Disclosure: The views and opinions expressed right here belong solely to the writer and don’t symbolize the views and opinions of the crypto.information principal article.

Decentralized finance (defi) is now not restricted to the digital world. As we glance round at a few of at this time’s most essential points, from shopping for a house to combating local weather change, defi is more and more enjoying an important function.

You may additionally like: Cryptocurrency Consciousness vs. Information: Training and Empowerment | Opinion

Some could also be skeptical, given how overhyped defi has been prior to now. That is comprehensible. However you solely have to go searching to see that Defi has an actual affect on our lives in the true world.

And there are good causes to imagine that this affect will solely enhance within the coming years. Innovators are implementing decentralized finance in methods that can profit the lives of many individuals. As these improvements progress, extra will probably be constructed on high of them.

Utilizing cryptocurrency tokens, traders can now purchase shares of current properties and houses beneath development. This improves entry to the true property market as a larger variety of folks can now take part in transactions by investing small quantities.

Firms like RealT, Propy, and Homebase are experimenting with one of the best methods to tokenize actual property so it really works for a variety of individuals. It is already catching on.

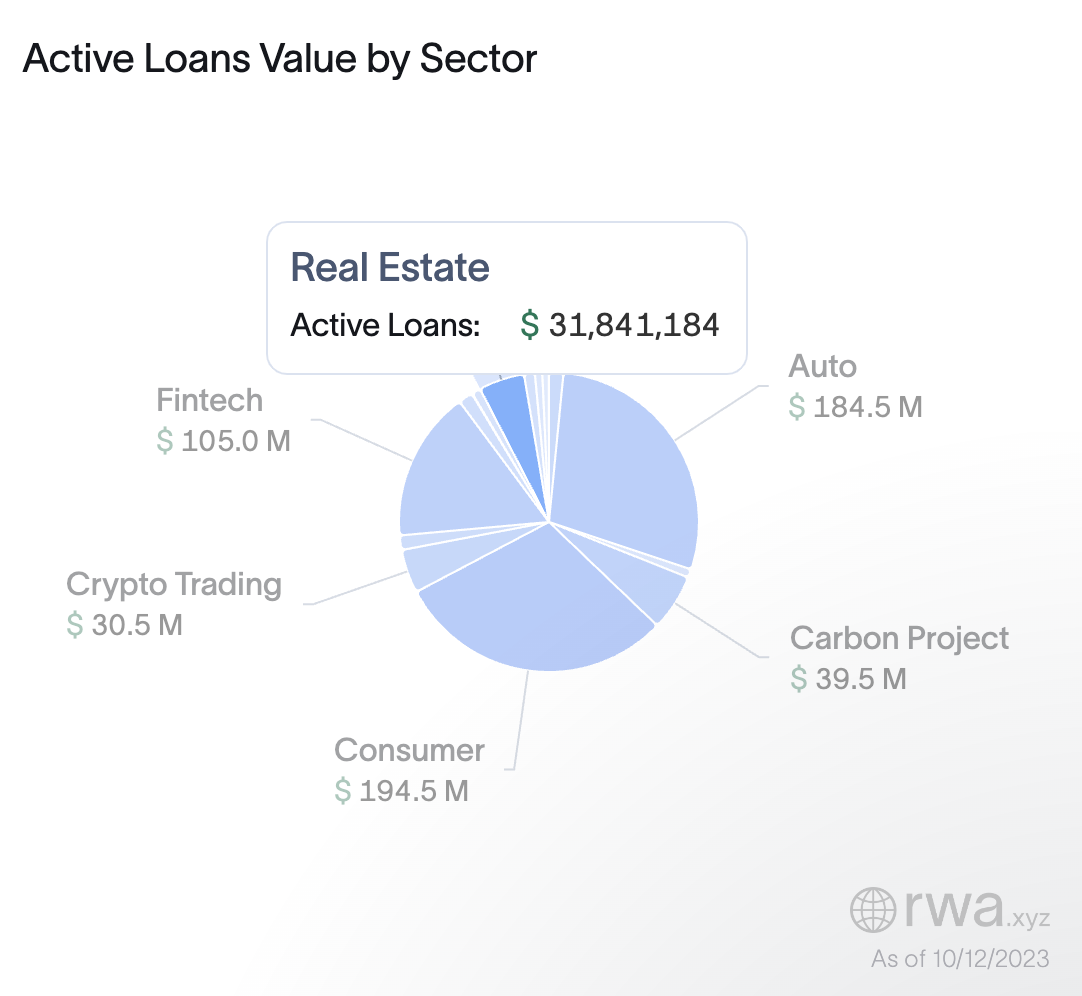

In line with RWA, an analytics firm for tokenized real-world belongings, there’s at present $31 million in energetic actual property loans – an enormous marketplace for tokenization. RealT launched in 2019 with the promise of creating actual property accessible for investments beginning at $50. Three and a half years later, greater than 390 properties price greater than $92 million have been tokenized. Moreover, Propy has processed greater than $4 billion in transactions within the US

Worth of energetic loans by sector | Supply: RWA

There might be different essential penalties for the true property sector. For instance, good contracts can remove the necessity for attorneys in actual property transactions. This implies extra folks can afford to spend money on actual property.

