, can result in the event of honest, sensible rules that meet trade progress and consumer safety,” Bencomo emphasised.

Learn extra: Crypto regulation: what are the professionals and cons?

Moreover, know-how options similar to verifiable credentials (VCs) and zero-knowledge proofs (ZKPs) are heralded as crucial instruments in aligning with regulatory necessities whereas preserving consumer privateness.

VCs present a digital illustration of private credentials, facilitating compliance with KYC and AML pointers with out direct entry to private knowledge. Equally, ZKPs present a cryptographic option to validate possession of knowledge with out revealing the knowledge itself, which is instrumental in age verification with out disclosing date of delivery.

“Whereas the trade-off between decentralization and permissioned constructs is palpable, with potential dangers of censorship, the overarching advantages of regulatory alignment, cultivating belief, and enabling customers typically outweigh the decentralization trade-off for a lot of DeFi entities. Because the DeFi panorama matures, the emergence of extra permissioned designs is anticipated given their instrumental position in reconciling the decentralized nature of DeFi with regulatory compliance, creating an enabling surroundings for DeFi progress and adoption ,” stated Bencomo.

Trying forward, the steadiness between innovation in DeFi and regulatory compliance depends upon a synergy of training, collaboration and compromise. Bencomo emphasised the significance of a collaborative ethos the place regulators and DeFi corporations work collectively to create honest, workable rules.

Organising regulatory sandboxes can present a managed testing floor for brand spanking new DeFi services and products. This might help regulators perceive the potential and dangers of DeFi.

“By adopting a studying mindset, staying abreast of DeFi developments and being open to adapting rules in response to the quickly evolving panorama, US regulators can create a regulatory framework that’s each innovation-friendly and efficient is in defending the pursuits of stakeholders, and guaranteeing that the US continues to play a crucial position within the international blockchain and DeFi area,” stated Bencomo.

Collectively for the expansion of Web3

Forming trade associations might additionally resolve the strain between DeFi innovation and regulatory compliance. In accordance with Bencomo, these DeFi associations can act as a channel to characterize their pursuits and interact with regulators on honest regulatory frameworks.

Common dialogues between the 2 sides can promote belief and understanding and determine alternatives for regulatory enchancment.

“Working with regulators and initiating dialogues to make clear your actions and the potential of the DeFi sector is invaluable. Leverage authorized experience with an understanding of fintech and DeFi rules and set up strong compliance procedures similar to KYC and AML processes. Preserve operational transparency and keep detailed, auditable data to construct belief with regulators and customers. A radical danger evaluation together with insurance coverage can restrict monetary dangers,” concludes Bencomo.

In mild of regulatory challenges and potential compliance measures, the evolution of DeFi corporations is at an important juncture. Integrating technological improvements, lively engagement with regulators, and a willingness to adapt to altering regulatory mandates are important to navigating this advanced terrain.

A considered steadiness between regulatory compliance and selling innovation can domesticate a good ecosystem for DeFi progress. This may guarantee stakeholder safety and propel the US to the forefront of the worldwide DeFi story.