Buying and selling volumes on decentralized exchanges (DEX) have fallen for six months in a row to the bottom degree since January 2021.

Quantity on DEXs fell to $44.28 billion in September, the sixth consecutive month-to-month decline and the bottom recorded quantity since January 2021, in keeping with DefiLlama information.

Throughout the first quarter of this yr, DEXs noticed a surge in month-to-month buying and selling exercise. This progress was accelerated by elevated regulatory scrutiny targeted on their centralized counterparts, together with main platforms like Kraken, Bittrex, Coinbase and Binance.

Because of these regulatory measures, crypto merchants migrated their operations to DEX protocols. In March, buying and selling quantity on these decentralized platforms reached a formidable $140 billion. Nevertheless, this peak was short-lived, with volumes falling to round $82 billion in April.

Subsequently, buying and selling exercise on these DEXs has repeatedly declined. This decline may be attributed to a mix of things, together with normal market situations and the continued regulatory stress dealing with the sector.

For context, the US Commodity Futures Buying and selling Fee (CFTC) has filed prices in opposition to three DeFi protocols, together with Opyn, Deridex, and ZeroEx. The regulator claims that they illegally provided unregistered derivatives buying and selling merchandise on their platforms.

Moreover, these platforms have repeatedly fallen sufferer to hacks and exploits, making it tough for customers to belief them with their property.

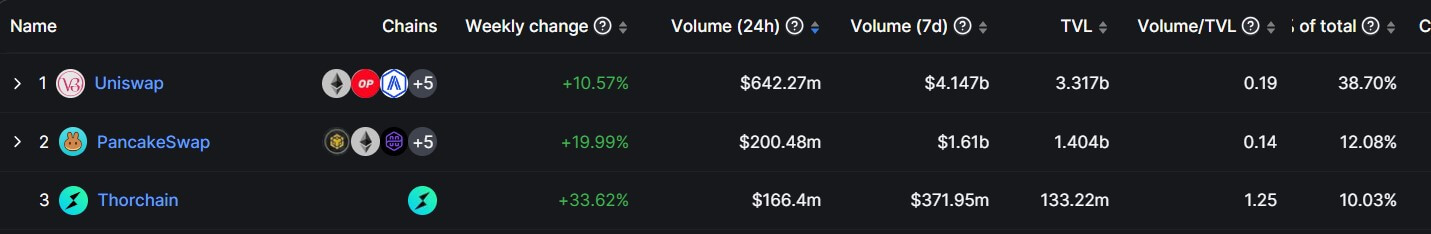

Uniswap stays the dominant decentralized trade platform, regardless of declining quantity throughout the board. The protocol contributes greater than 38% of day by day quantity, and its cumulative quantity is thrice increased than that of its largest competitor, PancakeSwap.

In the meantime, buying and selling exercise on centralized crypto exchanges can also be experiencing a decline. In accordance with out there information, buying and selling quantity on these platforms fell 26% in September to $311.93 billion, the bottom degree since November 2020.