What’s a decentralized bodily infrastructure community (DePIN)? Uncover how this framework is altering real-world infrastructure.

The comparatively new idea of a decentralized bodily infrastructure community, or DePIN, goals to essentially change sectors akin to telecommunications, cloud computing, transportation, and power distribution.

Tech giants have historically dominated these sectors, wielding appreciable management and sustaining their market share by way of huge capital investments and complex logistics. DePIN affords a framework the place the group builds, maintains, and collectively operates bodily infrastructure utilizing blockchain protocols.

So, what precisely is DePIN, and the way is it poised to show infrastructure companies on its head? Learn on to seek out out extra.

DePIN defined: what’s DePIN in crypto?

DePIN is the convergence of blockchain expertise with stable infrastructure companies. These networks are utilizing cryptocurrency to assist develop essential companies, leveraging the rising recognition of on-line connections to start out a brand new sort of dapps that mixes digital and real-world companies.

The crypto analytics platform Messari first launched the time period DePIN in November 2022, following a public ballot on X to discover a title for web3’s bodily framework.

DePIN received greater than 31% of the vote, outperforming different proposed names like “proof of bodily work (PoPw)” and “token-incentivized bodily networks (TIPIN).”

Web3 bodily infrastructure wants a reputation!

Sometimes called Proof of Bodily Work (PoPw), Token Incentivized Bodily Networks (TIPIN), EdgeFi, or Decentralized Bodily Infrastructure Networks (DePIN), crypto has but to achieve a consensus.

Vote beneath, or add a suggestion

— Messari (@MessariCrypto) November 5, 2022

As Messari highlights, DePIN represents a standout development for peer-to-peer infrastructure. In 2023, the sector grew to greater than 650 tasks with a mixed market cap north of $20 billion.

Moreover, the Messari report indicated that the DePIN trade was essentially the most resilient crypto sub-sector in 2023, experiencing worth drops of between 20-60% in comparison with the 70-90% registered within the broader crypto market.

Messari’s evaluation of decentralized bodily infrastructure networks revealed two major DePIN classes based mostly on the character of their contributions.

The primary sort, bodily useful resource networks (PRNs), are geographically anchored entities that provide location-specific assets—from connectivity to mobility—from a consortium of unbiased suppliers. Such assets are inherently distinctive, tied to the locale, and non-transferable.

The second sort, generally known as digital useful resource networks (DRNs), entails contributors who supply transferable digital assets like computational energy, bandwidth, or storage. These assets transcend geographical restrictions, broadening the scope and fluidity of digital asset provisioning.

Moreover, real-world functions of DePIN expertise span throughout 4 foremost classes, every providing distinctive options to various challenges:

Cloud and storage networks: This class encompasses companies like file storage, relational databases, content material supply networks (CDNs), and digital personal networks (VPNs). Initiatives like Filecoin (FIL) exemplify decentralized cloud networks, enabling people to monetize their spare pc cupboard space. By collaborating in Filecoin, customers contribute to a digital storage rental service the place out there area is tracked on a blockchain, incomes cryptocurrency rewards in return.

Wi-fi networks: With a concentrate on applied sciences like 5G and low-power wide-area networks (LoRaWAN), this class is especially related to the Web of Issues (IoT). Initiatives akin to Helium empower people to determine hotspots of their houses, extending protection and supporting IoT units. Members earn cryptocurrency by contributing to the Helium community.

Sensor networks: This class entails units geared up with sensors to gather real-time information from the surroundings, together with geographical info techniques (GIS). One instance is Hivemapper, a platform involving individuals mapping their communities. It encourages people to share native information and real-time information captured by way of their dashcams. In alternate for his or her contributions, customers are rewarded with digital forex.

Power networks: This class goals to enhance energy grid reliability and effectivity by utilizing numerous renewable power sources. Arkreen is one such platform that connects inexperienced power suppliers, permitting them to share information from their renewable assets. By bringing these suppliers collectively, Arkreen encourages the combination of sustainable power into the broader power infrastructure.

