The futures market has historically been a barometer for investor sentiment. Open curiosity, representing the whole variety of excellent futures contracts that haven’t been settled, is a measure of market exercise. Traditionally, rising Bitcoin costs have been correlated with a rise in open curiosity, signaling heightened speculative exercise.

Nevertheless, Bitcoin’s latest ascent previous $28,000 defies this development.

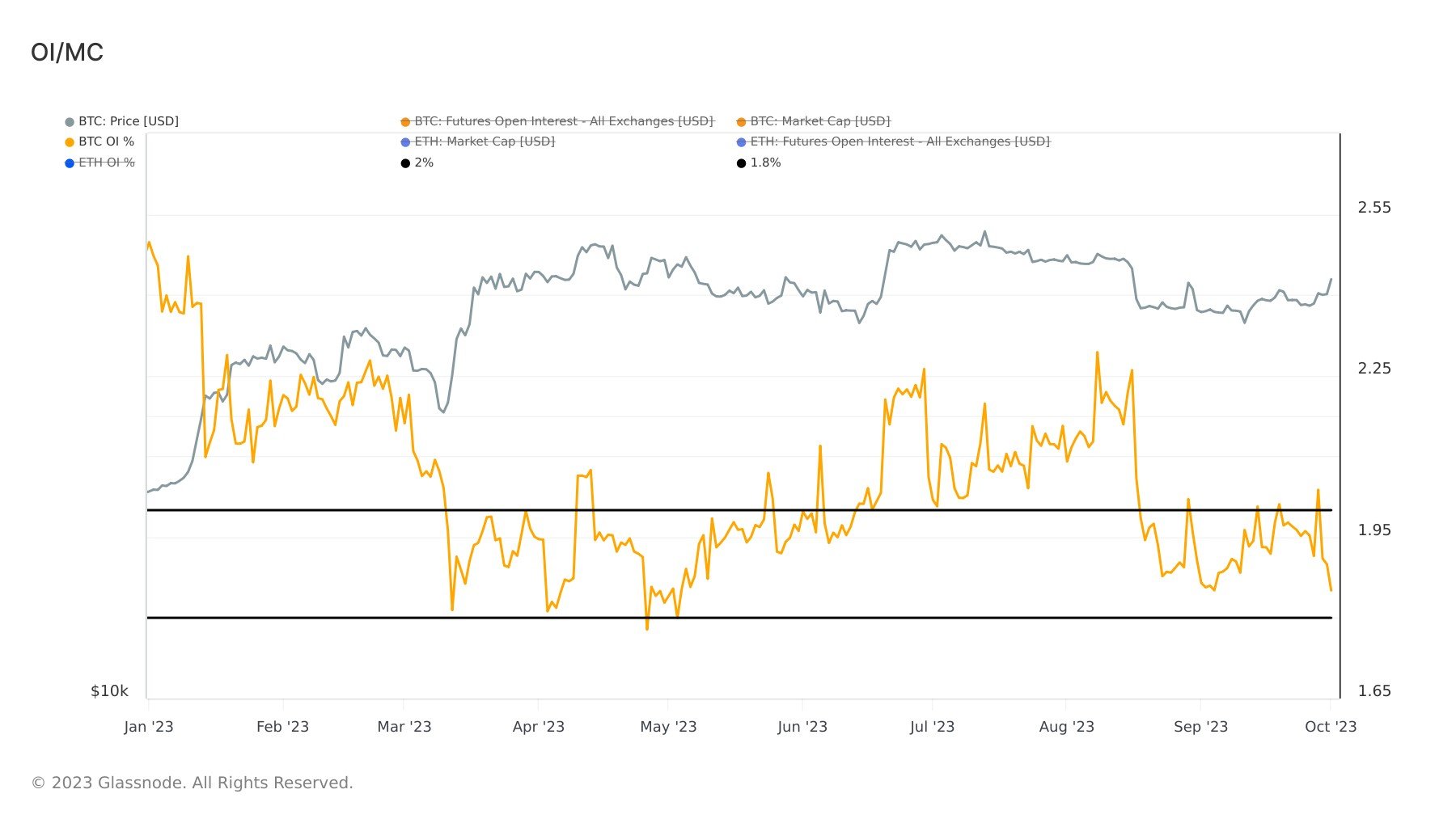

Regardless of this week’s rally, open curiosity in Bitcoin futures has notably declined. Particularly, open curiosity, as a share of Bitcoin’s market cap, is approaching a year-to-date low of 1.82%. This marks a 28% decline from figures at first of the yr. Such a contraction in open curiosity sometimes signifies a decline in speculative buying and selling, a shocking development given the cryptocurrency’s bullish momentum.

