- Bitcoin has held firmly above $60K since mid-July.

- A number of optimistic catalysts are lined up. Will BTC climb larger?

After staying under $60K within the first half of July, Bitcoin [BTC] reclaimed the psychological stage and former range-low, partly induced by the Trump assault.

The mid-week restoration prolonged, posting over 8% beneficial properties however hit an impediment close to $65K. As of press time, the restoration cooled off and slid under $64K.

‘Trump commerce’ to spice up Bitcoin?

In response to Charles Edwards, founding father of crypto hedge fund Capriole Funding, BTC stalled close to $65K as a result of the worth of NASDAQ dropped.

“Bitcoin is down as a result of the NASDAQ is down. However the NASDAQ is down due to imminent easing and an AI earnings plateau. The latter has no affect on BTC, and the previous is bullish BTC.”

NASDAQ is closely centered on tech shares. Nevertheless, buyers have been reportedly rotating out massive tech shares to small-cap shares to capitalize on a probable Trump win. Market pundits referred to as it “Trump commerce.”

In response to some market analysts, Trump’s pro-crypto stance may bolster the bullish situation for BTC. For instance, QCP Capital analysts viewed Trump’s VP decide, J.D. Vance, as a optimistic catalyst for BTC.

“Trump choosing J.D. Vance as his Vice President offers one other optimistic catalyst. Vance holds BTC, and we count on him to foyer for crypto-friendly rules if Trump will get elected.”

The agency added that the upcoming launch of the Ethereum [ETH] ETF, anticipated to happen on the twenty third of July, was one other bullish catalyst. On-chain metrics additionally corroborated the bullish outlook.

