TennesseePhotographer

Whereas the restaurant {industry} group has had a tough few months, few names have suffered as badly as Cracker Barrel Previous Nation Retailer (NASDAQ:CBRL), which is now down 28% year-to-date and over 60% from its highs reached in 2018. This underperformance may be attributed to lackluster gross sales efficiency and continued margin compression, with working margins sinking by over 400 foundation factors since 2017 and the corporate seeing industry-lagging unit development with simply ~11% development previously six years regardless of the acquisition of Maple Avenue. Sadly, the corporate’s FY2023 outcomes weren’t significantly better, and with earnings taking one other dive on a year-over-year foundation, the corporate’s payout ratio has spiked above 90%, up from ~55% in FY2017.

Though this does not imply {that a} dividend minimize is imminent, it actually places a query mark across the dividend if the corporate cannot flip issues round quickly. In the meantime, though some buyers may need hoped for a greater begin to its fiscal yr, industry-wide visitors isn’t offering any assist, with informal eating visitors sinking once more in September to its worst ranges year-to-date, with an additional deceleration on a month-to-month foundation. That is in step with Cracker Barrel flagging a tender begin to 2024 (quarter beginning July twenty ninth) in its year-end outcomes, suggesting little reprieve from what’s been a disappointing trailing-twelve-month visitors development for the corporate. Let us take a look at the latest outcomes and developments under:

Cracker Barrel Menu – Firm Web site

Current Outcomes & Q1 2024 Outlook

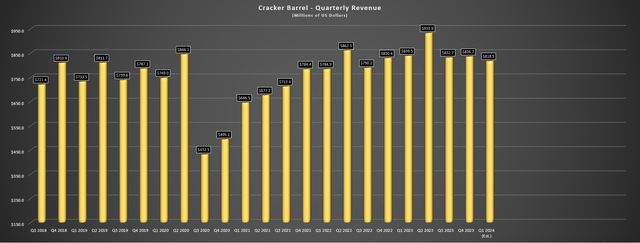

Cracker Barrel launched its fiscal This autumn and FY2023 outcomes final month, reporting quarterly income of $836.7 million, a 1% enhance year-over-year that was under expectations in accordance with the corporate. These outcomes have been extra disappointing provided that the corporate was operating with excessive single digit menu pricing within the interval which implied a pointy decline in visitors, and the corporate reported comp restaurant gross sales development of simply 2.4% within the interval whereas comparable retail gross sales development sunk 6.8%. On a two-year stacked foundation, this resulted in 8.5% and [-] 3.8% comp gross sales for its restaurant and retail section, respectively, which isn’t all that inspiring. Cracker Barrel famous that its softness confirmed up in all cohorts, and that its over 65 age group that seems to be extra even handed on the place they spend with worth in thoughts noticed extra softness than its youthful cohort.

CBRL – Quarterly Income – Firm Filings, Creator’s Chart

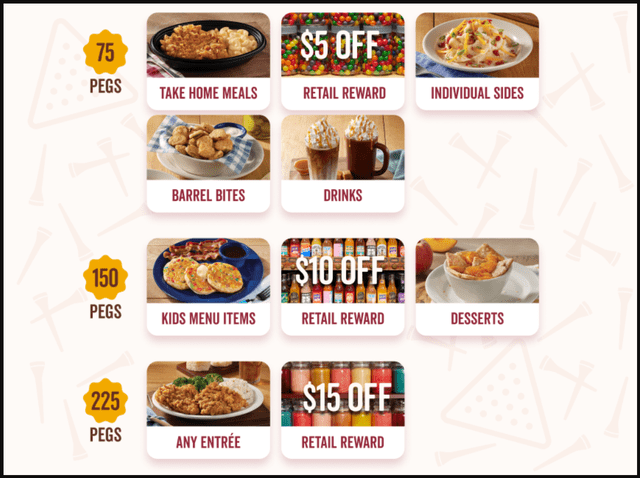

Whereas the corporate is trying to enhance visitors with a brand new Rewards Program that it believes “has the potential to be the very best and most enjoyable within the {industry}”, it’s coming from behind with a number of different manufacturers having a multi-year head begin on their Rewards Packages. And whereas this system will award pegs ($1 per peg) for every greenback spent to redeem for meals, retail gadgets, and appetizers/desserts that would assist drive gross sales for its youthful cohort, it is early to say whether or not this can resonate as a lot with its extra worth aware 65+ cohort which may be getting priced out of informal eating a bit after three years of above common menu worth will increase. Making issues worse, the atmosphere has change into extra promotional, with Cracker Barrel’s worth proposition shining much less when others are leaning into worth as nicely to drive gross sales.

