- Bitcoin has appreciated by over 4% within the final seven days.

- Most market indicators hinted at a worth correction quickly.

Bitcoin [BTC] and Ethereum [ETH] displayed bullish efficiency over the past seven days as their weekly charts had been inexperienced. Right here’s an in depth take a look at the highest two cash to learn the way the crypto week forward can be.

Bitcoin and Ethereum’s goal

Based on CoinMakrtetCap, BTC’s worth elevated by over 3% within the final seven days. Likewise, the king of altcoins additionally witnessed a 2% worth rise.

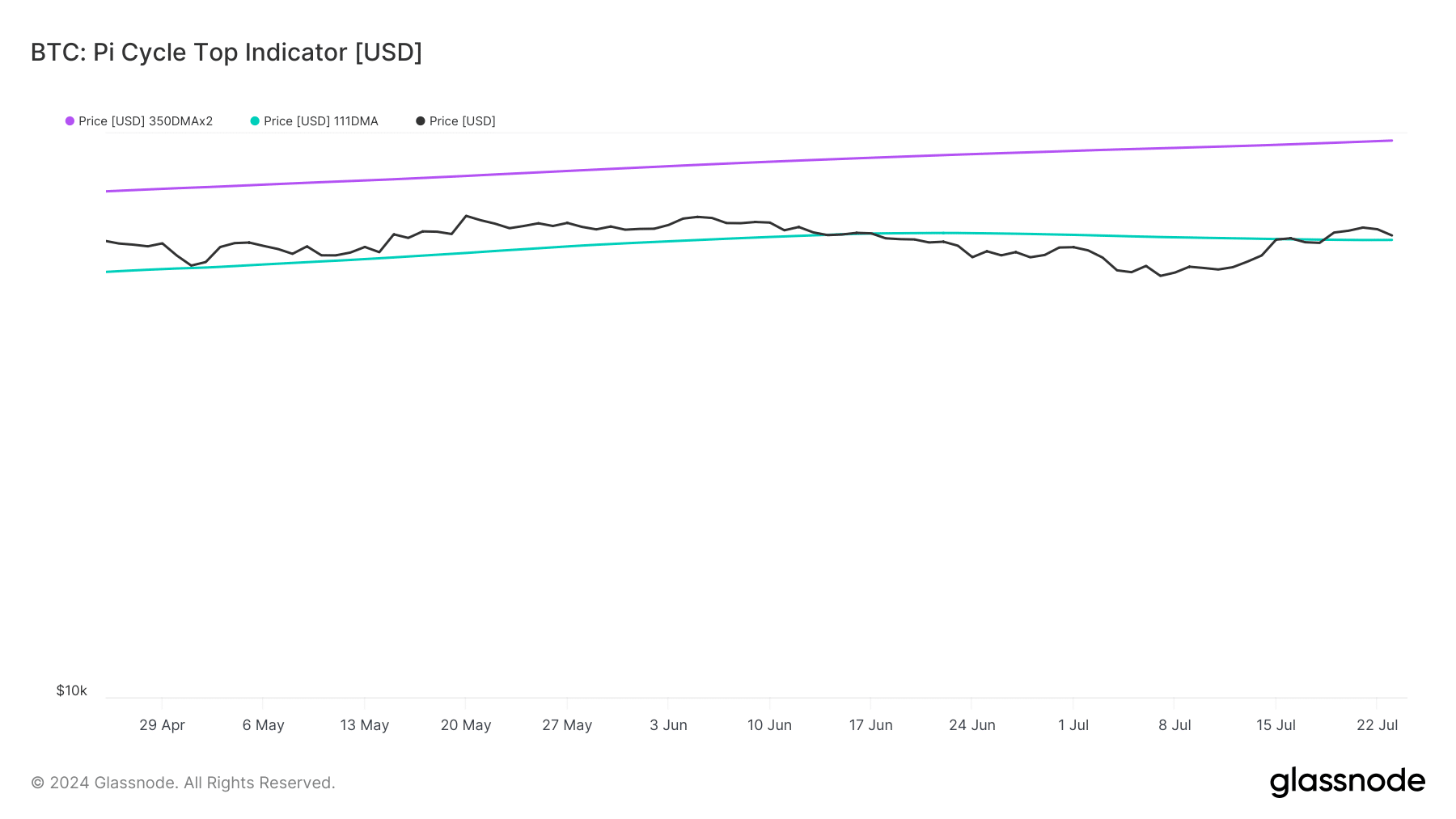

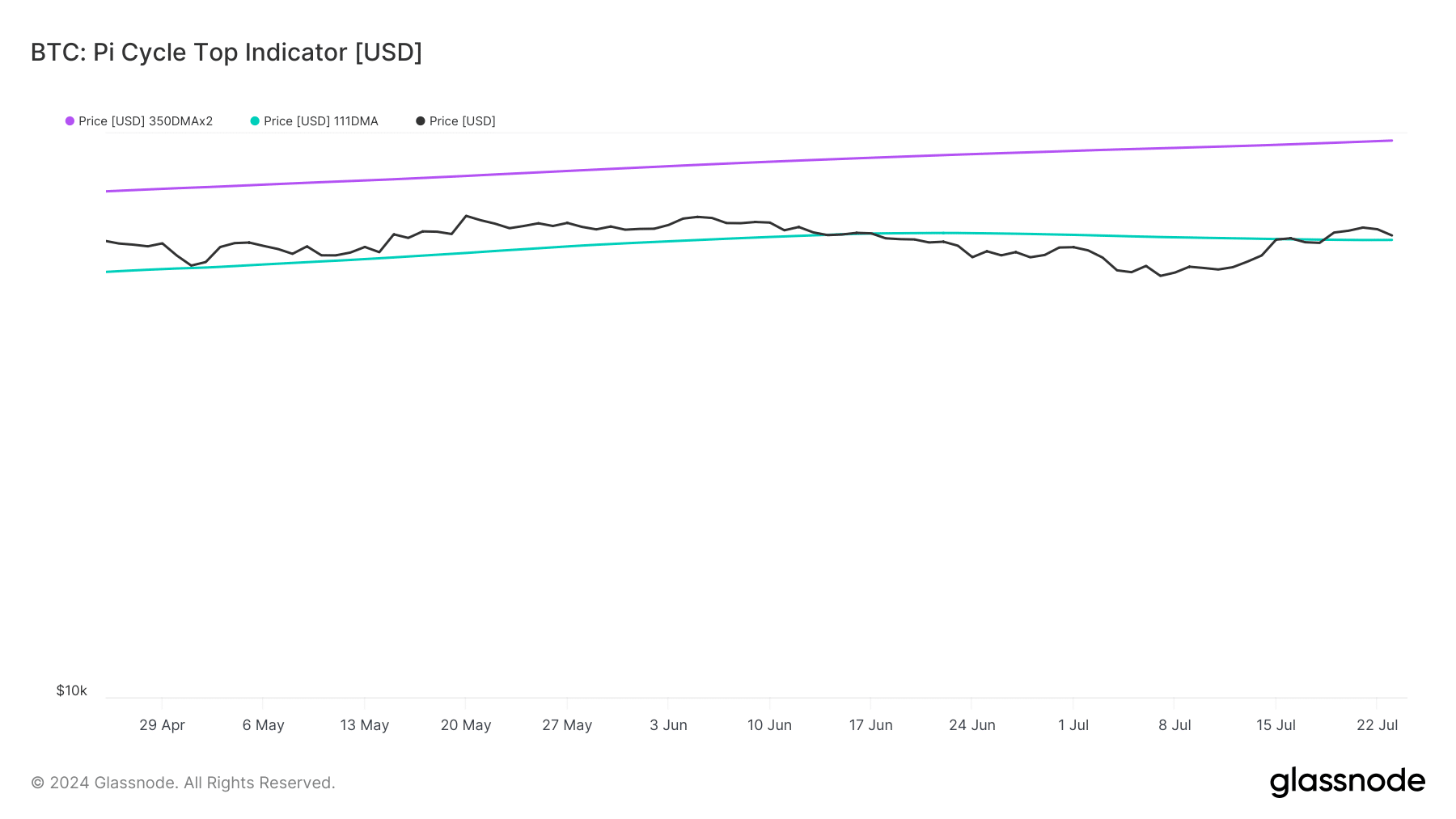

On the time of writing, BTC was buying and selling at $64k whereas ETH was buying and selling at $3.5k. AMBCrypto’s evaluation of Glassnode’s data revealed that BTC was buying and selling method under its market prime. As per the information, BTC’s doable market prime was round $97k.

Supply: Glassnode

In the meantime, Ethereum’s worth considerably gained bearish momentum as its worth was touching the market backside. As per the Pi cycle prime indicator, ETH’s worth may hit a market prime at $5.2k.

If the week forward goes bullish, then these two prime tokens may attain their targets.

What to anticipate from BTC and ETH

AMBCrypto then planed to take a look at each of those cash’ metrics to raised perceive whether or not the upcoming week will likely be bullish or bearish.

