Singapore-based digital asset funding agency Spartan Group has introduced investments in decentralized finance (DeFi) protocol Pendle Finance (PENDLE).

After actively supporting Pendle since its launch in 2021, Spartan Group’s crypto enterprise capital arm Spartan Capital has made a follow-on funding in Pendle Finance through an over-the-counter or OTC buy.

The corporate highlighted that Spartan and Pendle have had a powerful partnership for the reason that inception of the DeFi undertaking, noting that the most recent funding goals to help the undertaking in its additional ambitions.

Spartan Capital has been with Pendle for the reason that very starting of our journey for the reason that days of Pendle V1.

It is an honor to affix forces with one in all our longest supporters once more on our subsequent leg as we attempt to reshape the crypto panorama collectively https://t.co/7C1t8g5DQu

— Pendle (@pendle_fi) November 9, 2023

“At Spartan Capital, we acknowledge the transformative potential of Pendle and their important function in driving the development of on-chain yield buying and selling,” Spartan famous.

Spartan mentioned Pendle is steadily rising as a serious DeFi protocol, with complete worth locked (TVL) rising by greater than 2,000% in a 12 months as of November 2022, based on information from DefilLama. The VC agency expressed confidence that Pendle’s options, equivalent to Liquid Staking Derivatives and the high-yield Actual World Property undertaking, will assist convey extra off-chain capital to the sector.

“The convergence of Liquid Staking Derivatives and Actual World Property presents an distinctive progress alternative for the DeFi sector,” mentioned Kelvin Koh, managing accomplice of Spartan Capital, including:

“Their yield buying and selling toolkit is designed to enhance and add worth to all digital yield-bearing belongings, which additionally means Pendle will probably be uniquely positioned as an accelerator for extra future DeFi developments.”

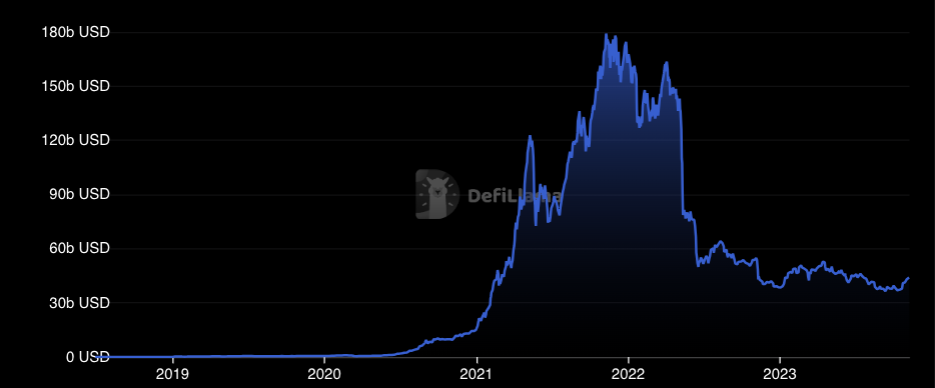

Spartan’s optimism about DeFi comes amid a scenario the place the sector has failed to achieve a lot momentum to date in 2023. Regardless of complete DeFi TVL rising by round 18% for the reason that begin of the 12 months, the business has failed to succeed in early 2022 ranges and is down 279% from all-time highs above 177 billion {dollars} recorded in November 2021.

Spartan Capital didn’t instantly reply to Cointelegraph’s request for remark.

Associated: Bitget integrates DeFi aggregator into crypto change app

Not like DeFi, another markets, equivalent to Bitcoin (BTC), have risen considerably this 12 months. The world’s largest cryptocurrency is up greater than 120% since January after beginning the 12 months round $16,600, based on information from CoinGecko.

Regardless of DeFi-related financial exercise declining considerably in 2023, the sector has seen vital funding. Earlier this 12 months, enterprise capital group Blockchain Capital introduced two new funds, totaling $580 million, targeted on DeFi growth alongside gaming and infrastructure investments.