Jira Pliankharom/iStock through Getty Pictures

Wells Fargo argued on Tuesday that the separation between mega cap shares, which have led the inventory rally up to now in 2023, and the remainder of the inventory market will possible start to slim quickly, with macro pressures elevating the probabilities for a doable “catching down” for Wall Road’s marquee names.

“We count on latest outperformance of bigger cap names to ultimately right, as we’ve seen via historical past, both by the highest names ‘catching down’ to the typical inventory or the typical inventory catching as much as the highest names,” Wells Fargo said in an investor observe. “For the latter situation, we count on the macro atmosphere would want to enhance. With our forecast of recession on the horizon, we consider the typical inventory ought to possible proceed to wrestle.”

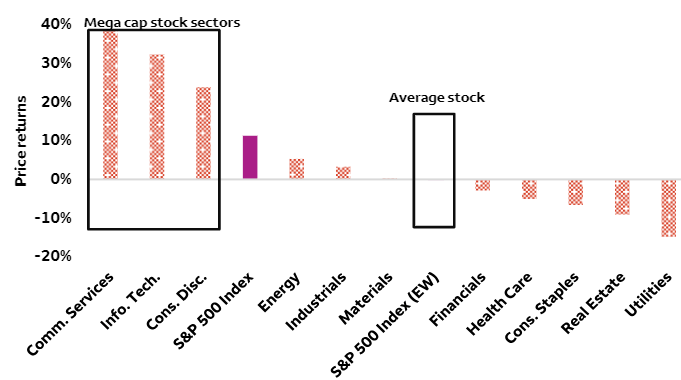

Based on Wells Fargo as of September twenty seventh 2023, 7 mega cap tech names have been driving nearly all of returns seen available in the market. These shares have popped 80.1% on common, in comparison with the standard inventory measured by the S&P 500 equal weight index, which is basically flat.

Furthermore, via the identical September twenty seventh date, Communication Providers (XLC) have superior 38.8%, whereas Data Expertise (XLK) has climbed 32.3%, and the Client Discretionary (XLY) sector is up 23.8% in comparison with the 11.3% that the S&P 500 Index (SP500) and its benchmark monitoring ETFs (NYSEARCA:SPY) (NYSEARCA:VOO) (NYSEARCA:IVV) are up by.

Concerning the ‘Magnificent 7’ names, see how they’ve fared up to now in 2023:

- Alphabet (GOOG) (GOOGL) +48.8% YTD.

- Amazon (AMZN) +45.4% YTD.

- Apple (AAPL) +37.5% YTD.

- Meta Platforms (META) +141.8% YTD.

- Microsoft (MSFT) +30.5% YTD.

- Nvidia (NVDA) +204.5% YTD.

- Tesla (TSLA) +128.1% YTD.