- Greater than $300M was liquidated from the crypto market, as costs retraced from the weekend rally.

- Bitcoin dropped from $62K to under $59K earlier than making a slight restoration.

The cryptocurrency market bled as we speak, with by-product merchants taking a serious blow. Per Coinglass, the futures market skilled $320 million in liquidations on the time of writing. Merchants with lengthy positions skilled probably the most losses with $285 million liquidated.

This comes amid a drastic value drop that noticed the entire crypto market cap tank by 6.7%. All the highest 50 cryptos by market cap had been additionally buying and selling within the purple.

Bitcoin [BTC)] dropped by 6% to hit a weekly low of round $58,000. It has recovered barely to commerce at $59,430 on the time of writing.

Ethereum [ETH] skilled a steeper decline of seven.8% to commerce at $2,430 whereas Solana [SOL] dropped 6.8% to $148. XRP and Dogecoin [DOGE] additionally posted 3.7% and 6% dips, respectively.

What brought on the liquidations?

On-chain analytics platform Santiment attributed the liquidations to market greed after longs elevated their positions following the twenty fifth August rebound. This stirred an enormous spike in funding charges, which had been sure to get liquidated.

Supply: X

Macro components may be behind the volatility. Nvidia is about to launch what has been popularly known as “an important tech earnings.” Per CNBC, Nvidia’s outcomes will “set the tone” for markets earlier than the discharge of different key financial information subsequent month.

Nvidia earnings sometimes stir market volatility. If the chip-making firm beats expectations in its Q2 earnings, it may increase a rally throughout the crypto market. Nonetheless, if the corporate falls quick, it may trigger additional declines.

Will BTC value rebound?

