- Bitcoin merchants’ exercise has declined as worth consolidation persists.

- Bitwise cited traditionally weak summer season and September seasons because the trigger for BTC weak spot.

Since early August’s huge sell-off, Bitcoin [BTC] has struggled to remain above $60K. The muted worth motion has continued within the first half of September.

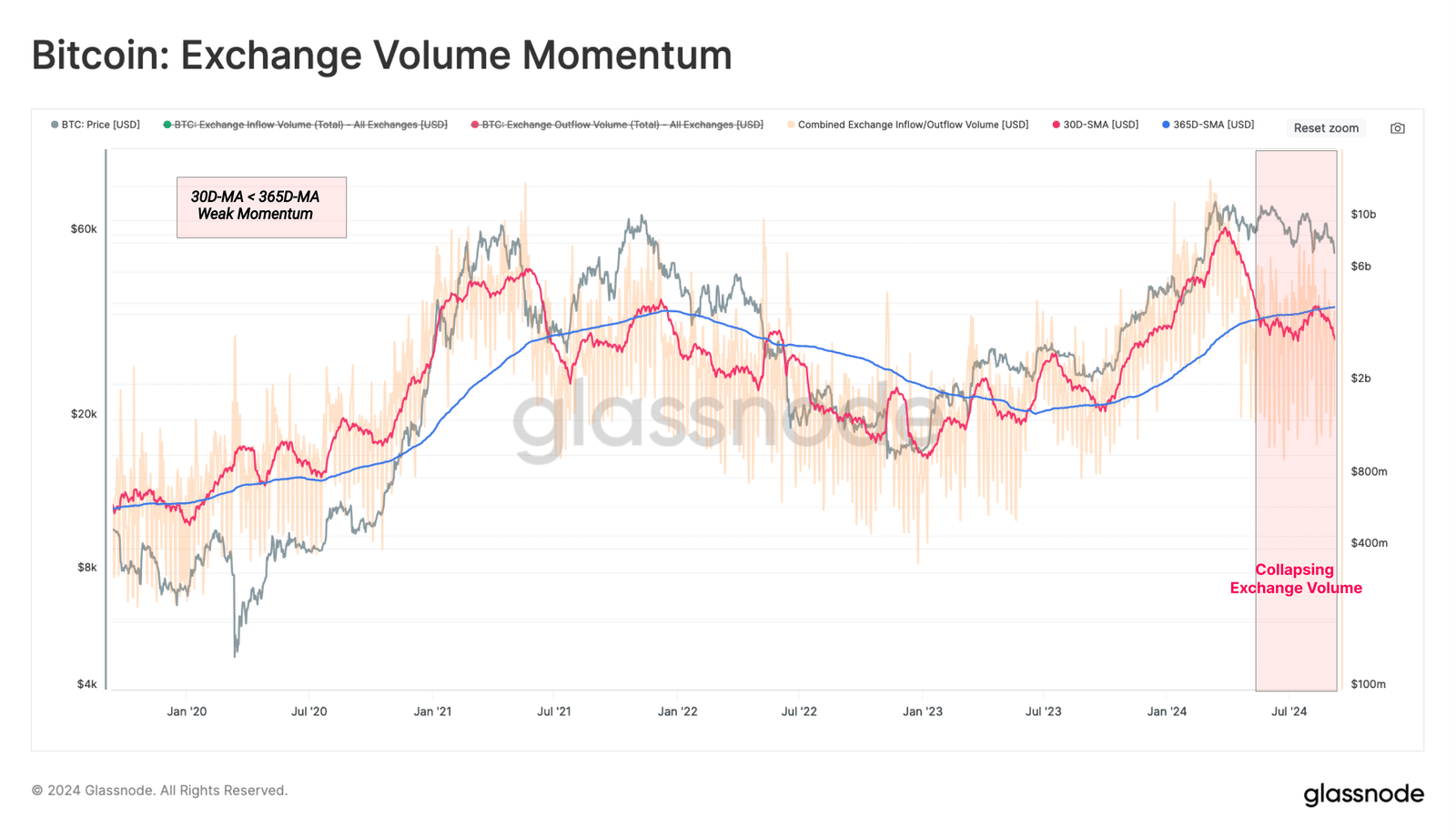

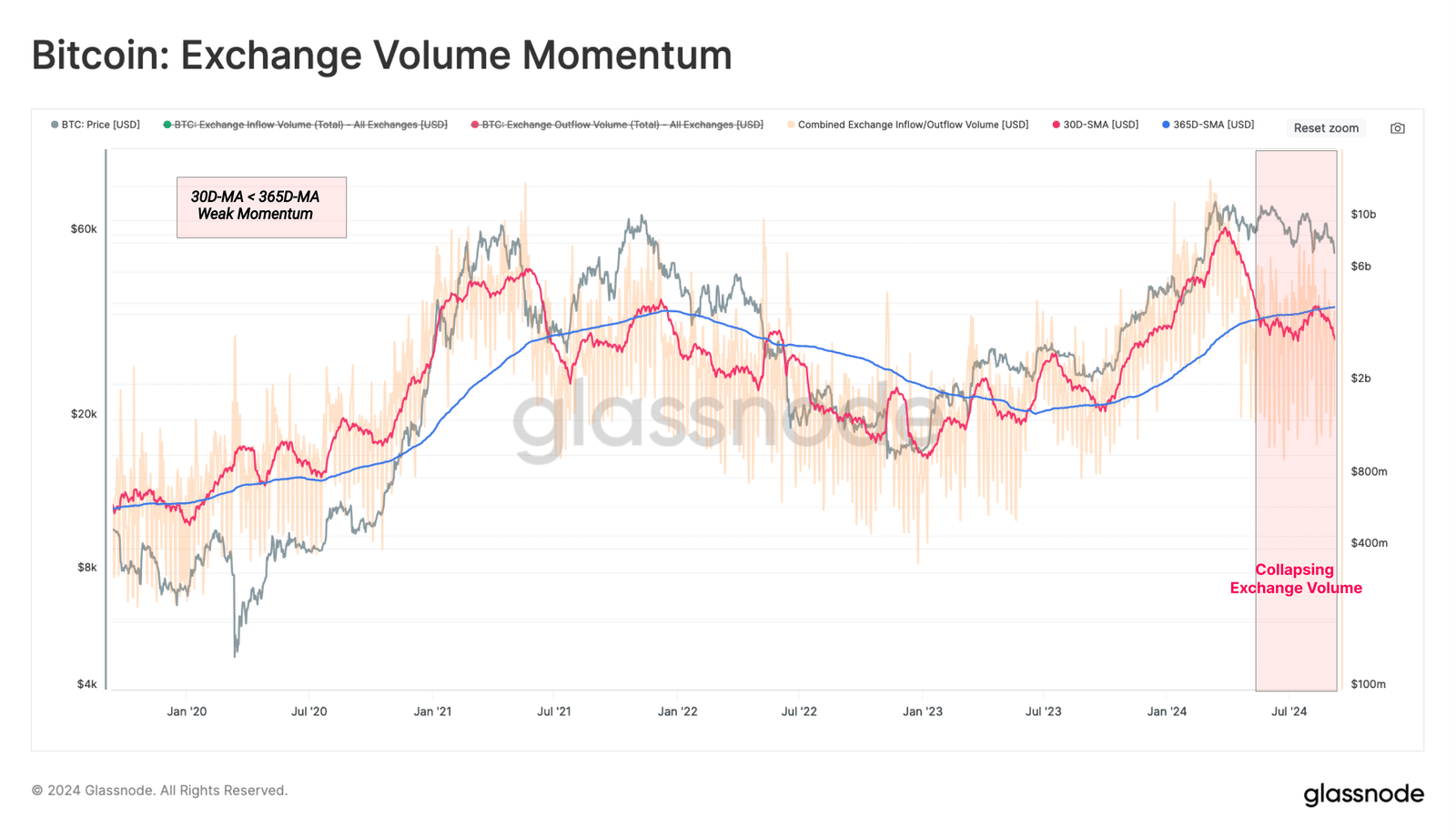

In line with a Glassnode report, this weak worth motion has led to a “lowered buying and selling urge for food” from BTC merchants. A part of its newest report cited low crypto change volumes and skim,

“We will see that the month-to-month common quantity has fallen effectively beneath the yearly. This underscores a decline in investor demand and fewer buying and selling by speculators inside the present worth vary.”

