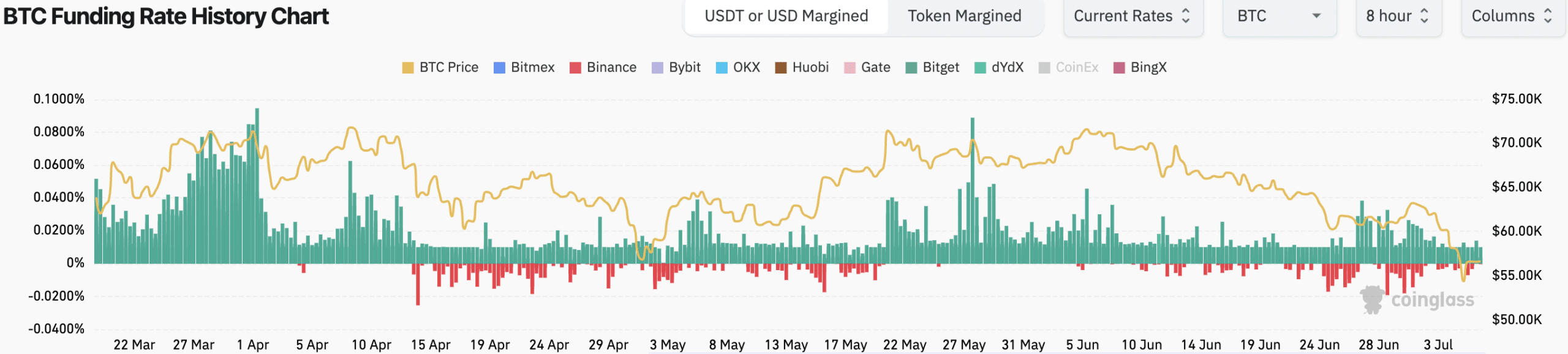

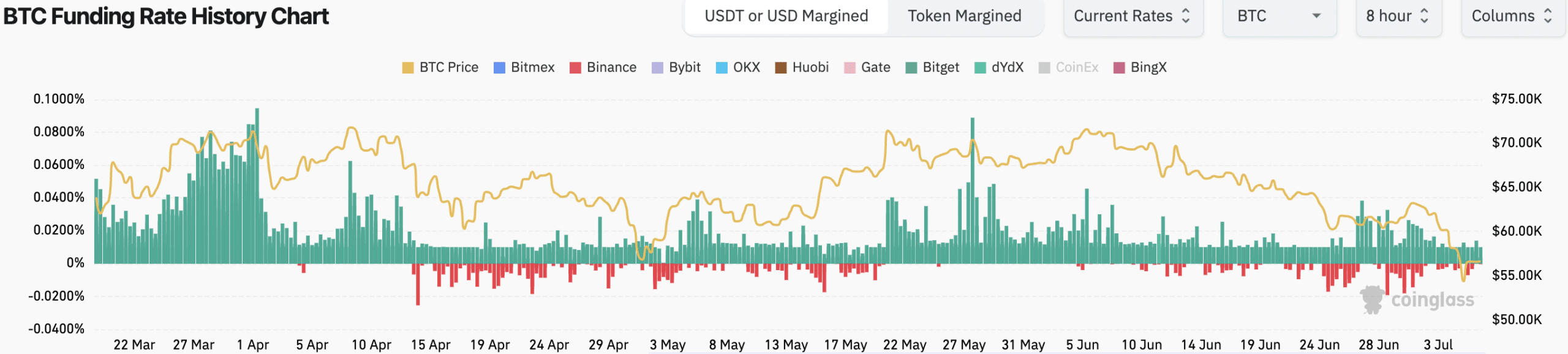

- Crypto funding charges for Bitcoin and Ethereum declined considerably over the previous couple of days.

