- Bitcoin whale to probably face liquidation of $28M WBTC.

- The value motion reveals worth is about for additional decline.

Bitcoin’s [BTC] latest worth motion continued to frustrate merchants as uncertainty loomed over the “king of crypto.”

Whereas different cryptocurrencies confronted comparable declines, BTC was particularly affected by whale exercise.

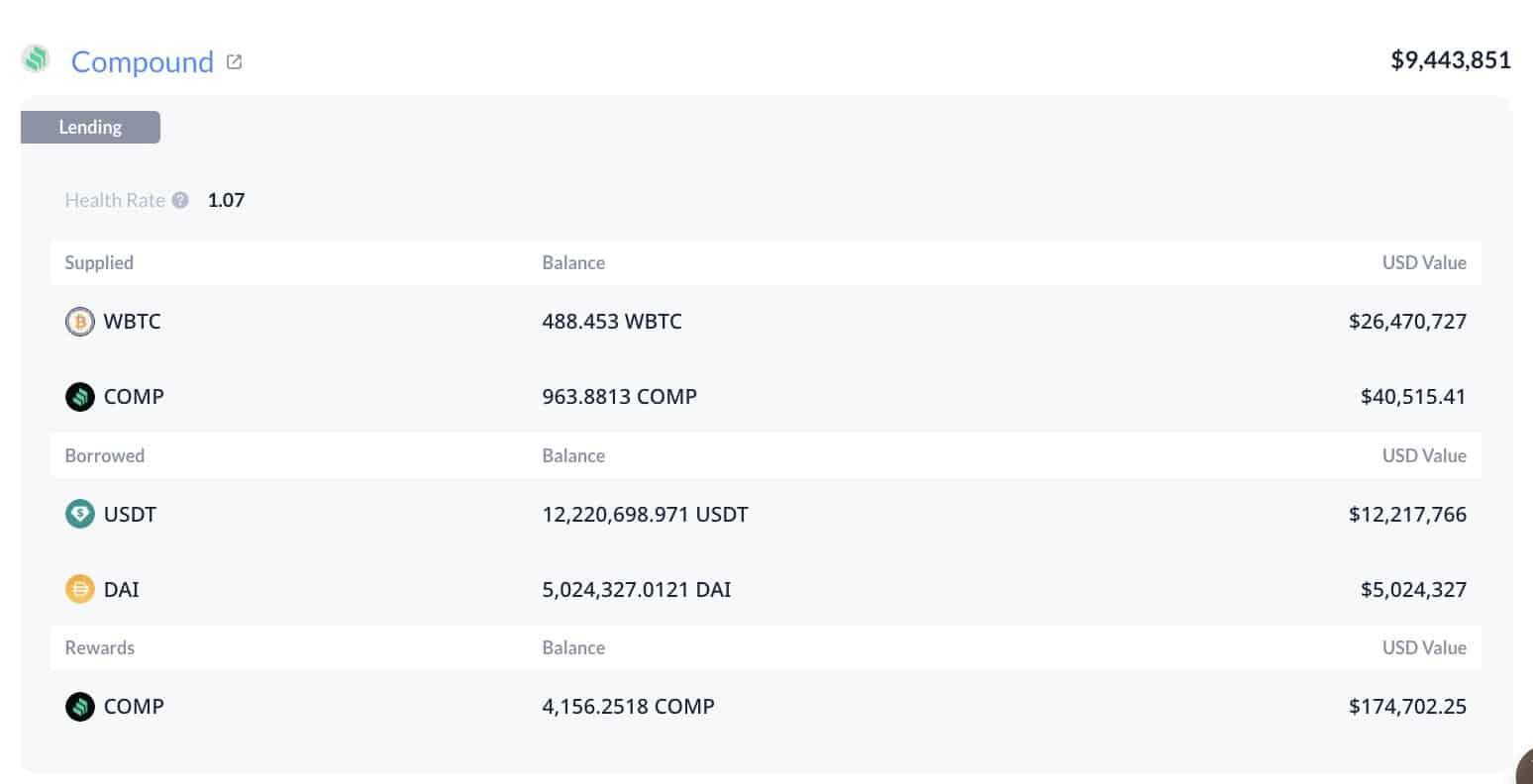

One distinguished whale dangers liquidation of 488.45 WBTC, value $28M, on Compound [COMP], with a well being fee of 1.07 and a liquidation worth at $50,429.

