- Ethena, Core, and Pendle had the largest good points of the week.

- Conflux, Wormhole, and Floki had been the largest losers for the week.

The previous week proved to be intriguing for each crypto gainers and losers, with important belongings lacking out on high rankings on both aspect of the spectrum. It was additionally every week when ‘W’ took an “L.”

Largest winners

Etherna

Ethena [ENA] emerged as the highest gainer for the week, showcasing a development that any asset holder would welcome.

The chart confirmed that ENA began the week at round $0.6, swiftly rising to over $0.8 by the 2nd of April.

What’s notably noteworthy is the numerous surge in quantity accompanying this value degree, hovering to over $2 billion.

By the week’s finish, the worth surged to round $1.17, marking a exceptional improve of over 70%. This propelled Ethena to say the title of the largest winner for the week.

With a market capitalization of $922 million, it additionally secured the highest spot when it comes to market cap among the many high three gainers.

Core

Core [CORE] offered a blended efficiency all through the week, exhibiting a stronger begin however ending on a lesser be aware.

The token began the week at round $2.5, climbing steadily to over $3.6 by the tip of the primary day. Subsequently, it surged to over $4 earlier than experiencing a decline.

By the week’s conclusion, CORE settled round $2.6.

Regardless of fluctuations, CORE secured the second-highest good points for the week, boasting a powerful improve of over 62% in seven days. Its market capitalization stood at round $2.3 billion on the time of writing.

