In accordance with a Messari report, the Polkadot (DOT) blockchain protocol made important progress within the first quarter (Q1) of the yr when it comes to market capitalization, income, and Cross-Consensus Message Format (XCM) exercise, in addition to a report enhance in day by day energetic addresses.

DOT’s Market Cap Surges 16% QoQ

Throughout This fall 2023, Polkadot’s market capitalization skilled a notable 111% quarter-on-quarter (QoQ) enhance, reaching $8.4 billion. Constructing on this momentum, Q1 2024 witnessed an additional 16% QoQ rise, elevating the circulating market cap to $12.7 billion.

Regardless of these positive factors, DOT’s market capitalization stays 80% beneath its all-time excessive of $55.5 billion, set on November 8, 2021.

In This fall 2023, Polkadot’s income additionally skyrocketed by 2,880% QoQ, amounting to $2.8 million. Per the report, this surge was primarily attributed to an exponential enhance in extrinsics, pushed by the Polkadot Inscriptions.

Nonetheless, income metrics for Q1 2024 declined considerably on a QoQ foundation, with income in USD dropping by 91% to $241,000 and income in DOT lowering by 92% to twenty-eight,800. It’s value noting that Polkadot’s income tends to be comparatively decrease in comparison with its rivals as a result of community’s structural design.

Polkadot’s XCM exercise continued to point out development in Q1 2024. Day by day XCM transfers surged by 89% QoQ to succeed in 2,700, whereas non-asset switch use circumstances, generally known as “XCM different,” witnessed a 214% QoQ enhance, averaging 185 day by day transfers.

The entire variety of day by day XCM messages grew 94% QoQ to 2,800, demonstrating the community’s dynamic ecosystem. As well as, the variety of energetic XCM channels grew 13% QoQ to a complete of 230.

Polkadot’s Parachain Community Soars To New Heights

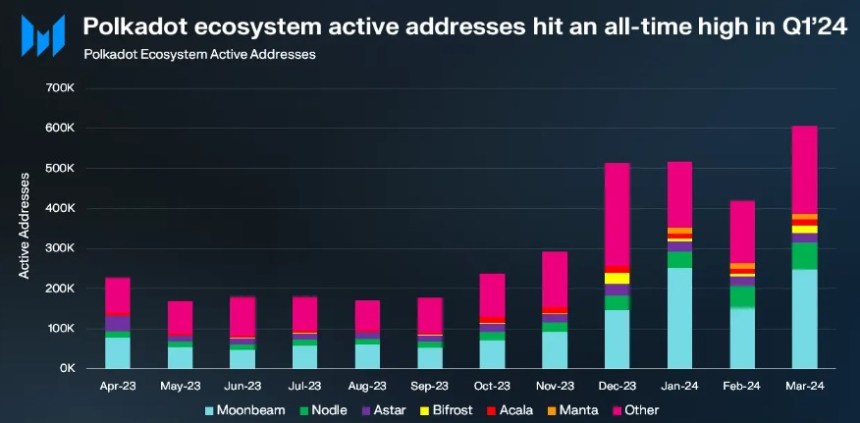

Q1 2024 marked a big kick-off to the yr for Polkadot’s parachains, with energetic addresses reaching an all-time excessive of 514,000, representing a considerable 48% QoQ development.

Moonbeam emerged because the main parachain with 217,000 month-to-month energetic addresses, a stable 110% QoQ enhance. Nodle adopted carefully with 54,000 month-to-month energetic addresses, doubling from the earlier quarter.

Astar alternatively, skilled a modest 8% QoQ development to succeed in 26,000 energetic addresses, whereas Bifrost Finance grew barely by 2% QoQ to 10,000 addresses. Nonetheless, Acala skilled a decline, with month-to-month energetic addresses falling to 13,000, down 16% QoQ.

Notably, the Manta Community stood out amongst parachains in Q1 2024, with a big surge in day by day energetic addresses, reaching 15,000. In accordance with Messari, this enhance was fueled by the profitable launch of the MANTA token TGE and subsequent itemizing on Binance, propelling Manta’s Whole Worth Locked (TVL) to over $440 million.

Polkadot Value Sees Upside Potential Forward

By way of worth motion, Polkadot’s native token DOT has regained bullish momentum following a pointy drop to the $5.8 worth mark after reaching a yearly excessive of $11 on March 14.

At present, DOT has regained the $7.25 stage, up 7% over the previous week. Nonetheless, DOT’s buying and selling quantity decreased barely by 4.7% in comparison with the earlier buying and selling session, amounting to $320 million over the previous 24 hours, in accordance with CoinGecko data.

If the bullish momentum persists, Polkadot faces its first resistance on the $7.4 zone, which serves because the final threshold earlier than a possible retest of the $8 resistance wall.

Alternatively, the $6.4 assist flooring has confirmed to achieve success after being examined for 2 consecutive days this week, highlighting its significance as a key stage to look at for the token’s upward motion prospects.

Featured picture from Shuttestock, chart from TradingView.com

Disclaimer: The article is offered for academic functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your individual analysis earlier than making any funding selections. Use data offered on this web site solely at your individual danger.