Dilok Klaisataporn

By Ryan McMaken

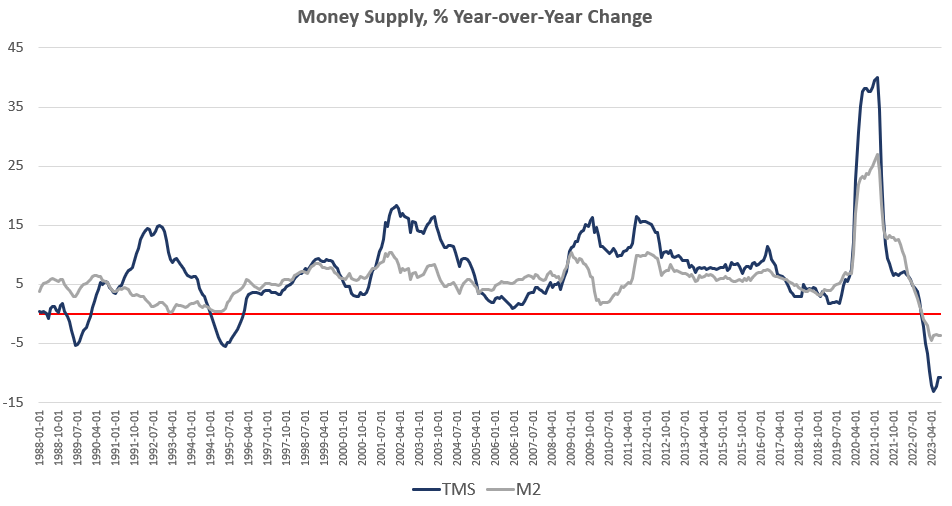

Cash provide progress fell once more in August, remaining deep in unfavourable territory after turning unfavourable in November 2022 for the primary time in twenty-eight years. August’s drop continues a steep downward pattern from the unprecedented highs skilled throughout a lot of the previous two years.

Since April 2021, cash provide progress has slowed rapidly, and since November, we have been seeing the cash provide repeatedly contract yr over yr.

The final time the year-over-year (YoY) change within the cash provide slipped into unfavourable territory was in November 1994. At the moment, unfavourable progress continued for fifteen months, lastly turning constructive once more in January 1996.

Cash provide progress has now been unfavourable for ten months in a row. Throughout August 2023, the downturn continued as YoY progress within the cash provide was at –10.8 %.

That is unchanged from July’s price of –10.8 %, and was far under August 2022’s price of 4.4 %.

With unfavourable progress now falling close to or under –10 % for the sixth month in a row, money-supply contraction is the biggest we have seen because the Nice Despair. Previous to this yr, at no other point for at least sixty years has the cash provide fallen by greater than 6 % (YoY) in any month.

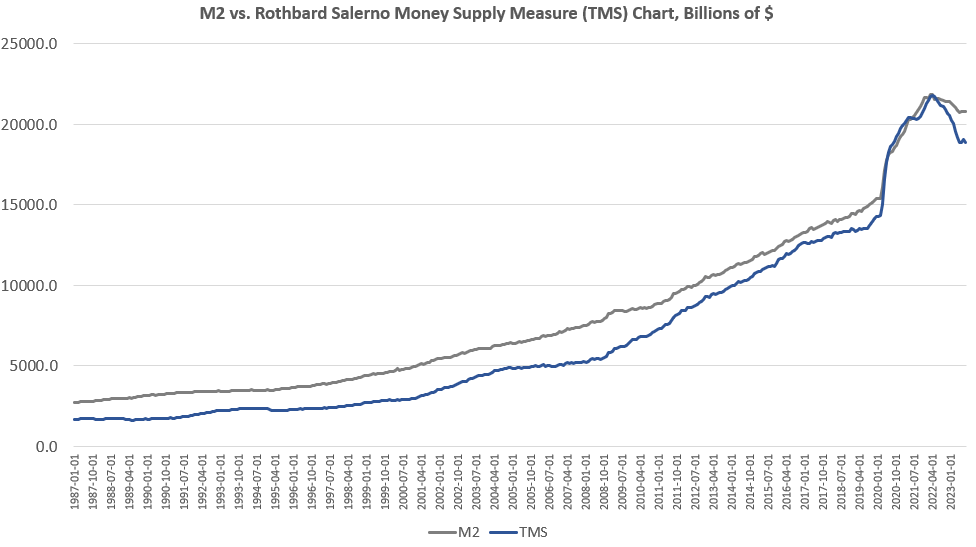

The cash provide metric used right here – the “true,” or Rothbard-Salerno, money supply measure (TMS) – is the metric developed by Murray Rothbard and Joseph Salerno, and is designed to supply a greater measure of cash provide fluctuations than M2.