How do DePINs work?

DePINs perform by way of the decentralized blockchain expertise framework, successfully distributing management and accountability throughout a community fairly than permitting it to pool inside a singular entity.

On the coronary heart of the DePIN sector lies a cryptocurrency-based financial system that rewards contributors for contributing assets akin to computing energy, web connectivity, or storage capabilities.

When the idea began, most of those DePIN crypto rewards didn’t maintain tangible worth, akin to early speculative investments. Members primarily functioned as “threat miners”, betting on the potential of nascent DePIN tasks and eyeing rewards within the type of future token worth hikes and accumulation.

Each DePIN software is constructed upon 4 basic pillars:

- Bodily community infrastructure consists of tangible belongings wanted for community capabilities, like servers and transportation techniques.

- Off-chain computing techniques bridge real-world contributions to blockchain incentives and supply sensible contract information.

- Blockchain framework is a clear and immutable ledger that employs sensible contracts to handle community transactions.

- Token rewards system encourages infrastructure contributions that feed the early progress of the community till it matures right into a self-sustaining ecosystem by way of transaction charges.

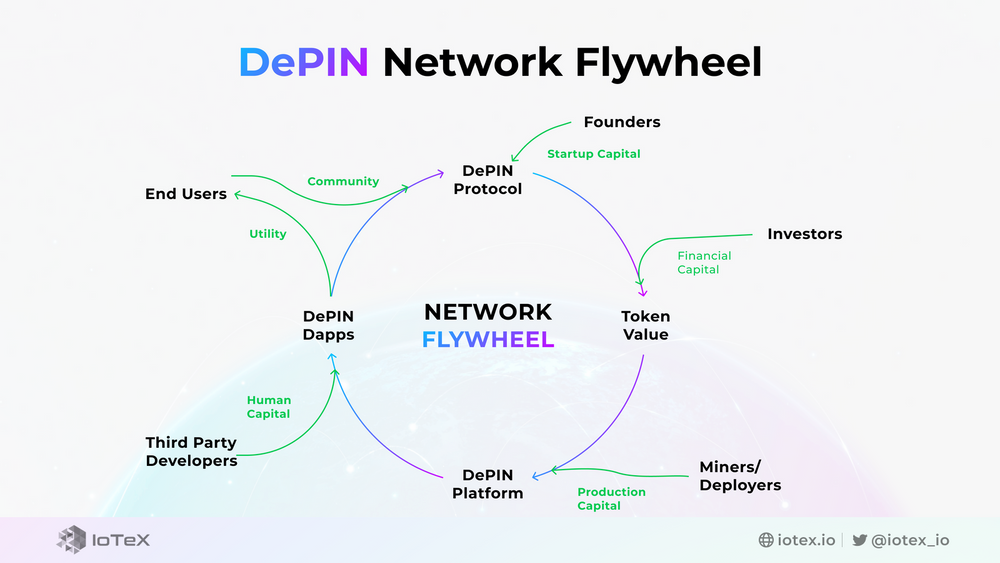

The DePIN flywheel

DePIN tasks are inclined to harness the potential of their native crypto tokens to drive a self-reinforcing cycle generally known as a flywheel impact. As consumer engagement rises, the demand for DePIN crypto tokens naturally grows, rising their market worth.

DePIN flywheel | Supply: iotex.io

This surge in worth then incentivizes builders and contributors to double down on their efforts to enhance the community because the rewards for his or her work turn into extra profitable.

The enlargement of the community then piques the curiosity of traders, drawing extra capital and assist, which, in flip, propels community progress.

Open-source tasks and people sharing information overtly function fertile floor for constructing dapps on prime of this information layer, thus enhancing the ecosystem’s worth. This, in flip, attracts a broader base of customers and contributors, additional spinning the flywheel and persevering with this cycle of progress and innovation.

