- Bitcoin has fallen 22.5% from its peak, with present minor beneficial properties inadequate for restoration.

- Current futures market knowledge suggests a bearish sentiment, probably setting the stage for future bullish developments.

Over the previous weeks, Bitcoin [BTC] has recorded a big plunge in its worth, dropping by 22.5% from its all-time excessive above $73,000 in March.

Though the asset has struggled to make a rebound this week following the ‘Pink Monday’ it has not been sufficient. Presently, BTC is up by 0.6% up to now 24 hours nonetheless, the asset remains to be down by 11% on the 7-day chart.

Futures market sentiment

ShayanBTC, an analyst from CryptoQuant, shared insights on the Quicktake platform highlighting the affect of perpetual markets and long-squeeze occasions on Bitcoin’s value.

In keeping with Shayan, the important thing driver behind Bitcoin’s latest value drop could possibly be attributed to elevated promoting exercise inside these markets. This was additional evidenced by the sharp drop in funding charges, a significant indicator of market sentiment.

Funding charges have just lately turned adverse, signaling a bearish sentiment dominated by quick sellers. This shift means that the futures market is cooling down, probably setting the stage for a extra secure bullish development sooner or later.

Shayan significantly famous:

“The funding charges have now turned adverse, reflecting an total bearish sentiment and the dominance of quick sellers. Nevertheless, this is also seen as a constructive signal, because it suggests the futures market is not overheated. This situation might create circumstances for a extra sustainable bullish development within the coming months, offered there aren’t any drastic adjustments.”

Bitcoin restoration on the horizon?

Regardless of the gloomy short-term outlook, there are indicators that recommend a possible path to restoration.