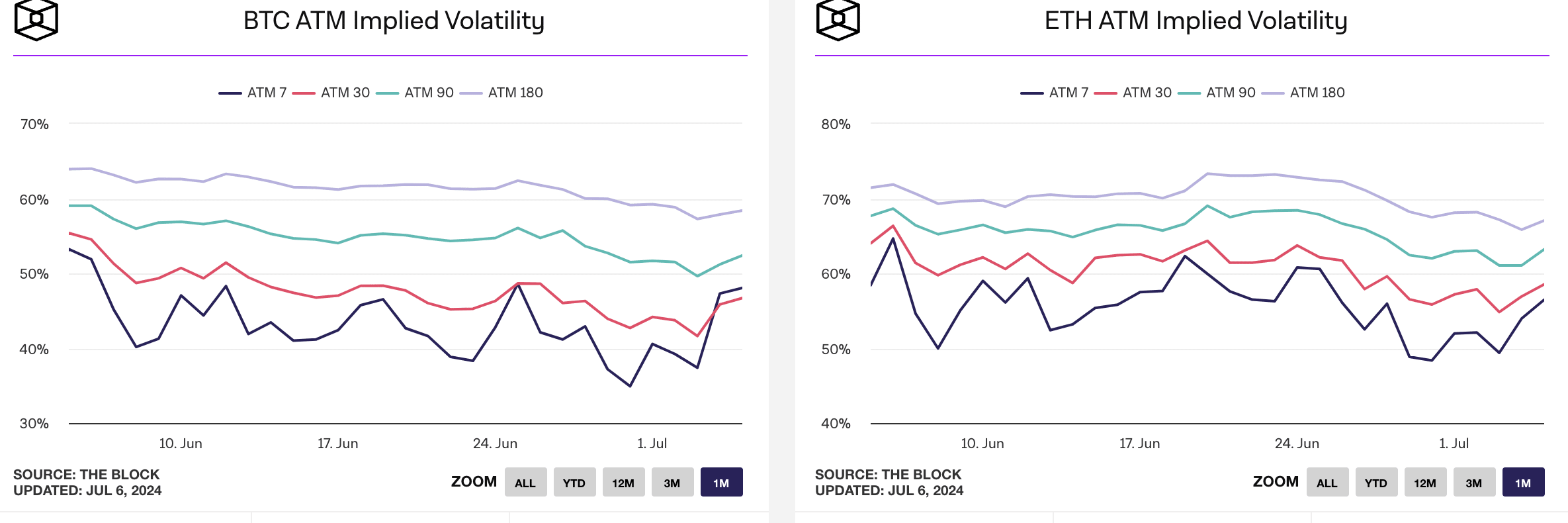

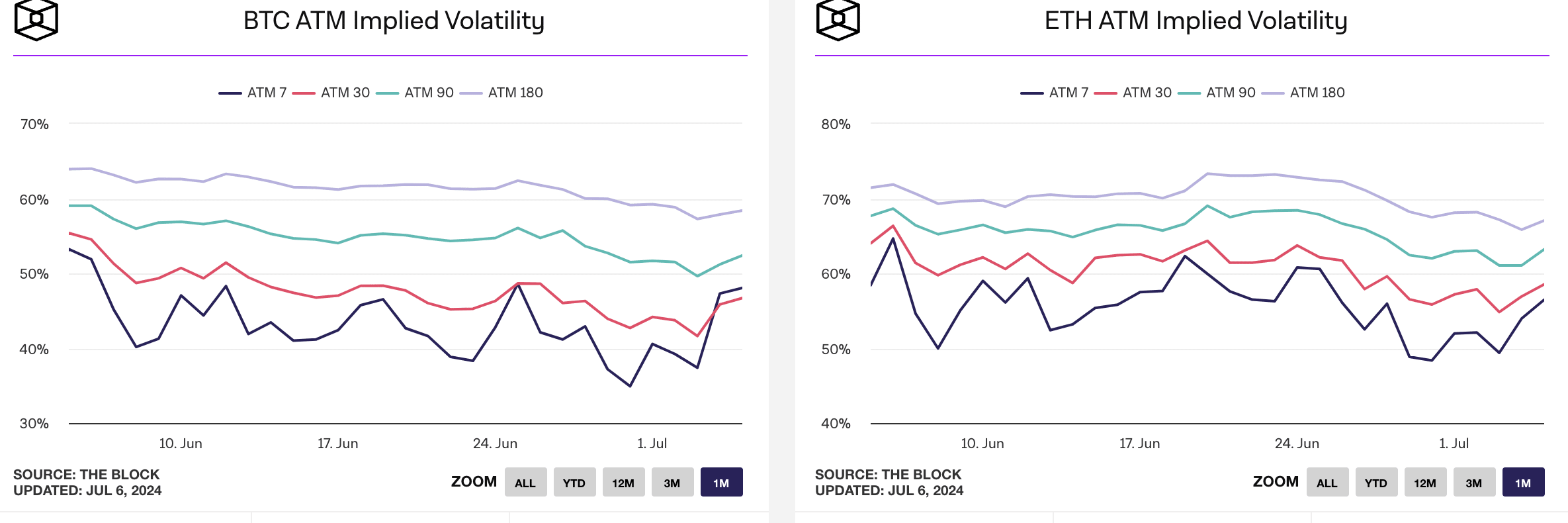

- Implied volatility for Bitcoin and Ethereum surged materially throughout this era.

Bitcoin [BTC] and Ethereum [ETH] holders have been severely impacted by the latest market drawdown. Nevertheless, it wasn’t simply holders who had been affected.

Low on funding charges

The funding charges for each BTC and ETH fell materially over the previous couple of days. Destructive crypto funding charges would possibly lead some buyers to consider a worth decline is imminent, encouraging them to promote their holdings or take brief positions themselves.

This promoting strain can contribute to an precise worth drop for BTC and ETH.

With unfavourable funding charges, holding lengthy futures contracts turns into much less enticing. The charges eat into potential earnings, making some merchants unwind their lengthy positions or be extra cautious about opening new ones.

This reduces total shopping for strain, which may weaken the value help for BTC and ETH.

The shift in sentiment can result in larger volatility within the brief time period. As lengthy and brief positions battle it out, worth swings for BTC and ETH would possibly change into extra pronounced.

Conversely, a major and sustained drop in funding charges might be seen as a contrarian indicator by some buyers.

They could view it as an indication of extreme bearishness, presenting a possible shopping for alternative for BTC and ETH at what they understand as a reduced worth.