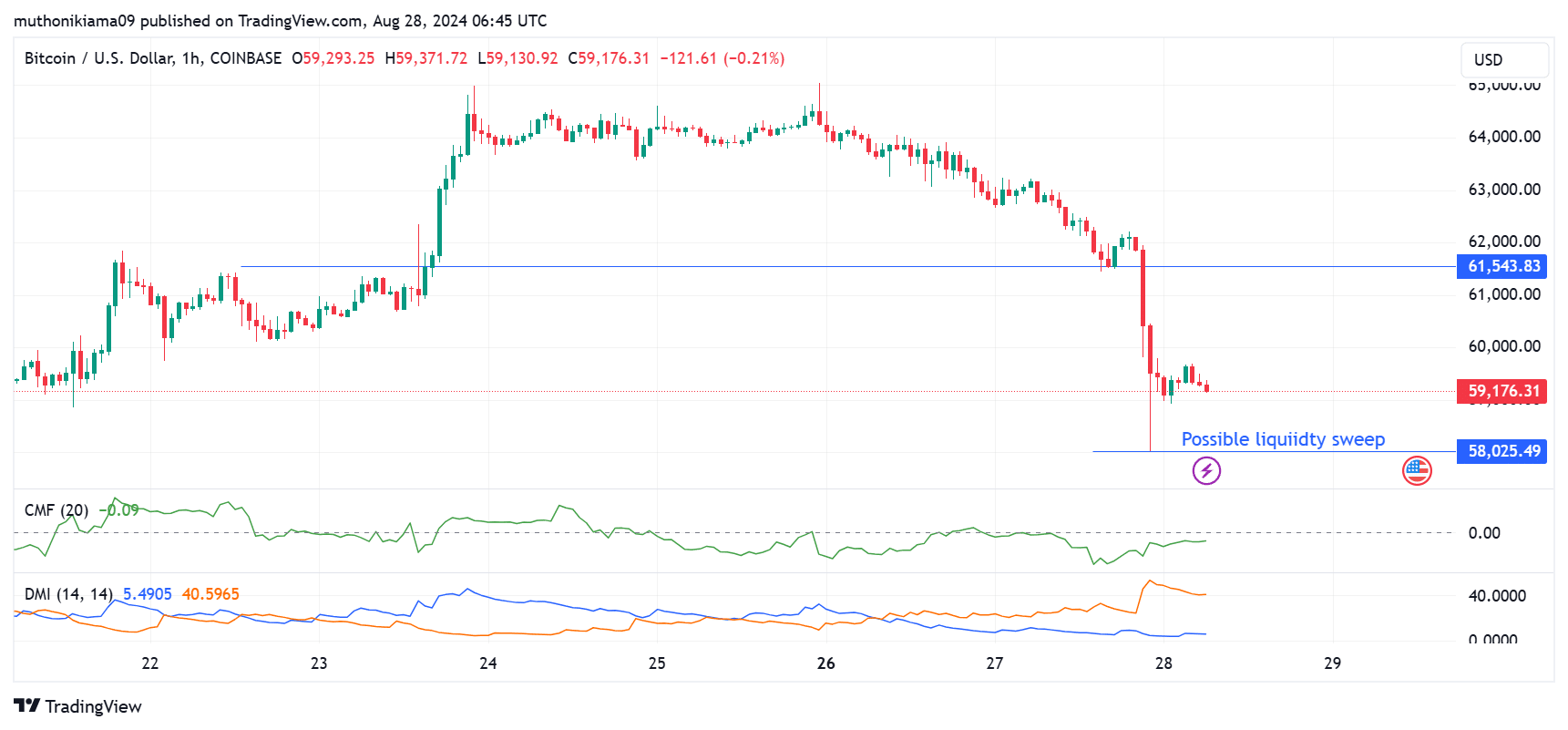

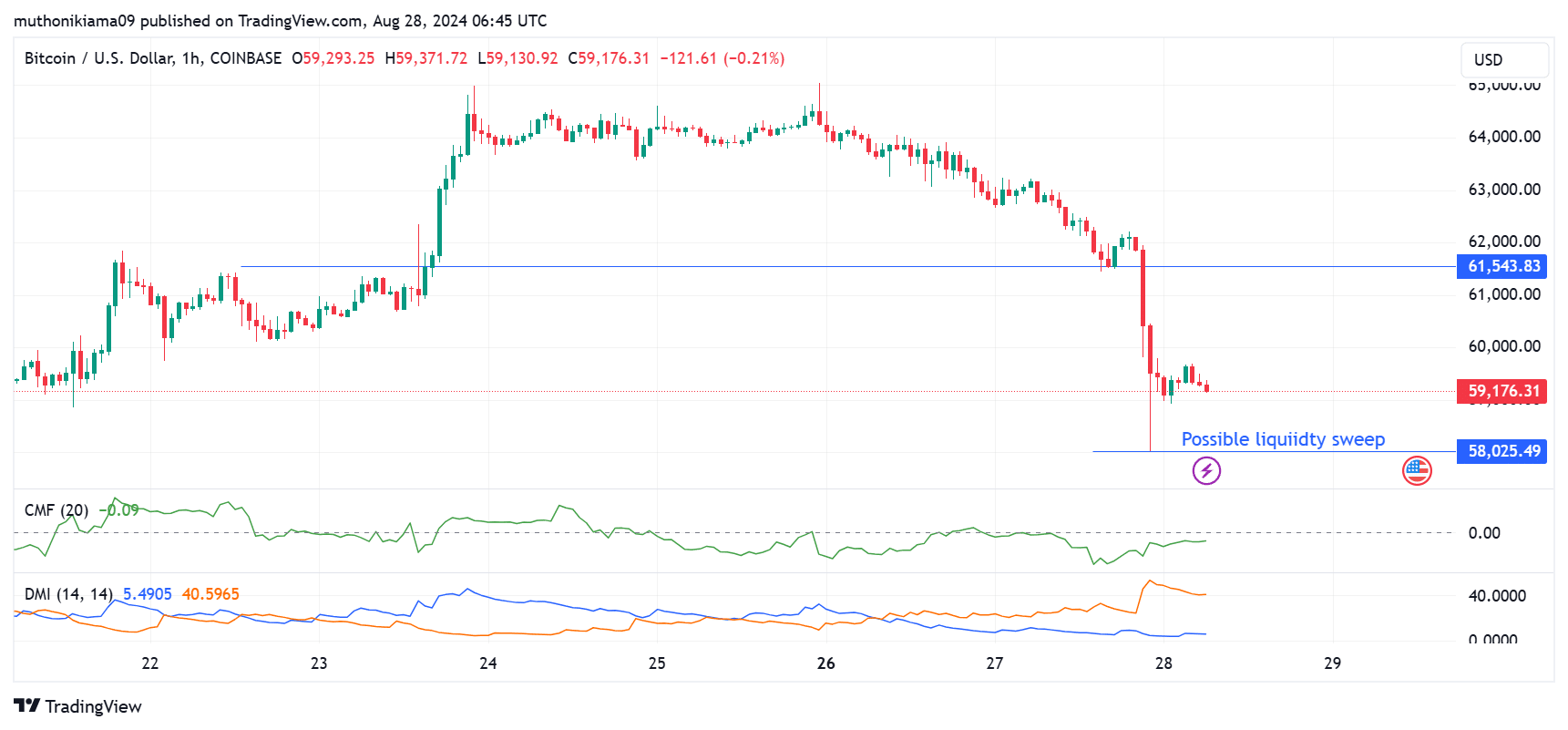

Bitcoin value failed to carry a assist stage above $61,500, inflicting a steep decline in value. Since twenty third August, BTC has been buying and selling above this stage, and sustaining the assist supported the uptrend.