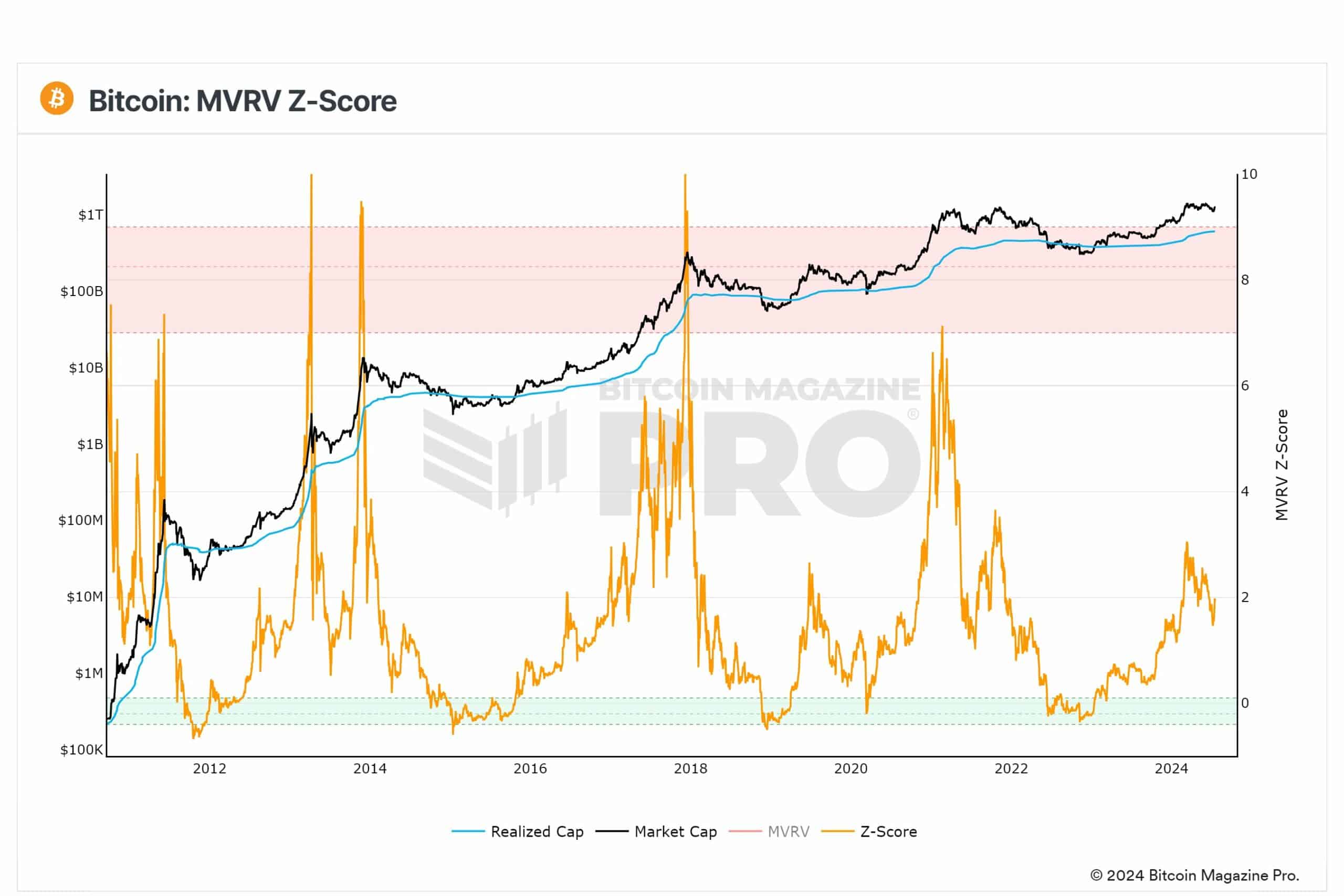

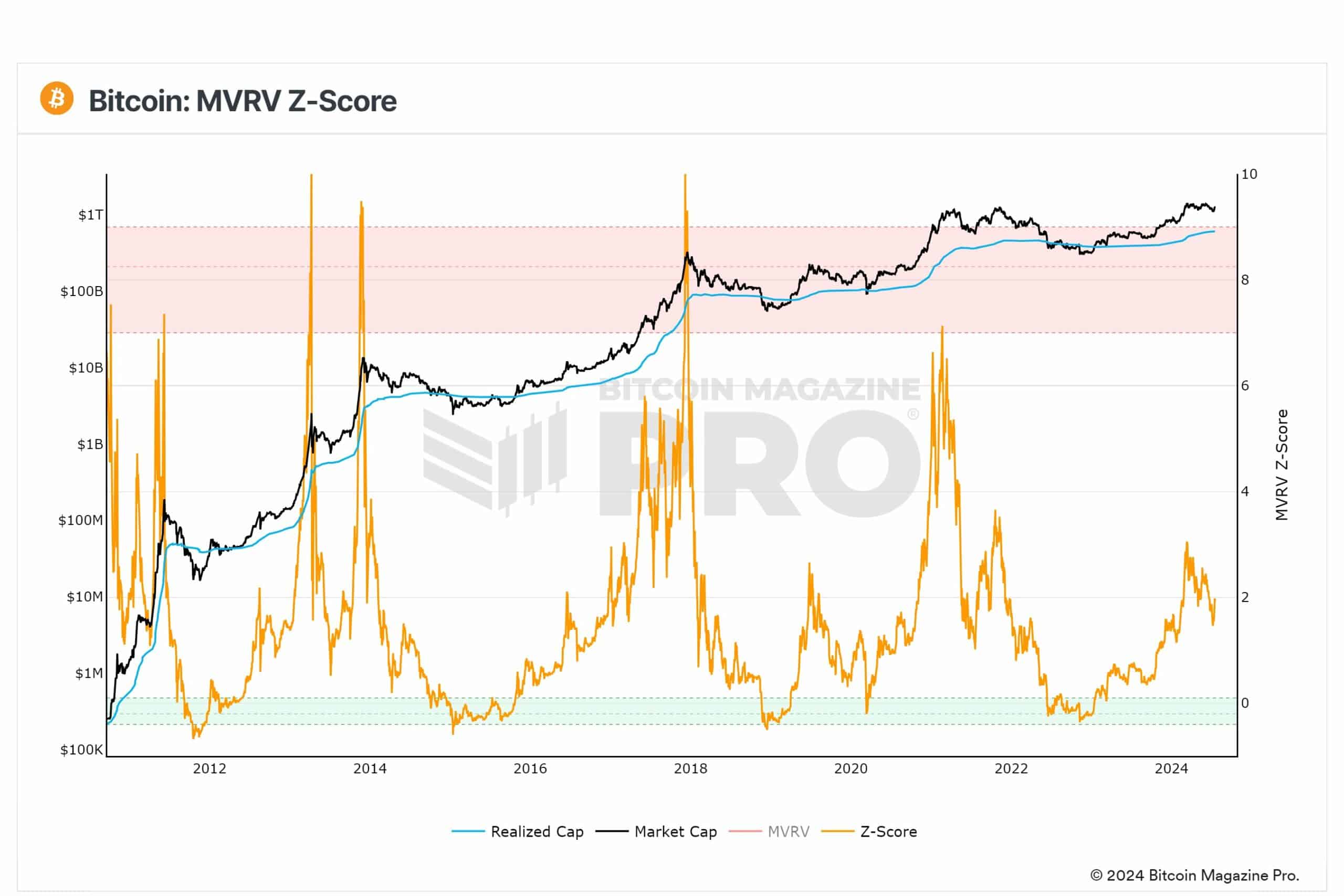

MVRV-Z rating sign extra upside potential

Supply: X

Philip Swift, founding father of Look Into Bitcoin, which rebranded to Bitcoin Journal Professional, noted that BTC bears have been in disbelief because the MVRV-Z rating recovered.

“MVRV Z-Rating: Nonetheless a lot extra to come back from this bull cycle. Z-score bouncing again up now to 2. Bears in disbelief.”

The MVRV (Market Worth to Realized Worth)-Z rating is a BTC market cycle prime and backside indicator. It has precisely predicted previous market tops (>7) and bottoms (0).

Nevertheless, the metric was not overheated and didn’t sign a market prime as of press time. That meant extra headroom for BTC.

Additionally, crypto options value $1.8 billion are set to run out on the nineteenth of July, per Deribit information. The max ache for each BTC and ETH for the looming choices expiry stood at $62K and $3.15K, respectively.

It meant that an general dip by BTC and ETH towards the max pains could possibly be anticipated. Nevertheless, a leg up couldn’t be overruled, given the doubtless launch of ETH ETF subsequent week.