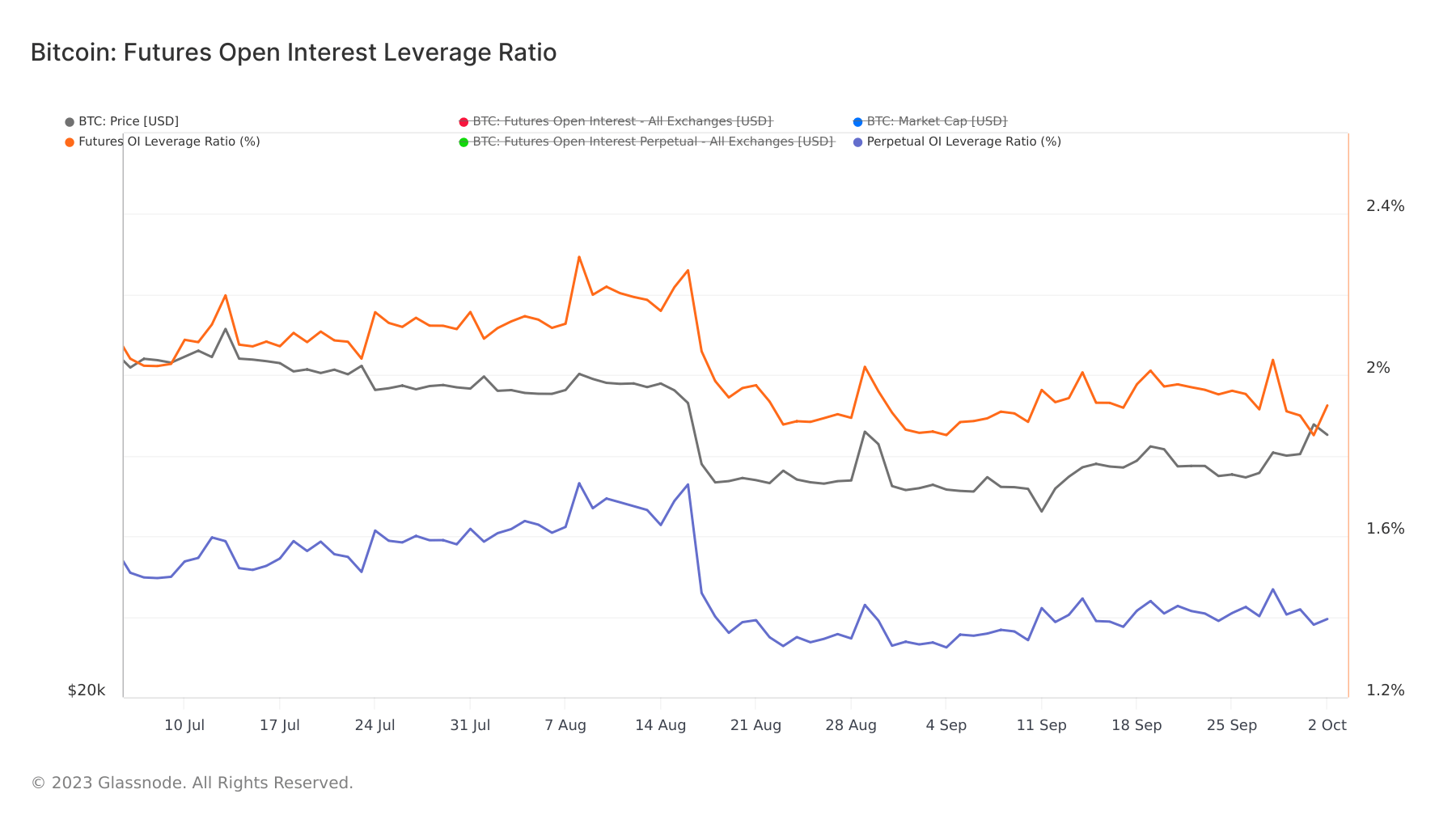

Digging deeper into the futures market reveals extra about this evolving dynamic. The futures open curiosity leverage ratio, which measures the whole open curiosity of futures contracts relative to the underlying asset’s market cap, offers a lens into merchants’ danger urge for food. On Sept. 27, this ratio stood at 1.91%, rising to 2.03% on Sept. 28, solely to drop again to 1.85% by Oct. 1. An analogous development was noticed within the perpetual futures open curiosity leverage ratio, which rose from 1.4% to 1.46% after which decreased to 1.38% inside the identical timeframe.

Regardless of the additional worth enhance on Oct. 1, the drop in leverage ratios may point out that merchants had been changing into extra cautious or taking income. It means that some merchants might need been anticipating a possible worth correction or consolidation, and therefore, they lowered their leveraged positions to reduce danger.

