Authored by David Stockman via InternationalMan.com,

These individuals must be stopped!

We’re speaking in regards to the nation’s unhinged financial politburo domiciled within the Eccles Constructing, in fact. It’s unhealthy sufficient that their relentless inflation of economic belongings has showered the 1% with untold trillions of windfall good points, however their final crime is that they lured the nation’s elected politician right into a veritable fiscal trance. Consequently, future generations will likely be lugging the service prices on insuperable public money owed for years to return.

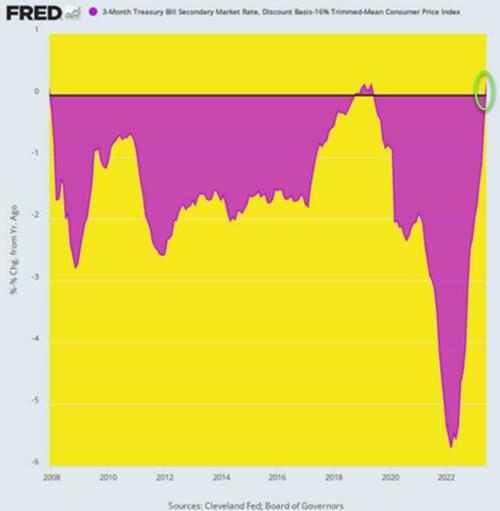

For greater than twenty years these silly PhDs and financial apparatchiks drove your complete Treasury yield curve to all-time low, at the same time as public debt erupted skyward. On this context, the one largest chunk of the Treasury debt lies within the 90-day T-bill sector, however between December 2007 and June 2023 the inflation-adjusted yield on this workhorse debt safety was damaging 95% of the time.

That’s proper. Throughout that 187-month span, the rate of interest exceeded the working (LTM) inflation fee throughout solely 9 months, as depicted by the purple space choosing above the zero sure within the chart, and even then by only a tad. All the remainder of the time, Uncle Sam was fortunately taxing the inflationary rise in nominal incomes, at the same time as his debt service funds have been dramatically lagging the 78% rise of CPI throughout that interval.

Inflation-Adjusted Yield On 90-Day T-bills, 2007 to 2022

The above was the fiscal equal of Novocain. It enabled the elected politicians to merrily jig up and down Pennsylvania Avenue and stroll the Ok-Avenue corridors meting out bountiful goodies left and proper, whereas experiencing nary a second of ache from the massive debt burden they have been piling on the primary avenue financial system.

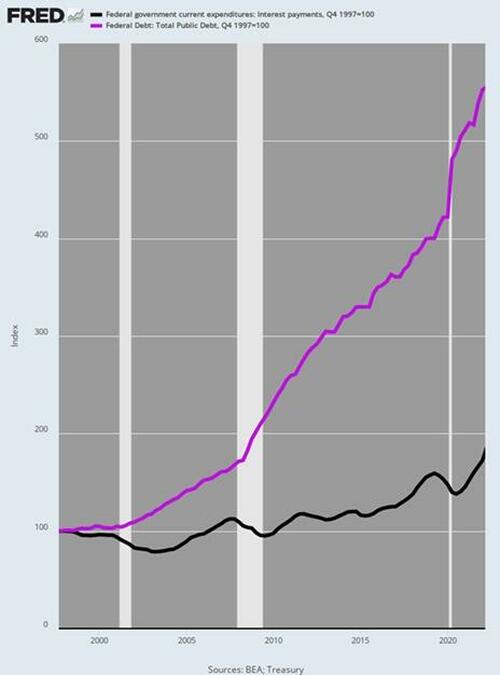

Accordingly, in the course of the quarter-century between This fall 1997 and Q1 2022 the general public debt soared from $5.5 trillion to $30.4 trillion or by 453%. In any rational world a commensurate rise in Federal curiosity expense would have certainly woke up at the least a few of the revilers.

However not in Fed World. Because it occurred, Uncle Sam’s curiosity expense solely elevated by 73%, rising from $368 billion to $635 billion per yr throughout the identical interval. In contrast, had rates of interest remained on the not unreasonable ranges posted in late 1997, the curiosity expense degree by Q1 2022, when the Fed lastly woke up to the inflationary monster it had fostered, would have been $2.03 trillion every year.

Briefly, the Fed reckless and relentless repression of rates of interest throughout that quarter century fostered an elephant within the room that was one for the ages. Annualized Federal curiosity expense was absolutely $1.3 trillion decrease than would have been the case on the yield curve in place in This fall 1997.

Alas, the lacking curiosity expense amounted to the equal of your complete social safety price range!

So, we’d guess the politicians might need been aroused from their slumber had curiosity expense mirrored market charges. As a substitute, they have been really getting dreadfully incorrect worth alerts and the current fiscal disaster is the consequence.

Index Of Public Debt Versus Federal Curiosity Expense, This fall 1997-Q1 2022

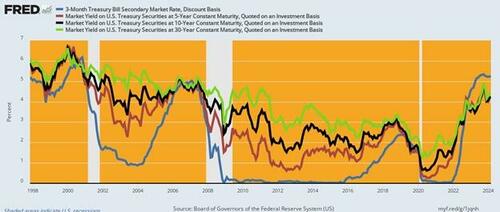

For sure, the US financial system was not wallowing in failure or under-performance on the charges which prevailed in 1997. In reality, throughout that yr actual GDP development was +4.5%, inflation posted at simply 1.7%, actual median household earnings rose by 3.2%, job development was 2.8% and the actual rates of interest on the 10-year UST was +4.0%.