The Chaikin Cash Movement was unfavorable at press time, suggesting promoting strain. The CMF confirmed that purchasing strain began weakening after the weekend rally. Due to this fact, there haven’t been sufficient consumers to drive the value motion.

Supply: Tradingview

The bearish thesis is additional confirmed by the Directional Motion Indicators (DMI). The constructive DI is way under the unfavorable DI, which reveals that the bearish pattern is stronger than the bullish pattern.

Merchants must also be careful for a potential liquidity sweep on the $58K stage.

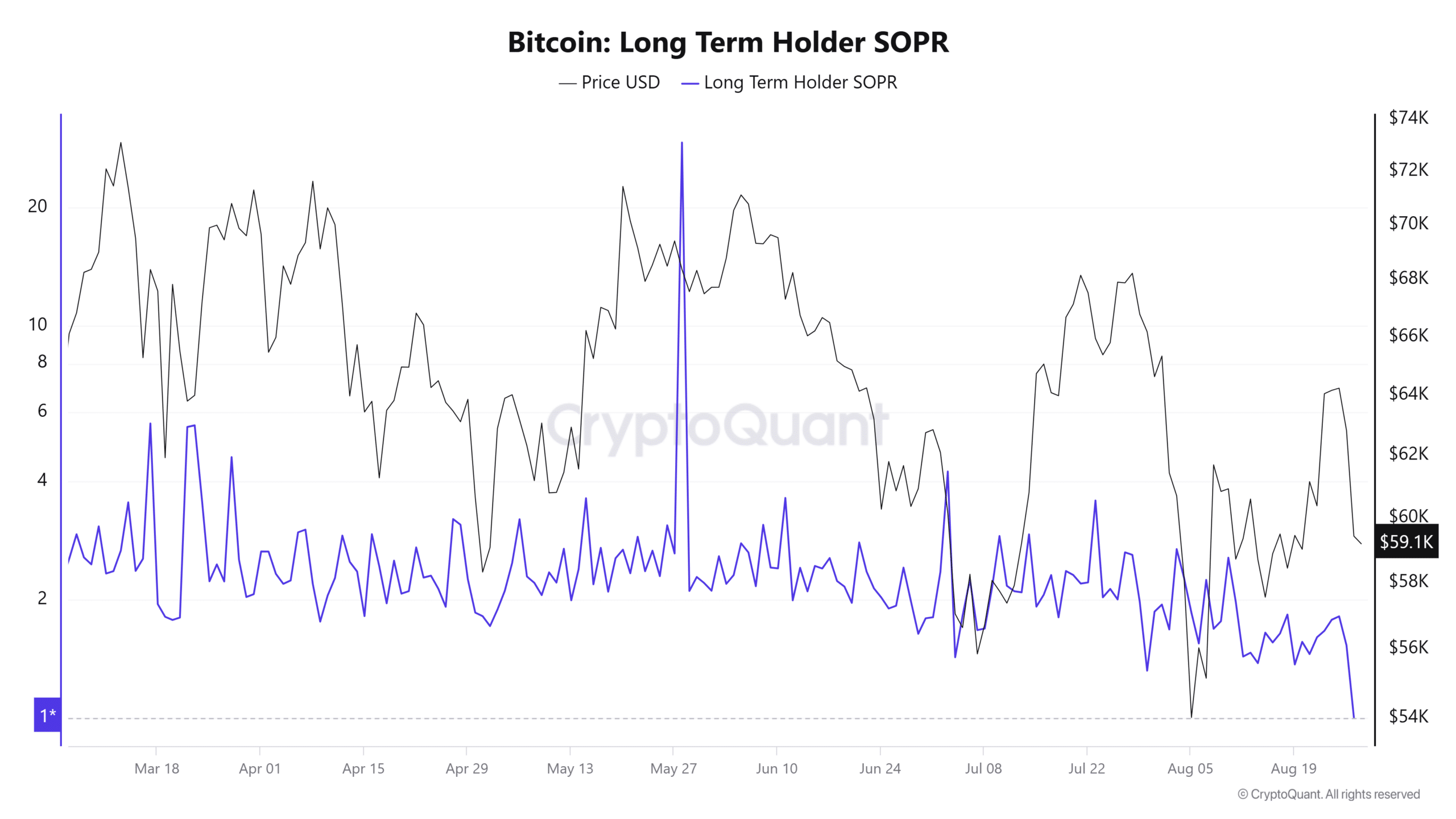