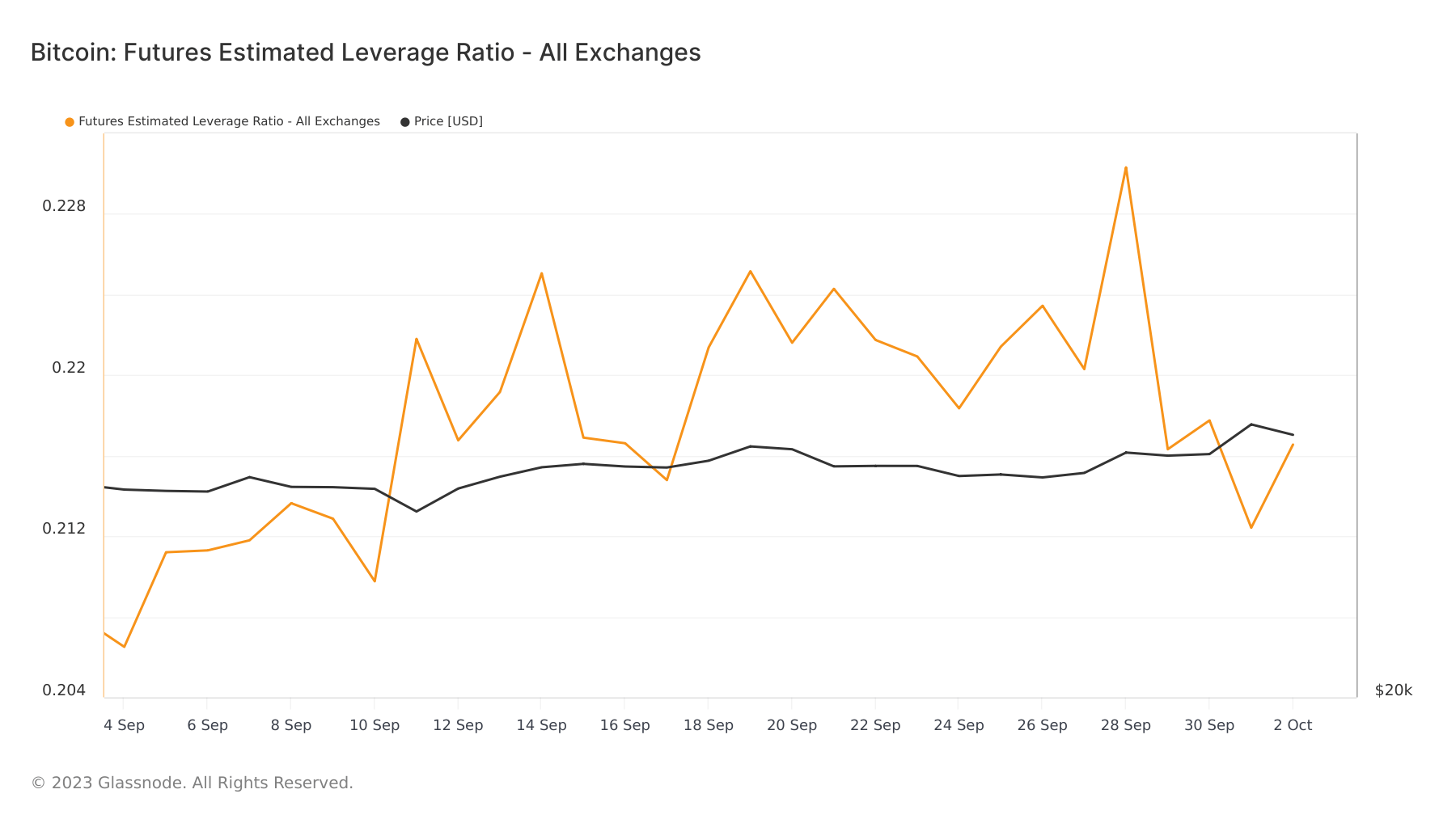

One other metric, the futures estimated leverage ratio throughout exchanges, dropped from 0.23 on Sept. 28 to 0.21 on Oct. 1. The metric offers a mean measure of the leverage utilized by merchants within the futures market. When this ratio decreases, it typically signifies that merchants use much less leverage throughout exchanges.

The preliminary enhance in leverage ratios on Sept. 28 may recommend that merchants had been utilizing extra borrowed funds to take a position on additional worth will increase. Nevertheless, the following drop in each the precise futures open curiosity leverage ratios and the overall estimated leverage ratio throughout exchanges by Oct. 1 signifies a broader development of lowered leverage use. Whilst Bitcoin’s worth continued to rise, merchants, on common, lowered their leverage. This may recommend that merchants had been managing their danger by not over-leveraging in a market that had not too long ago seen important worth motion.

The rising worth of Bitcoin amidst falling open curiosity and lowered leverage signifies that the present worth rally is perhaps pushed much less by short-term hypothesis and extra by real long-term investor confidence. This might imply elevated participation by institutional traders or a broader shift in retail investor technique from speculative buying and selling to long-term holding.

Whereas lowered speculative exercise can stabilize the market and scale back volatility, it additionally signifies lowered liquidity. For merchants, which means that whereas the market is perhaps much less susceptible to sudden worth corrections as a consequence of liquidation occasions, it may be much less responsive to purchase or promote orders, resulting in potential worth slippages.

The submit Declining open curiosity in futures market contrasts Bitcoin’s bullish rally appeared first on CryptoSlate.