Briefly, 1997 generated one of many strongest macroeconomic performances in current many years—even with inflation-adjusted yields on the 10-year UST of +4.0%. So there was no compelling cause for a large compression of rates of interest, however that’s precisely what the Fed engineered over the subsequent twenty years. As proven within the graph beneath, charges have been systematically pushed decrease by 300 to 500 foundation factors throughout the curve by the underside in 2020-2021.

Present yields are increased by 300 to 400 foundation factors from this current backside, however right here’s the factor: They’re solely again to nominal ranges prevalent originally of the interval in 1997, at the same time as inflation is working at 3-4% Y/Y will increase, or double the degrees of 1997.

US Treasury Yields, 1997 to 2024

Sadly, even because the Fed has tepidly moved towards normalization of yields as proven within the graph above, Wall Avenue is bringing unrelenting strain for a brand new spherical of charges cuts, which might lead to yet one more spree of the deep rate of interest repression and distortion that has fueled Washington’s fiscal binge because the flip of the century.

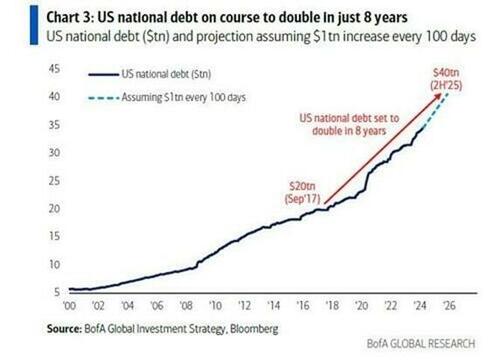

As it’s, the general public debt is already rising at an accelerating clip, even earlier than the US financial system succumbs to the recession that’s now gathering power. And we do imply accelerating. The general public debt has just lately been rising by $1 trillion each 100 days. That’s $10 billion per day, $416 million per hour.

In reality, Uncle Sam’s debt has risen by $470 billion within the first two months of this yr to $34.5 trillion and is on tempo to surpass $35 trillion in just a little over a month, $37 trillion properly earlier than yr’s finish, and $40 trillion a while in 2025. That’s about two years forward of the present CBO (Congressional Finances Workplace) forecast.

On the present path, furthermore, the general public debt will attain $60 trillion by the tip of the 10-year price range window. However even that relies upon upon the CBO’s newest iteration of Rosy Situation, which envisions no recession ever once more, simply 2% inflation so far as the attention can see and actual rates of interest of barely 1%. And that’s to say nothing of the trillions in phony spending cuts and out-year tax will increase which might be constructed into the CBO baseline however which Congress won’t ever really enable to materialize.

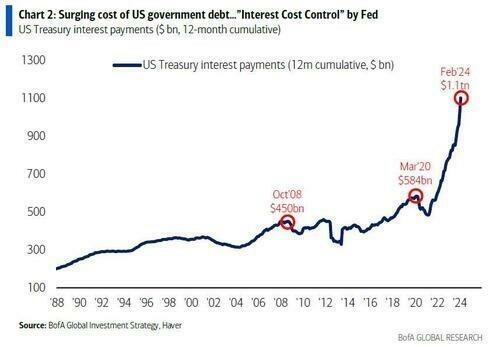

What’s worse, even with partial normalization of charges, a veritable tsunami of Federal curiosity expense is now gathering steam. That’s as a result of the ultra-low yields of 2007 to 2022 are actually rolling over into the present market charges proven above—on the similar time that the quantity of public debt excellent is heading skyward. In consequence, the annualized run fee of Federal curiosity expense hit $1.1 trillion in February and is heading for $1.6 trillion by the tip of the present fiscal yr in September.

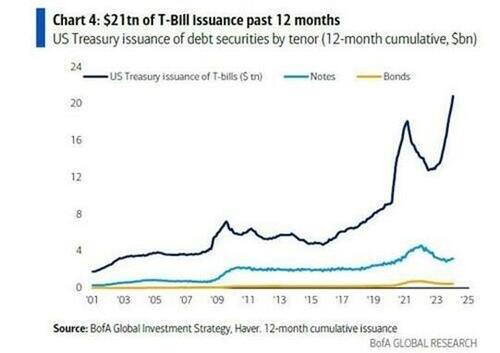

Lastly, even because the run-rate of curiosity expense has been hovering, the bureaucrats on the US Treasury have been drastically shortening the maturity of the excellent debt, because it rolls over. Accordingly, greater than $21 trillion of Treasury paper has been refinanced within the below one-year T-bill market, thereby reducing the weighted-average maturity of the general public debt to lower than five- years.

The obvious guess is that the Fed will likely be slicing charges quickly. As is turning into extra obvious by the day, nonetheless, that’s simply not within the playing cards: Regardless of the way you slice it, the working degree of inflation has remained exceedingly sticky and reveals no indicators of dropping beneath its present 3-4% vary any time quickly.

What can also be turning into extra obvious by the day is that the money-printers on the Fed have led Washington into a large fiscal calamity. It is just a matter of time, subsequently, till the brown stuff hits the fan like by no means earlier than.

* * *

The reality is, we’re on the cusp of an financial disaster that would eclipse something we’ve seen earlier than. And most of the people received’t be ready for what’s coming. That’s precisely why bestselling creator Doug Casey and his staff just released a free report with all the small print on tips on how to survive an financial collapse. Click here to download the PDF now.

Loading…