CBRL Reward Program – Firm Web site

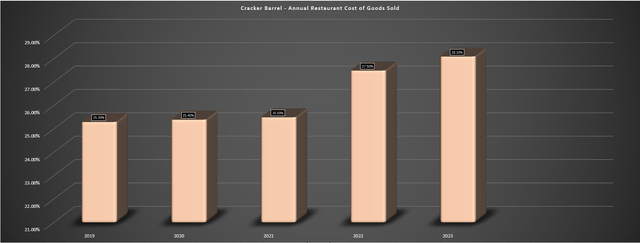

Lastly, from a margin and earnings standpoint, there wasn’t a lot to jot down dwelling about both. It is because annual EPS sunk to $5.47 vs. $6.09 regardless of continued share repurchases on account of increased curiosity expense, increased G&A, and better impairment/retailer closing prices, whereas restaurant value of products offered rising by 60 foundation factors to twenty-eight.1%, rising for the fourth consecutive yr in a row. And whereas the corporate was in a position to maintain the road on labor on a full yr foundation, G&A was up as a proportion of gross sales, with working earnings sinking but once more. Luckily, Cracker Barrel was capable of finding $30 million in value financial savings and push its catering enterprise above $100 million for the yr, and is assured it has extra value financial savings within the pipeline this yr to assist to claw again some margin losses. On a constructive word, the corporate is guiding for commodity deflation which is able to assist to offset the 4.5% wage inflation forecasted within the upcoming quarter.

Trade-Large Traits

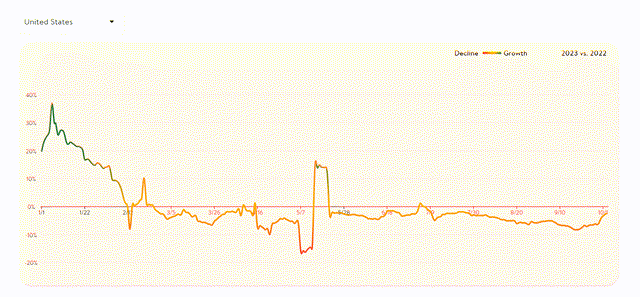

Whereas calendar yr 2023 has been a troublesome yr from a visitors standpoint for many segments of the restaurant {industry}, issues haven’t improved, at the least in accordance with OpenTable information which measures seated diners in the USA. The truth is, as proven under, January noticed robust visitors development year-over-year after lapping Omicron, and there have been temporary spikes into double-digit constructive territory in February and Might, however since Might, seated diner development has struggled to even return to constructive territory. Worse, we will see it decelerated by means of calendar yr Q3, suggesting that the softness in early fiscal Q1 2024 that Cracker Barrel was experiencing would not appear to have improved. Given this softness, it appears like Cracker Barrel may battle to ship above its steerage midpoint of $825 million in fiscal Q1 2024, and this already implied a 2% from the ~$840 million reported final yr.

Seated Diners 12 months-over-12 months – OpenTable

Nonetheless, there are two issues to be constructive about within the upcoming yr. For starters, Cracker Barrel has a brand new President & CEO in Julie Felss Masino that may start subsequent month, with expertise at Yum! Manufacturers (YUM) with Taco Bell (Worldwide President & North America), Starbucks China (SBUX) as Chief Advertising Officer, and VP World Beverage and World Merchandise at Starbucks. Lastly, she additionally served as SVP, President & GM of Fisher Value at Mattel (MAT). This appears like a really strong appointment given the intensive restaurant and retail expertise at main manufacturers, and infrequently new management is required to spur a profitable turnaround, and this might assist to hammer out a backside within the inventory.

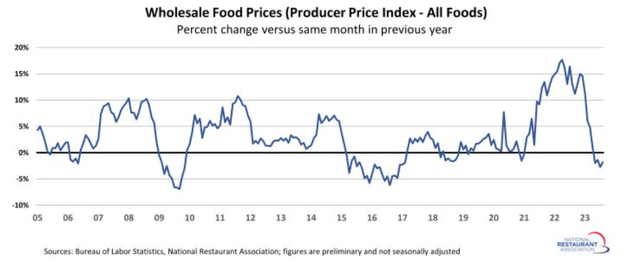

Wholesale Meals Costs – Nationwide Restaurant Affiliation, BLS

The second constructive improvement is that though the {industry} is getting little assist from a labor value standpoint (albeit turnover is at the least bettering), the restaurant {industry} has seen a major enchancment in commodity costs which have dipped into damaging territory on a year-over-year foundation. This can be a big enchancment from the double-digit commodity inflation that put a dent in margins final yr, and several other manufacturers are forecasting low single-digit commodity inflation or commodity deflation within the again half of CY23. So, whereas Cracker Barrel has seen a gradual rise in value of products offered for its restaurant enterprise, this minor tailwind coupled with continued work on value financial savings ought to assist to stabilize after what’s been a troublesome few years of margin softness. Let’s examine whether or not that is priced into the inventory but:

