georgeclerk

Funding outlook

In a world of heightened volatility, larger yields, and tighter cash, high quality companies with sturdy financial traits stand entrance and centre. After in depth evaluation, CrossAmerica Companions LP (NYSE:CAPL) is one such title for my part. A extra considerate evaluation was warranted with the inventory buying and selling at 11x ahead EBITDA, 0.4x ahead gross sales and a 13% money circulate yield.

The corporate’s 9% trailing dividend yield is fairly effectively supported, with 8 years of consecutive funds. There’s a substantial case for getting CAPL for this sort of yield. The corporate can help its present payout (as you will see right here immediately) and the market will proceed to low cost its funds to a good worth.

This report won’t have a look at this issue however at what you’d get out of this for capital positive aspects, the place enterprise returns and FCF progress are paramount in several methods.

CAPL runs a multifaceted portfolio engaged within the wholesale distribution of motor fuels. This side extends to:

- Possession or leasing of web sites devoted to retail gas distribution. This generates rental earnings by lease or sublease.

- Moreover, it sells motor fuels immediately to finish clients.

- Past gas distribution, the corporate operates retail websites. This includes the sale of motor fuels but in addition contains the retail gross sales, additional diversifying the corporate’s income streams.

The distribution of CAPL’s providing at a number of factors alongside the worth chain is intriguing. Does this pull its financial weight? And what worth are we observing as shareholders.

Evaluation of (i) the corporate’s newest numbers and (ii) the agency’s worth drivers utilizing sound financial rules, point out worth buyers could also be higher served parking capital elsewhere. The funding information sample is:

- The corporate is coming off a excessive progress interval,

- It’s extremely worthwhile, due to leverage results,

- Enterprise returns do not match as much as the online returns on capital.

Internet-net, I charge CAPL a maintain for the explanations raised on this report.

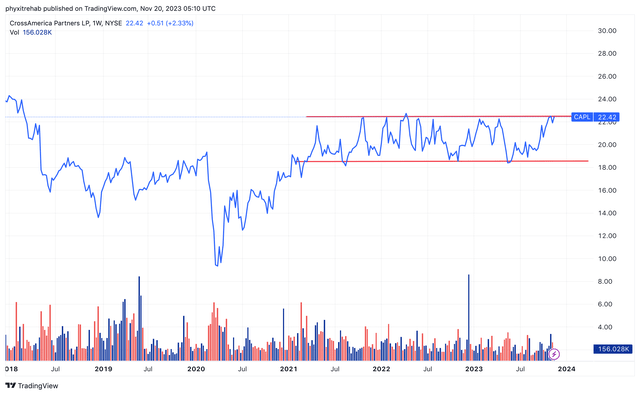

Determine 1. CAPL buying and selling in a variety since 2019

Supply: Tradingview

Important funding information forming the thesis

1. Q3 Earnings Insights

The corporate got here off a interval of sturdy enterprise final yr, so its Q3 numbers had been blended. This was to be anticipated, so he post-earnings drift in market worth has been negligible.

In Q3 the corporate clipped adj. EBITDA of $44.2mm, a notable lower from $62.6mm final yr, on earnings of $12.3mm down 55% YoY. This was to be anticipated seeing the irregular gas margins noticed in Q3 ’22. As proof of optimistic quarter, distributable money circulate was up $16mm YoY to $31.4mm.

Operational dynamics embody the next:

-

Inside gross sales and merchandise gross margin:

- Inside gross sales on a same-site foundation elevated by c.4% YoY, demonstrating resilience of the core enterprise. Actually, as seen in Determine 1, the enterprise has been sturdy in market worth too. Regardless of the sharp selloff in broad market values in ’22, CAPL has traded flat. This sort of top-line efficiency indicators one purpose why.

- Excluding cigarettes, same-store inside gross sales had been up 9% YoY progress.

- Merchandise gross margin decompressed by 160 foundation factors, lifting gross revenue 23% YoY to $25.4mm.