The Mises Institute now affords common updates on this metric and its progress. This measure of the cash provide differs from M2 in that it contains Treasury deposits on the Fed (and excludes short-time deposits and retail cash funds).

In latest months, M2 progress charges have adopted the same course to TMS progress charges, though TMS has fallen sooner than M2. In August 2023, the M2 progress price was –3.7 %. That is unchanged from July’s progress price of –3.7 %. August 2023’s progress price was additionally effectively down from August 2022’s price of three.8 %.

Cash provide progress can usually be a useful measure of financial exercise and an indicator of coming recessions. During times of financial growth, cash provide tends to develop rapidly as business banks make extra loans. Recessions, however, are usually preceded by slowing charges of cash provide progress.

It ought to be famous that the cash provide doesn’t want to truly contract to sign a recession and the boom-bust cycle. As proven by Ludwig von Mises, recessions are sometimes preceded by a mere slowing in money supply growth.

However the drop into unfavourable territory we have seen in latest months does assist illustrate simply how far and the way quickly cash provide progress has fallen. That’s typically a crimson flag for financial progress and employment.

The truth that the cash provide is shrinking in any respect is exceptional as a result of the cash provide in fashionable occasions virtually by no means will get smaller. The cash provide has now fallen by $2.9 trillion (or 13.4 %) because the peak in April 2022.

Proportionally, the drop in cash provide since 2022 is the biggest fall we have seen since the Depression. (Rothbard estimates that within the lead-up to the Nice Despair, the cash provide fell by 12 % from its peak of $73 billion in mid-1929 to $64 billion on the finish of 1932.)

Despite this latest drop in whole cash provide, the pattern in cash provide stays effectively above what existed throughout the twenty-year interval from 1989 to 2009. To return to this pattern, the cash provide must drop no less than one other $3 trillion or so – or 15 % – right down to a complete under $15 trillion.

Since 2009, the TMS cash provide is now up by practically 185 %. (M2 has grown by 142 % in that interval.) Out of the present cash provide of $18.8 trillion, $4.6 trillion – or 24 % – of that has been created since January 2020.

Since 2009, $12.2 trillion of the present cash provide has been created. In different phrases, practically two-thirds of the overall current cash provide have been created simply prior to now 13 years.

With these sorts of totals, a ten-percent drop solely places a small dent within the big edifice of newly created cash. The US economic system nonetheless faces a really massive financial overhang from the previous a number of years, and that is partly why after eighteen months of slowing money-supply progress, we aren’t but seeing a large slowdown within the labor market. The inflationary growth has not but ended.

Nonetheless, the financial slowdown has been enough to significantly weaken the economic system. The Philadelphia Fed’s manufacturing index is in recession territory. The Main Indicators index keeps looking worse.

The yield curve factors to recession. Temp jobs were down, year-over-year, which regularly signifies approaching recession. The bank card default price is rising rapidly.

