- ONDO, TON, and FTM had the week’s greatest good points.

- INJ, JUP, and BONK had been the largest losers for the week.

Final week was marked by a normal decline in bullish sentiment within the cryptocurrency market, which impacted the efficiency of a number of belongings.

Throughout that interval, the worldwide cryptocurrency market capitalization fell by 7%. Right here’s AMBCrypto’s record of the largest winners and losers from the seventeenth to the twenty fourth of March.

Greatest winners

Ondo [ONDO]

Ondo [ONDO], the native token of securities tokenization venture Ondo Finance, led the cryptocurrency market because the asset with probably the most good points within the final week.

Exchanging palms at $0.75 at press time, the token’s worth rose by over 57% over the past seven days.

On the twenty first of March, ONDO climbed to an all-time excessive of $0.81. This adopted reports that BlackRock had dedicated one other spherical of capital to launch a tokenized cash market fund.

Though ONDO’s worth was up virtually 10% up to now 24 hours, the double-digit decline in its buying and selling quantity inside the similar interval created a divergence that hinted at a potential downside within the token’s worth.

Toncoin [TON]

Per CoinMarketCap’s information, TON noticed a formidable weekly rally of 46% to rank because the asset with the second-highest good points final week.

The surge within the token’s worth was as a result of graduation of the primary full season of The Open League, which the Ton Basis introduced on twentieth March.

In accordance with the weblog submit, this system will enable TON-based tasks to compete for rewards, and the community’s customers will obtain rewards for his or her on-chain exercise.

By this occasion, 30 million TON price round $115 million can be distributed to ecosystem members.

As of this writing, the altcoin exchanged palms at $5.10, with a 109% uptick in its buying and selling quantity up to now 24 hours.

Fantom [FTM]

