The worth of Curve DAO (CRV) plummeted by as a lot as 35% inside just a few hours. This sharp decline got here after information broke that Michael Egorov, the founding father of Curve, may file for chapter.

Egorov, a key determine within the decentralized finance (DeFi) business, is at present in a precarious buying and selling scenario.

Attainable liquidation of Curve founder causes panic

In accordance with Arkham, an on-chain analytics platform, Egorov is about to see CRV value $140 million liquidated. He has lent roughly $95.7 million in stablecoins, primarily crvUSD, versus $141 million in CRV, throughout 5 accounts through completely different lending protocols.

“Based mostly on present charges, Egorov pays $60 million yearly to maintain his positions open on Llamalend,” Arkham mentioned.

Learn extra: What’s Curve (CRV)?

Egorov lent $50 million via the DeFi platform – Llamalend at an annualized price of return (APY) of roughly 120%. This excessive price is essentially as a result of digital absence of crvUSD obtainable to borrow towards CRV on Llamalend. Notably, three of Egorov’s accounts maintain greater than 90% of the crvUSD borrowed via this protocol.

Moreover, knowledge from Spot On Chain exhibits that Egorov at present has 139 million CRV tokens value $37 million as collateral, with money owed of $27 million throughout three platforms. In accordance with the newest updates, Egorov’s $20.2 million place on DeFi platform UwULend has been liquidated.

The falling worth of CRV additionally impacts different main gamers out there. For instance, a crypto whale, 0xF07, was pressured to switch 29.62 million CRV, value roughly $7.68 million, to Binance as a result of a Fraxlend liquidation.

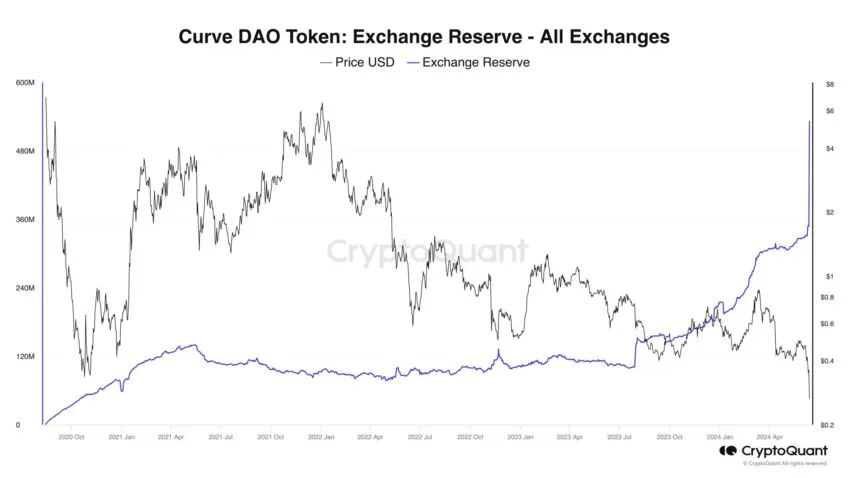

That mentioned, Ki Younger Ju, founding father of one other on-chain analytics platform – CryptoQuant, famous a major improve in CRV balances on exchanges, reaching an all-time excessive. In simply 4 hours it elevated by 57%.

Curve DAO Token Change Reserves. Supply: CryptoQuant

After initially falling from $0.35 to $0.21, CRV’s worth has since proven resilience and recovered to round $0.26, marking an 18% restoration. This state of affairs highlights the unstable and unpredictable nature of the crypto markets.