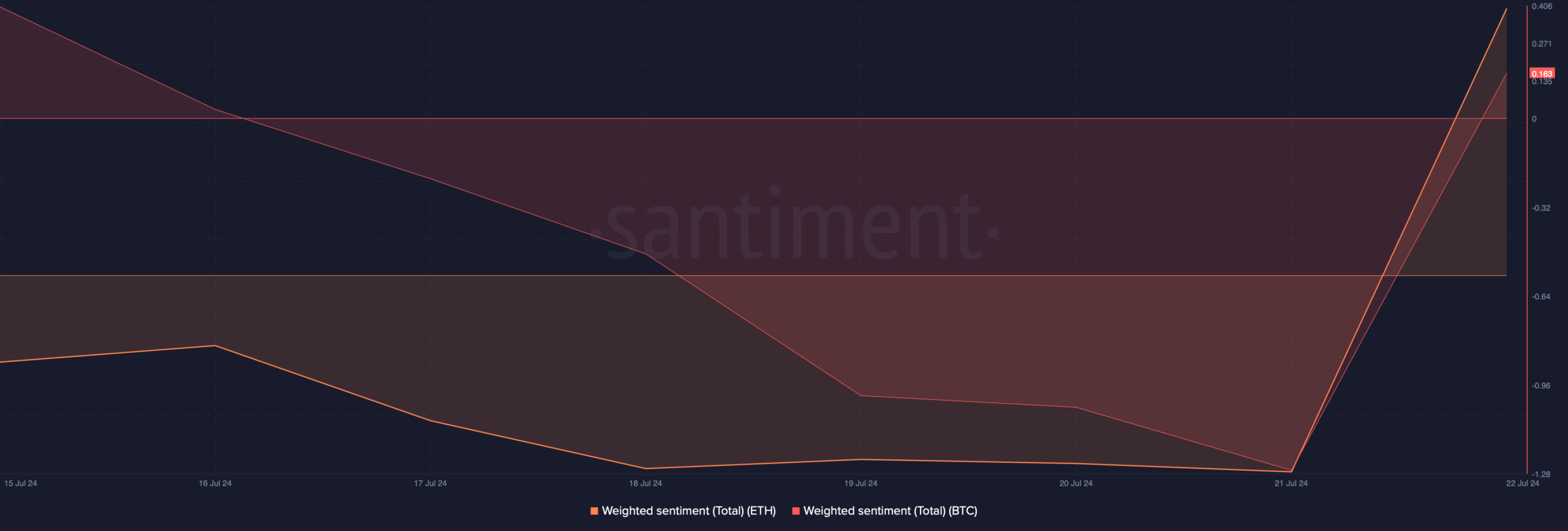

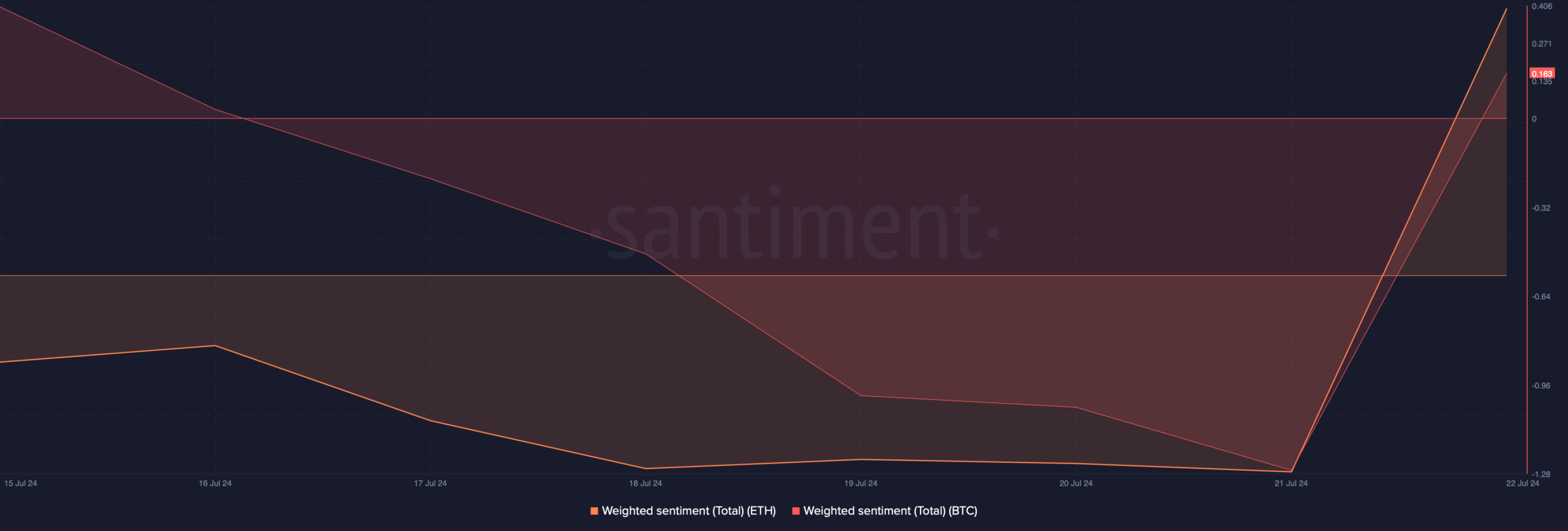

As per our evaluation of Santiment’s knowledge, sentiment round BTC and ETH turned bullish. Each the tokens’ weighted sentiments went into the constructive zone, that means that bullish sentiments had been dominant out there.