Pendle

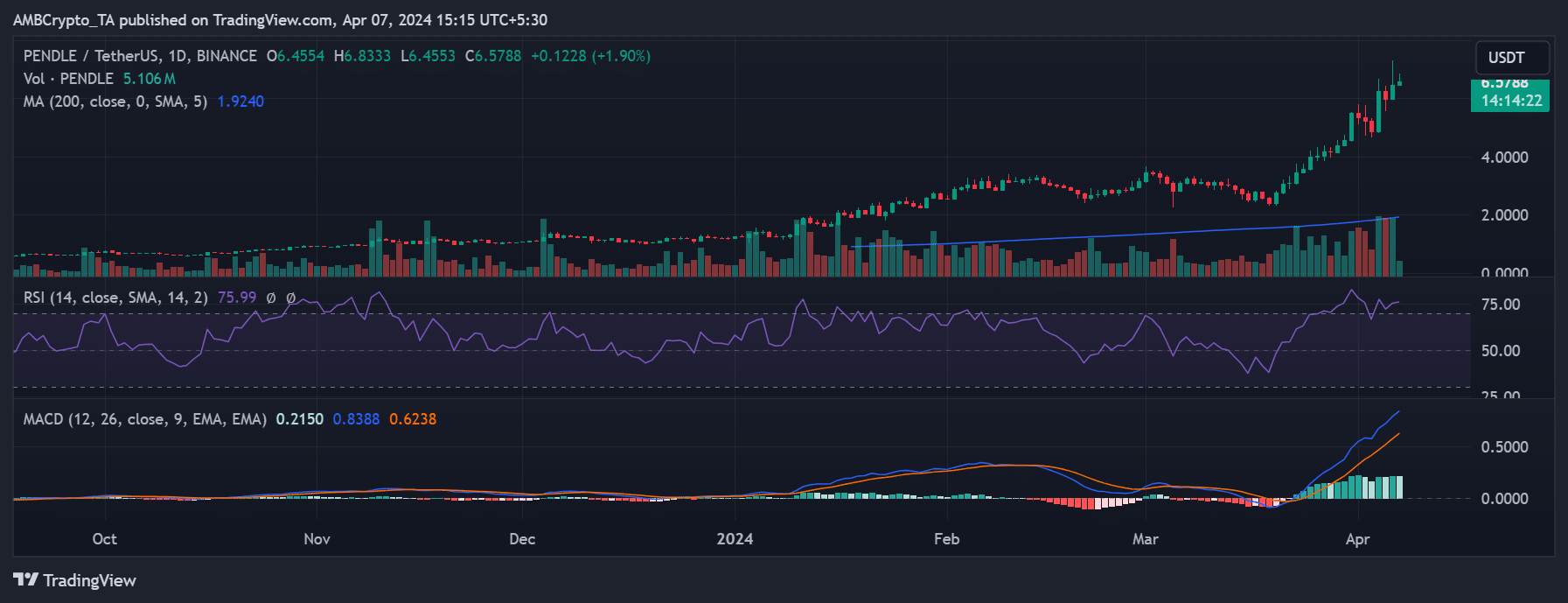

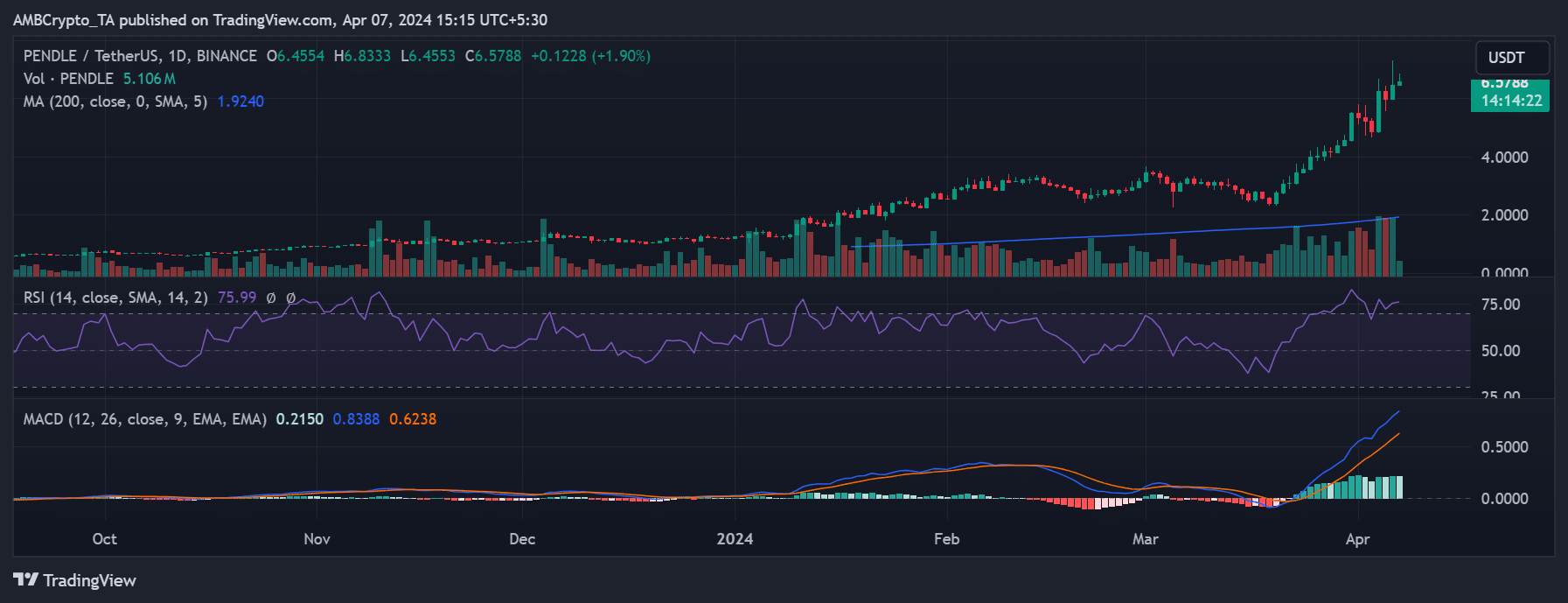

AMBCrypto’s evaluation of the Pendle [PENDLE] chart revealed important fluctuations over the previous seven days, securing its place because the third-highest gainer for the week.

Notably, Pendle skilled substantial upward swings from the 4th to the sixth of April. Between the 4th to the fifth of April, PENDLE surged from round $4.9 to over $6.4.

It witnessed one other notable uptick, reaching a peak of over $7, leading to a weekly achieve of over 35.5%. On the time of writing, it was buying and selling at round $6.5, boasting a market capitalization of over $1.5 billion.

