ozgurcankaya/E+ through Getty Photographs

Funding thesis

The truth that Crown Fort Inc. (NYSE:CCI) demonstrated a strong 20% rally over the past month, along with a beneficiant 5.4% dividend yield, grasped my consideration. The corporate faces near-term headwinds for the highest line, however its profitability continues to be strong in comparison with its nearest rivals. I think about the top-line headwinds to be non permanent and never secular. CCI seems well-rounded to capitalize on regular business progress over the following years. My evaluation means that the dividend yield is secure, and CCI has a strong document of dividend progress lately. The dividend low cost mannequin simulation means that the inventory is attractively valued as properly. All in all, I assign a “Purchase” score for CCI.

Firm info

Crown Fort Worldwide is an actual property belief fund [REIT] that owns, operates, and leases shared communication infrastructure throughout the U.S., which incorporates greater than 40 thousand cell towers and roughly 85 thousand route miles of fiber.

The corporate’s fiscal 12 months ends on December 31. In accordance with the most recent 10-Okay report, it generates roughly three-fourths of its whole income from the American “Massive 3” telecom operators: Verizon (VZ), AT&T (T), and T-Cellular (TMUS). CCI operates through two segments: Towers and Fiber. Towers generated nearly 70% of whole gross sales in FY 2022.

Financials

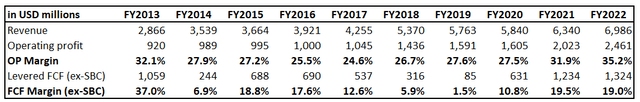

CCI’s monetary efficiency has been strong over the past decade. Income compounded at a powerful 10.4% CAGR with strong profitability and free money movement [FCF] metrics ex-stock-based compensation [ex-SBC]. The FCF margin has been comparatively unstable over the last decade however by no means unfavourable and principally within the double-digits.

Writer’s calculations

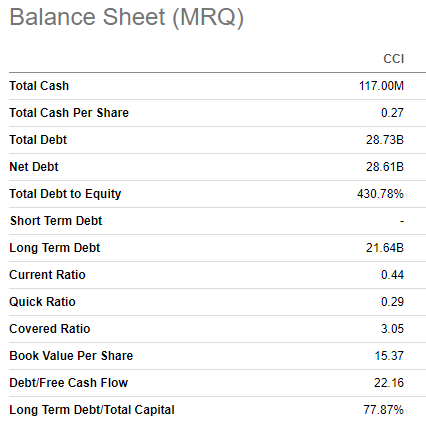

Due to the strong monetary efficiency over the past decade, the administration was in a position to implement a really aggressive capital allocation coverage. CCI is in a large web debt place with a sky-high leverage ratio, however given the corporate’s persistently optimistic and broad FCF margin, I don’t think about CCI overleveraged. Regardless of having a extremely leveraged stability sheet, the corporate’s sturdy dividend consistency provides me excessive conviction that the present 5.4% yield is secure.

Looking for Alpha

The most recent quarterly earnings had been launched on October 18, when the corporate missed consensus estimates. Whole income declined 4.5% YoY, and the FFO adopted the highest line by narrowing from $1.93 to $1.61.

Alternatively, the core rental income demonstrated a slight YoY enhance. The Towers web site rental revenue declined YoY by 1%, offset by a 4% progress in Fiber rental income. If zoomed out, for the primary 9 months of 2023, the Fiber phase demonstrated a strong 15% YoY progress. Quite the opposite, Tower web site rental revenue has stagnated year-to-date. The profitability decline was primarily attributable to decreased pay as you go lease amortization and better Towers web site rental operations prices.

In accordance with the most recent earnings name, Crown Fort faces headwinds in income attributed to the Dash cell tower lease cancellations, lowered web site rental revenues, decrease tower exercise ranges, and a decline in straight-lined adjustment and amortization of pay as you go lease. I think about these challenges primarily non permanent, stemming from particular elements corresponding to modifications in enterprise actions moderately than enduring secular shifts. Whereas the business is near full penetration, the cell knowledge market is predicted to reveal a 3.6% CAGR for the following 5 years, which is favorable for CCI.

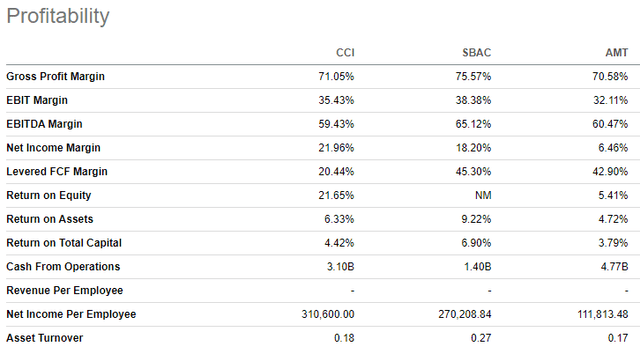

Total, CCI’s huge scale and broad web site geographical presence make the corporate well-positioned to capitalize on the modest however predictable and regular business progress. The corporate’s two main rivals are American Tower Company (AMT) and SBA Communications Company (SBAC). From the income perspective, CCI is considerably behind AMT however by far bigger than SBAC. Comparative evaluation of those three corporations’ profitability supplies blended outcomes, however most of CCI’s profitability metrics are consistent with opponents, that means that each one three gamers ship nearly the identical stage of effectivity. The enterprise is extremely capital intensive in nature, and it’ll require many years to construct out the identical infrastructure, that means that the positions of those three gamers are intact.