Supply: Santiment

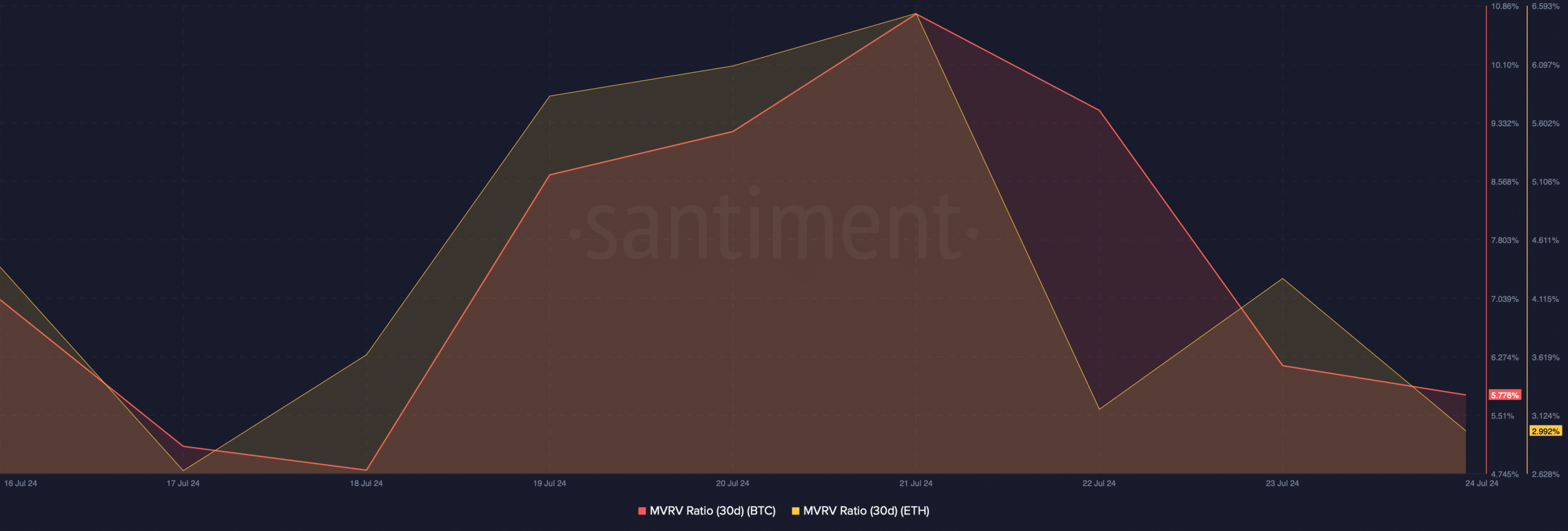

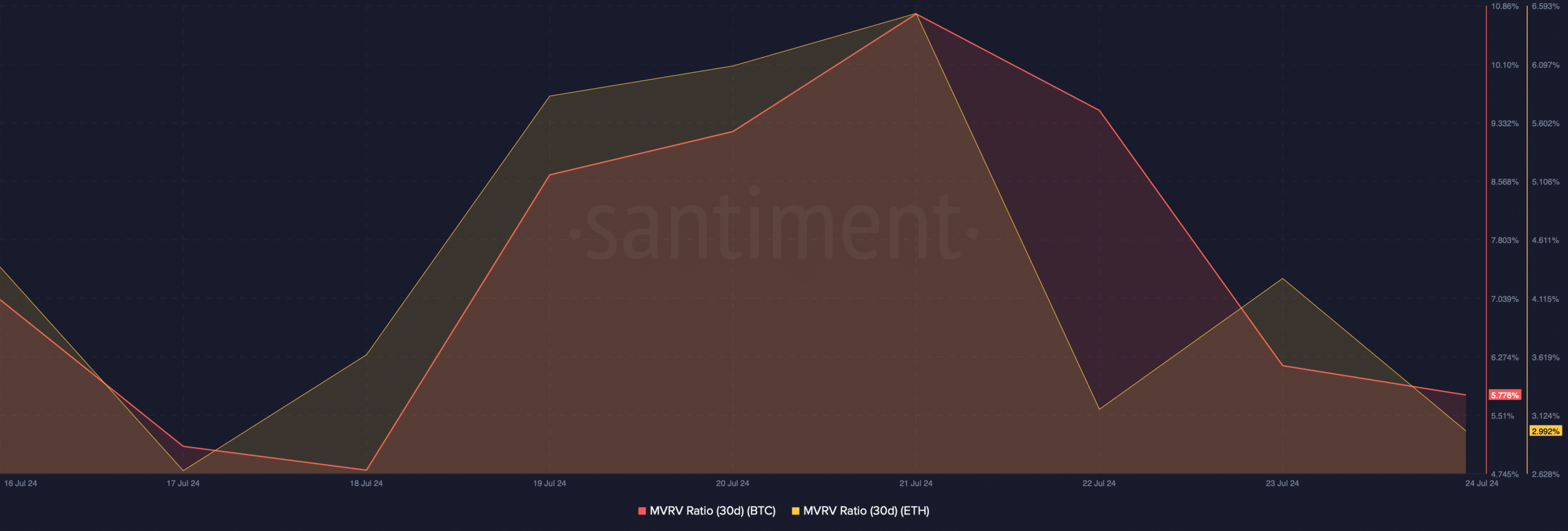

One other bullish sign was the MVRV ratio, because it registered an uptick over the past seven days. It signifies that the probabilities of a bull rally are excessive.

Supply: Santiment

Let’s take a look on the day by day charts of BTC and ETH to raised perceive what to anticipate from them within the coming days.