Defi is starting to play a task in decreasing the affect of local weather change, with the potential to carry giant emitters accountable in a manner that has been not possible till now. Carbon reductions are notoriously troublesome to trace, given the potential for knowledge manipulation. However with regards to immutable blockchains, the numbers can’t be shifted. Sensible contracts could be written to regulate monitoring mechanisms, providing rewards and punishments to these being tracked.

In a inexperienced defi market, carbon tokens are used as proof of emissions reductions and whilst collateral for big transactions. Local weather change protocols – focused purposes are nonetheless within the works and widespread adoption is underway. However pilot packages and demonstrations exist.

In 2022, tokenized carbon credit started buying and selling on blockchain by way of using digital voluntary carbon markets. These credit have been used as collateral to borrow in opposition to. As demand grew, it turned clear that tokenization of carbon credit on blockchain was an effective way to scale the clear administration of carbon markets.

For instance, Toucan Protocol gives the essential infrastructure for tasks that tokenize carbon credit utilizing blockchain know-how. In line with Toucan, it has awarded greater than 20 million carbon credit and influenced greater than 50 local weather tasks. One other instance is KlimaDAO, a decentralized autonomous group (DAO) and defi protocol launched in October 2021. The proprietary device offers customers “the power to selectively filter, select and withdraw carbon credit from greater than 20 million tons of accessible digital carbon credit.”

Defi offers people in undercapitalized areas entry to funds with out counting on centralized banking establishments. We have been listening to this promise within the crypto area for a few years; now it’s changing into actuality.

Defi allows crowdsourcing and different various financing strategies for tasks that conventional banks could not need to help. There isn’t a cause why bold enterprise concepts ought to wither as a result of folks haven’t got entry to capital.

An ecosystem is creating to allow folks in nations with creating economies to develop alongside the defi sector. For instance, Goldfinch permits third-party traders to take a position cryptocurrency funds in tasks world wide. Goldfinch makes use of facility agreements to allow the receipt and reimbursement of funds, connecting on-chain and off-chain operations.

Within the conventional insurance coverage mannequin, human specialists determine the payouts, which requires a time-consuming and costly course of. Defi is revolutionizing this, enabling computerized payouts to beneficiaries through good contracts as soon as particular situations are met.

This higher protects customers as a result of their payouts should not depending on one individual’s resolution, however on an unchangeable contract. Intermediate negotiations are now not mandatory.

For instance, Ethrisc, as a part of the Lemonade Crypto Local weather Coalition, offered parametric crop safety to 7,000 Kenyan farmers throughout the late 2022 rising season to guard their crops from drought and floods. These farmers used telephones to register, with their bounty being lower than a greenback.

Prompt and near-instant money transfers primarily based on space yield knowledge have been mechanically credited to their accounts with M-Pesa, Kenya’s most generally used cost system, with out the necessity to file any claims. Examine this to conventional payouts, which may take a number of months and even years.

Regulatory limitations, particularly from the SEC, might be a significant impediment to integrating decentralized finance into the true world. The SEC has not offered a roadmap for the longer term right now, and up to date actions such because the lawsuit in opposition to Coinbase point out that issues could worsen.

Moreover, good contracts could cause issues if bugs happen. At current, few authorized frameworks exist to find out legal responsibility and beneath which jurisdictions sure issues fall.

Given the unbelievable quantity of innovation on this space, it will be a disgrace if options weren’t developed. Defi clearly reveals its skill to rework our world. Because it continues to evolve, it’s essential that regulators hold tempo in order that its potential could be totally realized.

Learn extra: 2050: CBDCs, AI and the unknown path forward | Opinion

Pratik Wagh

Pratik Wagh is head of analysis at Forex trade. Wagh beforehand labored for main oil and gasoline shoppers, performing superior ultrasound strategies and NDT analysis. He ran an NDT coaching faculty known as the Institute for Non-Damaging Testing and Coaching. He holds a grasp’s diploma in supplies science and engineering from Iowa State College and a bachelor’s diploma in mechanical engineering from the College of Mumbai.