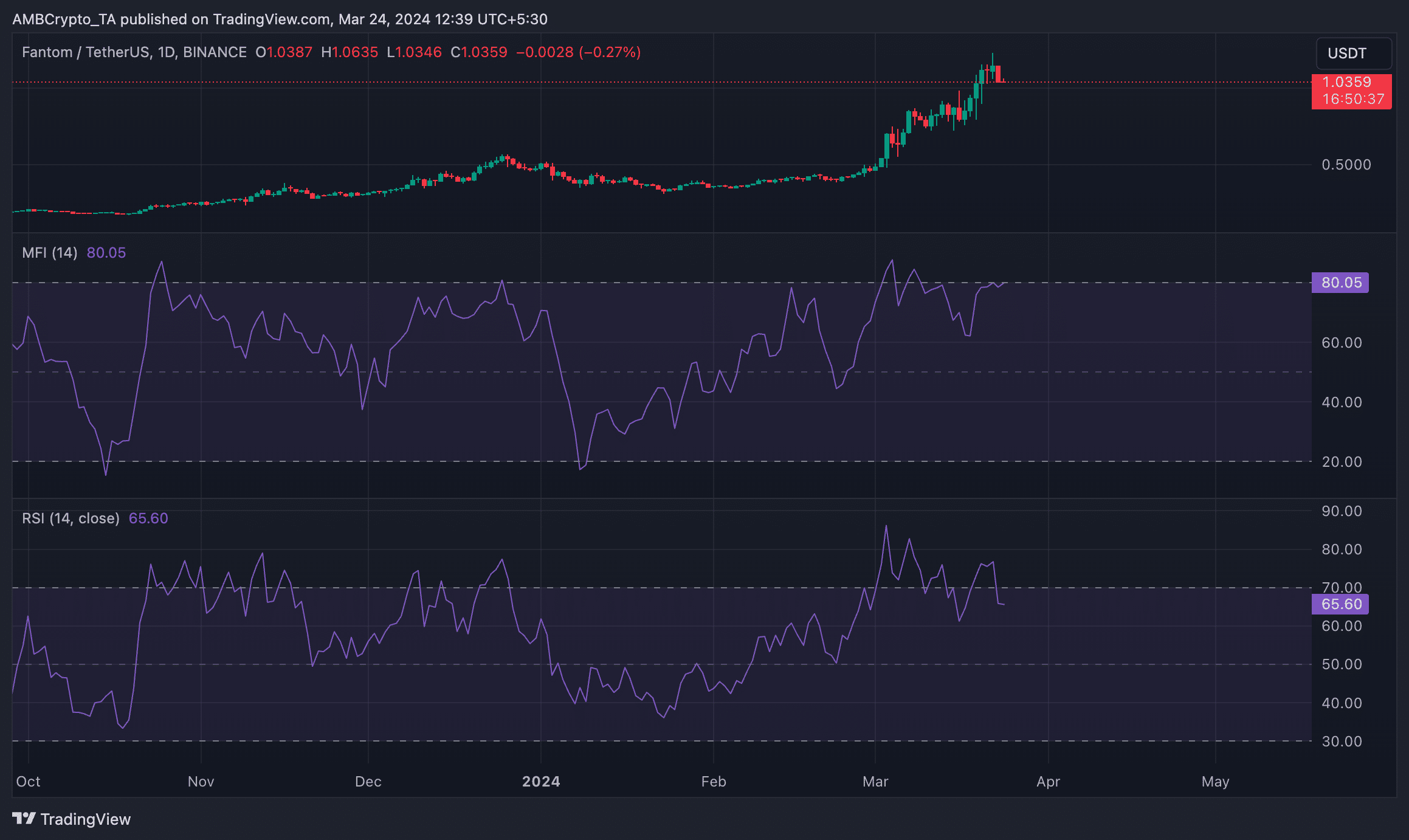

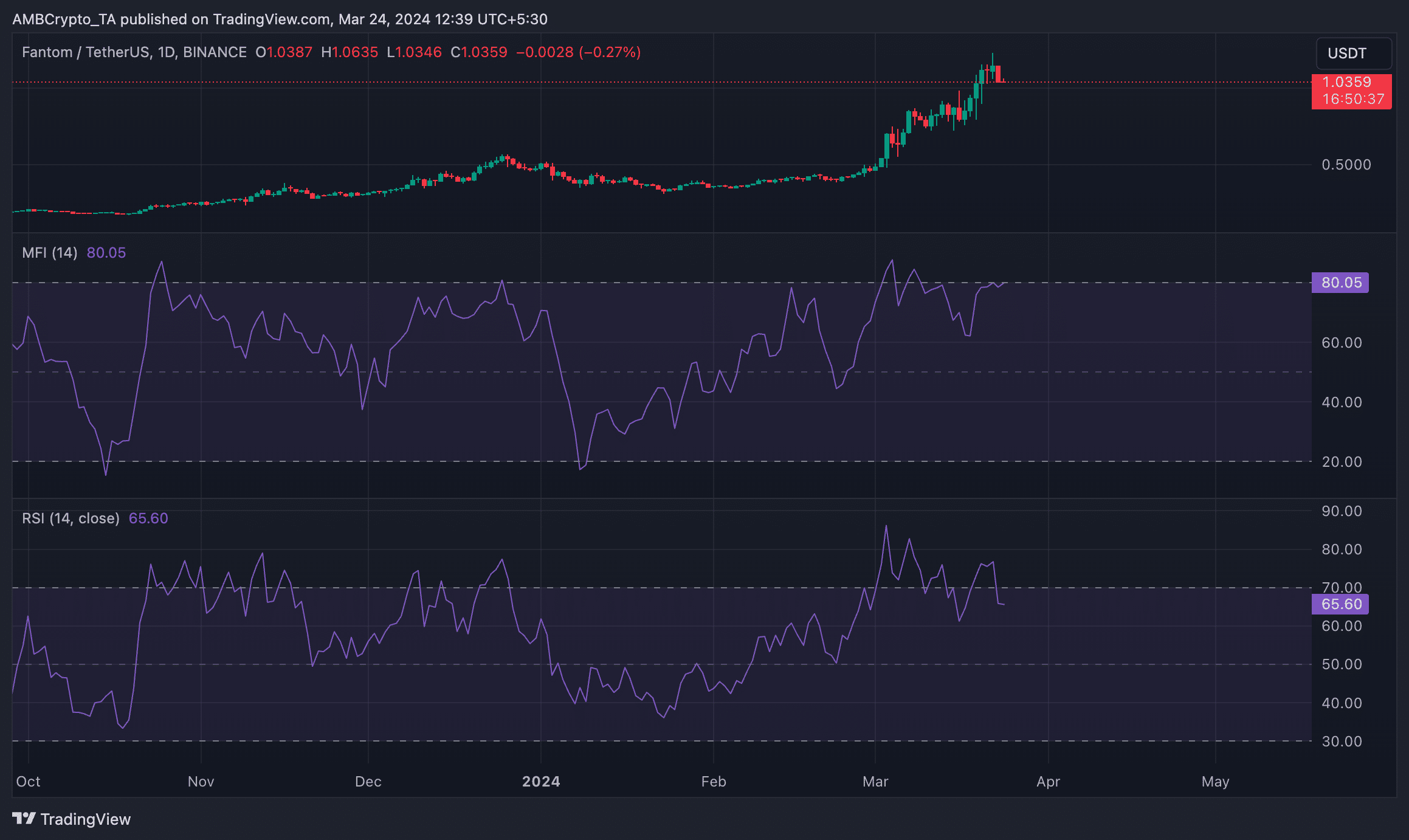

FTM, the native utility token that powers your complete Fantom blockchain ecosystem, witnessed a 34% development in its worth final week.

In the course of the week, the token climbed to a 30-day excessive of $1.18 on twenty second March earlier than witnessing a correction to its present market worth of $1.06.

The double-digit rally in FTM’s worth within the final week has been as a result of sustained demand for it.

In accordance with its key momentum indicators assessed on a 24-hour chart, regardless of the final market downside, FTM traders proceed to favor accumulation over promoting their holdings for a revenue.

Supply: FTM/USDT on TradingView

Greatest losers

Injective [INJ]

