Leon Neal

Protection shares have been among the many prime 5 gainers, whereas airline shares dipped following Hamas’ assault on Israel final weekend.

The Industrial Choose Sector (XLI) rose +0.96% for the week ending Oct. 13, whereas the SPDR S&P 500 Belief ETF (SPY) ticked +0.46% greater. 12 months-to-date, or YTD, XLI has gained +3.60%, whereas SPY has climbed +12.83%.

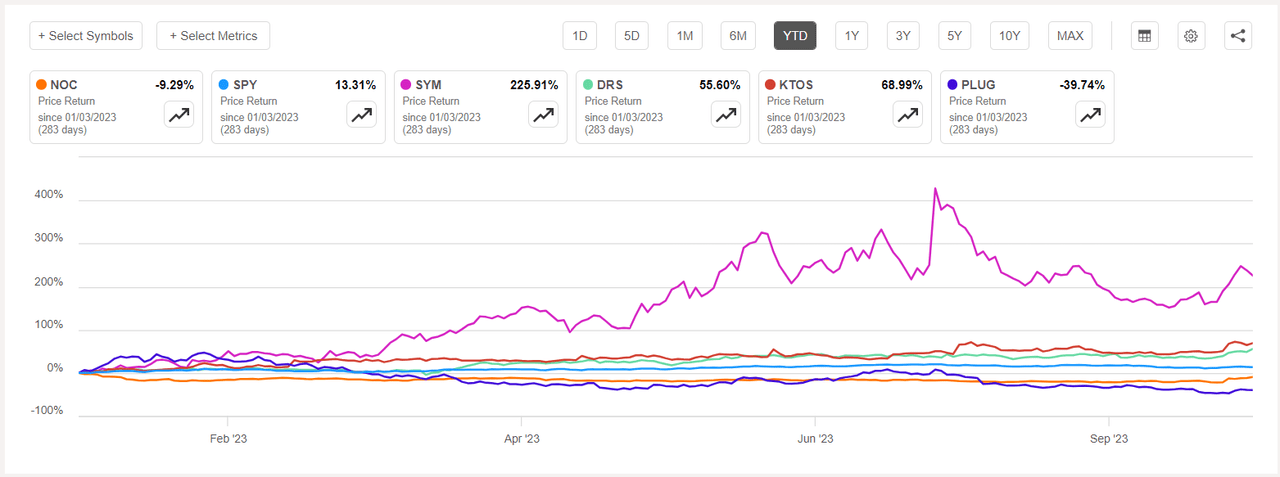

The highest 5 gainers within the industrial sector (shares with a market cap of over $2B) all gained greater than +11% every this week. YTD, 3 out of those 5 shares are within the inexperienced.

Northrop Grumman (NYSE:NOC) +15.81%. The Falls Church, Va.-based drone maker’s inventory jumped +11.43% on Monday to guide good points in aerospace and protection corporations following Hamas’ assault on Israel on Oct. 7.

Northrop has a SA Quant Score — which takes into consideration components equivalent to Momentum, Profitability, and Valuation amongst others — of Maintain. The inventory has an element grade A for Profitability however F for Progress. The typical Wall Road Analysts’ Score differs and has a Purchase score, whereby 8 out of 23 analysts tag the inventory as Robust Purchase. YTD, -10.16%.

Symbotic (SYM) +12.53%. The corporate, which provides warehouse automation programs, has been seeing good points once more previously few weeks after having witnessed slowdown within the earlier weeks of September and August. YTD, the shares have soared +228.64%, essentially the most amongst this week’s prime 5 gainers for this era.

The SA Quant Score on SYM is Maintain with rating of A+ for Momentum and F for Valuation. The typical Wall Road Analysts’ Score has a extra constructive view with a Purchase score, whereby 8 out of 13 analysts see the inventory as Robust Purchase.

The chart beneath exhibits YTD price-return efficiency of the highest 5 gainers and SPY:

Leonardo DRS (DRS) +12.04%. The Arlington, Va.-based protection digital system maker’s inventory additionally rose on Monday (+5.63%). YTD, the shares have gained +47.81%. DRS has a mean Wall Road Analysts’ Score of Robust Purchase, whereby 4 out of 5 analysts view the inventory as such.

Kratos Protection & Safety Options (KTOS) +12.03%. The San Diego-based firm was one other protection inventory which made it to the highest 5 gainers after having surged on Monday (+11.10%). YTD, the shares have risen +64.24%.

The SA Quant Score on KTOS is Maintain, whereas the common Wall Road Analysts’ Score is Purchase.

Plug Energy (PLUG) +11.04%. Shares of the corporate bought a lift on Tuesday (+11.70%) after noting in an investor presentation that it expects to generate ~$6B in revenues by 2027 and $20B by 2030. PLUG has an SA Quant Score of Promote, which in distinction to the common Wall Road Analysts’ Score of Purchase. YTD, the inventory has tumbled -40.66%, themost amongst this week’ prime 5 gainers for this era.

