- Analyst identifies a Bull-Flag sample suggesting Bitcoin may quickly reverse its June downtrend.

- MVRV ratio and trade stablecoin ratio present key insights into Bitcoin’s market situations.

Bitcoin [BTC], the flagship cryptocurrency, has proven indicators of a possible reversal from its latest downtrend, sparking discussions amongst market analysts and buyers alike.

After a difficult month that noticed costs dip as little as $58,000 earlier this week, Bitcoin has made a modest restoration, buying and selling at round $61,516, on the time of writing.

This restoration features a temporary surge above the $62,000 mark earlier at this time, signaling to some specialists {that a} extra important breakout might be on the horizon.

Notable market analyst Rekt Capital has gone as far as to recommend that the continued downtrend that characterised June would possibly quickly come to an finish, spurred by rising patterns in Bitcoin’s every day buying and selling information.

Bitcoin bull-flag emergence

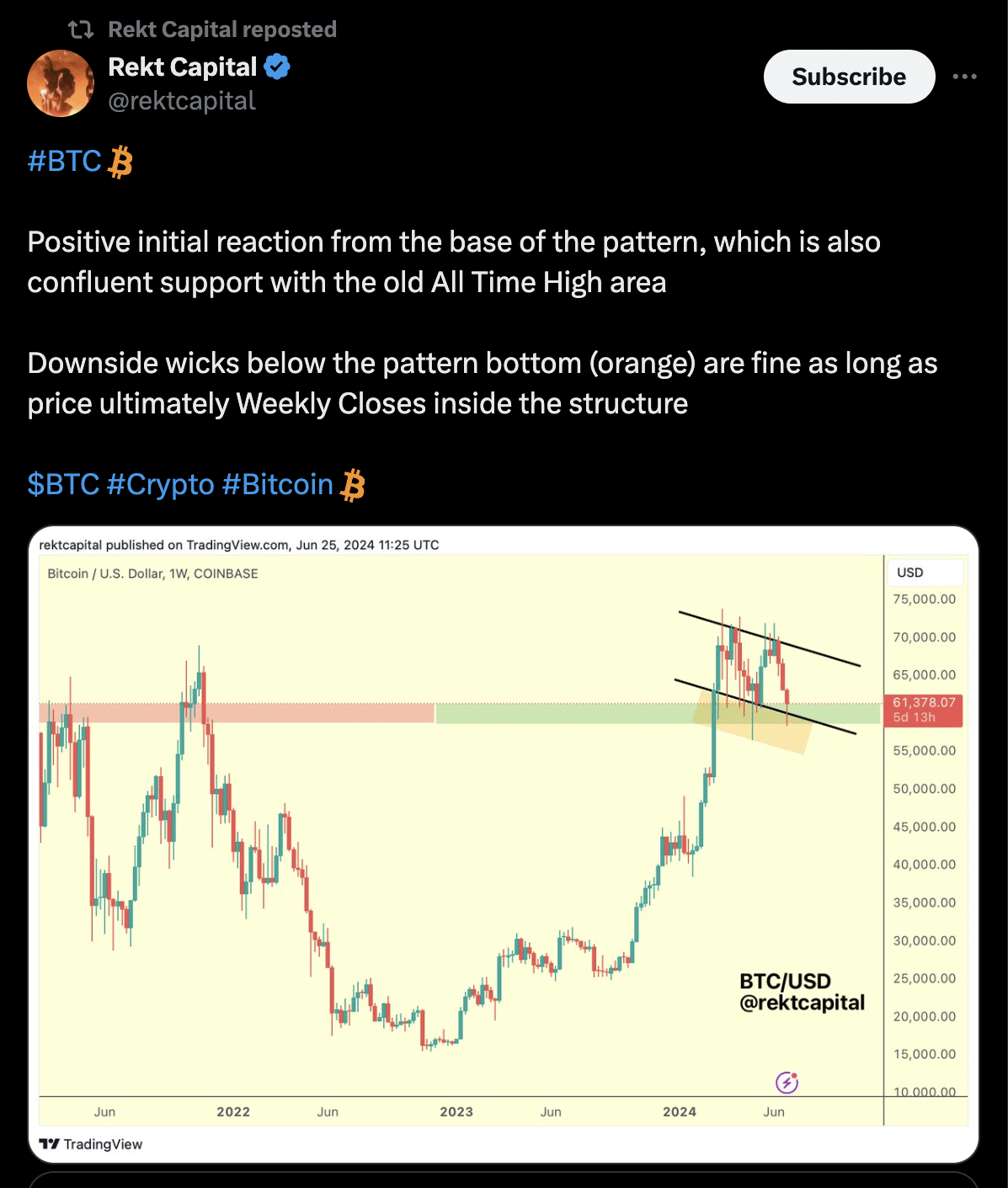

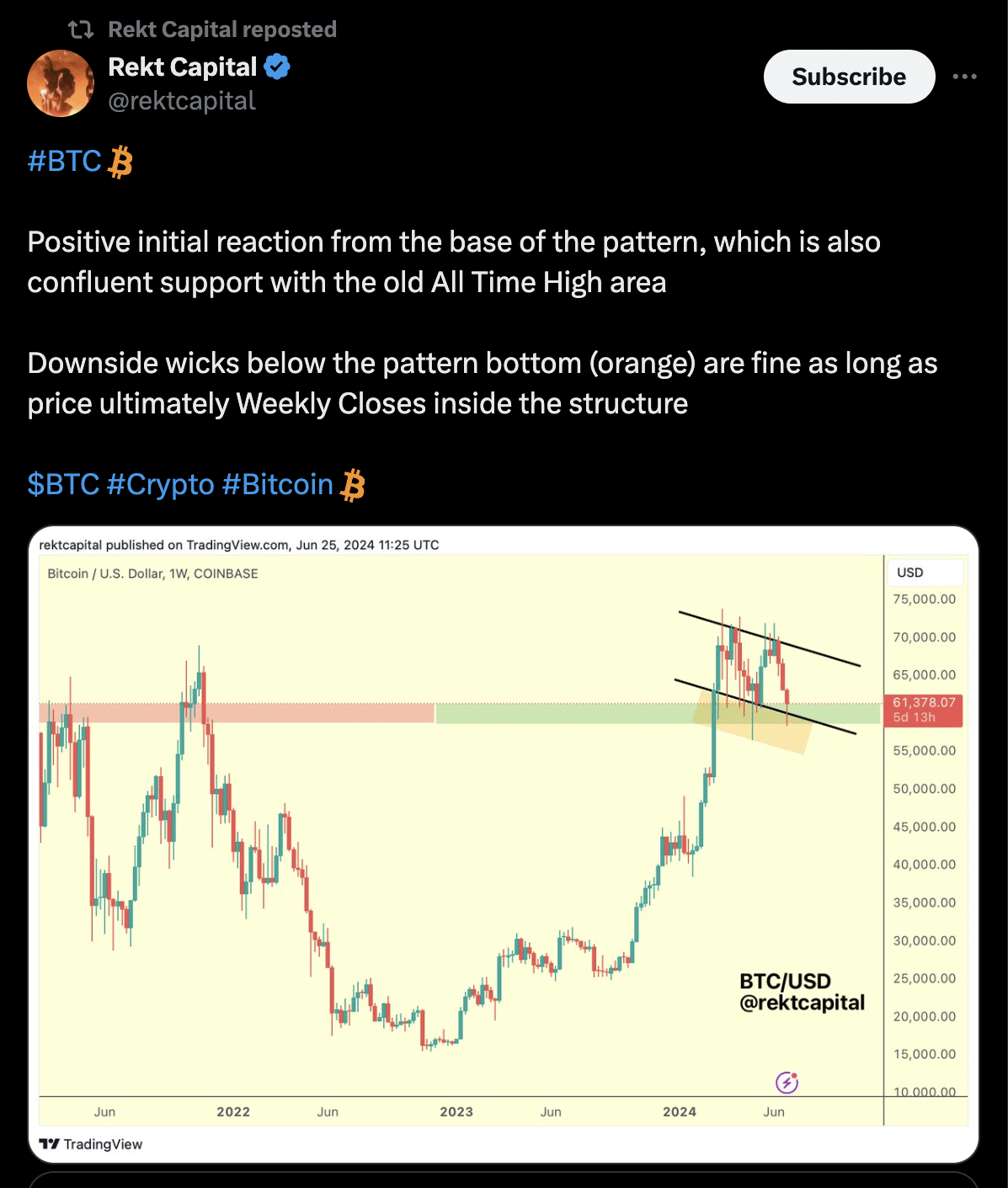

Rekt Capital points to the formation of what seems to be an early-stage Bull-Flag sample within the every day worth charts. This sample, if totally realized, may point out that Bitcoin is gearing as much as problem and probably escape from the downtrend it has been experiencing.

Such technical formations are carefully watched by merchants for indicators that the present worth motion would possibly translate into a serious transfer upward.