Supply: Glassnode

The report added {that a} crypto change is middle of worth discovery and hypothesis exercise. So, a contracting quantity on this entrance signaled weak demand from BTC merchants and buyers.

BTC promoting stress intensifies

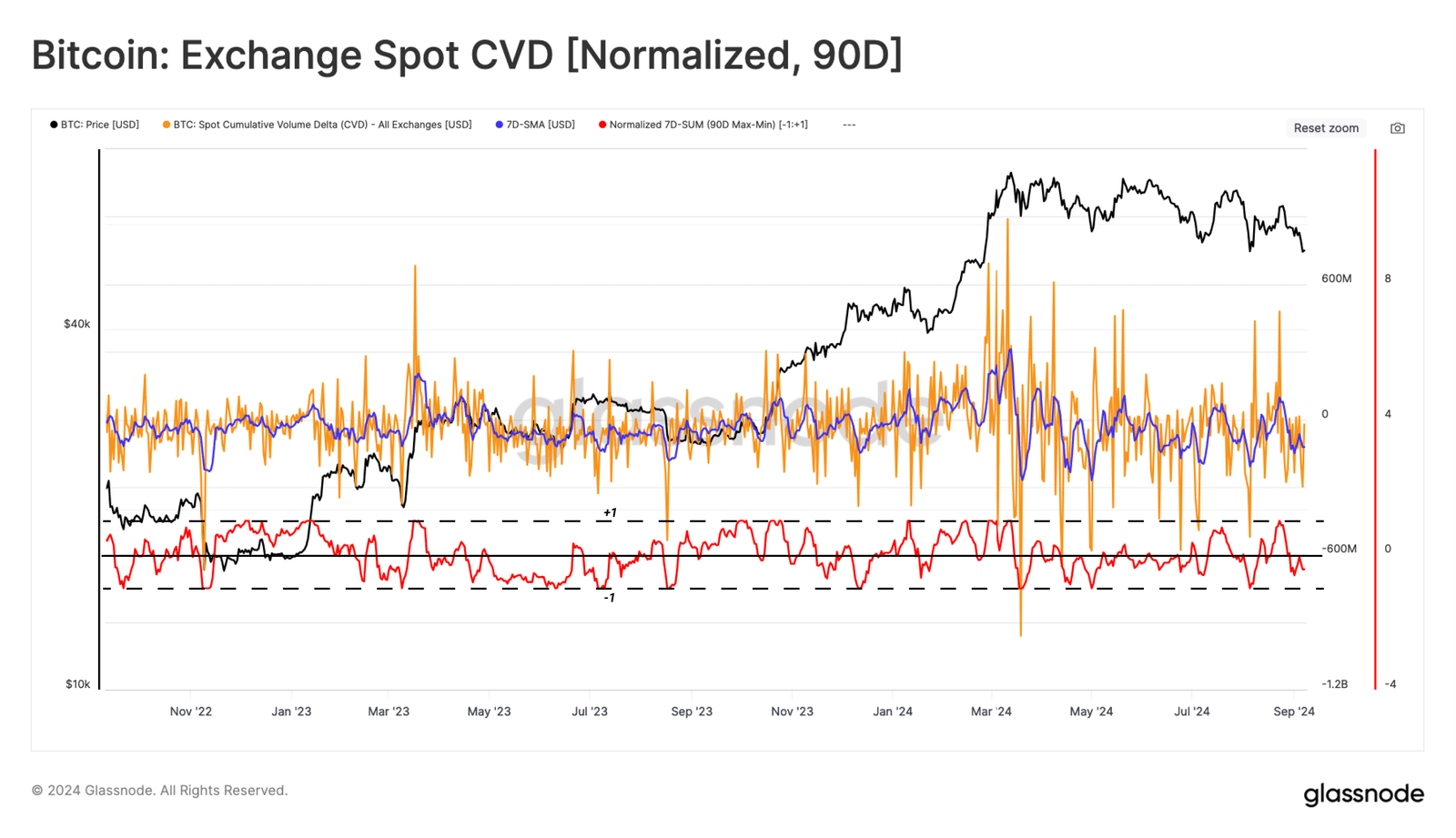