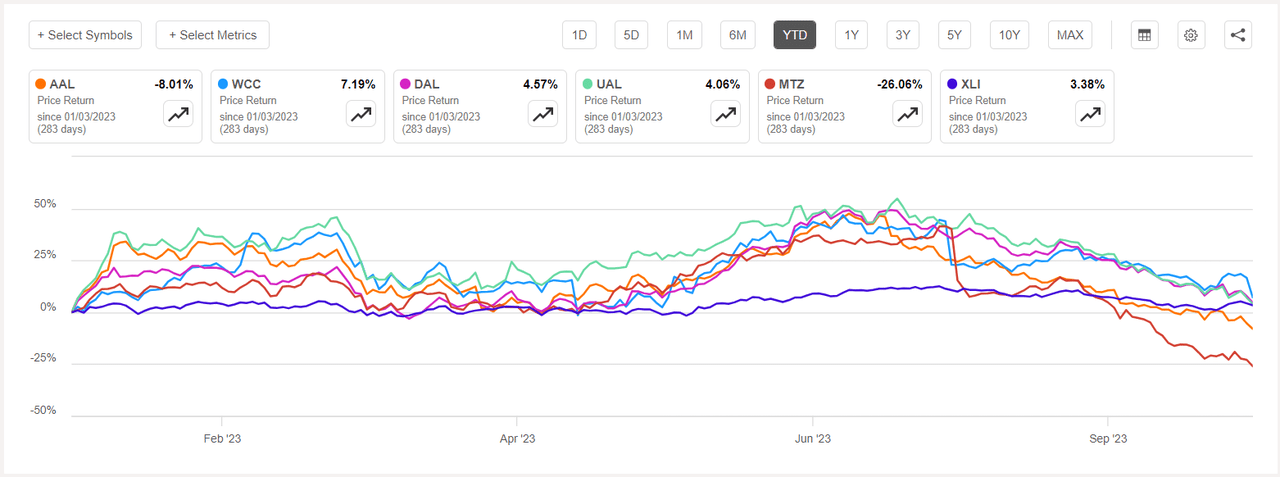

This week’s prime 5 decliners amongst industrial shares (market cap of over $2B) all misplaced greater than -7% every. YTD, 2 out of those 5 shares are within the crimson.

American Airways (NASDAQ:AAL) -8.15%. Fort Price, Texas-based firm was among the many airways which suspended direct flights to Israel following the advisories from the U.S. and Israel. The corporate, reportedly, has suspended flights to the countrry via Dec. 4. Airline monitoring knowledge indicated that worldwide flights to Israel have been down about 90% from the extent it have been the earlier week. YTD, -7.86%.

The SA Quant Score on AAL is Maintain with an element grade of A for Profitability and D for Momentum. The typical Wall Road Analysts’ Score agrees with a Maintain score of its personal, whereby 14 out of 21 analysts view the inventory as such.

WESCO Worldwide (WCC) -8.15%. The business-to-business distribution and logistics companies’ supplier noticed its inventory fall essentially the most on Friday -8.06%. The SA Quant Score on WCC is Maintain with rating of A+ for Progress and B- for Valuation. The typical Wall Road Analysts’ Score has a very completely different view with a Robust Purchase score, whereby 8 out of 12 analysts tag the inventory as such. YTD, +6.79%.

The chart beneath exhibits YTD price-return efficiency of the worst 5 decliners and XLI:

Delta Air Traces (DAL) -7.84%. The shares dipped essentially the most on Monday (-4.65%) amid the warfare in Israel. The corporate famous that it could not fly to Israel via the tip of October. Delta additionally reported its Q3 outcomes beating estimates.

The SA Quant Score on DAL is Purchase with rating of A+ for Profitability and A for Progress. The typical Wall Road Analysts’ Score is extra constructive with a Robust Purchase score, whereby 14 out of 20 analysts tag the inventory as such. YTD, +3.77%.

United Airways (UAL) -7.41%. The Chicago-based airline, which noticed its inventory fell -4.88% on Monday, reportedly, has indefinitely suspended flights to Israel. YTD, +2.71%. The SA Quant Score on UAL is Maintain, whereas the common Wall Road Analysts’ Score is Purchase.

MasTec (MTZ) -7.40%. The infrastructure development firm was upgraded to Purchase at Craig-Hallum Capital but it surely didn’t assist increase the inventory. YTD, the shares have declined -25.24%, essentially the most amongst this week’s worst 5 performers for this era.

The SA Quant Score on MTZ is Promote. Extra on MTZ – Warning: MTZ is at excessive danger of performing badly. The typical Wall Road Analysts’ Score differs fully with a Robust Purchase score.

Pricey Readers: We acknowledge that politics typically intersects with the monetary information of the day, so we invite you to click on right here to hitch the separate political dialogue.