Rekt Capital famous,

“Let’s see if this present worth motion on the Every day continues to type this small, early-stage Bull Flag,”

Moreover, Rekt Capital has not too long ago disclosed that the latest retracement in Bitcoin’s worth is approaching the frequent 22% correction noticed all through varied market cycles. This adjustment is initially met with constructive responses that correlate with help ranges beforehand seen at all-time highs.

Rekt Capital stresses the significance of Bitcoin’s worth closing above the sample’s decrease boundary on weekly charts to maintain this important help degree, though temporary dips under are thought-about tolerable.

Supply: RektCapital

Are there indicators of a bullish breakout?

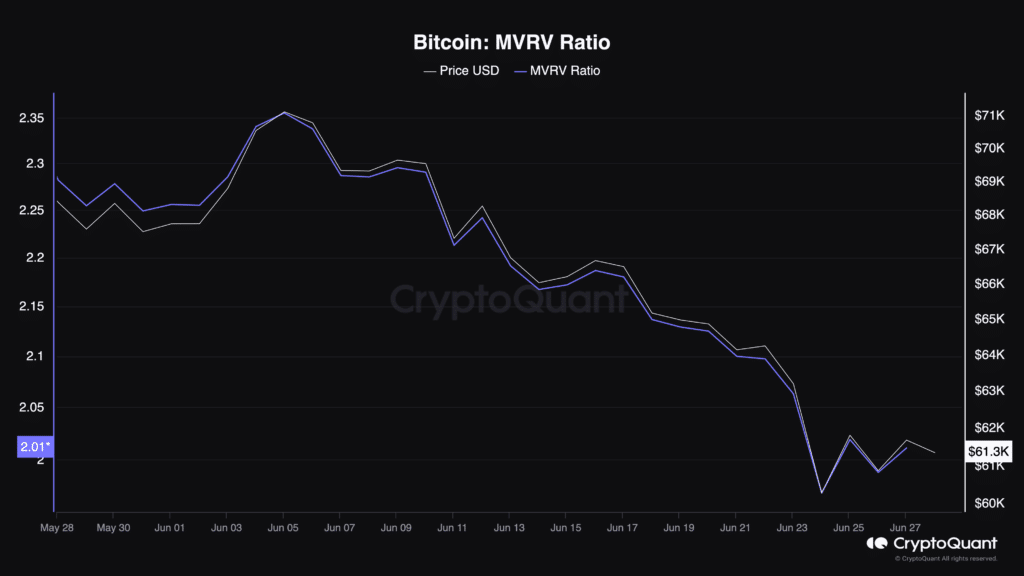

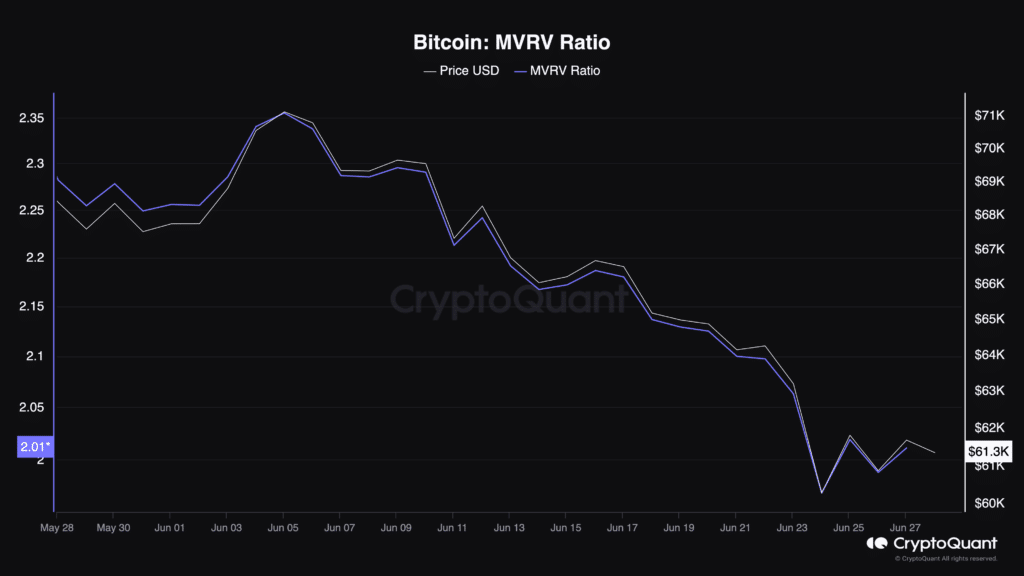

Regardless of the optimistic technical evaluation from Rekt Capital, it’s essential to contemplate Bitcoin’s core market indicators to grasp whether or not the crypto is certainly poised for a bullish breakout. One such indicator is the MVRV ratio, which at present stands at 2.01.