-

Wholesale gas section, gas margin + quantity:

- Wholesale gas gross revenue was down 4% YoY, reaching $18.8mm in comparison with $19.5mm in Q3 final yr.

- The Wholesale gas margin contracted by 7%, declining from $0.092 per gallon in Q3 2022 to $0.086/gallon.

- Q3 wholesale quantity elevated to $217.3mm gallons, a 2% YoY progress, with contribution from neighborhood service station belongings made in This fall ’22.

- Capital expenditures + use of capital

- CapEx funding was $10.4mm, with $8.5mm attributed to progress investments.

- Gas utilization costs had been the main issue and used working capital throughout Q3. The corporate had $762mm beneath its whole credit score facility steadiness, so is effectively captilalized to soak up short-term fluctuations.

- The opposite factor is it disposed 8 properties to acknowledge $8.3mm in capital proceeds. In line with the CEO, the agency is trying to “liberate capital on this method, which we are going to both put in direction of lowering leverage or investing in progress alternatives.“

So allocation over the approaching 12 months is one thing I’d be carefully watching. It appears as if there is a bias to getting cash out within the area. The market has been receptive to this recently, so keep watch over it for CAPL.

2. Financial worth

The prospect of including CAPL to our guide boils down to 2 crucial notions:

(1). Is the corporate rising its FCF per share (or wealth) over time,

(2). How effectively is it doing so.

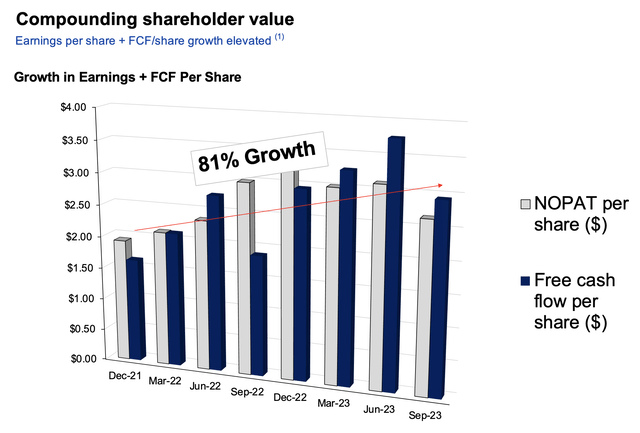

In some respects, CAPL is compounding shareholder wealth over time. Taking the strategy that, the worth of any asset because the money it produces for its homeowners, CAPL shareholders have been pretty handled previous few years. The corporate has grown its FCF per share 81% in whole since December 2021 to $2.95/share. NOPAT per share has grown in synch, to indicate this wasn’t simply asset disposals. Dividends have remained flat.

Determine 2.

Supply: BIG Insights, Firm studies

That is an environment friendly course of for CAPL, too. Round $26/share of capital invested within the enterprise produces 10% charge of return in earnings, a determine that has crept larger on combination since 2021. The crucial information are this:

- This can be a low-margin, excessive capital turnover enterprise; 2-3% post-tax coupled with 3-4x capital turns. This squares off with the economics. All product is out the door as rapidly as doable, retaining the ratio of belongings to gross sales low. CAPL clearly enjoys price management benefits the place it may possibly promote choices beneath trade averages, thus making a aggressive place.

- That’s enticing arithmetic. Every $1 the corporate invests into operations can produce as much as $4 in gross sales. For a 1–3 yr funding horizon, that is the sort of state of affairs one desires to see.

- With all FCF per share and dividends paid up, buyers have been handled to $7-$8/share every rolling TTM interval since 2022. Nevertheless–we will not ignore the actual fact there’s been no capital progress, the crucial takeout.

So 10-11% enterprise returns, 4x capital turnover on single-digit margins—that is the financial profile of the agency. Stock out and in for low margins however excessive turnover and money conversion attributable to brief working capital.