Cracker Barrel – Annual Restaurant COGS – Firm Filings, Creator’s Chart

Valuation

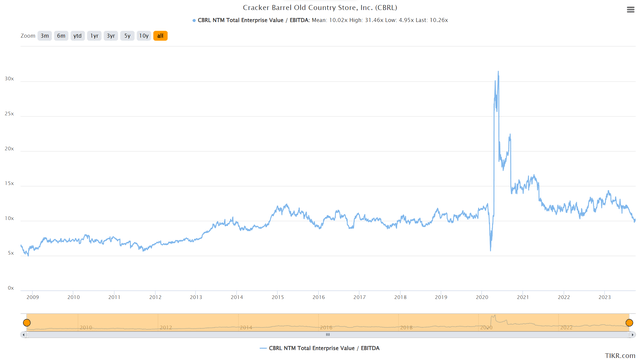

Based mostly on ~22.2 million shares and a share worth of $68.00, Cracker Barrel trades at a market cap of ~$1.51 billion and an enterprise worth of ~$2.65 billion. This can be a vital departure from Cracker Barrel’s peak market cap of ~$4.4 billion in 2018, and the relative efficiency in comparison with friends has been extraordinarily disappointing even when accounting for the industry-leading dividend yield. Sadly, though the inventory is down over 55% from its highs, it is onerous to argue for the inventory being considerably undervalued. It is because even after this violent decline, it is nonetheless buying and selling at ~17.5x FY2024 free money movement estimates on an enterprise worth foundation, and over 10.0x EV/EBITDA. And whereas these aren’t costly metrics by any means, I would not take into account them as overly enticing for a low-growth that is seeing constant margin compression, and one which’s struggled to keep up earnings energy regardless of aggressive buybacks.

Cracker Barrel – Historic A number of (EV/EBITDA) – TIKR.com

Worse, whereas the corporate has plowed vital capital into buybacks over the previous two years to melt the decline in annual earnings per share [EPS], the worth at which this capital has been deployed has been lower than optimum, with ~350,000 shares repurchased close to its highs in FY2021, one other ~1.25 million shares repurchased at ~$105.00, and ~171,800 ounces shares repurchased above $101.00 per share final yr. And whereas this has helped to shrink the float by neatly 10%, the corporate may have accomplished a way more impactful job of retiring shares if it have been extra affected person and waited for a close to double-digit free money movement yield to place cash to work. Clearly, this would possibly seem to be arguing from the advantage of hindsight, however I feel within the present atmosphere, being extra even handed with buybacks would have made extra sense.

So, what’s a good worth for the inventory?

Utilizing what I imagine to be a extra conservative a number of of 10.5x EV/EBITDA estimates of ~$260 million in FY2024, I see a good worth for Cracker Barrel of ~$1.63 billion after subtracting out internet debt. This interprets to a good worth of $74.10 when dividing by ~22 million shares, suggesting that Cracker Barrel remains to be not all that undervalued underneath extra conservative assumptions regardless of its sharp decline. Clearly, some buyers might disagree with this assumption and argue that truthful worth sits a lot increased. Nonetheless, for a low-growth restaurant chain within the present market atmosphere (~4.6% risk-free charge), I feel this a number of would possibly truly be beneficiant, proven by the inventory’s long-term chart with its common a number of coming in simply over 10.0x.

Measuring from a present share worth of $68.00, this factors to a 9% upside from present ranges or a ~16% complete return when together with its industry-leading dividend yield of ~7.6%. Nonetheless, I feel it is tough to completely rule out a dividend minimize when the corporate is paying out over 90% to shareholders primarily based on FY2024 estimates. Apart from, I’m in search of a minimal 25% low cost to truthful worth for small-cap shares to make sure a margin of security, and after making use of this low cost, CBRL’s supreme purchase zone is available in at $55.50 or decrease. So, though the reward/danger for the inventory has actually improved following its ~55% correction, I nonetheless do not see an satisfactory margin of security at present ranges, and it is onerous to rule out a closing leg down within the inventory over the following 12 months.

Abstract

Cracker Barrel has been one of many worst-performing restaurant shares over the previous two years and whereas it’s got extra fascinating from a technical standpoint because it nears main assist within the $51.00 to $56.00 area, I nonetheless do not see sufficient of a margin of security at present ranges. And with a lot higher-growth names (~5% unit development and excessive single-digit comp gross sales development) buying and selling at extra enticing free money movement yields like Aritzia (OTCPK:ATZAF), I proceed to see extra enticing bets elsewhere available in the market. That mentioned, the reward/danger setup is lastly bettering for CBRL with it being extra hated, so I might take into account the inventory from a swing-trading standpoint if we have been to see a pullback under $57.00 earlier than December.