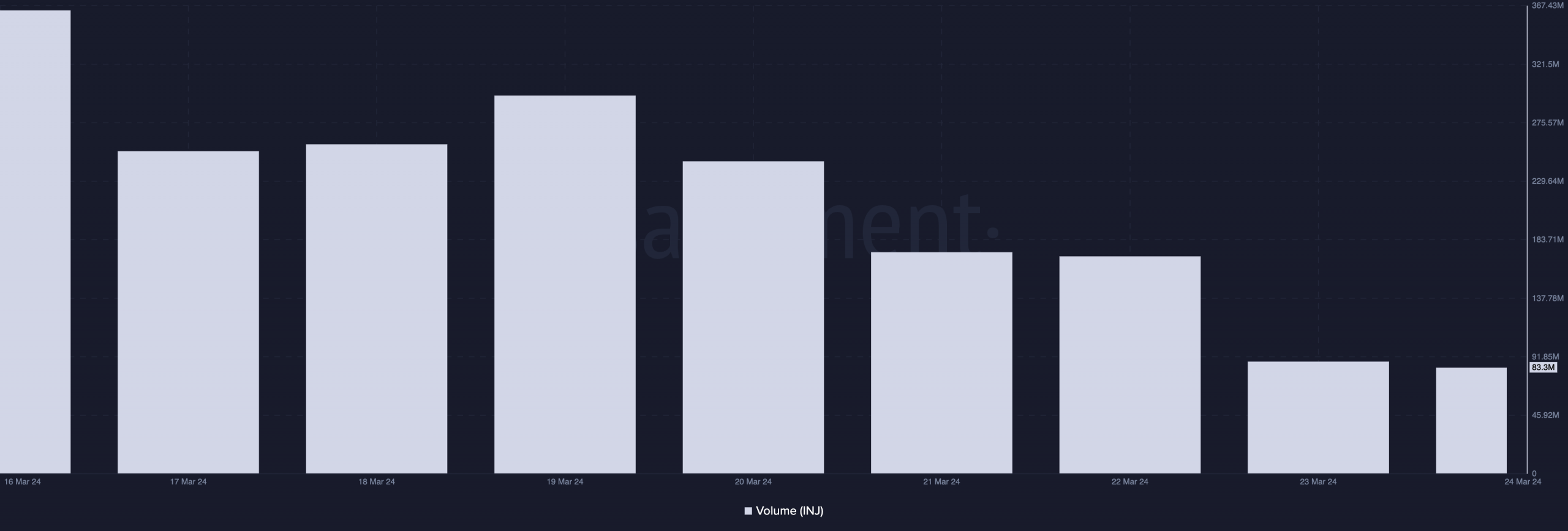

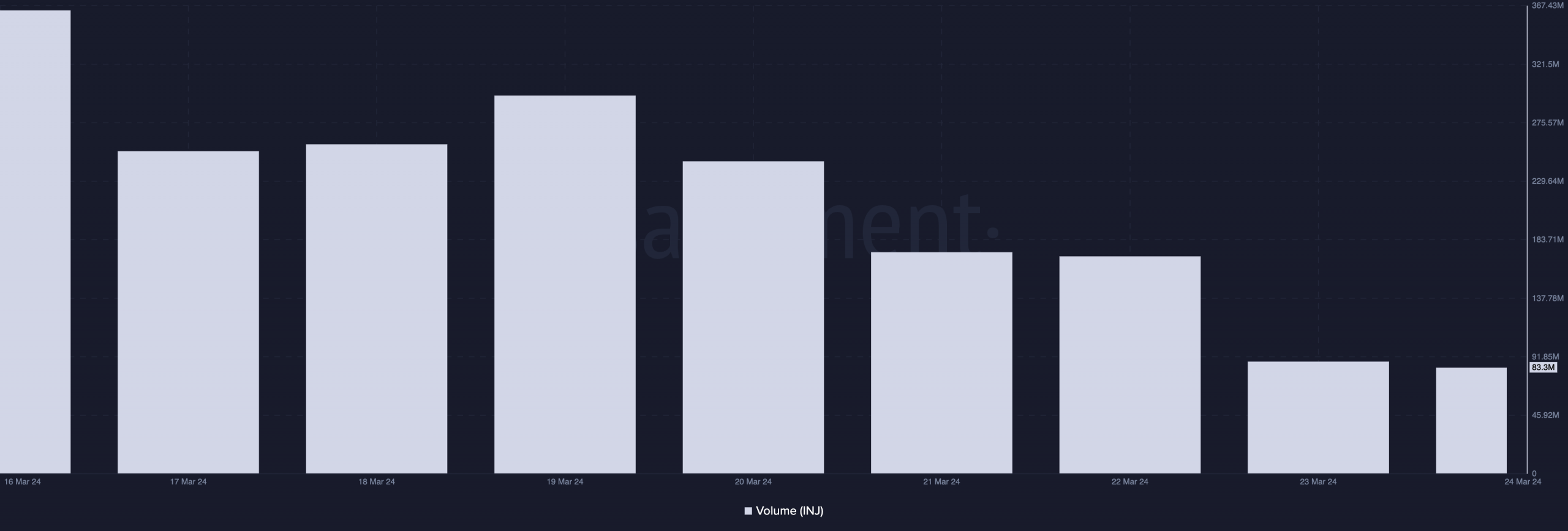

Following an prolonged interval of rally, INJ peaked at $52.38 on thirteenth March to shut the week as the largest loser.

Buying and selling at $35.40 at press time, the altcoin’s worth fell by 14% up to now seven days and by 32% from its latest peak.

In the beginning of the week, INJ exchanged palms at $41.01. Nevertheless, as the final market retraced, INJ’s day by day buying and selling quantity shrunk by 65%, in keeping with Santiment’s information.

This resulted in a corresponding decline in its worth through the interval beneath evaluation.

Supply: Santiment

The low buying and selling quantity was because of a decline in demand for the altcoin, on-chain information revealed. Per Santiment’s information, within the final week, the day by day rely of addresses concerned in INJ transactions fell by 33%.

Likewise, the variety of new addresses created to commerce the altcoin day by day plummeted by 14%.

Jupiter [JUP]

JUP, the token that powers Jupiter, the Solana-based decentralized alternate (DEX), ranked because the asset with the second-highest losses over the previous week.

At press time, the governance token traded at $1.17, recording a 13% decline in its worth through the interval beneath evaluation.

The token tried to reclaim its $1.4 worth mark on the twenty first of March, however the shopping for strain was not sufficient to maintain the rally, inflicting a further 10% worth decline since then.

Extending its weekly losses at press time, JUP’s worth was down 3% up to now 24 hours because of a 30% fall in buying and selling quantity.

