baona

Coterra Vitality (NYSE:CTRA) is an power exploration and manufacturing firm with a market cap that’s nearing 20 billion {dollars}.

Historical past of Coterra Vitality

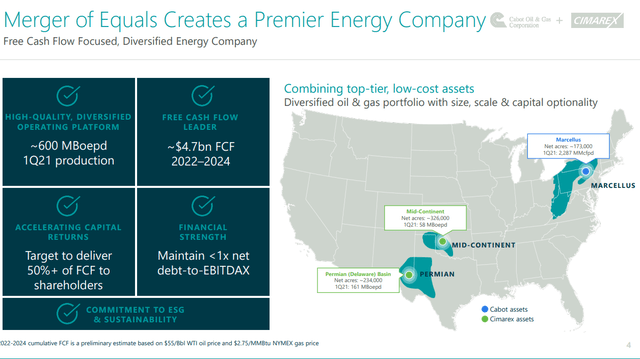

Coterra Vitality as an entity in its present state could be very younger. That is as a result of it was shaped because the “merger of equals” between Cabot Oil & Fuel and Cimarex Vitality in October 2021. Per a press release, on the time of the merger, the corporate held 700,000 internet acres of drilling stock. As with every merger, the corporate hoped to attain synergy value financial savings within the quantity of $100 million yearly.

When the merger occurred, the mixed entity traded at roughly $22 per share. As of right this moment, the corporate’s shares commerce close to $26 per share.

One of many merged firms, Cabot Oil & Fuel, traced its roots all the way in which to the early 1900s when Godfrey Cabot started a enterprise targeted on oil & pure fuel in Pennsylvania.

Cimarex Vitality additionally had a really lengthy legacy. It was based in 2002, as a by-product from Helmrich and Payne, a contract drilling firm. Nevertheless, the corporate Helmrich and Payne goes again a lot additional, having been based in 1920 by Walt Hemerich II and Invoice Payne in South Bend, Texas.

It’s price noting that on the time of the merger, Coterra Vitality held roughly 234,000 acres within the Permian basin and right this moment holds 307,000 acres. Here’s a graphic exhibiting the corporate in addition to a few of their targets over a 3 to 4 yr time horizon on the time of the merger. Let’s dig deeper to see how the corporate is performing.

Merger Between Cabot and Cimarex (Coterra Q2 Presentation)

Coterra’s Present Operations

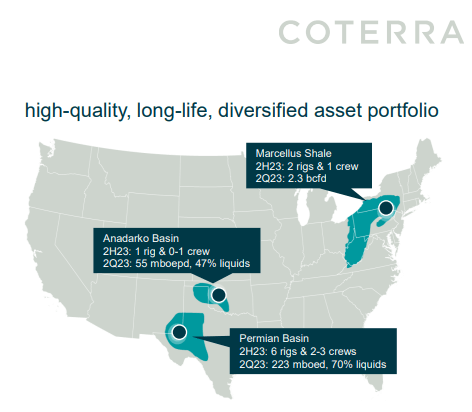

This slide exhibits the place Coterra’s present “power” is targeted. Proper now they’ve 2 rigs and 1 frac crew working within the Marcellus Shale, 1 rig and a part-time frac crew working within the Anadarko Basin, and 6 rigs and a pair of to three frac crews working within the Permian Basin. As with most firms, their major focus is extracting enticing charges of return from their Permian Basin acreage. Extra on that later.

Coterra’s Asset Places (Coterra Q2 Presentation)

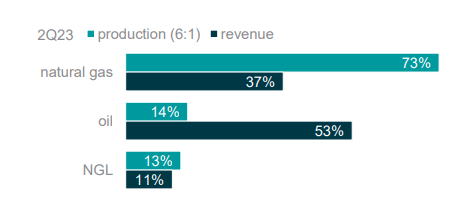

Presently, Coterra receives most of their manufacturing from pure fuel, however as a result of there’s an power differential of 6 to 1, the corporate generates extra income from its oil and ngls which primarily comes from its oil manufacturing within the Permian Basin. Some might not like an organization with such a powerful pure fuel profile, however I’ve come to view firms like Coterra, the place they make use of a diversified technique between pure fuel and oil, as a power. In reality, I’ve highlighted in a number of articles how I imagine publicity to pure fuel offers strategic upside as increasingly oil and fuel firms uncover easy methods to mine bitcoin. Successfully, they are going to be promoting their pure fuel to the bitcoin market. I focus on this idea explicitly in my article on Microstrategy, and extra conceptually on this article.