Cash Provide and Rising Curiosity Charges

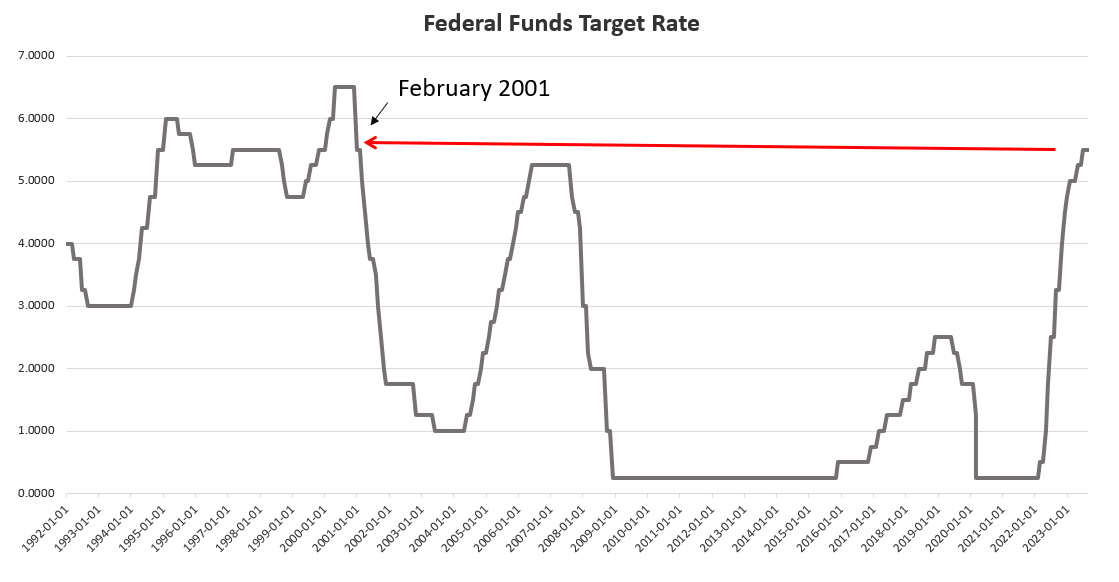

An inflationary growth begins to turn to bust once new injections of money subside, and we’re seeing this now. Not surprisingly, the present indicators of malaise come after the Federal Reserve lastly pulled its foot barely off the money-creation accelerator after greater than a decade of quantitative easing, monetary repression, and a basic devotion to simple cash.

As of September, the Fed has allowed the federal funds price to rise to five.50 %, the very best since 2001. This has meant short-term rates of interest general have risen as effectively. In September, for instance, the yield on 3-month Treasurys reached the highest level measured in greater than 20 years.

With out ongoing entry to simple cash at near-zero charges, nevertheless, banks are much less captivated with making loans, and lots of marginal corporations will now not be capable to stave off monetary hassle by refinancing or taking out new loans.

The banking sector itself has warned investors to prepare for new rounds of layoffs. In the meantime, massive company chapter filings surged within the first half of the yr. Based on a new report from Cornerstone Analysis:

“The surge in massive company chapter filings within the first half of 2023 is per financial situations posing heightened chapter danger for extremely leveraged corporations,” mentioned Matt Osborn, a principal at Cornerstone Analysis and coauthor of the report. “Together with a basic rise in rates of interest, credit score spreads for extremely leveraged company issuers in comparison with funding grade issuers started widening in mid-2022, a shift that typically persevered into the primary half of 2023.”

The variety of mega bankruptcies, these filed by corporations with over $1 billion in reported property, additionally elevated. Within the first half of 2023, the variety of mega bankruptcies already matched the full-year whole for 2022 of 16 and surpassed the 2005–2022 half-year common of 11. The biggest chapter was filed by SVB Monetary Group, with $19.68 billion in property on the time of submitting. The biggest non-financial-firm chapter submitting was by Mattress Bathtub & Past Inc., with $4.40 billion in property on the time of submitting. Six mega bankruptcies have been filed by corporations within the Providers business.

Lending for personal consumption is getting dearer additionally. This week, the common 30-year mortgage price rose to the very best level reached because the yr 2000.

These elements all level towards a bubble that’s within the technique of popping. The scenario is unsustainable, but the Fed can not change course with out reigniting a brand new surge in value inflation.

Though some skilled economists insist that price inflation has all however disappeared, the sentiment on the bottom is clearly one wherein most employees believe their wages are not keeping up with rising prices.

Any surge in costs could be particularly problematic given the rising value of dwelling. Atypical People face the same drawback with dwelling costs. Based on the Atlanta Fed, the housing affordability index is now the worst it’s been since 2006, within the midst of the Housing Bubble.

If the Fed reverses course now, and embraces a brand new flood of recent cash, costs will solely spiral upward. It did not need to be this fashion, however strange individuals are actually paying the value for a decade of simple cash cheered by Wall Avenue and Washington.

The one option to put the economic system on a extra secure long-term path is for the Fed to cease pumping new cash into the economic system. Which means a falling cash provide and popping financial bubbles.

But it surely additionally lays the groundwork for a actual economic system – i.e., an economic system not constructed on infinite bubbles – constructed by saving and funding fairly than spending made potential by artificially low rates of interest and simple cash.

Disclosure: No positions

Editor’s Notice: The abstract bullets for this text have been chosen by In search of Alpha editors.