- Bitcoin and Ethereum have been seemingly headed for his or her native highs this week.

- The band of resistance under $70k might pose a considerable impediment to the patrons.

Bitcoin [BTC] managed to climb previous the resistance zone at $60k-$61k and was buying and selling a couple of {dollars} under $63k at press time. Merchants have taken this as an indication that Bitcoin is headed towards its all-time excessive at $73.7k.

Promoting strain on BTC from the German authorities was depleted and spot ETF inflows final week have been strongly constructive, establishing a pleasant surroundings for a worth rebound.

This sentiment noticed a constructive uptick on Monday, however right here’s what is probably going in retailer subsequent.

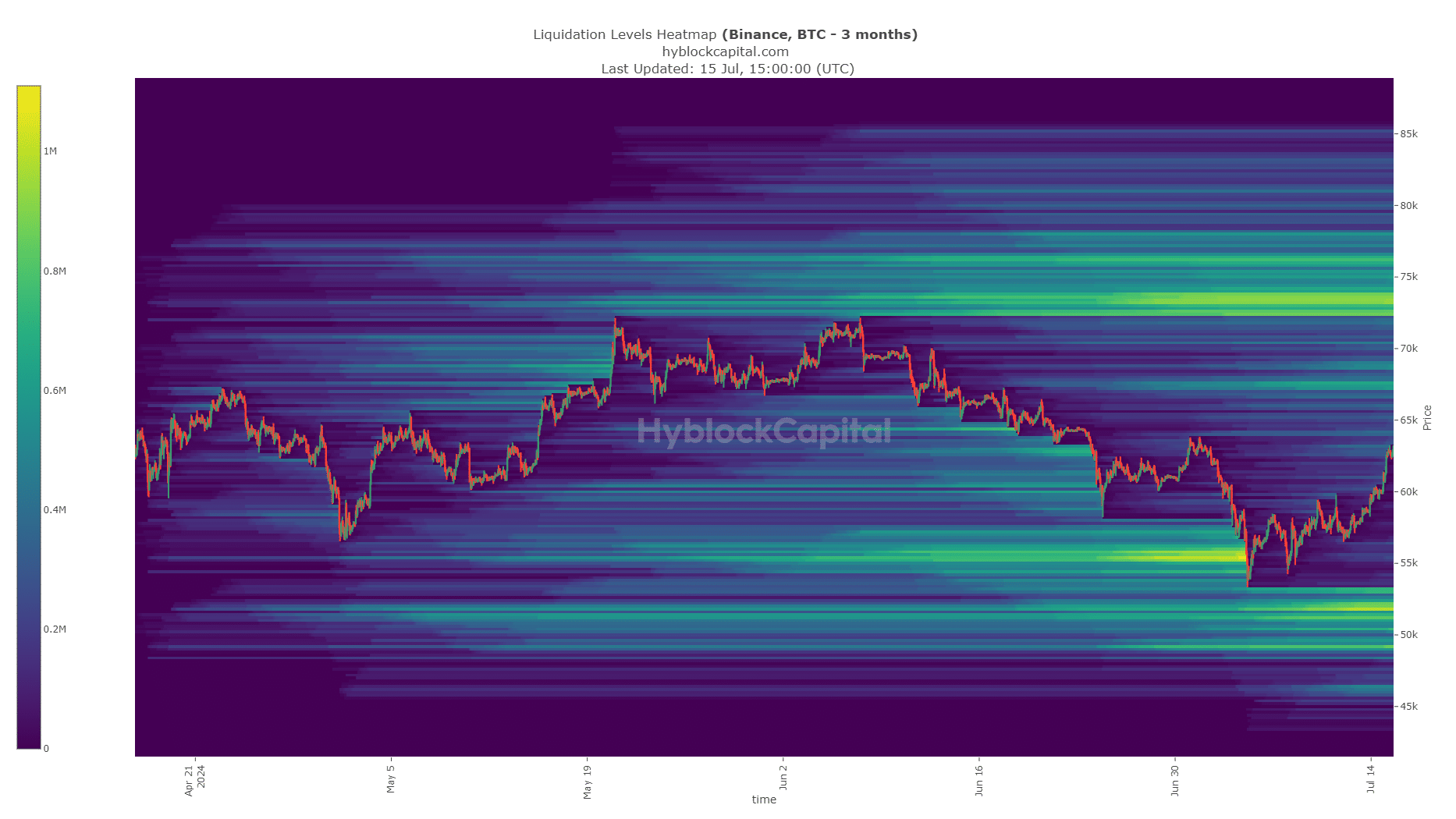

Utilizing the liquidation charts as a compass

In a publish on X (previously Twitter) crypto analyst CrypNuevo highlighted two scenarios for Bitcoin within the coming days. Certainly one of them was invalidated, which was a rejection from the previous vary lows at $60k.

The opposite was that the $60.6k resistance zone was flipped to help and retested earlier than the costs sure greater towards the $68k and $73k resistance zones.