BTC and ETH worth chart evaluation

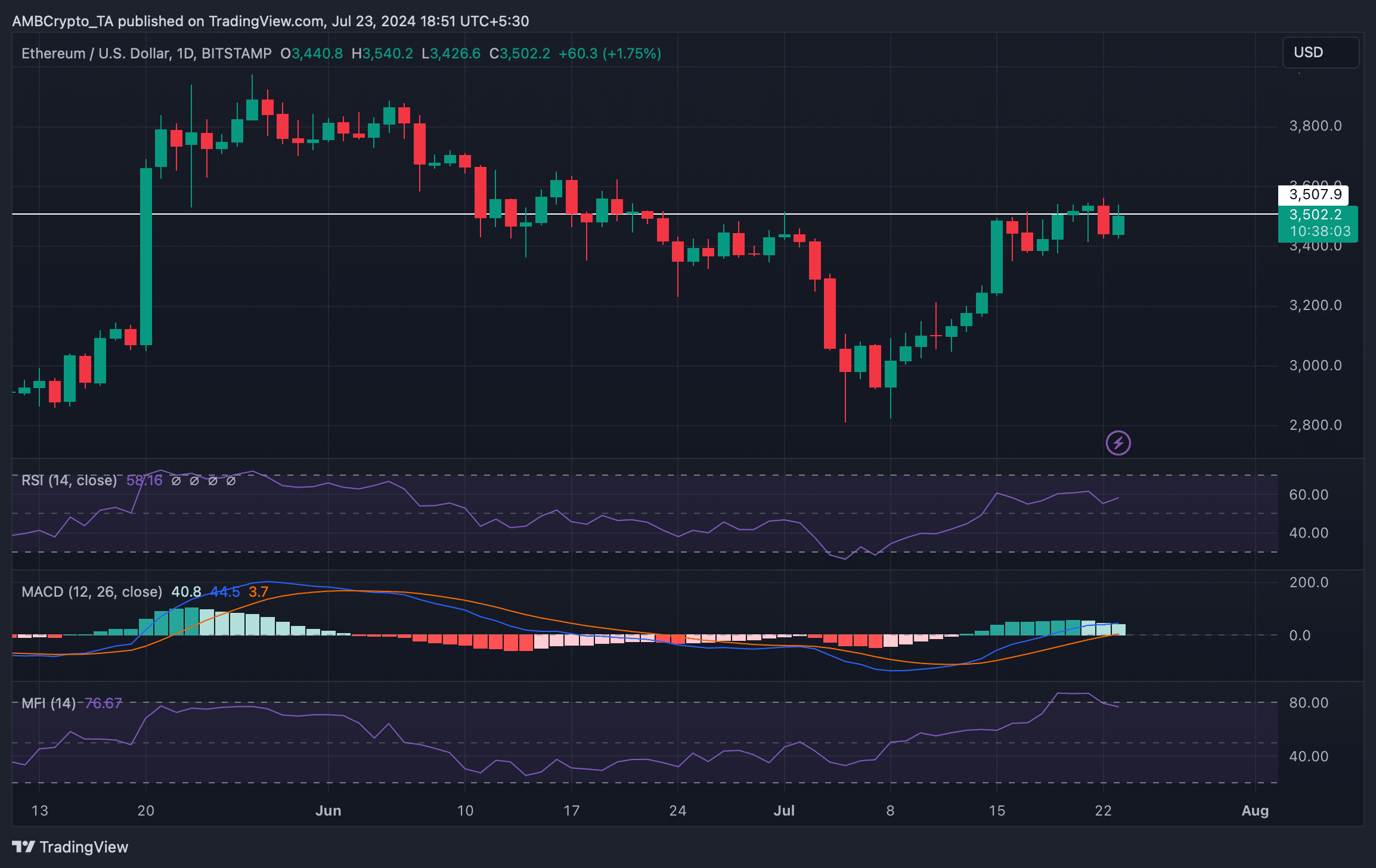

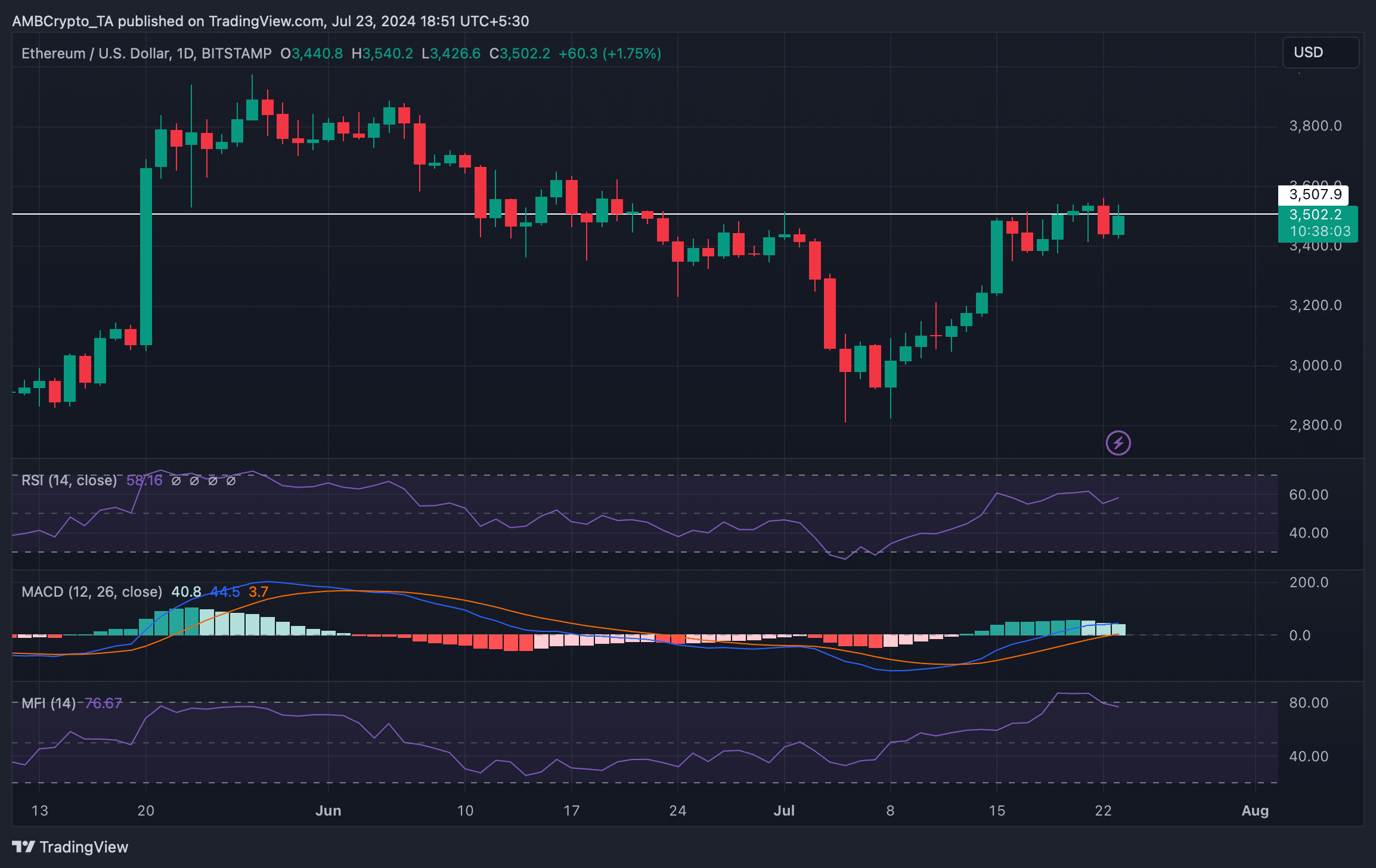

As per our evaluation, the MACD displayed a bullish benefit out there for ETH. Nevertheless, the remainder of the market indicators had been bearish.

For example,, the Relative Energy Index (RSI) and the Cash Circulate Index (MFI) had been each about to enter the overbought zone. This may enhance promoting stress on ETH and, in flip, may push the coin’s worth down.