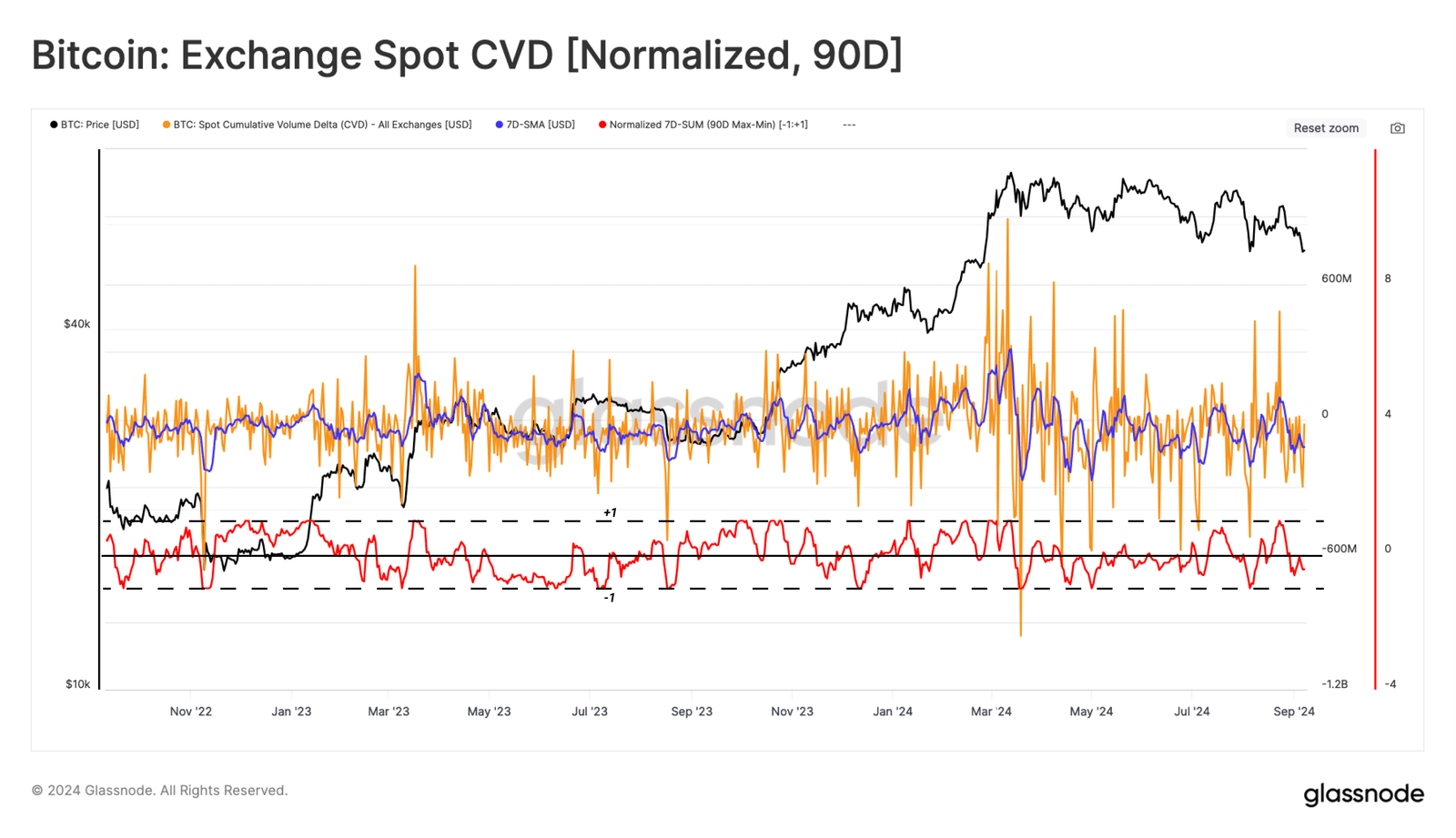

Glassode additionally famous that the spot market witnessed general promote stress in August and the whole quarter.

Utilizing the spot CVD (Cumulative Quantity Delta), which tracks the web steadiness between purchase and promote volumes, the metric was overwhelmingly adverse in Q3.

