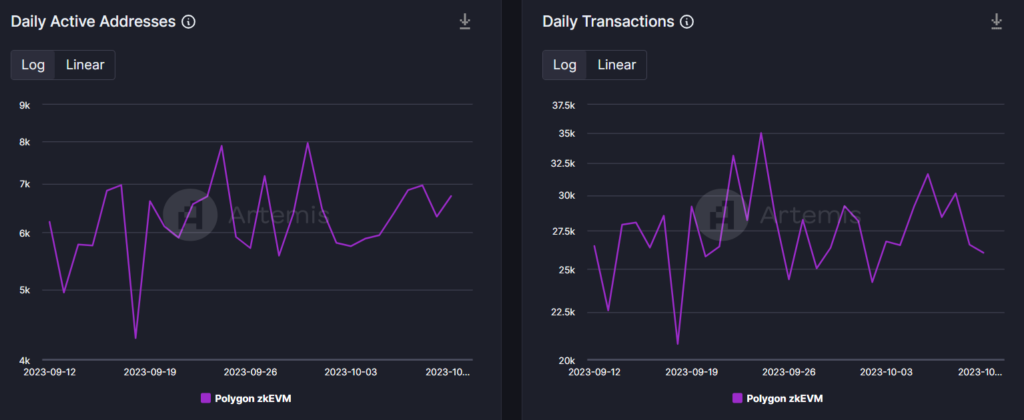

- Other than TVL, zkEVM’s lively addresses and transactions additionally elevated barely.

- MATIC was down by over 8% final week, and metrics remained bearish.

Over the previous few months, Polygon [MATIC] zkEVM registered a decline in a key metric. Nevertheless, the most recent information revealed that the state of affairs modified a couple of days in the past. To be exact, TVL on Polygon zkEVM has elevated by 30% over the past 30 days. This seemed optimistic for the rollup, as larger the TVL, the extra reliable the platform or dApp is perceived to be.

Learn Polygon’s [MATIC] Worth Prediction 2023-24

Polygon zkEVM is lastly reviving

As per Artemis’ data, zkEVM TVL plummeted sharply over the past 3 months, which seemed regarding for the rollup’s presence and efficiency within the DeFi area. However Immediately in Polygon’s newest tweet rightly identified that the rollup was getting again on observe as its TVL surged in double digits over the previous month.

JUST IN:

TVL on Polygon zkEVM has elevated 30% over the past 30 days. pic.twitter.com/XHu4XjhPAb

— Immediately In Polygon (@TodayInPolygon) October 11, 2023

Not solely did the rollup’s TVL register a rise, however the same rising development was additionally famous in different metrics that urged a hike in community exercise.

As per Artemis, each zkEVM’s every day lively deal with and every day transactions went up considerably over the past month. Regardless of the expansion in community exercise, zkEVM’s charges failed to maneuver up, which was a bit worrying.

Supply: Artemis

Although zkEVM’s few metrics went up, it was nonetheless behind its rivals on a number of fronts. For example, each zkSync Period and Base’s TVLs had been significantly larger than these of zkEVM. The Polygon rollup’s DEX quantity additionally remained considerably decrease than the remainder of the 2 rollups.

Supply: Artemis

MATIC is underperforming

Whereas zkEVM’s TVL and community exercise elevated, MATIC’s worth motion went the other route. In line with CoinMarketCap, MATIC’s worth dropped by greater than 8% within the final seven days.

On the time of writing, it was buying and selling at $0.5134 with a market capitalization of over $4.7 billion.

The worth decline additionally propelled destructive sentiment across the token, which was evident from the drop in its weighted Sentiment within the current previous. Nonetheless, its Social Quantity remained comparatively excessive.

Supply: Santiment

Is your portfolio inexperienced? Examine the MATIC Revenue Calculator

If metrics are to be believed, MATIC buyers may need extra causes to fret. The token’s buying and selling quantity dropped, which means that buyers weren’t prepared to commerce MATIC actively.

Its MVRV ratio additionally dropped over the past week, which may additional push Polygon’s worth down within the coming days. Nonetheless, its Community Development remained excessive. As per CryptoQuant, MATIC’s Change Reserve was additionally lowering, which meant that the token was not below promoting stress.

Supply: Santiment