These are the 2 liquidity swimming pools to be careful for greater, with $76.4k being one other zone that would set off a considerable amount of quick liquidations.

This expectation got here as a result of the decrease timeframe market construction would flip bullishly, and the liquidity ranges to the north can be the subsequent goal after searching the $55k zone earlier this month.

A retest of the $61k-$62k area may very well be a set off for bullish merchants to enter lengthy positions focusing on the $72k-$73k zone.

A rise of $3.4 billion in Open Curiosity because the thirteenth of July indicated bullish sentiment. Therefore, merchants can anticipate a constructive crypto week forward.

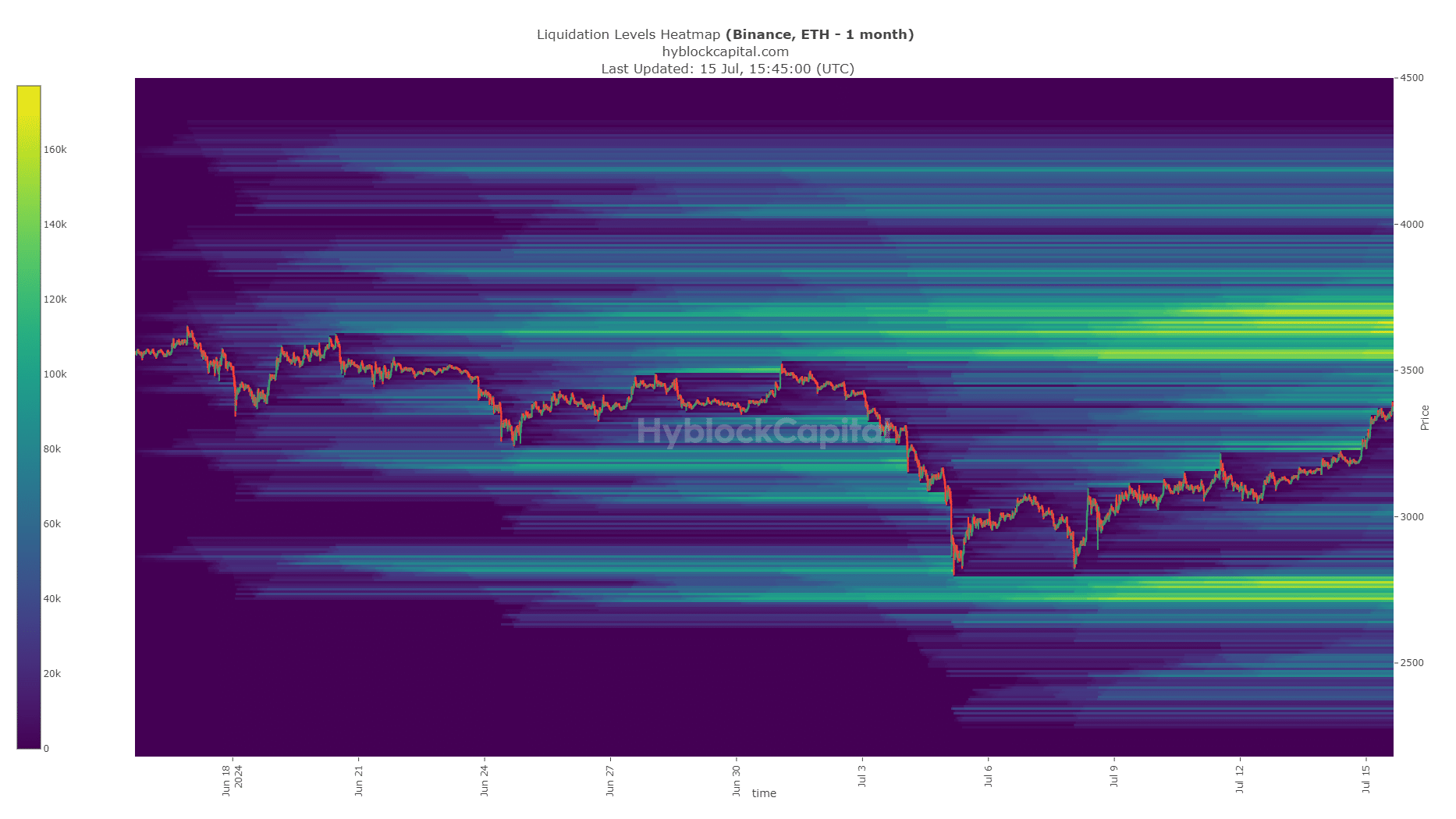

Ethereum additionally targets the native highs

The Ethereum liquidation heatmap confirmed that $3.5k-$3.7k is more likely to be revisited quickly.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

This was one other constructive improvement because the ETH bulls defended the $2.9k degree, the 61.8% Fibonacci retracement degree, and initiated a restoration from there.

A transfer towards $3.7k and as excessive as $4k was attainable within the coming weeks. Over the subsequent week, a transfer to $68k for Bitcoin and $3.7k for Ethereum was seemingly primarily based on the proof at hand.