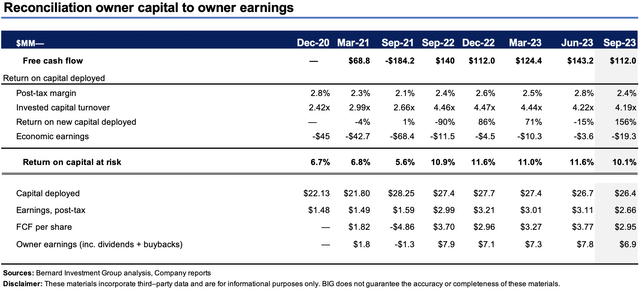

Determine 3.

BIG Insights

These figures—while outstanding—are little related with out context. What permits these are smart enterprise returns?

What makes any return worthwhile to the investor is whether or not it beats the chance price. Lengthy-term market averages are 12%. One can subsequently assemble a single-instrument portfolio with a 12% anticipated return over most horizons.

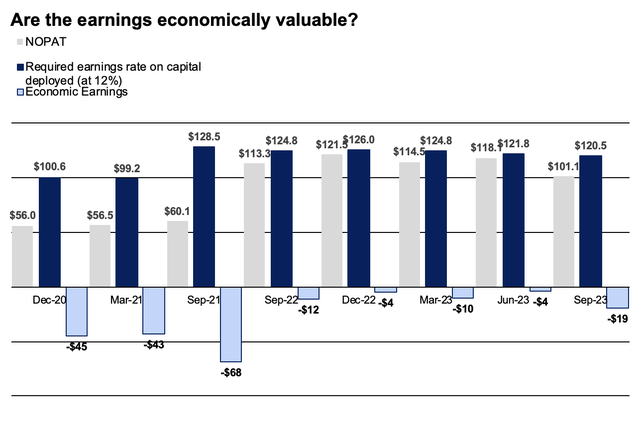

Evaluating CAPL’s enterprise returns to the market’s threshold return on capital reveals why it has doubtless compressed sideways for round 12 months now. The speed on its invested capital (gray bars) has lagged the 12% hurdle charge (darkish blue bars), so none of its earnings are economically worthwhile (sky blue bars).

Determine 4.

Supply: BIG Insights, Firm filings

So we’ve got a scenario the place an organization is (i) compounding its FCF per share, however (ii) not above the required threshold charge (c.12%). It’s not sufficient to easily ‘develop’ earnings or produce extra free money circulate. How effectively you probably did that issues too, in comparison with the subsequent finest various.

Underneath this lens, the capital CAPL has tied up into the enterprise (what you personal because the fairness investor) is just not extra worthwhile than what you possibly can personal merely driving the benchmark (assuming a traditional distribution of future anticipated returns). That’s, it’s not producing earnings progress above the inventory market’s long-run averages (10-11% vs. 12%+). Will this proceed shifting ahead? My estimate is sure. The corporate has achieved job matching the chance price of capital, however not outpacing it, so there are challenges. In the event you benchmark CAPL in opposition to the SPY (SPY) the corporate really has fairly the job to do.

3. Extra elements of profitability

Regardless of the enterprise returns simply mentioned (of which the inventory returns will carefully mirror over the long run), buyers are effectively handled in proudly owning the fairness of the company—87% trailing ROE. Terrific return.

Nevertheless, you might want to gauge two very crucial notions because it pertains to the corporate’s return[s] on fairness. The corporate has achieved a terrific job at producing such interesting revenue numbers. Issues are barely totally different for the investor.

(i). ROE excessive due to make use of of leverage

Right here we extrapolate the drivers of the ROE by its core elements. Word the next observations:

(1). Earnings aren’t the driving pressure.

(2). As an alternative, the excessive ratio of gross sales to belongings ($3.24 for each $1 belongings employed), and

(3). Tremendously excessive a number of on fairness from leverage (24.8x) are the driving forces. If we utilized 1x leverage, the corporate’s ROE could be 3.5%.

