svetikd

Background

The housing market has, for the final two years, largely confounded buyers and economists with its resilience. It was largely thought {that a} rising rate of interest surroundings would dampen housing costs: that hasn’t occurred. It was thought that rising inflation would eat away at demand for houses as People delayed shifting: that additionally hasn’t occurred.

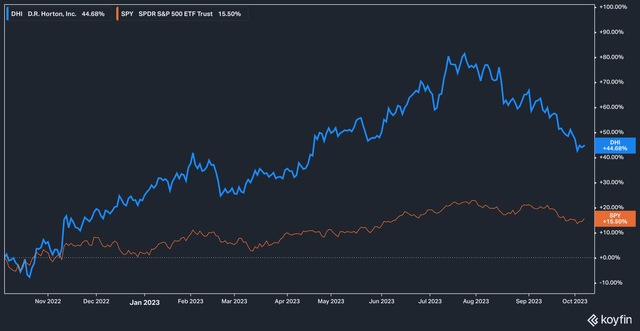

Certainly, evidently nearly each rising macro development has made house builders stronger, quite than weaker. Think about the chart for house constructing large D.R. Horton (NYSE:DHI):

DHI vs SPY, 1 yr (Koyfin)

Over the previous yr the inventory has handily crushed the S&P 500 (SPY) on a complete return foundation, producing a 44% return for buyers. From its peak on July twenty fifth, nevertheless, the inventory has fallen roughly 20% as fears of higher-for-longer rates of interest and the overall sense amongst buyers that customers will not be capable to sustain their frenetic tempo of shopping for bubble to the floor.

We contend, nevertheless, that this current drop presents a shopping for alternative, and that the construction of the market on the most elementary provide/demand degree are long run positives for D.R. Horton. Let’s dive in!

Properties For Sale

On the availability aspect of the housing market, the most important downside is that, nicely, there is not a lot provide. Gross sales of current houses have slowed to a snail’s tempo, and it is not obscure why. Listed here are two of the most important causes for decrease provide ranges within the used-housing market:

- Nearly all of householders in the present day are sitting on decrease rate of interest mortgages. Transferring would imply discovering a brand new house and (presumably) getting a brand new mortgage at a a lot increased charge. That is clearly unattractive until somebody has to maneuver.

- Members of the Child Boomer era are opting for starter houses or staying of their present houses longer in an effort to stave off having to dwell in retirement houses or communities. Given the bigger share of wealth held by Boomers versus youthful house consumers (Millenials and Gen-X, primarily), it is a highly effective market pressure.

With used homes being tough to come back by, new houses are the apparent different, and D.R. Horton is the most important homebuilder by quantity out there for this pool of consumers.

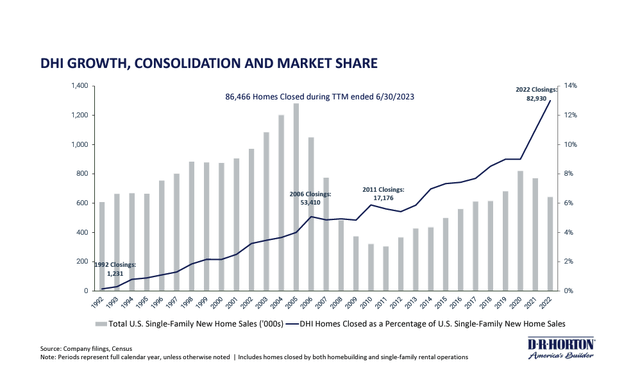

DHI Market Share (Investor Presentation)

It is not tough to see how dominant D.R. Horton is in a fractured market. The above chart, which works again to 1992, exhibits that the corporate’s administration has adroitly managed the corporate’s development: D.R. Horton did not even expertise a drop off in a share of closings towards all house gross sales throughout the housing bubble of 2008 (absolutely the quantity fell between 2006 and 2011, in fact, however this was resulting from macro points outdoors of the corporate’s management), and the corporate is now accountable for roughly 13% of all new household house gross sales nationally as of 2022.

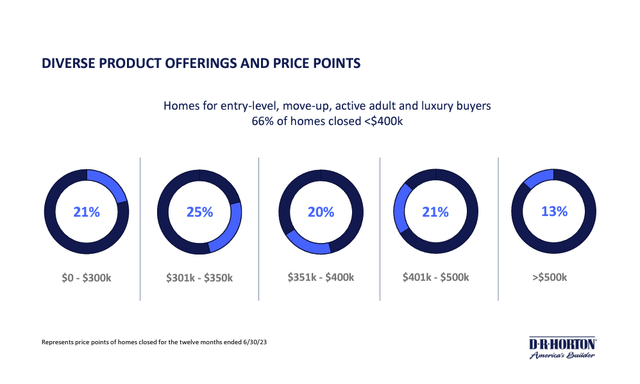

D.R. Horton Value Factors (Investor Presentation)

The corporate has additionally performed an excellent job of staying attuned to the pricing attitudes of the market. As rates of interest rise, consumers can afford much less house. 66% of D.R. Horton’s new houses checklist for below $400,000 (seen above).