This whale was liquidated 3 times through the 2022 crash, totaling 74,426 cWBTC value $32.82M. The present liquidation orders under $50,429 may drive the Bitcoin worth towards this stage.

Supply: Lookonchain

Extra BTC ranges to be liquidated

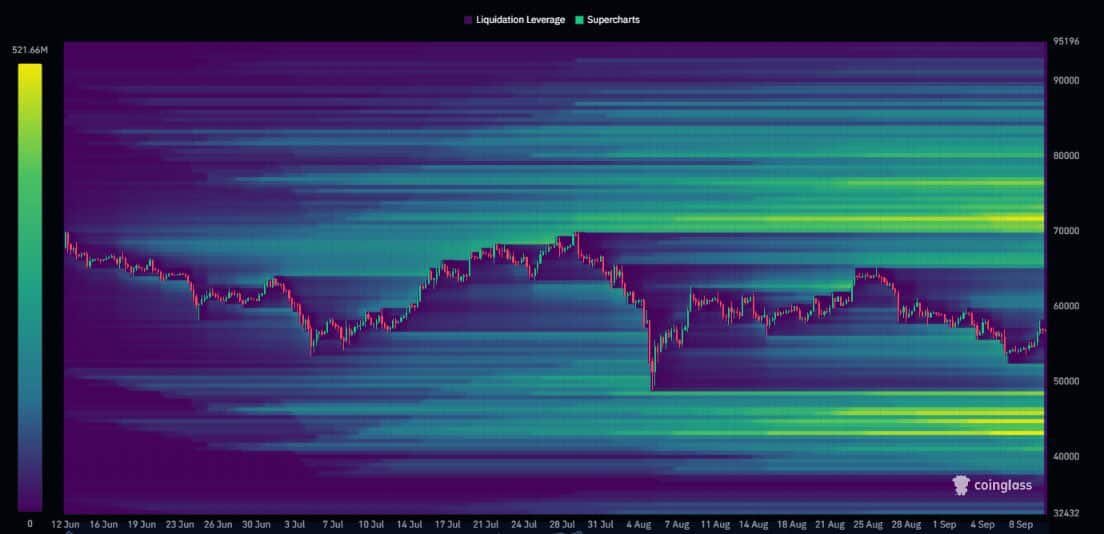

The broader Bitcoin market is vulnerable to additional liquidation. Notably, sell-side liquidations are projected to hit $1.07B across the $50K mark, with an additional $500 million anticipated under $55,000.

A 3-month heatmap revealed excessive liquidity ranges on either side of the market, with lengthy liquidations close to $45K and quick liquidations round $72K.

Merchants ought to keep away from leveraged positions because the market may transfer sharply in both route to seize liquidity.

Supply: Coinglass

After rejecting the $60K stage, Bitcoin’s worth could decline additional, probably choosing up liquidity under $50K earlier than making a reversal to the upside.

What’s subsequent for BTC?

On the 4-hour timeframe, Bitcoin has repeatedly failed to interrupt above the 200-day exponential transferring common (EMA) in latest weeks.

This urged that BTC may face extra downward stress. Costs are sometimes interested in liquidity resting above or under key ranges.

Whether or not BTC trades above or under its transferring averages affords perception into market power or weak point.

Bulls must reclaim these transferring averages to set off a bounce, however sentiment signifies that the worth would possibly drop additional as extra liquidity is concentrated on the psychological $50K stage.

