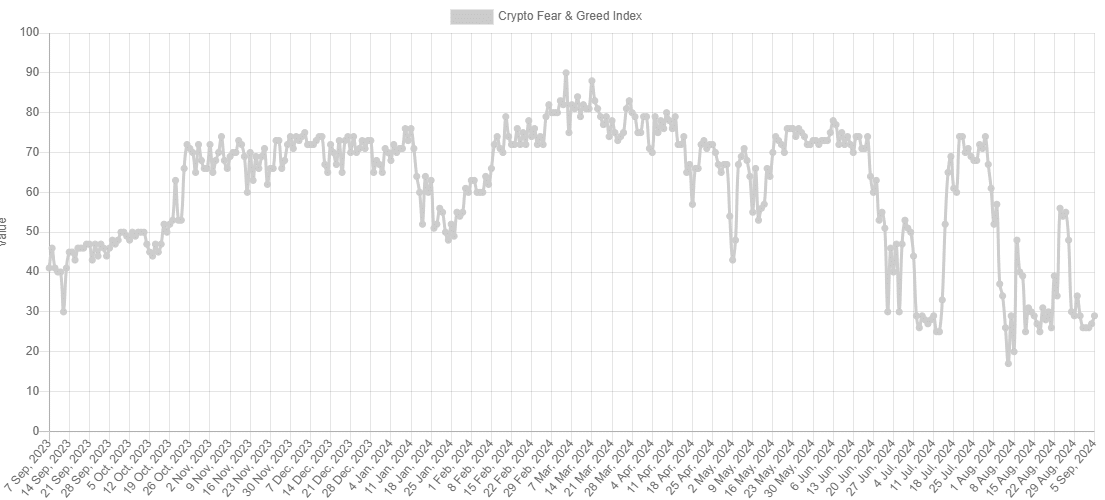

- The Worry and Greed Index reached lows not seen in a 12 months.

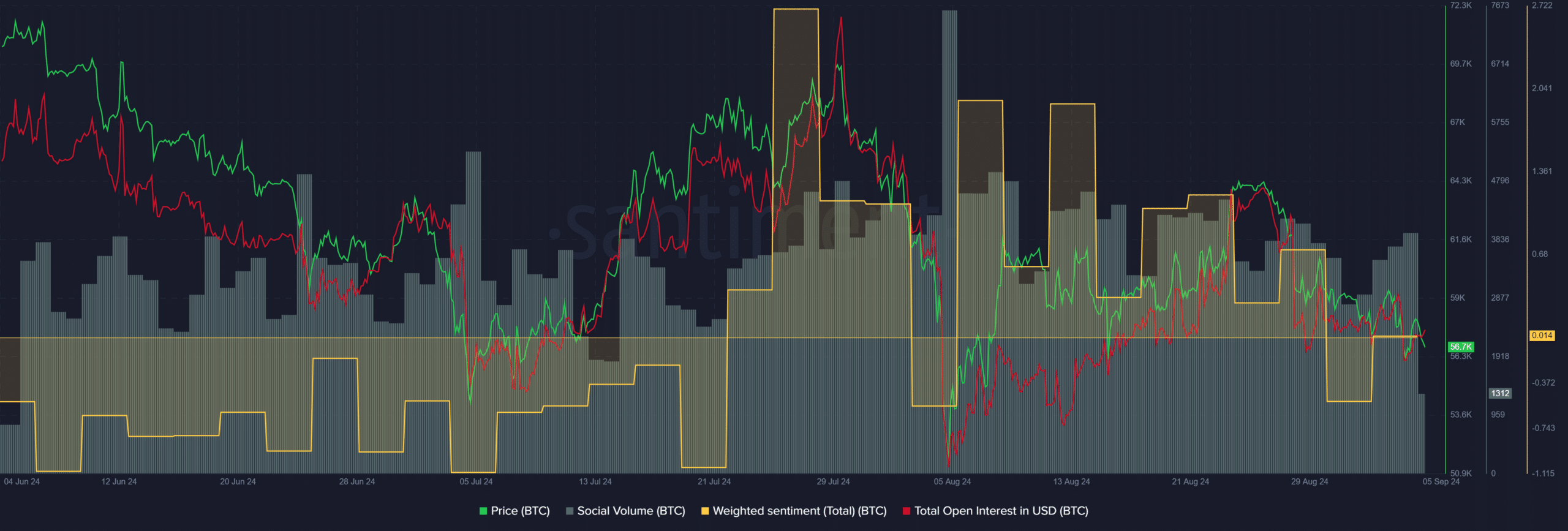

- The decline in Social Quantity and constructive engagement outlined the market despondence.

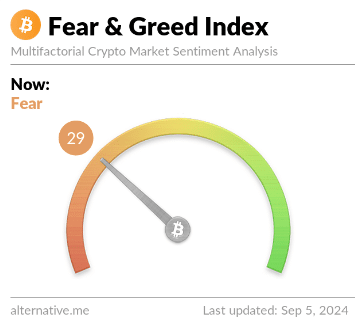

The Crypto Worry and Greed index stood at 29 at press time.

It confirmed concern was prevalent out there, however was nonetheless higher than the earlier month when heavy worth corrections affected the market-wide sentiment, worse than the current drop beneath $60k.

Supply: Alternative.me

The overwhelmingly destructive sentiment out there noticed a week-long, hefty torrent of outflows from the Bitcoin [BTC] spot ETFs. Alternatively, El Salvador continued to purchase 1 BTC a day.

The weakest sentiment in a 12 months

The Worry and Greed Index is a great tool that offers traders an concept of when to purchase and when to promote. Excessive concern readings are typically a superb purchase alternative in crypto, whereas euphoric markets are inclined to mark worth tops.

The Index values are calculated primarily based on the conduct of Bitcoin, for the reason that king coin largely dictates the crypto market conduct. This consists of volatility, market momentum, and social media engagement.

The Crypto Worry and Greed Index had been fairly hopeful in Could, however the sentiment has soured since then.

The promised bull run after the halving occasion in April didn’t take off instantly, however the continued downtrend since March has crypto traders very fearful.

In July and once more in early August, the Index values reached lows beneath 30 that weren’t seen for a 12 months.

At press time, the worth of 29 was additionally a considerably low one, nevertheless it could be a shopping for alternative for the subsequent 6–12 months.

Inspecting Bitcoin’s metrics

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

Bitcoin’s Social Quantity has slowly declined over the previous month. The Weighted Sentiment, which had been constructive when Bitcoin reclaimed the $60k stage in mid-August, started to climb decrease up to now three weeks.

The Open Curiosity additionally fell swiftly when BTC was rejected on the $64k resistance zone. Total, the market sentiment was bearish and people seeking to purchase had been within the minority.