Supply: Pendle/USDT on TradingView

Largest losers

Conflux

Conflux led the losers’ desk with a big lack of over 24% prior to now week, in accordance with information from CoinMarketCap.

Additional evaluation revealed that CFX started the week at round $0.4, however it had dropped to round $0.36 by the week’s finish.

AMBCrypto’s examination of the chart confirmed a steady decline in quantity alongside the worth lower. Originally of the week, the quantity was over $74 million, peaking at over $300 million at one level.

Nevertheless, on the time of writing, the quantity had decreased to round $35 million. Moreover, CFX was buying and selling at roughly $0.36 on the present time.

Wormhole

Earlier within the week, Wormhole [W] launched its token with an preliminary value of round $1.6 and a market capitalization of over $3 billion. This marked a big success for the platform.

Nevertheless, the worth skilled a notable decline earlier than the day’s finish. By the week’s conclusion, evaluation revealed that the worth had fallen to round $1.06, leading to a lack of roughly 22.6%.

Moreover, this decline decreased its market capitalization to round $1.9 billion on the time of writing.

Whereas the Wormhole token launch represented a big milestone for the platform, it confronted a significant setback in its first week of buying and selling.

Floki

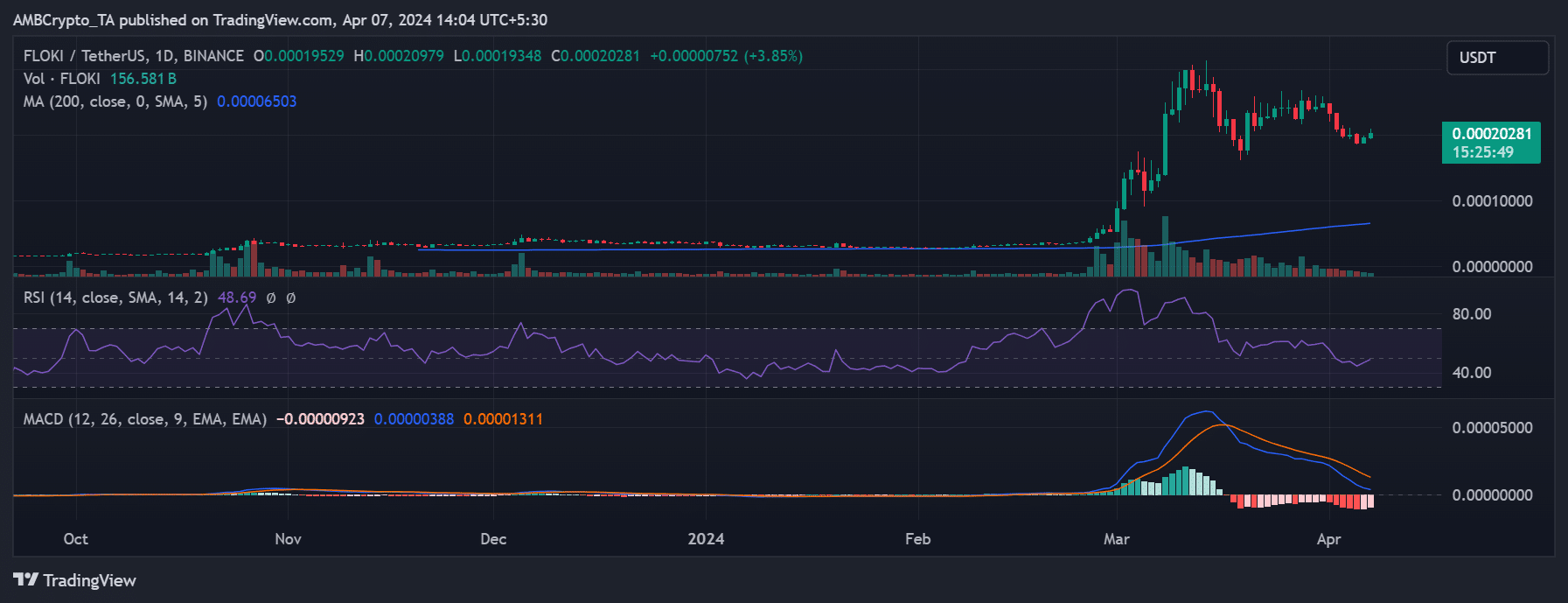

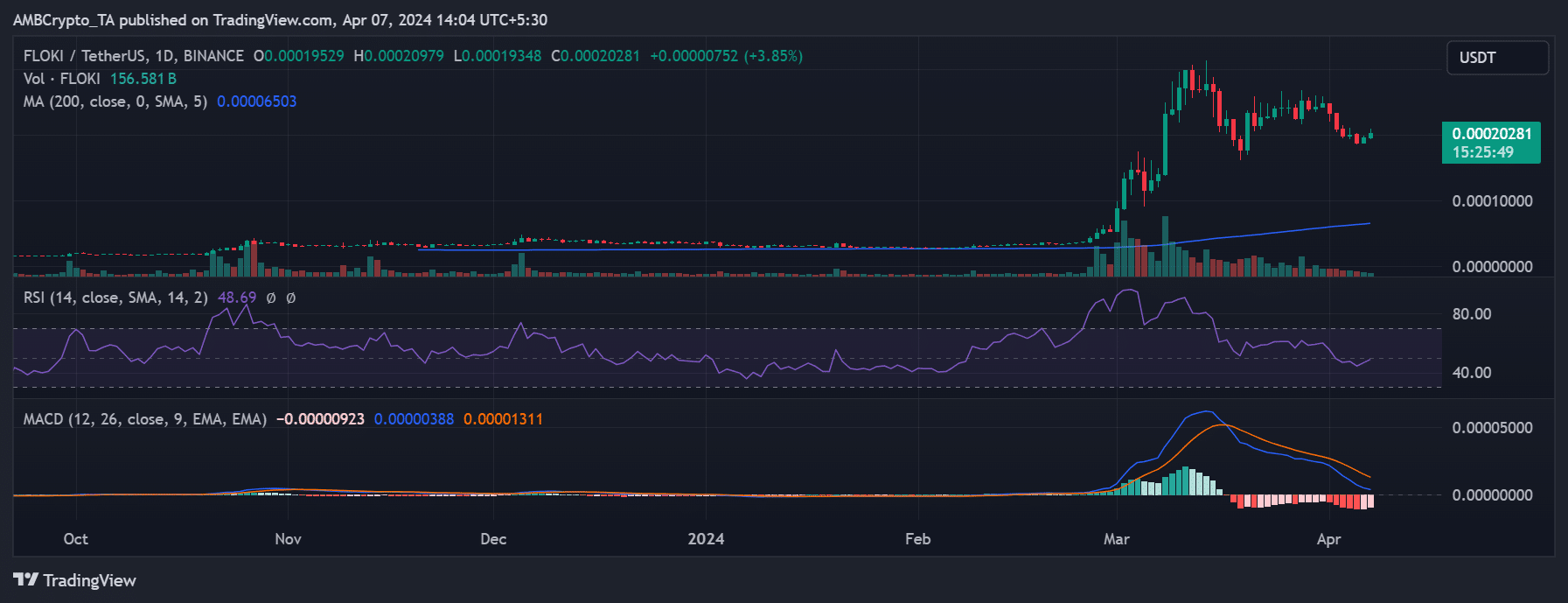

As a result of their surging costs, meme cash have garnered important consideration within the crypto house in current weeks.

Nevertheless, Floki Inu [FLOKI] couldn’t keep this momentum and emerged because the third-biggest loser prior to now week, experiencing a decline of over 19.2%.

AMBCrypto’s evaluation of its every day timeframe chart confirmed consecutive losses all through the week. Nonetheless, in the direction of the tip of the week, Floki witnessed a notable improve of over 3.8%.

On the time of writing, its upward development persevered with one other improve of over 3%.

Supply: TradingView

Its Relative Power Index (RSI) revealed a decline under the impartial line as its value decreased. Nevertheless, with the consecutive value uptrends noticed, it was nearing a possible climb again above the impartial line.

Conclusion

Right here’s the weekly recap of the largest gainers and losers. It’s essential to keep in mind the risky nature of the market, the place costs can shift quickly.

Thus, it’s best to do your individual analysis (DYOR) earlier than making any funding selections.