Supply: Coinglass

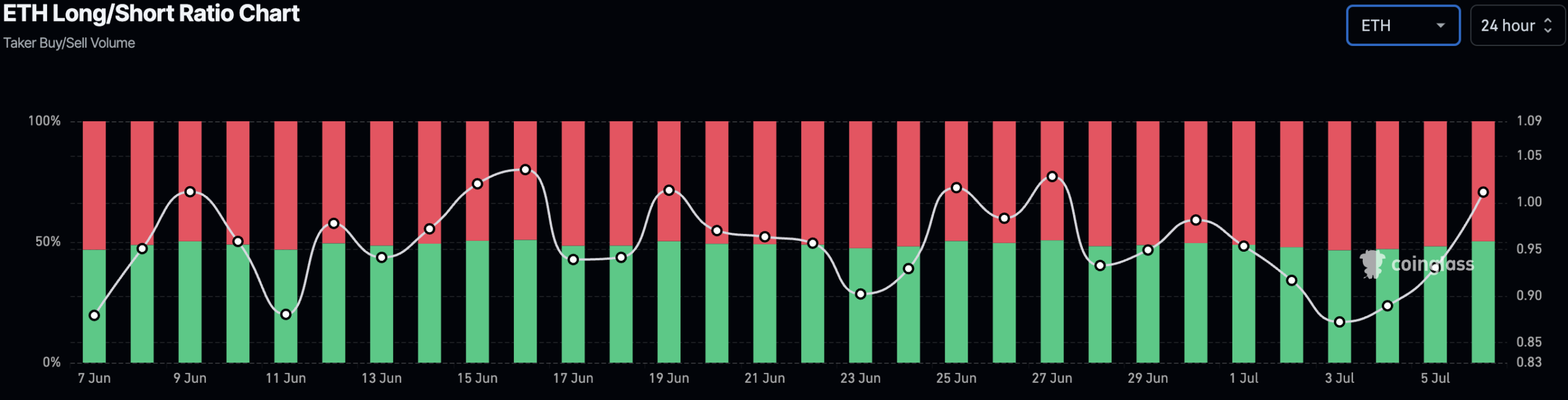

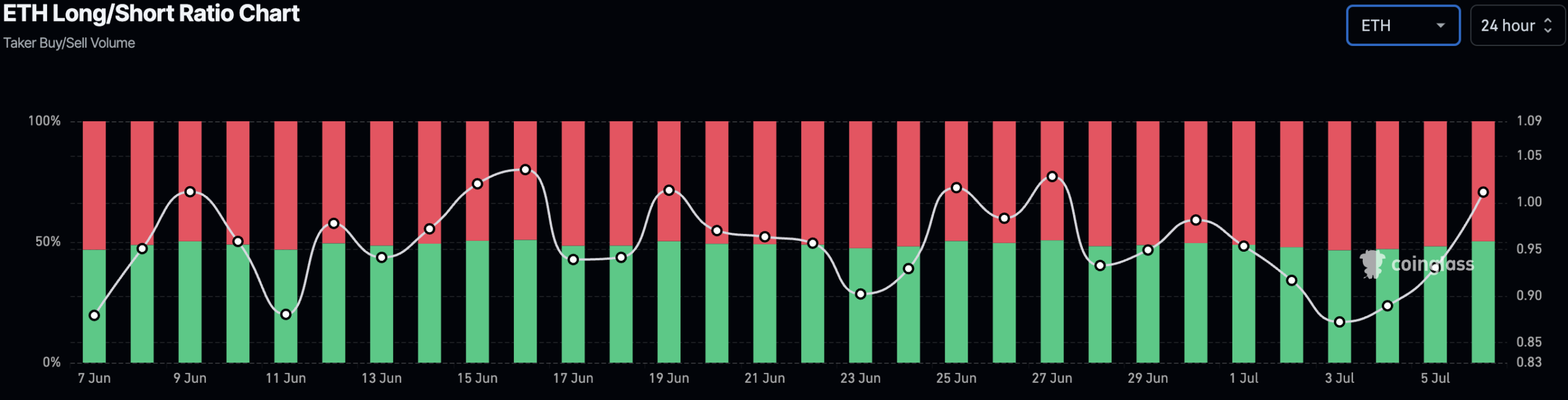

On the time of writing, merchants had been barely bullish round Bitcoin as longs had lastly surpassed brief positions accounting for 50.7% of all trades.

Ethereum witnessed the same rise in bullish sentiment as share of lengthy positions on ETH grew 50.9%.

Supply: Coinglass

IV grows as costs fluctuate

The Implied Volatility for each BTC and ETH additionally grew throughout this era. An increase in IV signifies that possibility merchants are pricing in the next probability of serious worth actions for BTC and ETH sooner or later.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

This means rising uncertainty concerning the future course of the markets. If the market sentiment sways closely in the direction of bearish, the unfavourable funding may amplify any worth drop as a result of elevated brief promoting.

In distinction to that, a sudden optimistic shift may result in a extra vital worth rise as a result of larger volatility.

Supply: IntoTheBlock