Enterprise capitalist Arthur Cheong thinks the decentralized finance (DeFi) business is within the midst of a “renaissance.”

The CEO of DeFiance Capital tells his 177,800 followers on social media platform

“As world rates of interest change, dangerous property like crypto, together with DeFi, turn out to be extra engaging to traders searching for larger returns.

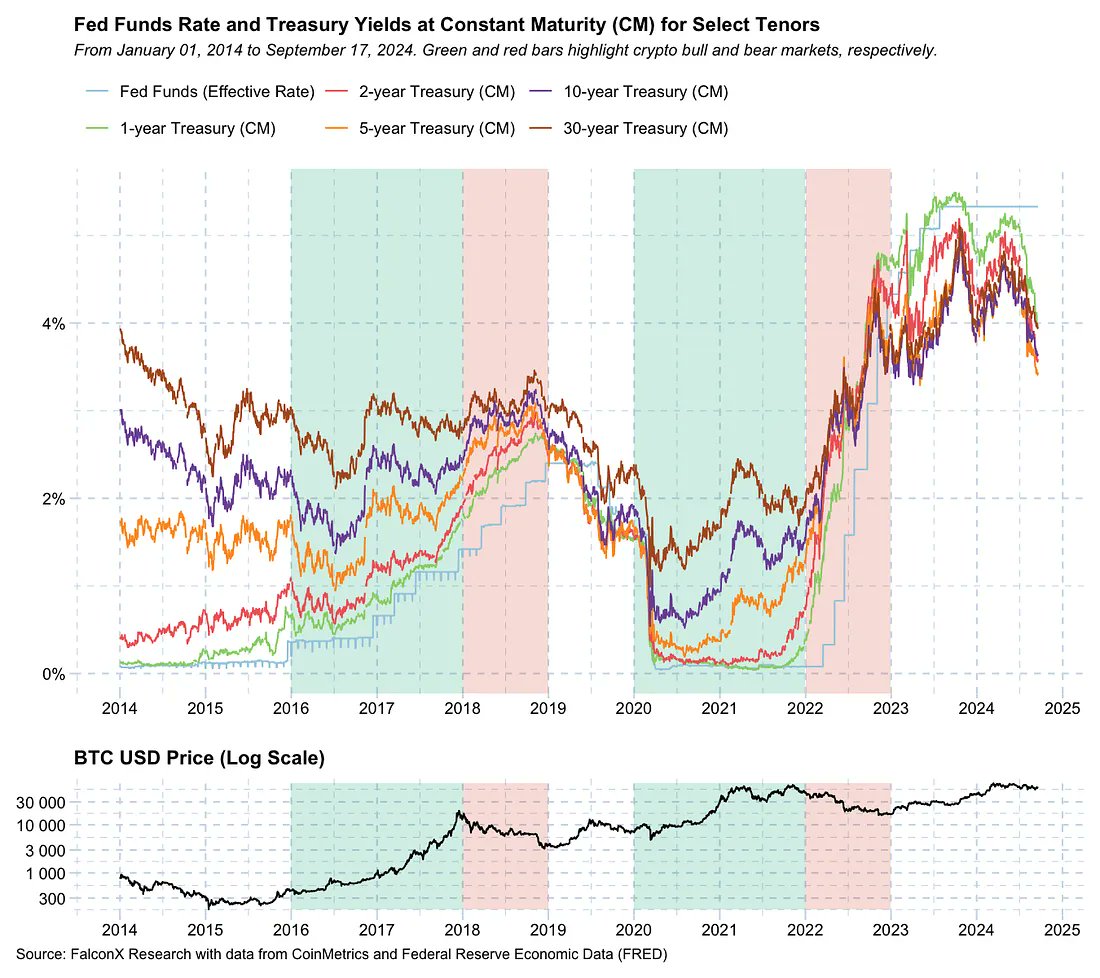

With the Federal Reserve delivering a 50 foundation level price minimize in September, the stage is about for a interval of decrease rates of interest, much like the setting that fueled the crypto bull markets of 2017 and 2020, as proven within the chart beneath. . Bitcoin (and crypto) bull markets are highlighted in inexperienced, traditionally in a regime of low rates of interest, whereas bear markets are highlighted in pink, usually in a time of rising rates of interest.”

Supply: Arthur Cheong/X

Particularly, Cheong says DeFi advantages from decrease rates of interest as a result of authorities bonds and conventional financial savings accounts provide decrease returns. In response to the enterprise capitalist, this convinces extra traders to show to DeFi protocols for larger returns.

The CEO of DeFiance Capital additionally notes that decrease funding prices may encourage DeFi customers to take out loans and funnel them into the sector’s ecosystem, growing exercise.

“Whereas rates of interest might not fall to the near-zero ranges seen in earlier cycles, the decrease alternative value of enabling DeFi will likely be considerably decreased. Even a modest rate of interest minimize is sufficient to make a giant distinction, because the distinction in curiosity and returns might be magnified with leverage.

Moreover, we anticipate that the brand new rate of interest cycle will likely be a significant driver of stablecoin development because it considerably reduces the price of capital for yield-seeking TradFi funds transferring to DeFi.”

Generated picture: Midjourney