Bonk [BONK]

In accordance with CoinMarketCap’s information, BONK, the Solana-based meme asset, ranked because the token with the third-highest weekly loss.

Throughout that interval, its worth plunged by 11%. Though it made makes an attempt at completely different factors to provoke an upward correction, the final market’s bearish sentiment made this inconceivable.

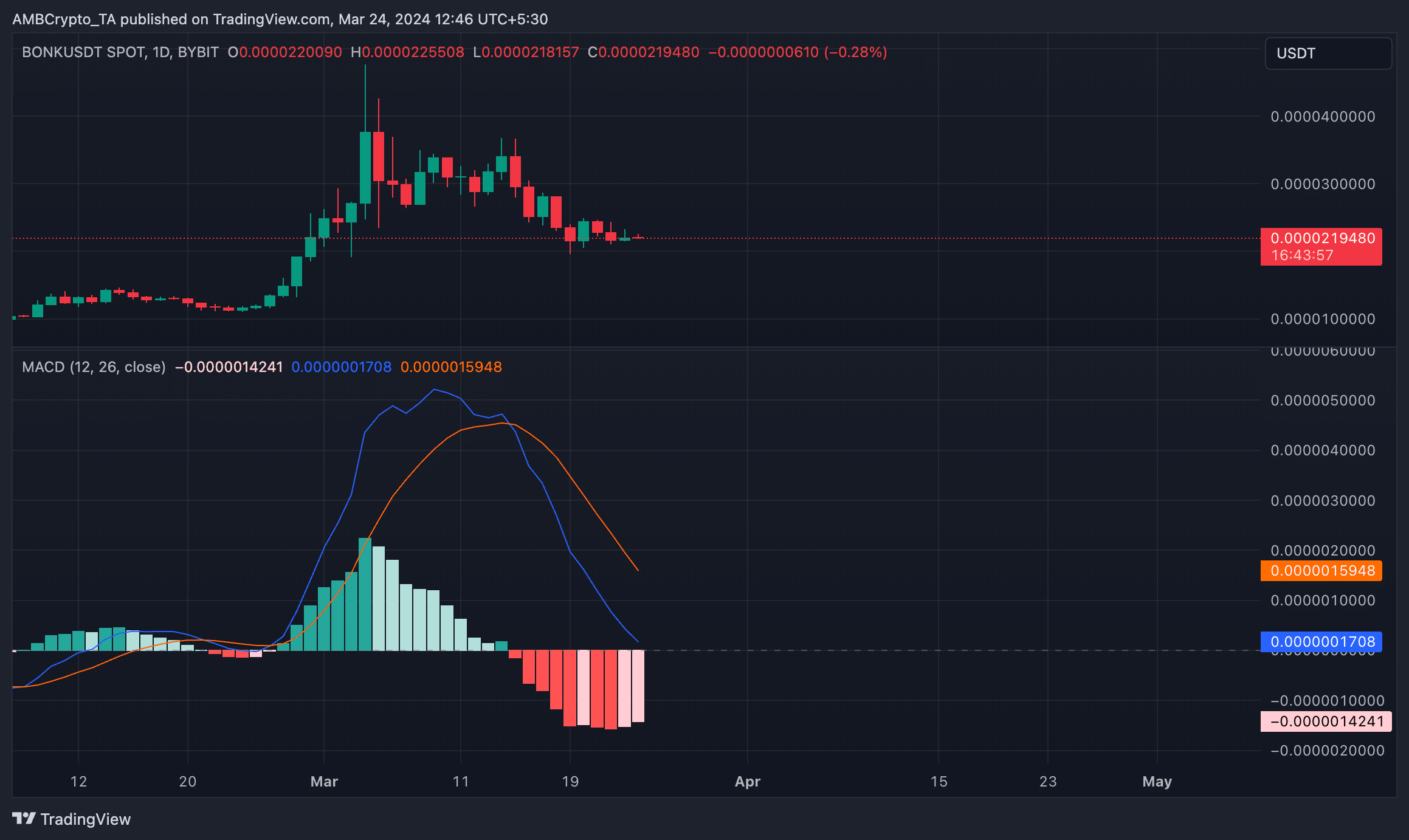

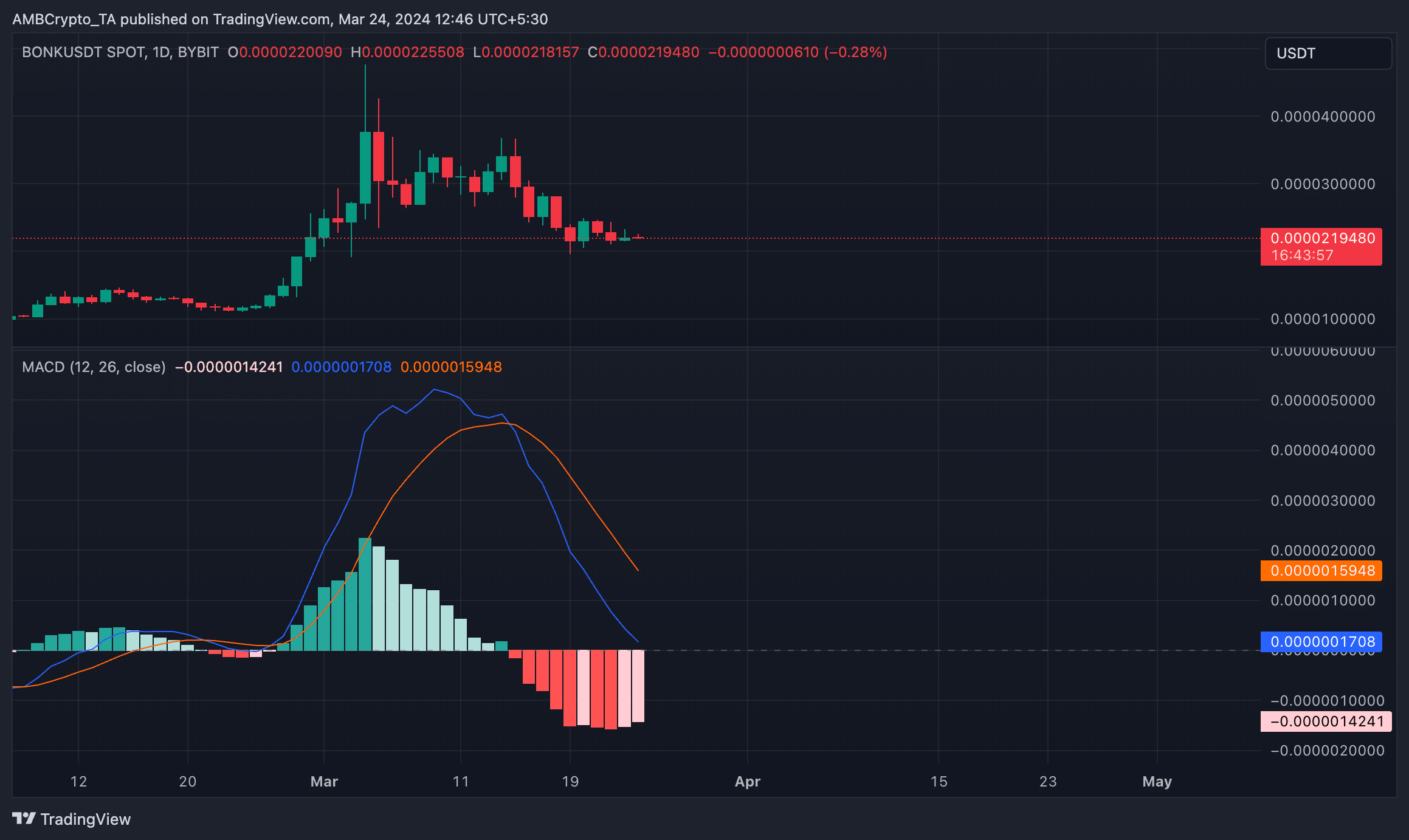

Confirming the bearish development, BONK’s MACD line rested beneath its sign line to counsel that its short-term transferring common is trending decrease than the longer-term transferring common.

This intersection alerts the re-emergence of bears and an increase in promoting exercise.

Supply: BONK/USDT on TradingView

At press time, BONK traded at $0.00002217, seeing a minor 0.23% worth rally up to now 24 hours.