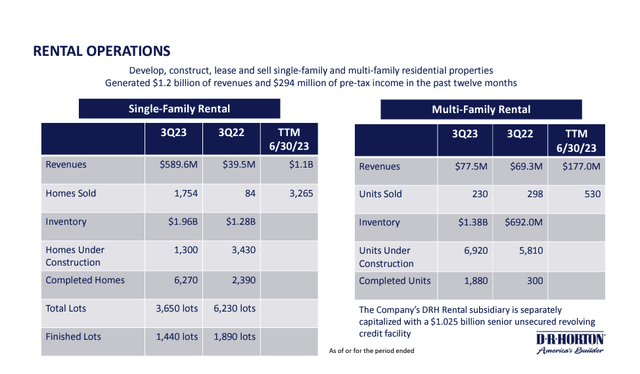

The corporate has additionally managed to faucet into one other pool of consumers with deep pockets: institutions who purchase houses en-masse to lease them.

D.R. Horton Rental Operations (Investor Presentation)

Within the twelve months ending the third quarter of 2023, the corporate reported $589 million in income from its rental operations, which is tremendously bigger than its twelve-month income ending the third quarter 2022 of $39 million, however stays solely a fraction of the corporate’s general trailing twelve-month income of $34.6 billion. Administration acknowledged within the newest convention name that rental margins are anticipated to be down within the near-term, however this isn’t shocking given the mix of upper rates of interest and inflation. We predict that the growth of D.R. Horton’s rental enterprise is probably going to offer a buffer sooner or later towards tough instances, and in addition showcases the nimbleness of administration and willingness to discover new methods for the corporate to generate income.

Valuation

Homebuilders, participating in a cyclical enterprise, have by no means loved premium valuations.

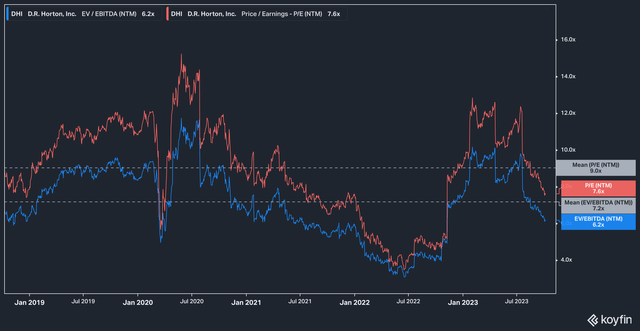

DHI Ahead EV/EBITDA and P/E (Koyfin)

On a ahead foundation, the inventory at the moment trades at 7.6x worth to earnings and 6.2x EV/EBITDA. That is under the inventory’s 5 yr common of 9x and seven.2x, respectively, which is a constructive signal to us in that the run-up in worth (and up to date pullback) has not pulled the inventory into the higher bounds of historic valuation.

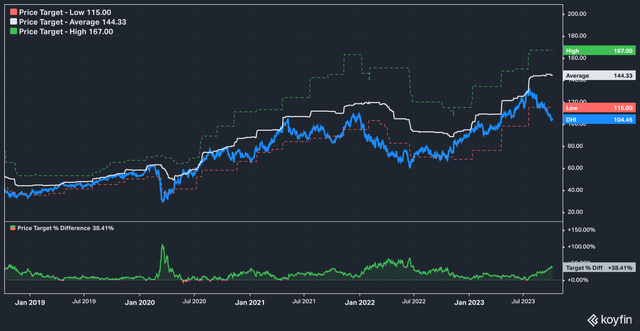

DHI Analyst Value Goal (Koyfin)

Analysts worth targets are additionally comfortably above present ranges, with no downward revisions to targets since 2022. Because it stands, in the present day’s present worth sits 38% under the median worth goal of $144.33.

The Backside Line

Whereas it’s not shocking that D.R. Horton’s inventory has tumbled within the final three months, we expect that the headwinds it faces are largely short-term, and the truth that valuations stay under five-year averages helps the concept that the inventory might have room to renew its upward momentum after they go. Dangers to our thesis embrace a stronger-than-expected U.S. recession, in addition to additional extensions of higher-for-longer rates of interest.