Supply: Glassnode

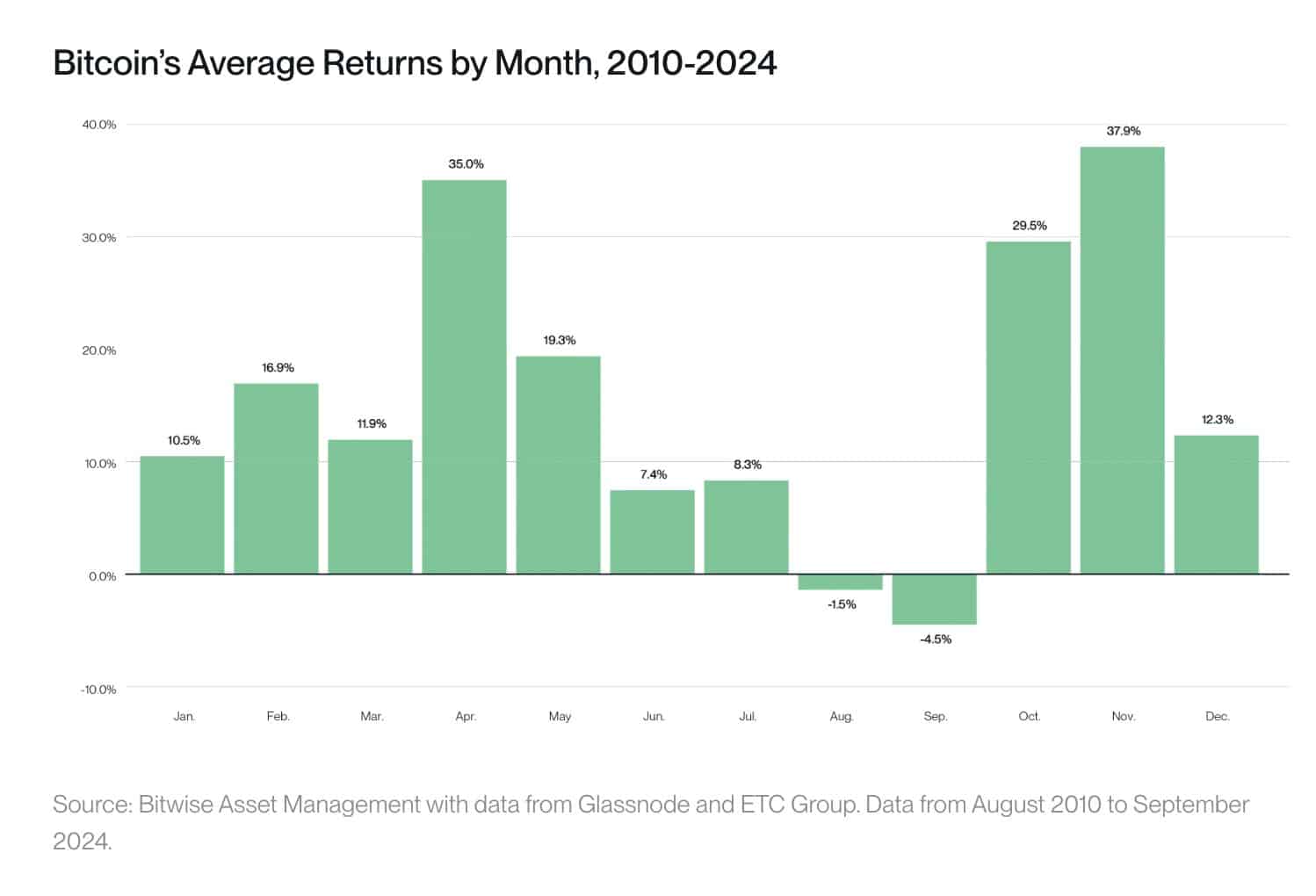

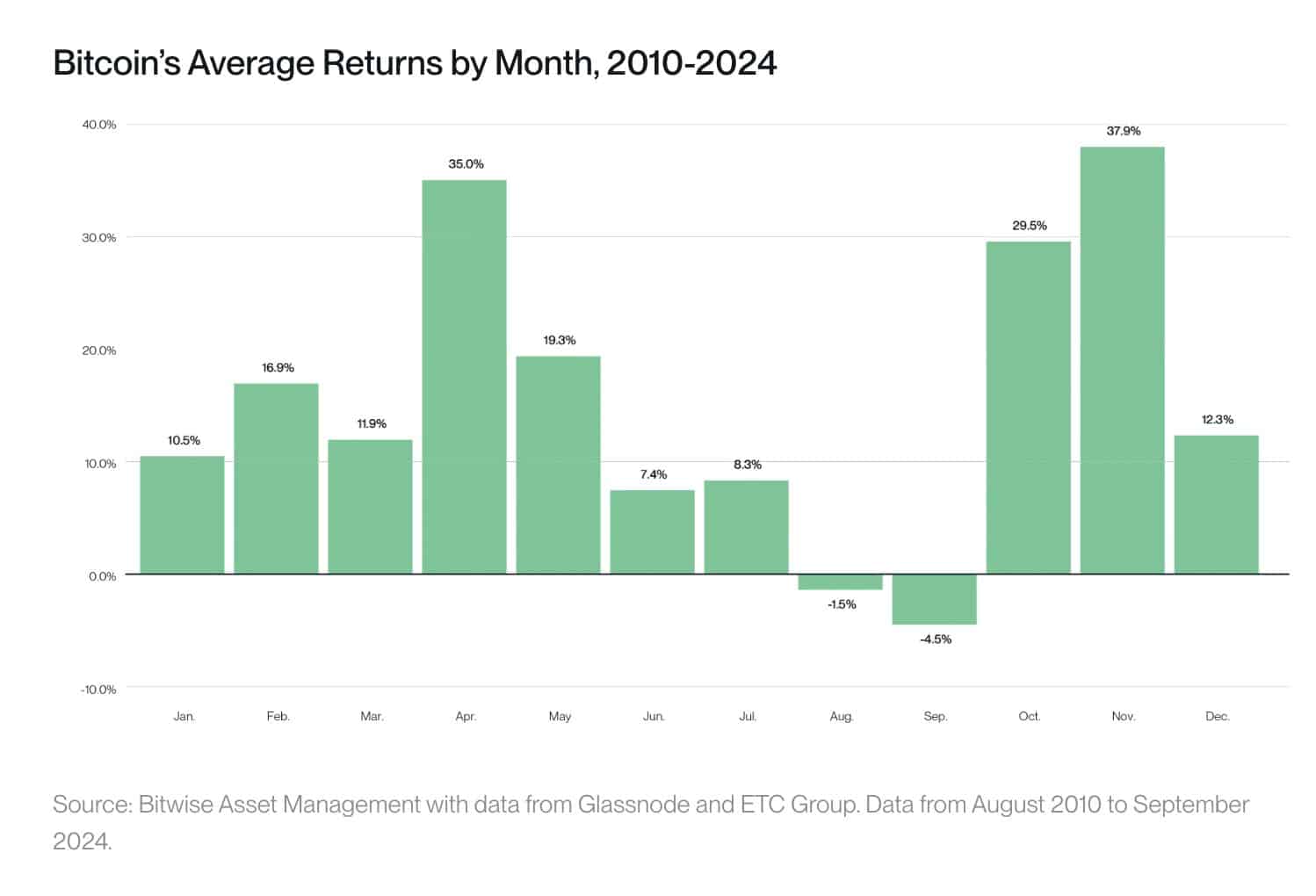

On its half, Bitwise cited seasonality as a probable consider BTC’s weak efficiency and sentiment in Q3, notably in September.

The asset supervisor illustrated that BTC has traditionally posted adverse returns in August and September.

Supply: Bitwise

Nevertheless, the agency famous a common development of poor summer season efficiency throughout all property, as buyers undertake the ‘promote in Might and go away’ mantra.

That mentioned, October has traditionally been a fantastic month for BTC, with a mean return of practically 30%.

If the development repeats, this would possibly sign a robust rebound for BTC in This autumn. Nevertheless, in response to crypto buying and selling agency QCP Capital, there’s one caveat.

Per QCP Capital, the latest Trump-Harris debate showed no sturdy lead among the many candidates and will set off a risk-off occasion.

“The absence of a transparent frontrunner on this election, coupled with the murky coverage stances from each events, heightens the potential for a risk-off transfer in threat property as we method Election Day.”

At press time, BTC traded at $57k, just a few hours earlier than the US August CPI (Shopper Value Index) information.