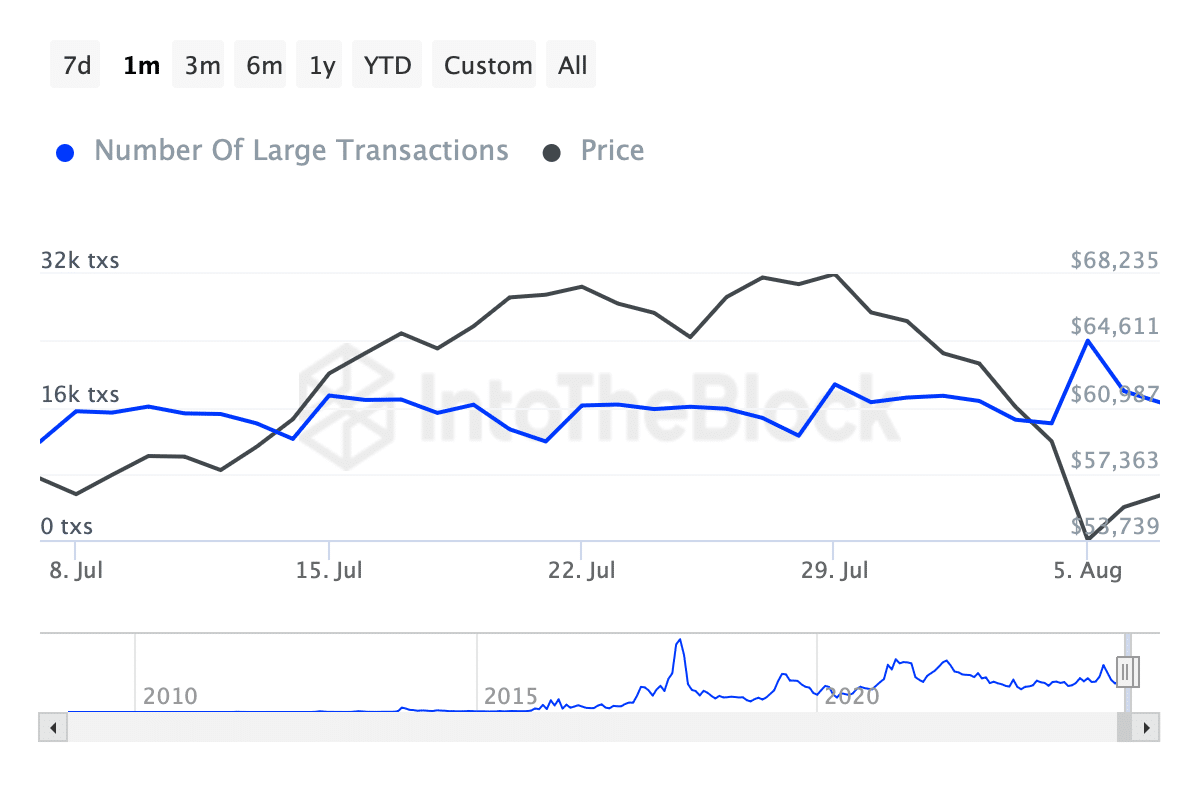

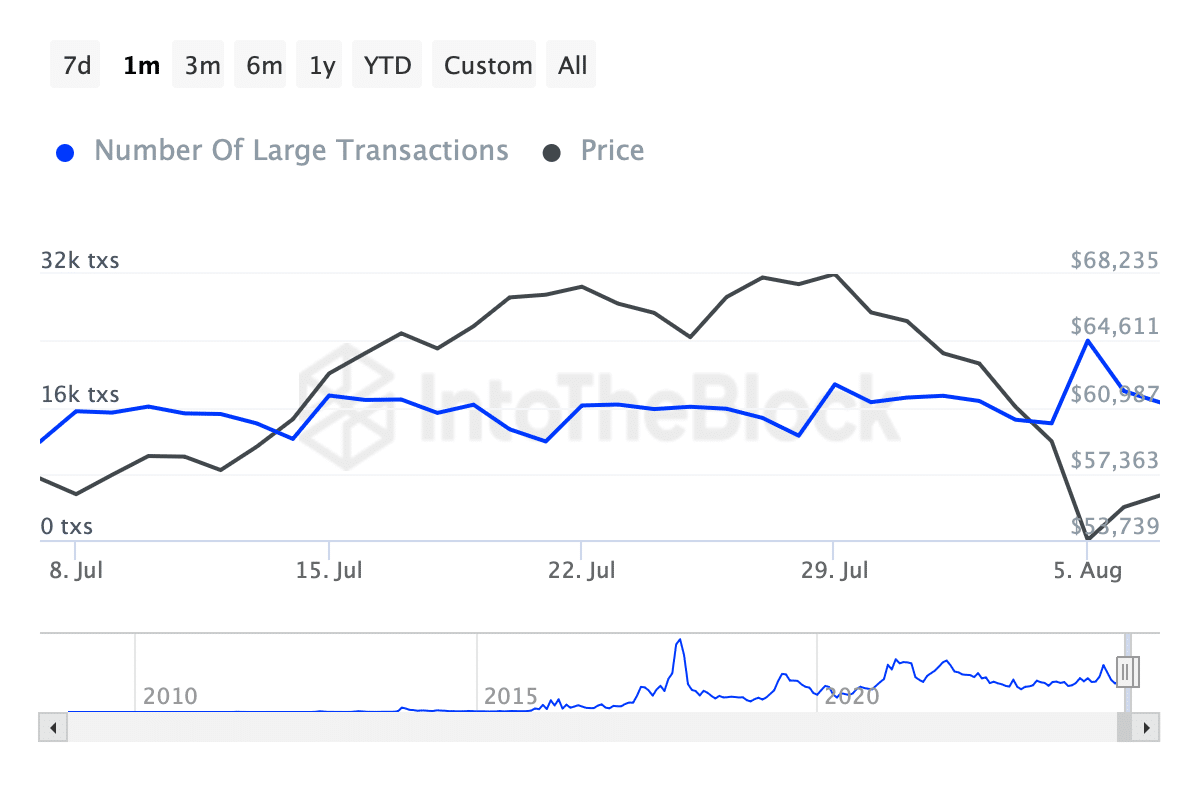

Data from IntoTheBlock reveals a rise in massive Bitcoin transactions (exceeding $100,000), which spiked from beneath 16,000 to over 23,000 transactions on fifth August, earlier than settling at round 16,560 at present.

Supply: IntoTheBlock

This fluctuation in whale exercise might signify renewed curiosity from massive buyers, presumably hinting at a strategic accumulation of belongings at decrease costs.

