The decentralized finance (DeFi) ecosystem is present process a shift towards extra rational investments and extra mature belief, in line with Exponential.fi’s final report “The start of a brand new period in DeFi: from winter chills to summer time thrills.” Because the ‘DeFi Winter’ weakens its grip, the report states that the trail forward will probably be a ‘scorching bull summer time’.

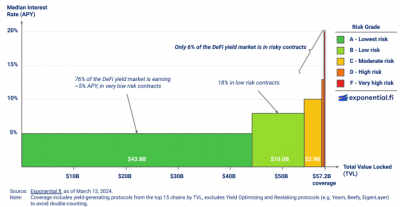

Buyers at the moment are displaying a transparent desire for security, with a big 75% of the overall worth of DeFi (TVL) flowing into swimming pools that supply modest annual returns (APY) of as much as 5%. This conservative shift is particularly noticeable in Ethereum’s stake swimming pools and highlights a broader pattern: the shift from the pursuit of returns to a need for predictability and safety.

Protocols like Lido have gotten the usual for a lot of, underscoring the desire for established platforms over speculative ventures.

Optimism and confidence

The report exhibits that DeFi’s TVL progress trajectory in return-generating protocols elevated by greater than 125% between the third quarter of 2023 and the primary quarter of 2024, from $26.5 billion to $59.7 billion. “This revival indicators a return of confidence and liquidity to the DeFi markets,” Exponential.fi analysts stated.

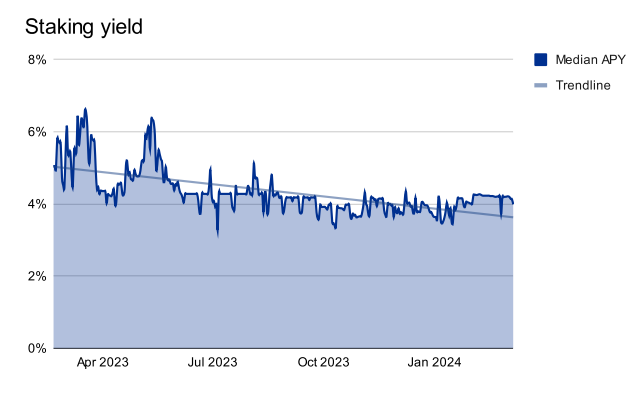

Moreover, the character of DeFi protocols’ technique of producing yield is evolving. The market is steadily turning to riskier ventures resembling staking and secured lending, whereas curiosity in advanced sectors resembling insurance coverage and derivatives seems to be waning.

Ethereum’s shift to a Proof-of-Stake mannequin after ‘The Merge’ was additionally a game-changer for DeFi. Staking has grow to be a basic component and is attracting an rising share of DeFi’s TVL. The introduction of resumption by way of platforms resembling EigenLayer additional pushes the boundaries and affords greater returns by means of further community safety, however with further danger.

One other widespread sector of the decentralized finance ecosystem in latest months is lending. Pushed by a collective urge for food for danger and better returns, improvements abound within the sector, with platforms like Ethena providing engaging returns by means of a mixture of staking and futures contracts. The arrival of remoted markets improves the safety of the platform and encourages extra customers to make the most of DeFi lending with out concern of dropping their collateral.

The market can also be on the lookout for new methods to resolve outdated pains, such because the challenges of impermanent loss, particularly the devaluation of a token locked in a liquidity pool. Advances in DeFi are paving the way in which for extra environment friendly use of capital, with the introduction of concentrated liquidity fashions and the rising recognition of secure swimming pools indicating the business is discovering methods to mitigate danger and adapt to the evolving market panorama.

Interoperability by means of cross-chain options additionally noticed developments, the report exhibits. The rise of Layer-2 blockchains and a transfer towards safer and environment friendly bridging fashions are fueling progress within the bridging business, filling the gaps between networks and facilitating smoother transactions throughout the blockchain panorama.

The report concludes by stating that the shift from rewards-based returns to returns pushed by precise on-chain actions marks a mature DeFi market, displaying evolving sophistication.