You may additionally like: Institutional adoption of crypto is rising. What can increase it additional?

Benefits of DePIN expertise

Decentralized bodily infrastructure networks (DePINs) supply a number of benefits that might change the best way we strategy scalability and group empowerment:

Scalability: DePINs leverage crowdsourced infrastructure, enabling sooner and less expensive enlargement in comparison with conventional frameworks. This horizontal scalability permits them to adapt to adjustments in demand with out requiring important useful resource will increase, sustaining effectivity with out main reorganization.

Neighborhood empowerment: In contrast to centralized platforms managed by a choose few, DePINs distribute {hardware} possession amongst customers, fostering collaboration and group involvement. This democratized strategy promotes equal entry and participation, empowering customers at each stage.

Clear governance: DePINs champion clear governance, changing opaque practices with open and democratic decision-making processes. This ensures equal entry for all customers and encourages community-driven initiatives.

Accessible participation: By eliminating centralized gatekeepers, DePINs prioritize open entry and censorship resistance. This inclusive mannequin promotes accessible participation for all customers, no matter background or location.

Value effectivity: DePINs goal to decrease prices by leveraging a various community of service suppliers who can competitively supply their companies. This aggressive surroundings encourages honest pricing and reduces the inflated prices typically related to centralized companies.

Incentivization: Inside the DePIN framework, incentivization constructions drive participation and progress by providing service suppliers alternatives for passive or energetic earnings. These incentives additional increase community engagement and enlargement.

You may additionally like: A information to crypto passive earnings alternatives

DePIN challenges

As DePIN navigates its early levels throughout the blockchain realm, it encounters a number of hurdles which will impede its progress:

Restricted curiosity and adoption: One of many major challenges stems from the novelty of DePIN, leading to restricted curiosity from each the blockchain group and infrastructure house owners. With out a vital mass of contributors, the ecosystem’s progress and success are at stake.

Complexity and training: The inherent complexity of DePIN expertise poses a barrier to entry, requiring intensive training to interact potential adopters successfully. Overcoming this hurdle entails simplifying the expertise and offering complete academic assets.

Monetary necessities: Sustaining personal networks comes with substantial operational prices, typically with out exterior funding. This monetary burden makes it difficult to draw potential community hosts and maintain community operations within the absence of adequate assets.

Supplier profitability: Profitability serves as a key motivator for community suppliers. DePIN platforms should strike a fragile steadiness between compensations and prices to make sure supplier profitability. Nonetheless, attaining this steadiness proves tough amid low engagement charges from each customers and suppliers.

Are DePINs paving the best way for web3’s future?

Some specialists within the blockchain and crypto group see DePIN developments as a big step ahead in shaping the way forward for web3 by addressing the constraints of centralized techniques. By distributing duties throughout a number of elements, DePINs goal to forestall bottlenecks and create a extra resilient community. Nonetheless, widespread adoption is essential for this idea to drive the evolution of digital interplay and infrastructure.

The potential advantages of DePINs might result in better accessibility in web3, particularly in areas the place conventional centralized networks are missing. By bridging this hole, DePINs might allow superior expertise to achieve a broader viewers, selling entry to decentralized options worldwide.

Analyzing sensible functions, initiatives like Render (RNDR) showcase the capabilities of DePIN tasks. Analysts recommend that Render might disrupt the 3D graphics market by providing high-quality rendering capabilities at a decrease value in comparison with conventional centralized rivals.

Trade specialists anticipate a grassroots motion towards elevated crypto engagement as extra progressive tasks emerge. These tasks empower communities to collaborate in constructing and sustaining infrastructure, probably decreasing prices by way of collective efforts. This strategy goals to problem monopolistic practices, typically resulting in inflated pricing because of market management. Profitable ventures on this course might spotlight the advantages of decentralized approaches in democratizing expertise and processes.

Learn extra: What’s the ERC-404 token commonplace: revolution or failure?