Sundry Images

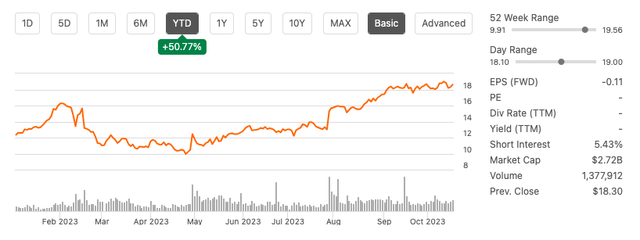

The fast-evolving world of expertise is working in favor of on-line training companies like Coursera, Inc. (NYSE:COUR). It’s because there’s a rising demand for studying new expertise or enhancing current ones, which is driving the expansion of Coursera’s on-line training companies. Though the corporate’s inventory worth dropped by 65% since its preliminary public providing (IPO) in 2021, it has proven vital enchancment this 12 months, with a year-to-date return of fifty.77%. This turnaround may be attributed to the increasing awareness of AI among the many common public.

Inventory pattern 12 months to this point (In search of Alpha)

The corporate is benefiting from the rising recognition of micro-credentials, the shift to digital greater training, and worldwide development alternatives. Nonetheless, I beforehand prompt a “maintain” score because of declining profitability, powerful competitors, and financial uncertainties. Whereas the corporate has adjusted its 2023 forecast, it nonetheless expects unfavorable earnings. Regardless of spectacular income development, it lags behind its friends when it comes to development and revenue margins. Whereas I see development potential, the inventory is buying and selling close to its goal value, and investing in a but unprofitable firm carries danger. Thus, I nonetheless suggest a “maintain” place.

Firm updates

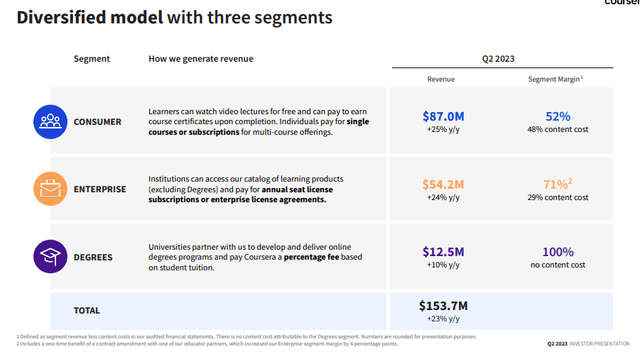

In my earlier article, I supplied an outline of the corporate. The corporate’s enterprise mannequin revolves round attracting learners by way of free choices after which encouraging them to discover numerous paid choices. Its income is derived from three major segments, and within the final quarter, all of them skilled double-digit development. Within the shopper phase, there was a notable addition of 5.7 million new registered learners in the course of the quarter, bringing the overall to 129 million. Moreover, the overall variety of paid enterprise clients elevated by 35% year-on-year, reaching 1,291. The depend of diploma college students additionally rose to 19,068.

Diversified mannequin development (Investor presentation 2023)

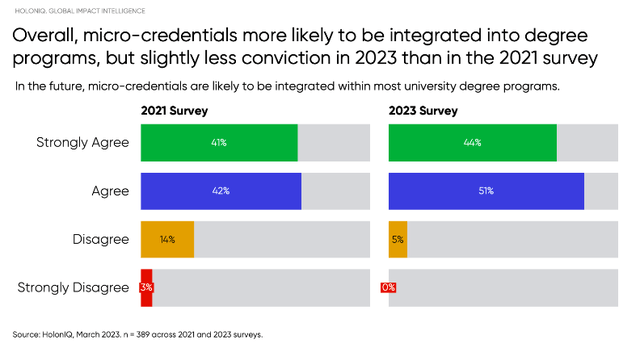

The corporate has skilled substantial income development, with a 41% compound annual development fee (CAGR) from 2017 to 2022. Administration’s projections point out a 19% CAGR of their whole addressable market, estimated at $309 billion by 2026. A number of vital development drivers are contributing to the corporate’s success. Firstly, there may be rising recognition of micro-credentials and a rising perception that these credentials are or will likely be built-in into diploma applications.

Micro-credit integration (Holoniq.com)

Secondly, the continued digital transformation inside greater training is proving advantageous for on-line training companies because it fosters partnerships and collaborations. Coursera, as an illustration, presents skilled certificates applications developed in collaboration with business leaders reminiscent of Google and IBM. These applications, together with new job coaching initiatives in partnership with Microsoft, are in excessive demand, particularly for job-related expertise. Thirdly, the corporate is capitalising on a rising variety of worldwide alternatives. Presently, nearly all of its learners are located outdoors of the US. Fourthly, the position of AI in training and upskilling is in its early phases however holds vital promise. AI can personalise and improve the educational expertise, making it a optimistic improvement and alternative for Coursera.