Supply: TradingView

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

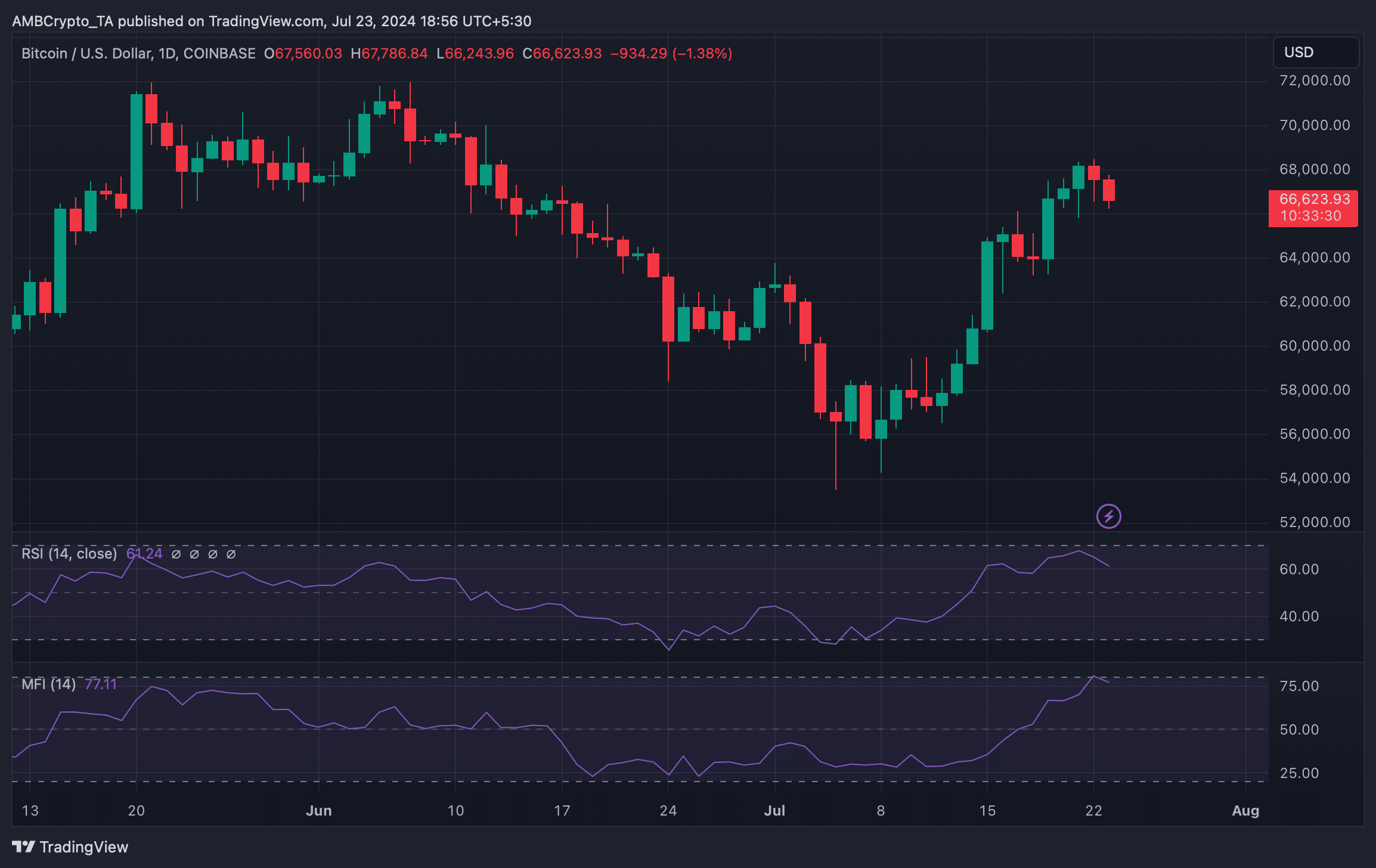

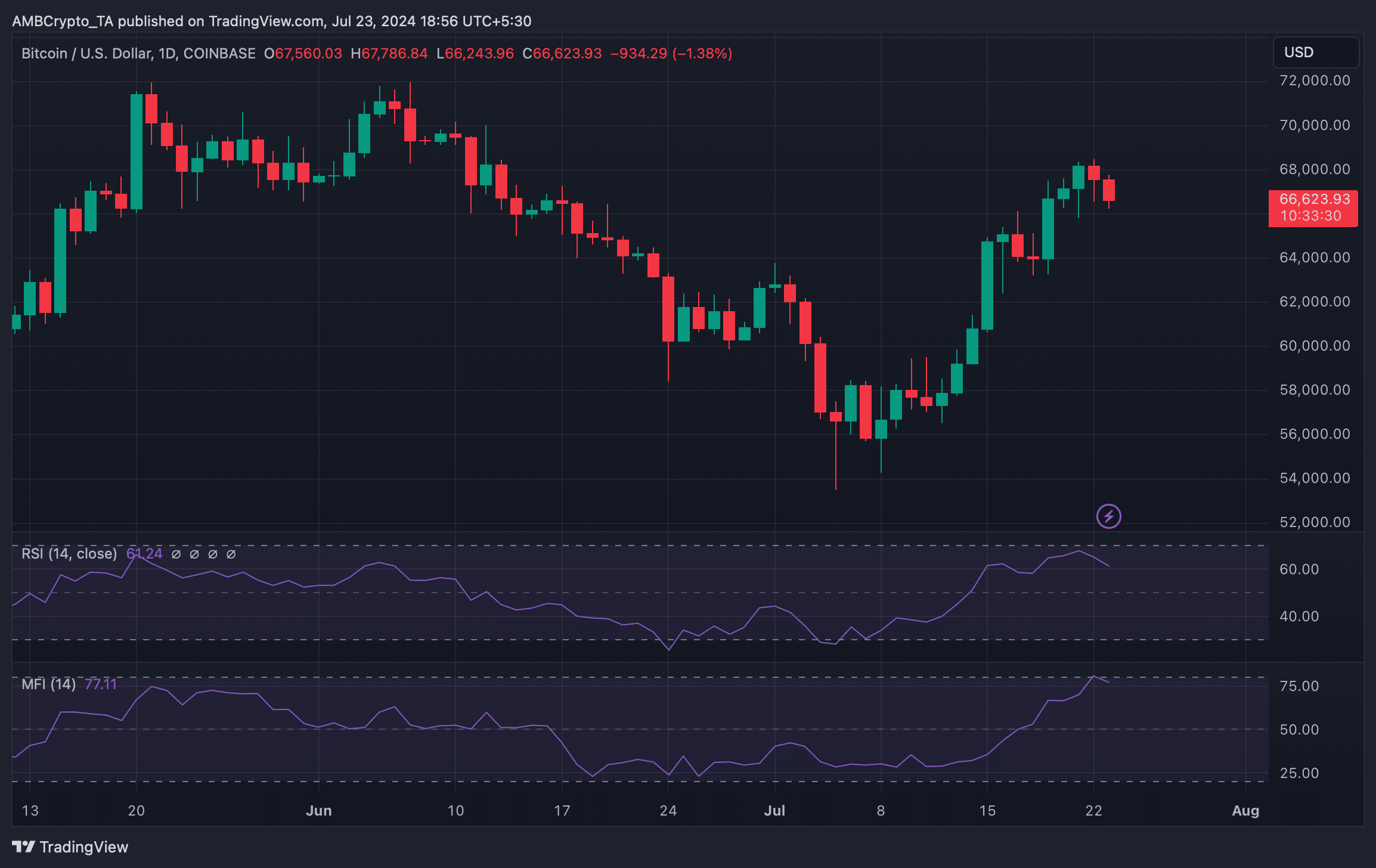

An analogous state of affairs was additionally famous on BTC’s charts. Each BTC’s Relative Energy Index (RSI) and Cash Circulate Index (MFI) registered downticks.

This meant the upcoming week is perhaps bearish for prime cryptos like ETH and BTC.

Supply: TradingView