Decentralized finance (DeFi) doesn’t but pose a major danger to total monetary stability, however does require supervision, the European Union’s monetary markets and securities regulator stated.

On October 11, the European Securities and Markets Authority (ESMA) launched a report entitled Decentralized finance within the EU: developments and dangers. Along with discussing the advantages and dangers of the rising ecosystem, the regulator concluded that it doesn’t but pose a major danger to monetary stability.

“Cryptoasset markets, together with DeFi, don’t at present pose important dangers to monetary stability, primarily because of their comparatively small dimension and restricted contagion channels between crypto and conventional monetary markets.”

The overall crypto market cap is simply over $1 trillion, and the whole worth of DeFi is simply $40 billion, in accordance with DefiLlama. By comparability, in accordance with the European Fee, the whole property of monetary establishments within the EU amounted to round $90 trillion in 2021.

DeFi TVL by protocol sort. Supply: ESMA

The report states that the whole crypto market is roughly the scale of the EU’s twelfth largest financial institution, or 3.2% of the whole property of EU banks.

The ESMA additionally checked out a number of crypto contagions of 2022, together with the collapse of the Terra ecosystem and FTX, noting that this crypto ‘Lehman second’ nonetheless had ‘no significant influence on conventional markets’.

Nonetheless, the regulator famous that DeFi has related traits and vulnerabilities to conventional monetary markets, akin to liquidity and maturity mismatches, leverage and interconnectedness.

It additionally highlighted that whereas investor publicity to DeFi stays low, critical dangers to investor safety nonetheless exist because of the “extremely speculative nature of many DeFi schemes, important operational and safety vulnerabilities, and the dearth of a clearly recognized accountable get together.”

It warned that this “might translate into systemic dangers if the phenomenon had been to achieve important consideration and/or if connections to conventional monetary markets grew to become materials.”

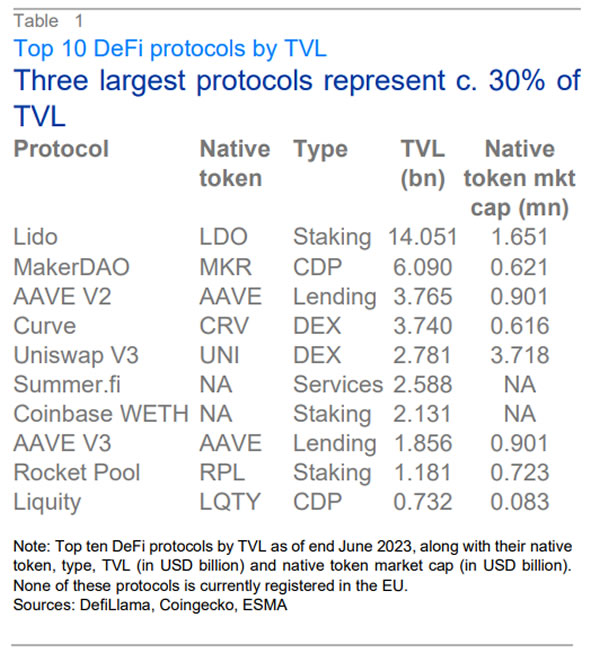

Moreover, the report recognized a “focus danger” related to DeFi actions.

“DeFi exercise is concentrated in a small variety of protocols,” it famous, including that the three largest symbolize 30% of TVL.

TVL’s Prime Ten DeFi Protocols. Supply: ESMA

“The failure of any of those main protocols or blockchains might reverberate all through the system,” the report stated.

The regulator is paying rather more consideration to the DeFi and crypto markets following the publication of its second consultative paper on the Markets in Crypto Belongings (MiCA) laws earlier this month.