Supply: CryptoQuant

The Market Worth to Realized Worth (MVRV) ratio compares the market cap of Bitcoin to its realized cap, offering insights into whether or not the asset is undervalued or overvalued in comparison with its historic worth norms.

A ratio above 2.0 usually means that Bitcoin is in a zone the place promoting strain would possibly start, as holders would possibly begin seeing earnings as engaging sufficient to liquidate a few of their holdings.

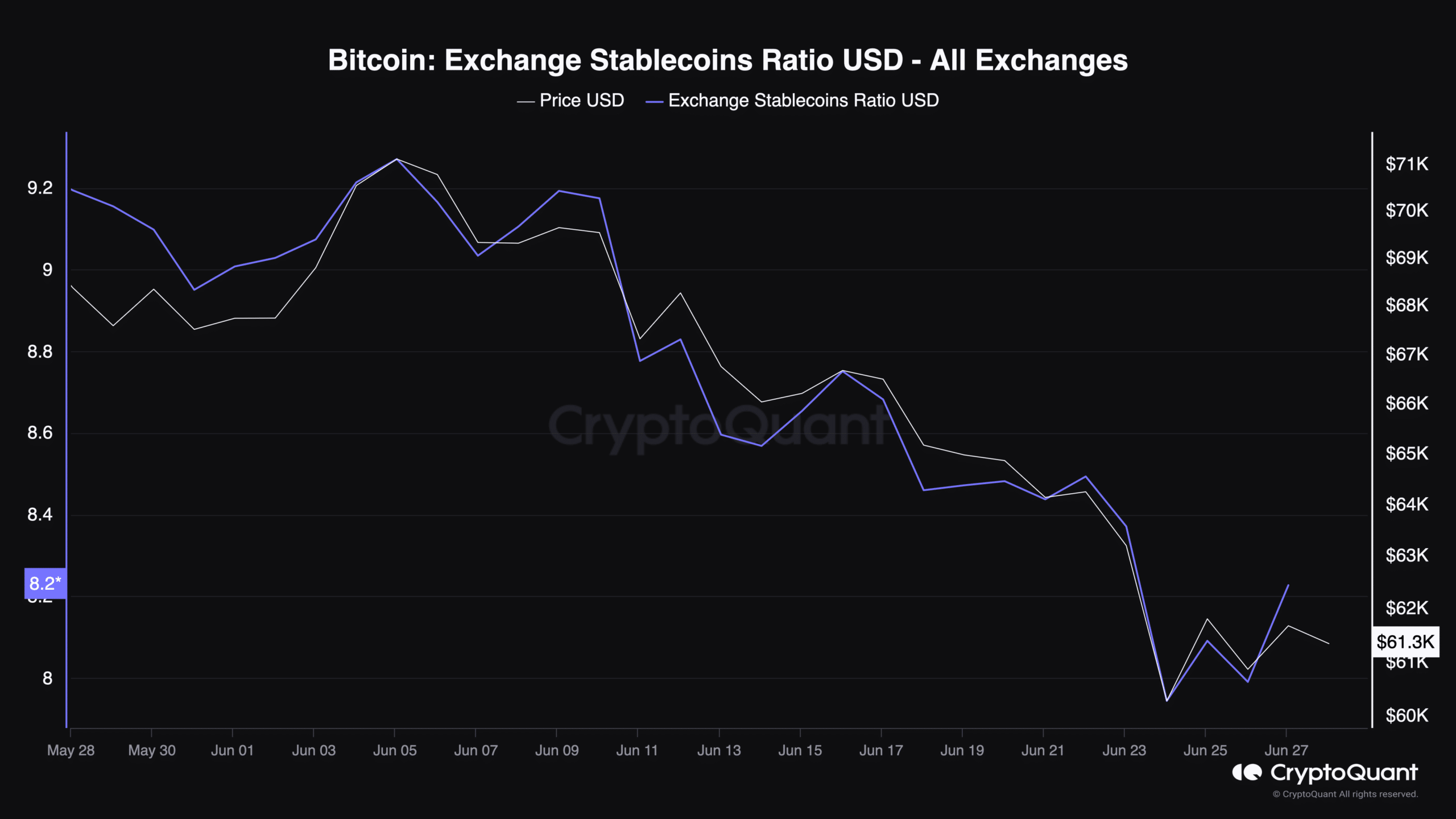

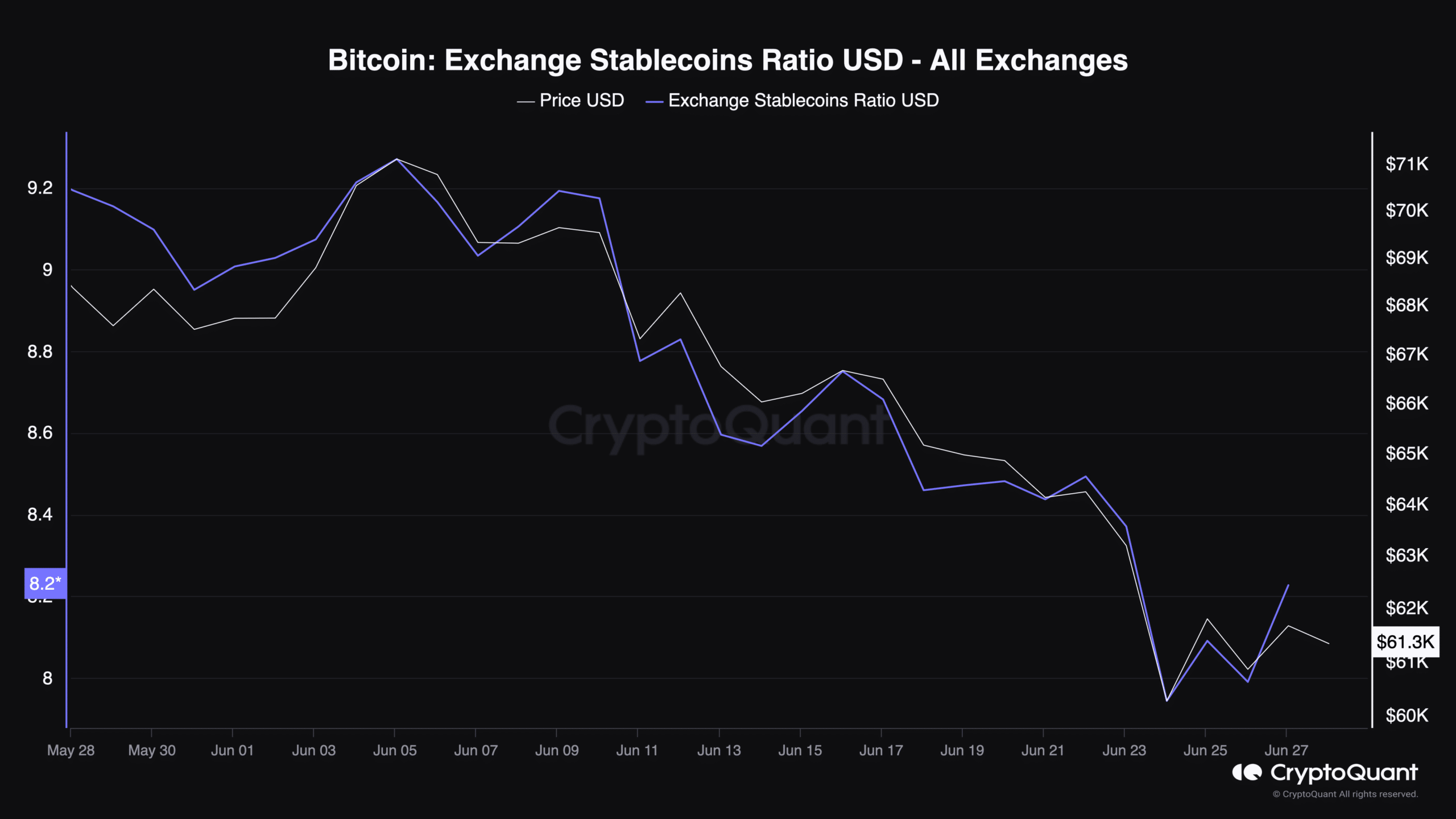

Moreover, the trade stablecoin ratio has seen a spike of two.33%, now at 8.22. This metric, which compares the overall stablecoin provide held in exchanges to Bitcoin reserves, can point out whether or not there’s potential shopping for energy to push costs increased.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

A better ratio means that merchants is perhaps poised to transform stablecoins into Bitcoin, probably driving up costs.

Supply: CryptoQuant

Nonetheless, the crypto market stays divided with different distinguished analysts like Willy Woo signaling warning, noting that Bitcoin bears are nonetheless in management, as not too long ago reported by AMBCrypto.