Looking for Alpha

From the buyers’ perspective, CCI seems like a greater funding alternative for dividend buyers because the inventory’s 5.4% ahead dividend yield is a number of occasions larger than the one supplied by SBAC and is considerably larger than the three.1% yield paid out by AMT.

Valuation

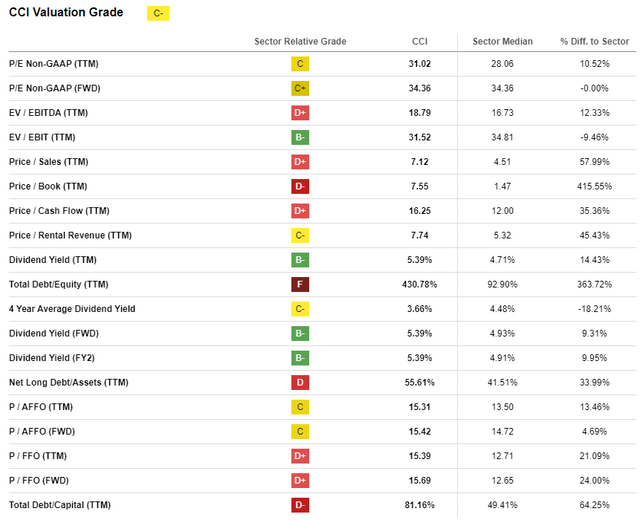

CCI tanked by 16% year-to-date, considerably lagging behind the broader U.S. inventory market. Looking for Alpha Quant assigns CCI a median “C-” valuation grade, that means the inventory is roughly pretty valued. Nonetheless, the comparative evaluation of CCI’s valuation ratios with the sector median supplies blended outcomes. Due to this fact, multiples evaluation doesn’t give me sufficient confidence, and I have to proceed with the dividend low cost mannequin [DDM].

Looking for Alpha

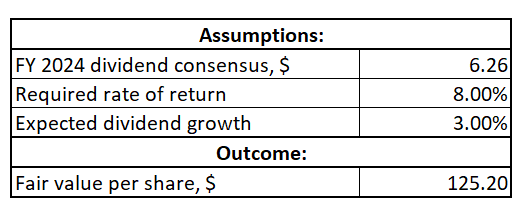

I take advantage of an 8% WACC as a required fee of return, which is a slight spherical down of the really helpful by Gurufocus stage. Consensus dividend estimates mission an FY 2024 dividend payout of $6.26, which I take advantage of for my DDM simulation. Regardless of dealing with macro headwinds, CCI’s long-term dividend progress historical past is strong. That stated, I believe that sustaining a 3% dividend CAGR is doable for CCI over the long run.

Writer’s calculations

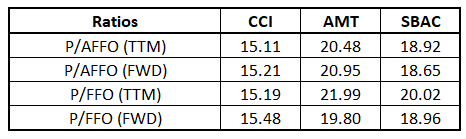

In accordance with my DDM valuation, CCI’s honest value is barely above $125. This means a modest 8% upside from the present inventory value stage. The upside potential seems respectable, given the 5.4% dividend yield. It’s also essential to underline that CCI’s price-to-FFO/AFFO ratios look far more engaging than AMT’s and SBAC’s.

Compiled by the creator based mostly on Looking for Alpha

Dangers to think about

The tighter financial coverage within the U.S. poses a near-term problem to Crown Fort’s prospects. Being closely reliant on capital-intensive investments in fiber and small cells means there’s much less room to put money into CAPEX for CCI underneath tight financial circumstances. Increased borrowing prices for longer might restrict the corporate’s capability to execute its strategic initiatives effectively. Moreover, the potential for larger rates of interest additionally weighs on the general financial exercise, affecting demand for Crown Fort’s providers as companies might develop into extra cautious of their capital expenditures.

The current speedy 20% rally in CCI inventory provides a layer of uncertainty to its near-term prospects. Whereas such surges are usually good and point out sturdy momentum, in addition they elevate the danger of short-term buyers in search of to appreciate their capital features by promoting the inventory. The potential for profit-taking actions might enhance inventory volatility and quickly influence the inventory’s stability. That stated, potential buyers needs to be cautious about short-term fluctuations in response to current features.

Backside line

To conclude, CCI is a “Purchase”. The valuation is engaging, and a strong dividend yield seems secure. The corporate is strategically positioned to proceed demonstrating modest income progress and broad profitability metrics. CCI seems environment friendly in comparison with its closest rivals, and the business’s high-capital-intensive nature means that the “large three” market positions are secure.