Supply: TradingView

Historical past reveals a return to a steadiness zone

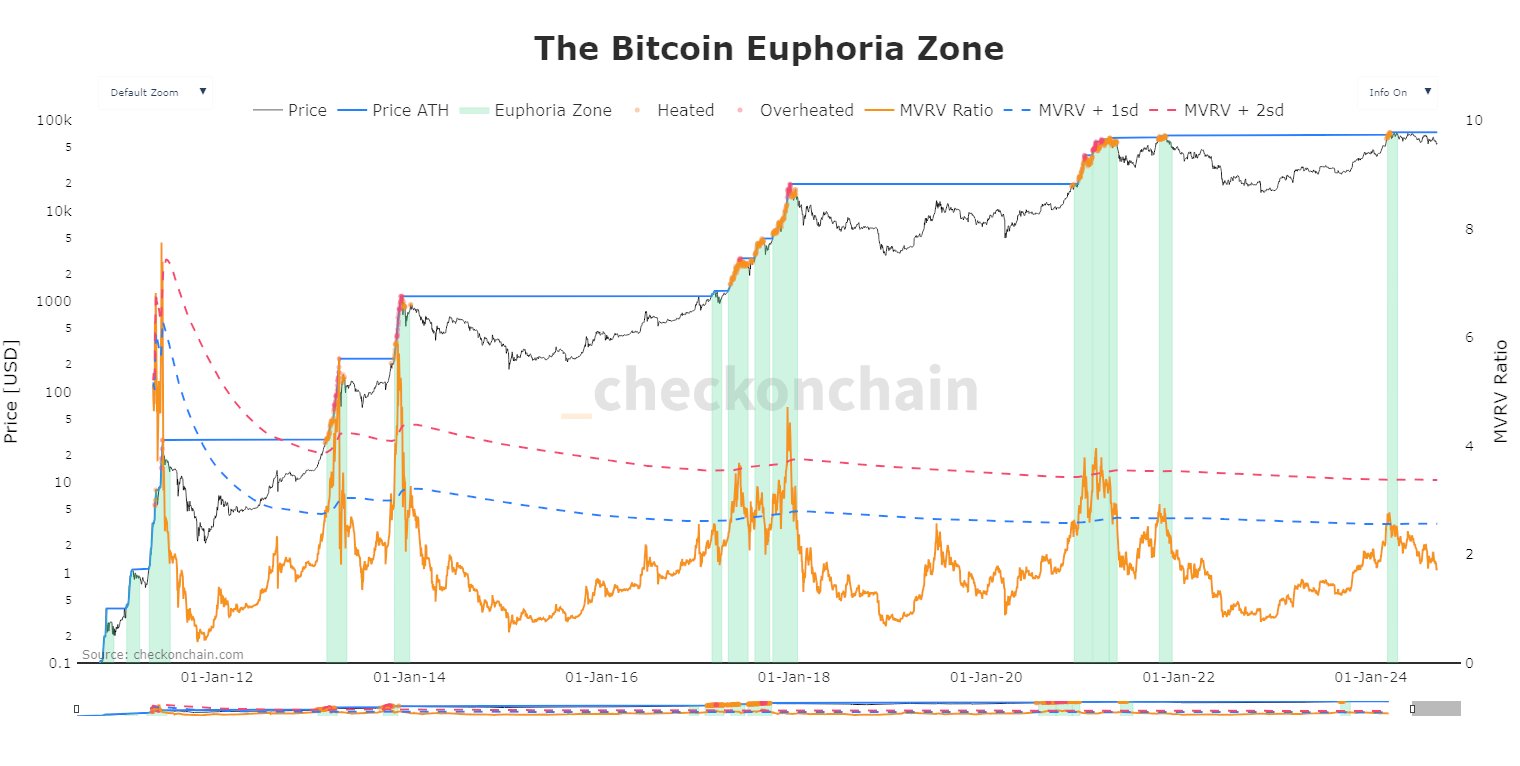

Traditionally, Bitcoin tends to return to a steadiness zone, providing potential for future worth development.

The Euphoria Zone metric means that the ATH of the earlier cycle usually turns into the low for the subsequent rally.

Different metrics just like the market worth/realized worth (MVRV) ratio present BTC is heading towards a steadiness zone, a essential stage from which worth traditionally bounces.

Supply: Checkonchain

Though Bitcoin hasn’t reached these ranges but, analysts predict BTC may dip under $50K, collect liquidity, after which rise to new highs, probably by late This autumn 2024 or early Q1 2025.

Learn Bitcoin’s [BTC] Value Prediction 2024–2025

Bitcoin’s worth motion and ongoing liquidations level to potential volatility within the close to future. As liquidity builds under key ranges, BTC may decline additional earlier than experiencing a considerable rebound.

Nonetheless, if Bitcoin follows historic patterns, it would possible rebound, setting the stage for a better worth surge as liquidity strengthens.