That in itself is a tough proposition to wrap round. On the one hand, the corporate must be applauded for its profitability. For the fairness investor, nevertheless, economics are a weak level right here.

Determine 5. CAPL ROE – DuPont breakdown

| Internet revenue margin | 1.02% |

| Asset turnover | 3.42 |

| Fairness multiplier | 24.84 |

| Return on Fairness | 86.6% |

| Return on Fairness with 1x leverage | 3.50% |

Supply: BIG Insights, Searching for Alpha

(ii). ROE adjustments with beginning valuations

Investor and firm returns on fairness differ in precept. One, the corporate would not face the frictional price an investor does. Two, buyers have to purchase their fairness available in the market on the market value. So you might want to contemplate the next:

- CAPL’s TTM ROE is 87% that means it produced $43mm of internet earnings on $49mm of fairness worth attributed to the enterprise (Determine 6).

- That’s the firm’s fairness. You might be being requested to pay 36x guide worth, i.e., $1.77Bn (49.3×36 = 1,775).

- The investor ROE is subsequently 2.4% (43/1,775 = 2.4%).

Together with the factors above, this illustrates why considerate evaluation is required to completely grasp outliers within the information. The corporate’s ROE is excessive at 87%, and must be recommended. Does this prolong to the investor? On nearer evaluation, maybe not. This factors on how we arrive on the identical ROE 2 alternative ways and what beginning valuations imply shouldn’t be missed.

Determine 6. CAPL ROE – Breakdown of beginning valuations

| ($MM / %) | ||

| (1) | Internet earnings | 43.0 |

| (2) | Ebook worth | 49.3 |

| (3) | Firm ROE (1/2) | 87% |

| (4) | A number of | 36x |

| (5) | Investor Pays —(2 x 4). | $1,775 |

| (6) | Investor ROE (1/5) | 2.4% |

Supply: BIG Insights, Searching for Alpha

Valuation and conclusion

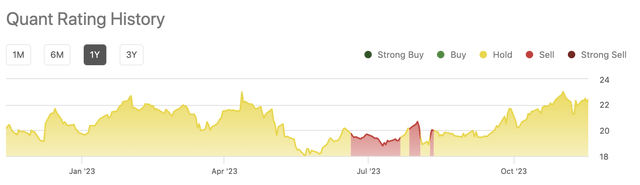

With the above factors in consideration it begins to make sense why the quant system has CAPL rated a maintain, with low grades on key elements similar to valuation, progress, profitability. The corporate’s gas distribution enterprise is a worthwhile franchise, with liquid belongings that produce predictable, giant money flows. It fulfils all requisites as company citizen on the subject of employment, taxation, financial progress, and so forth.

For the investor in search of to buy possession in CAPL’s fairness inventory, additional adjustments to the information should first occur.

(1). To purchase a lovely ROE (14% for instance), market values should contract so sharply to the $300mm vary. Not well worth the epic journey.

(2). Given the worth dislocations, buyers are promoting CAPL at 36x guide worth—or $1.775Bn—lowering the investor ROE to 2.4%. A progress in earnings above the $650mm mark is required to steadiness the scales.

At this level the valuations will not be effectively supported within the funding findings. To pay 36x an fairness worth that produces 2.4% for the investor, after producing 87% for the corporate, is a tough ask to recover from the road. My judgement is the market has is captured at 11x ahead EBITDA, however this has room to contract additional.

Determine 7.

Supply: Searching for Alpha

In brief, CAPL is the sort of firm that lends itself to buyers in search of publicity to top quality companies that may compound wealth over the very long run. The corporate presents with some fairly enticing financial traits, that maybe fall simply brief when in comparison with a excessive watermark. Valuations are additionally stretched, and run threat of repricing. My judgement is there are extra compelling funding alternatives with comparable threat on the market at this level. Internet internet, charge maintain.