Coterra’s Manufacturing Profile (CTRA Q2 Presentation)

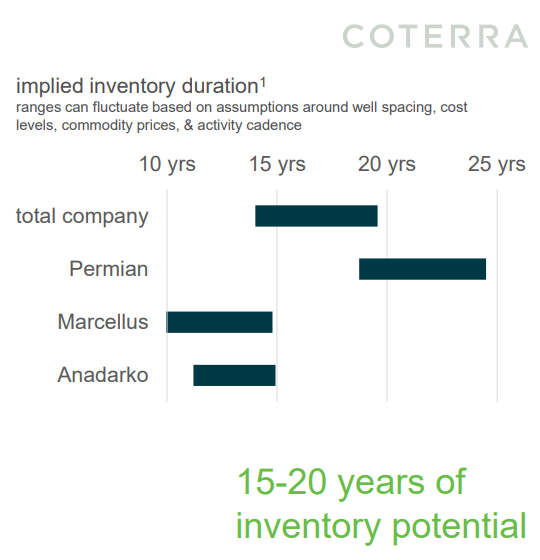

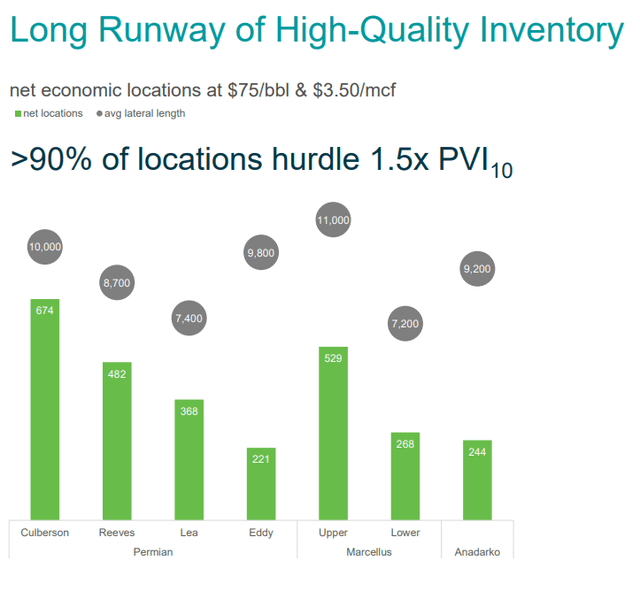

I wished to current this slide to show the very long time horizon of funding alternatives that the corporate has, particularly within the Permian Basin. For some, it will make you alarmed that in some unspecified time in the future sooner or later, they are going to run out of alternatives, however we should keep in mind the long-term nature of the oil enterprise. Corporations are at all times changing their reserves and there have been many occasions the place individuals believed we might run out of oil, just for extra oil to be found. See 1913 to 1920 or 2009. The purpose is, Coterra has a cushty stock of drilling prospects, which incorporates the premier play, the Permian.

CTRA Drilling Stock Period (CTRA Q2 Presentation)

This slide goes to point out the economics of Coterra’s drilling areas. Presently, the corporate believes that so long as oil stays above $75 per barrel, which appears extraordinarily probably, and that fuel stays above $3.50/mcf, these areas will generate a 1.5 PVI. Which means that if you happen to low cost money flows again to a gift worth, after investing capital, it ought to return a price 1.5 occasions larger than the capital invested. If that is the PVI with oil at $75 per barrel, what’s going to this appear like when oil is larger than $100 per barrel?

