Crypto information: It hasn’t been week for the US Securities and Trade Fee (SEC), who had been challenged in how they interpret US securities legal guidelines. The company additionally affirmed that it couldn’t contact PulseChain founder Richard Coronary heart to serve discover of its July enforcement.

This week, BeInCrypto’s technical analyst Valdrin Tahiri famous six bullish candlesticks for Bitcoin (BTC) in October. Recommendation from buyers and merchants factors to notable crypto progress within the coming months, and we begin with one of the crucial polarizing of all of them: Jim Cramer, the host of CNBC’s Mad Cash.

Cramer Goes Mad for Bitcoin

On Sunday, Cramer flipped bullish on Bitcoin after beforehand saying all the cash that could possibly be made in Bitcoin had been made. The transfer confounded buyers, a few of whom recommended adopting an anti-Cramer technique.

However crypto consultants cautioned that there was no motive to promote Bitcoin but. BeInCrypto’s Ali Martinez predicted vital resistances at $38,440 and $47,360, whereas others see Bitcoin rising above $41,000. BTC has damaged the primary resistance degree and is presently buying and selling at $38,440.

Learn extra: How To Purchase Bitcoin (BTC) and Every thing You Want To Know

Raoul Pal Says Crypto Will Beat Tech

Outstanding investor Raoul Pal agreed considerably, believing crypto will beat tech shares in 2024. He stated this in a Twitter thread he posted on Monday.

“Utilizing our GMI Monetary Situations Index, we are able to peer 11 months into the longer term, suggesting a robust 12 months in 2024. That is the place the expansion property of NDX and Crypto dwell. This is the reason they bottomed at first else…”

Researcher and analyst Vetle Lund stated open curiosity for lengthy Bitcoin positions is at an all-time excessive. The excessive premium between Bitcoin and futures contracts is a bullish indicator for Bitcoin.

Bitcoin’s Bullish Candlesticks

Talking of bullish predictions, BeInCrypto’s technical analyst Valdrin Tahiri famous how swiftly Bitcoin had risen in October. It reached an annual excessive of $38,437 that month.

On the best way to this excessive, Bitcoin created six consecutive bullish candlesticks. The final time this occurred was when the earlier bull cycle was beginning, round October 2020.

Nonetheless, Bitcoin can nonetheless drop 6% to its subsequent help degree of $35,000, Tahiri famous, in response to Elliot Wave Principle. The tactic makes use of long-term value patterns and investor psychology to find out a pattern’s route.

Hoskinson Critiques SEC Crypto Check

There have not often been boring moments throughout SEC chairman Gary Gensler’s warfare on crypto. This week, nevertheless, the company turned the implied object of Cardano co-founder Charles Hoskinson’s wrath.

Hoskinson slammed the inconsistent software of US securities legal guidelines. ADA isn’t anymore a safety than Bitcoin, given the best context, Hoskinson stated.

Crypto lawyer John Deaton agreed, saying an asset’s use is extra essential when testing whether or not it could be a safety. In response to the Howey Check, Bitcoin’s preliminary sale by Satoshi Nakamoto was doubtless an unregistered securities providing.

Because of this, it’s not sufficient to contemplate the asset solely when deciding whether or not it’s a safety. The circumstances that outline a sale have to be factored into the judgment, quite than the opinions of so-called Bitcoin maximalists.

Learn extra: What Is Bitcoin? A Information to the Authentic Cryptocurrency

SEC Fails to Discover Pulse of Richard Coronary heart

The SEC encountered extra issues after being unable to substantiate whether or not PulseChain founder Richard Coronary heart acquired its July lawsuit. The company accused Coronary heart of elevating $1 billion via an unregistered securities providing.

Coronary heart reportedly lives in Finland, making reaching him tough for the SEC. He allegedly supplied buyers as much as a 38% annual return for locking up tokens for an prolonged interval.

Learn extra: What Is a Rug Pull? A Information to the Web3 Rip-off

Terra Firma or Not Simply But?

Over 18 months after it collapsed, the Terra Traditional blockchain confirmed indicators of life. On Nov. 22, the blockchain recorded nearly double the every day common transaction rely in October. The variety of tokens staked additionally elevated to fifteen% of the provision two days later. Terra Luna (LUNC) additionally recorded a 60% value enhance within the month.

Learn extra: What Is Terra (LUNA)?

However time will inform whether or not these numbers are a false constructive or the beginning of a pattern. Sustained progress in community use will likely be wanted to make Terra Traditional a severe contender within the crowded blockchain area.

Crypto – Socially Talking

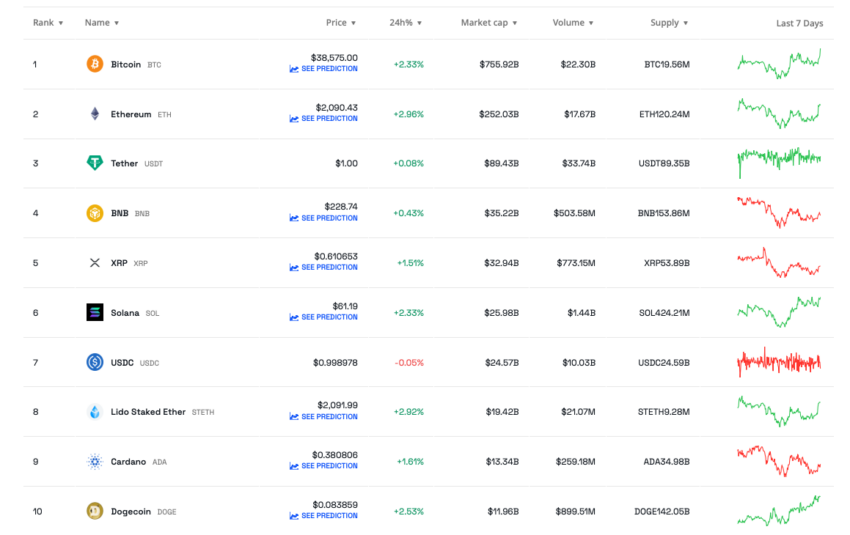

Prime 10 Cryptos’ Performances This Week

Do you’ve got one thing to say in regards to the largest crypto information this week, or the rest? Please write to us or be part of the dialogue on our Telegram channel. You may as well catch us on TikTok, Facebook, or X (Twitter).

Disclaimer

All the data contained on our web site is revealed in good religion and for common info functions solely. Any motion the reader takes upon the data discovered on our web site is strictly at their very own danger.