Is your portfolio inexperienced? Take a look at the BTC Revenue Calculator

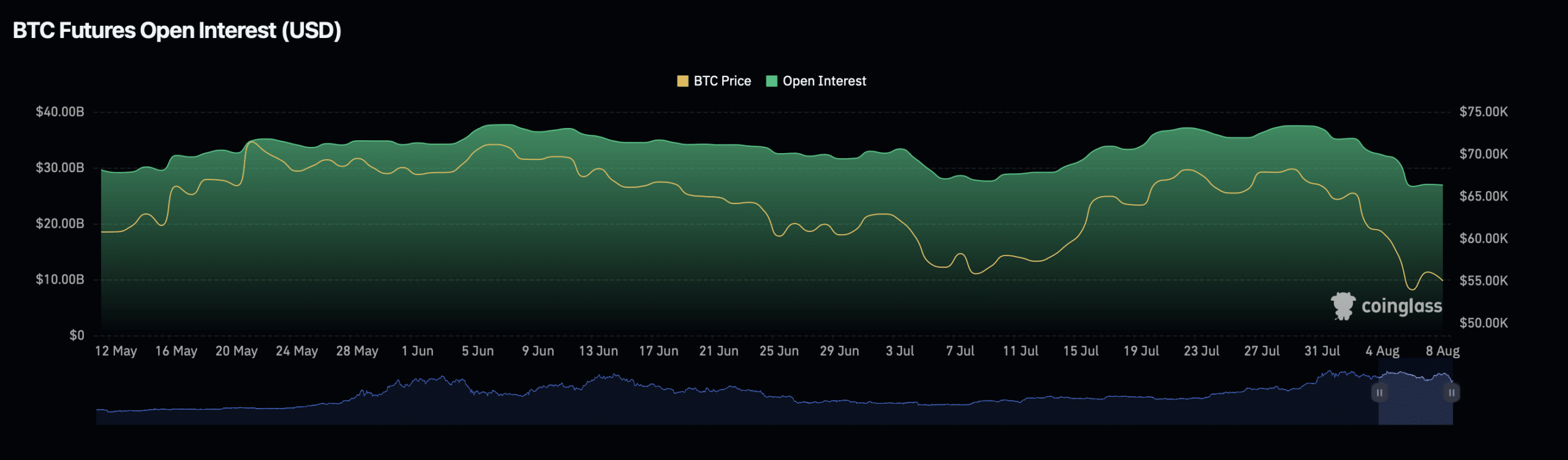

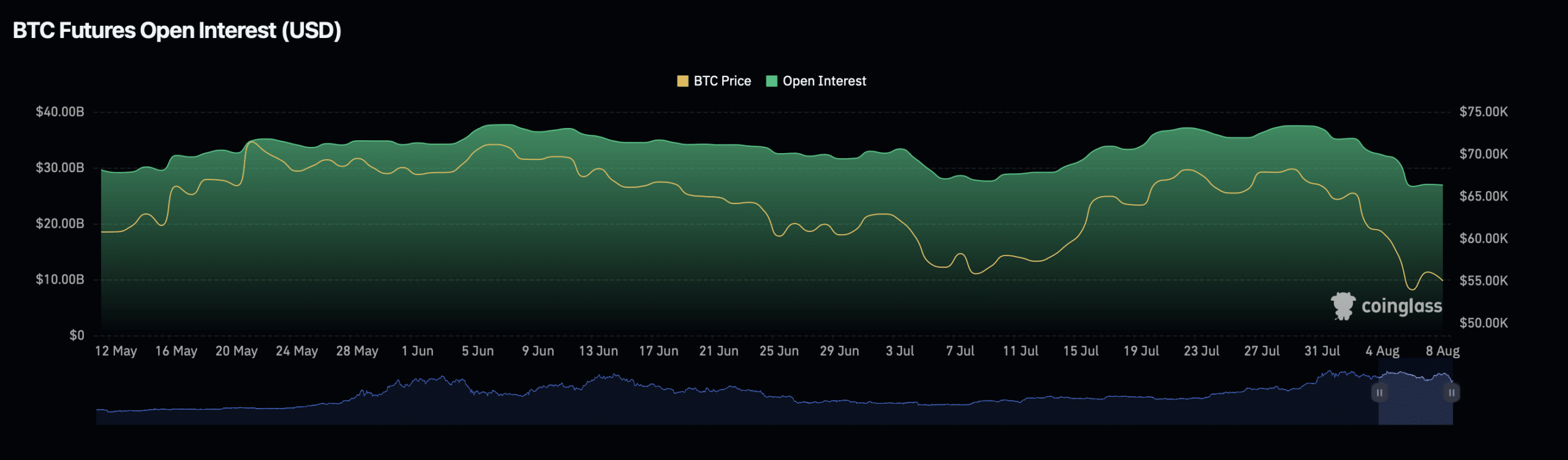

Moreover, Bitcoin’s open curiosity has seen a slight decline of 0.2% up to now day, totaling roughly $27.56 billion. This coincides with a 7% drop in open curiosity quantity, which now stands at $76.14 billion.

Supply: Coinglass

These shifts in open curiosity metrics might point out a cooling off of leveraged positions, presumably decreasing the danger of additional lengthy squeezes and contributing to market stabilization.