Economics of present drilling stock (Coterra Q2 Presentation)

Comparable Values Relative to Working Money Move on TTM Foundation

Proper now, Coterra is undervalued relative to its working money flows, when in comparison with different firms. I like utilizing working money move as a metric as a result of it offers an image of money the corporate has earlier than it reinvests the capital or returns capital to shareholders. No matter whether or not it will get reinvested or returned, that is the money move you’re “shopping for” as an investor.

Proper now, for Coterra, you’re shopping for a bigger stream of money flows relative to its share worth. Let us take a look at another metrics to see if there’s a attainable purpose for this.

| (EOG) | (COP) | (NOG) | (DVN) | (CTRA) | |

| Working CF | $13,749 | $24,589 | $1,141 | $7,097 | $5,395 |

| Market Cap($B) | $71.3 | $142.5 | $3.6 | $29.7 | $19.7 |

| MC / OCF | 5.19 | 5.79 | 3.16 | 4.18 | 3.65 |

Debt Ratios In contrast

On condition that Coterra trades at a decrease a number of in comparison with its money move from operations, I used to be curious if it had a bigger debt-to-asset ratio than its friends. Apparently, what I discovered is that it has a decrease ratio in comparison with numerous different firms I’ve written about extra lately. It even barely edged out EOG Sources.

| (EOG) | (COP) | (NOG) | (DVN) | (CTRA) | |

| Property | 41,487 | 89,605 | 3,665 | 23,355 | 19,879 |

| Liabilities | 15,230 | 42,074 | 2,249 | 12,205 | 7,212 |

| Debt-to-Property | .37 | .47 | .61 | .52 | .36 |

Web Permian Basin Acres In contrast

Amongst every of those firms, I assumed it will be attention-grabbing to see if Coterra has considerably much less acres within the Permian Basin. I assumed possibly this was why it was being discounted relative to its money flows. Nevertheless, this was not the case. Coterra reviews that it holds 307,000 internet acres within the Wolfcamp and Bonesprings performs within the larger Permian Basin. On a relative foundation, it is a excellent proportion of acres to personal in comparison with its valuation.

| (EOG) | (COP) | (NOG) | (DVN) | (CTRA) | |

| Web Acres | ~600,000 | ~600,000 | ~100,000 | ~400,000 | 307,000 |

Naturally, this does not consider every firm’s numerous property within the totally different performs, and so take this with a grain of salt. All that this says is that when you think about its Permian acres, its undervaluation might not be justified.

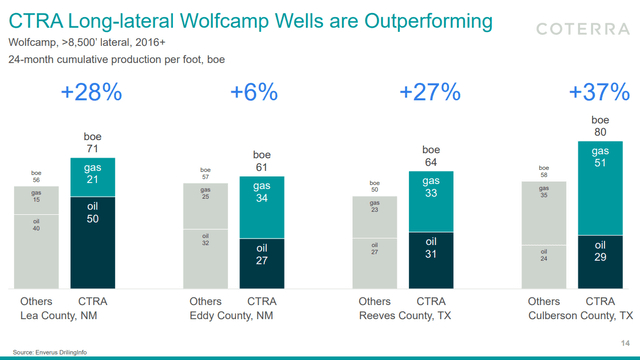

This is a slide evaluating its Wolfcamp nicely efficiency to the common nicely within the play. They’ve used a long-lateral technique to realize outperformance which I have to assume is price any further capital required for the longer-lateral.

CTRA Lengthy-Lateral Wolfcamp Technique (CTRA Q2 Presentation)

Conclusion

Coterra is positioned to revenue from their obvious capital self-discipline and powerful hydrocarbon costs within the coming years and quarters. And though I did not focus on it, the corporate can be devoted to paying a constant dividend. Because the oil and fuel trade has transitioned to horizontal drilling in shale performs, firm money flows have usually turn out to be predictable, which is why I make the declare that whereas many conventional dividend shares are slashing dividends, the oil and fuel firms are set to turn out to be generally known as constant dividend paying shares.

There are at all times dangers, however with any oil and fuel firm, and in right this moment’s setting, the biggest threat is at all times over-leverage within the face of an oil-price decline.

I fee Coterra a “Sturdy Purchase” contemplating its place within the larger Permian Basin, undervaluation relative to friends, and its robust steadiness sheet.