Upcoming earnings

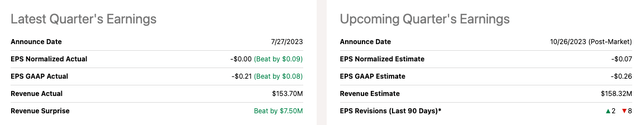

Coursera has beat EPS expectations for the final 4 consecutive quarters, though EPS stays unfavorable. Coursera will release its Q3 2023 Earnings report on Thursday, October 26, 2023.

Upcoming quarterly outcomes (In search of Alpha)

For Q3, the corporate anticipates income within the vary of $156 million to $160 million and an adjusted EBITDA loss between $9 million and $14 million. Waiting for FY2023, the corporate’s revised outlook expects income to fall throughout the vary of $617 million to $623 million, indicating an roughly 18% development on the midpoint of this vary. Notably, the full-year income outlook has elevated by $20 million for the reason that begin of the 12 months and by $15 million for the reason that earlier quarter. This displays the corporate’s elevated confidence in sustained demand throughout the shopper phase. As for adjusted EBITDA, the corporate foresees a loss starting from $19 million to $24 million, similar to a unfavorable 3.5% adjusted EBITDA margin on the midpoint of the income and EBITDA steerage ranges.

Steadiness sheet and money circulate

In Q2 2023, Coursera maintained a powerful monetary place with $717 million in whole money and no debt. Its trailing twelve-month (TTM) free money circulate was optimistic at $11.5 million, a considerable improve from the earlier 12 months’s $3.2 million. After we look at the liquidity ratios, we discover a present ratio of two.94 and a fast ratio of two.78, each of which point out the corporate’s means to comfortably cowl its short-term obligations. Furthermore, buyers can take confidence in the truth that the corporate has initiated a share repurchase program, with $54.5 million value of shares purchased again in Q2 2023.

Valuation

Coursera has garnered optimistic suggestions from numerous analysts, together with a Purchase score from BMO, primarily attributed to the increasing training market. Wall Road analysts have additionally assigned it a Purchase score with a rating of 4.2. Nonetheless, buyers ought to train warning because the inventory is at the moment buying and selling near its common value goal of $19.46. It is noteworthy that the corporate has not reported earnings, and its web losses have been rising for 4 consecutive monetary years. In a comparative evaluation with a few of its on-line training friends reminiscent of Udemy (UDMY), Arco Platform (ARCE), and Duolingo (DUOL), Coursera stands out with the best price-to-sales ratio amongst firms which have but to realize optimistic earnings, registering at 4.67.

Relative peer valuation (In search of Alpha)

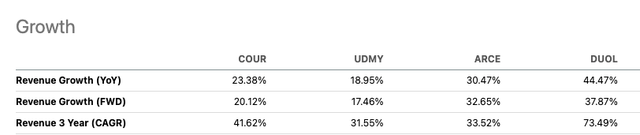

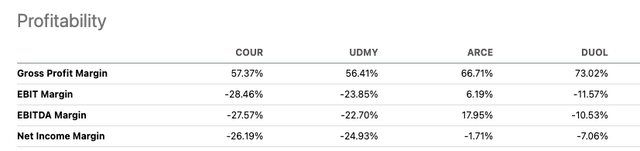

Moreover, once we look at the corporate’s year-on-year (YoY) development, it stands at 23.38%, which is considerably slower compared to Arco, reporting 30.47%, and Duolingo, which reported a powerful YoY development of 44.47%. If we flip our consideration to the gross revenue margin, it is famous at 57.37%, falling under that of all its friends, excluding Udemy, which stands at 56.41%. Furthermore, the EBITDA margin, at a unfavorable 27.57%, lags behind its friends on this regard.

Income development versus friends (In search of Alpha)

Profitability versus friends (In search of Alpha)

Dangers

Investing in Coursera entails a number of dangers. Firstly, the corporate’s persistent lack of sustained profitability is a monetary concern, marked by rising losses over the previous 4 years. Secondly, Coursera’s partnerships with universities, firms, and establishments are important to its success. Any deterioration in these relationships or the lack of key companions might have opposed penalties. Moreover, the fiercely aggressive nature of the web training sector presents a big danger, as Coursera competes with quite a few well-established and rising gamers. Lastly, Coursera, as a web based training platform, manages a considerable quantity of consumer knowledge. Potential knowledge breaches or privateness points might end in authorized and reputational challenges.

Closing ideas

Coursera’s income development and enhanced FY 2023 forecast are noteworthy. Nonetheless, the corporate’s persistent unprofitability, marked by rising losses over the previous 4 years, is a priority. Though it advantages from surging worldwide pupil enrollment, a rising urge for food for on-line upskilling, and elevated recognition from conventional academic establishments, its adjusted 2023 forecast nonetheless factors to unfavorable earnings. Coursera additionally falls behind business friends when it comes to development and revenue margins. Given its inventory’s proximity to the goal value and the inherent dangers of investing in an unprofitable entity, due to this fact I keep a “maintain” place.