A carefully adopted crypto strategist says that Bitcoin (BTC) is giving off a bullish studying that has beforehand preceded an enormous surge in value.

Pseudonymous analyst Cheds tells his 314,800 followers on the social media platform X that Bitcoin’s relative power index (RSI) indicator on the weekly chart is now in “overbought” territory.

The RSI is a momentum indicator that merchants use to identify pattern continuation or reversal.

Cheds says that when Bitcoin flashed the identical sign in October 2020, Bitcoin skyrocketed and printed beneficial properties of greater than 5x.

“Commentary:

BTC weekly RSI coming into energy zone (70+, also referred to as overbought).

Overbought = bullish.

The final time this occurred the value ran from $12,000 to $64,000.

Although the value context is completely different, it’s value observing.”

Historically, an overbought asset means that it’s buying and selling nicely above its honest worth and traders are inclined to suppose {that a} correction is in sight. Nevertheless, Cheds argues that the alternative applies to Bitcoin.

“Overbought means bullish. The one approach to change into overbought is to be bullish, and traits are inclined to proceed. Most of BTC’s greatest value beneficial properties traditionally have come whereas ‘overbought’ for what it’s value.”

At time of writing, Bitcoin is buying and selling for $37,002.

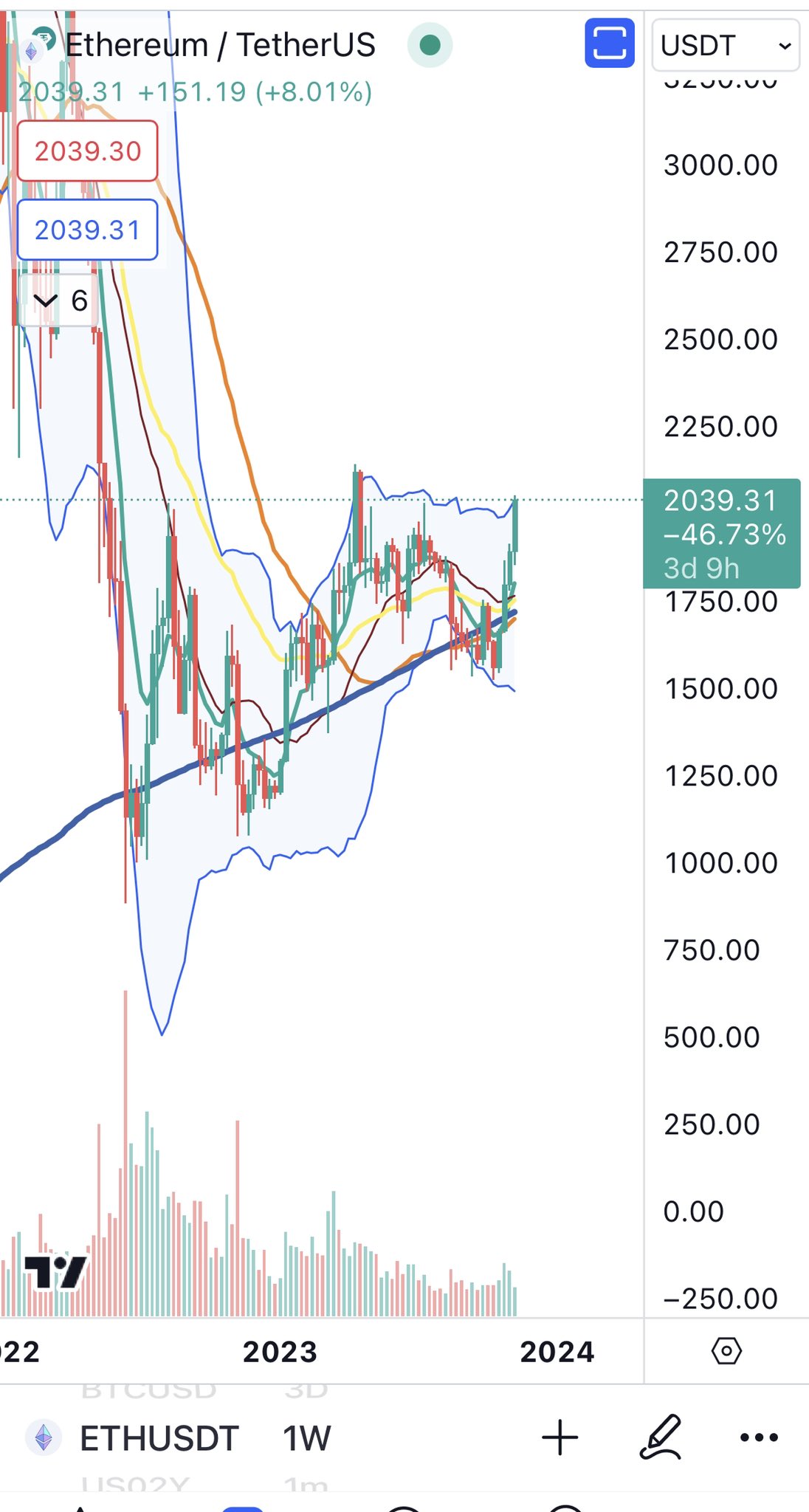

Wanting on the sensible contract platform Ethereum (ETH), Cheds says that bulls will doubtless begin to flex their muscle tissue as soon as the second-largest crypto by market strikes above as key value degree.

“ETH sideliners can use a break and maintain of $2,150 space as a protracted thesis.”

At time of writing, Ethereum is value $2,037.

Do not Miss a Beat – Subscribe to get e mail alerts delivered on to your inbox

Test Worth Motion

Observe us on Twitter, Facebook and Telegram

Surf The Day by day Hodl Combine

Generated Picture: Midjourney