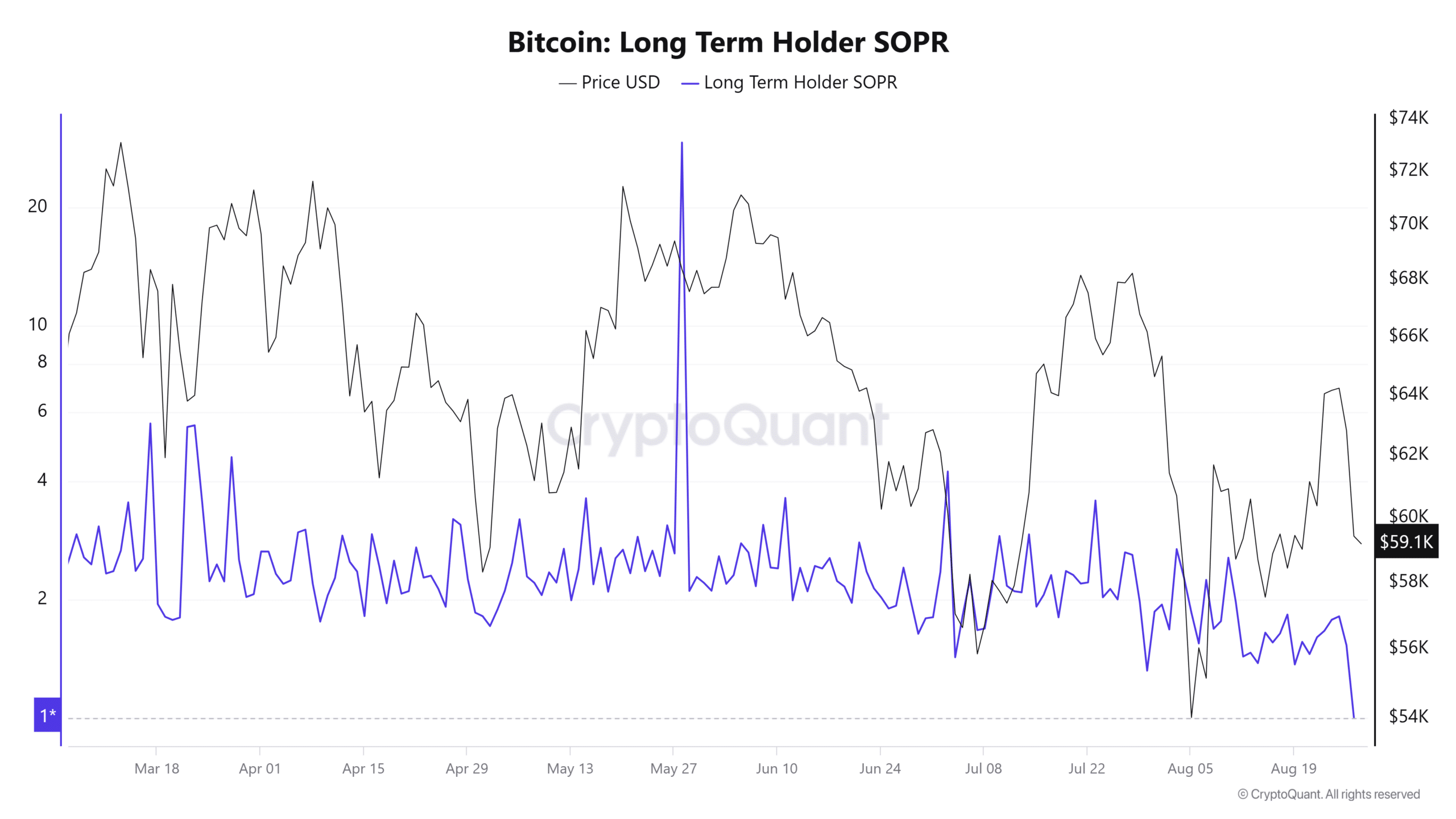

On-chain indicators present that the latest drop pushed long-term holders to a break-even level. The final time that this cohort was at this level was on fifth August, after which the value made a robust constructive correction.

This metric may point out that the latest drop shaped an area backside, suggesting that the value may rise.

Supply: CryptoQuant

Information from IntoTheBlock confirmed that greater than $3 million addresses purchased BTC at between $58K-$62K. Due to this fact, $62,355 would possibly act as an important resistance stage if BTC resumes the uptrend.