Justin Sullivan

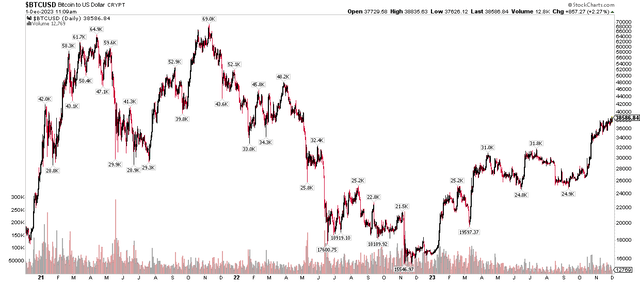

Bitcoin is again. The preferred (notorious with some buyers who purchased in on the high two years in the past) cryptocurrency is approaching $40,000 as the truth is {that a} slew of spot Bitcoin and different cryptocurrency ETFs are poised to hit the market someday in 2024. Elevated token buying and selling is assumed, by some, to be bullish for Coinbase (COIN) as curiosity renews on this traditionally risky area. A brand new ETF, centered on producing earnings, is available on the market, although.

I’ve a maintain score on the YieldMax COIN Choice Earnings Technique ETF (NYSEARCA:CONY).

Bitcoin: Recent Multi-Month Highs As Crypto Curiosity Grows Once more

StockCharts.com

In response to the issuer, CONY is an actively managed fund that seeks to generate month-to-month earnings by promoting/writing name choices on COIN. CONY pursues a method that goals to reap compelling yields whereas retaining capped participation within the worth positive factors of COIN.

CONY might be regarded as a lined name technique inside the effectivity of the ETF wrapper. The first danger with proudly owning CONY versus COIN is that if shares of Coinbase rise considerably in a brief time period – that will be a scenario whereby buyers can be referred to as away with their COIN shares had they owned the inventory outright. With the ETF, potential positive factors are capped because the Coinbase inventory will increase towards sure strike costs. What’s extra, low implied volatility may end up in much less earnings collected and paid out to COIN shareholders. Moreover, declines in COIN may end up in losses for CONY shares, too.

CONY doesn’t make investments immediately in Coinbase inventory. Slightly, it makes use of FLEX choices to duplicate publicity to a COIN lined name technique (lengthy inventory, brief upside calls). Treasuries are used as collateral inside the portfolio. In follow, the issuer buys COIN at-the-money name choices whereas promoting COIN at-the-money put choices to duplicate the efficiency of COIN inventory. These choices often expire inside six months to a yr.

To generate earnings, YieldMax sells out-of-the-money name choices expiring in a single month or much less with strike costs sometimes inside 5% to fifteen% of COIN’s inventory worth, capping potential positive factors. A brief put possibility exposes holders of the ETF to draw back danger.

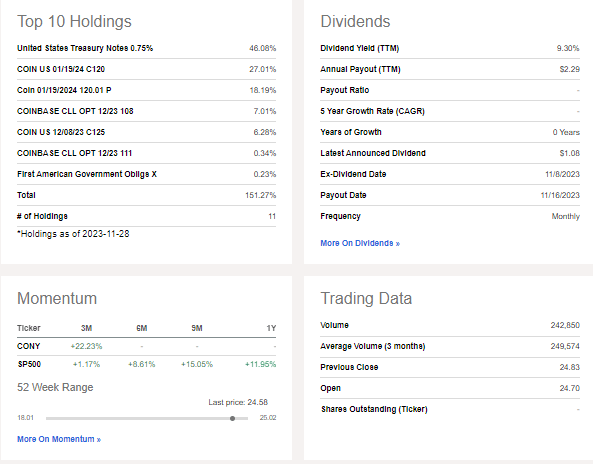

The ETF’s yield as of November 30, 2023, is 52.0% (annualized distribution fee) and 4.16% (30-day SEC yield). It is vital for buyers to think about that this yield is the results of the fund promoting name choices. YieldMax notes that the distribution fee is the annual yield an investor would obtain if essentially the most lately declared distribution, which incorporates possibility earnings, remained the identical going ahead. Alternatively, the 30-day SEC yield represents internet funding earnings (which excludes possibility earnings) earned by CONY over the newest 30-day interval, expressed as an annual share fee primarily based on such ETF’s share worth on the finish of the newest 30-day interval. Lastly, each of those yield measures shouldn’t be thought-about ensures of future earnings return.

Thus, it is primarily a trade-off between excessive earnings and capping upside potential relative to being lengthy COIN outright. In fact, a excessive earnings yield would assist CONY to outperform a protracted COIN place outright throughout pullbacks within the inventory.

Presently, the fund has $104 million in belongings beneath administration and its annual expense ratio is excessive at 0.99% whereas quantity is average at roughly 250k shares day by day, so utilizing restrict orders when buying and selling CONY is prudent.

CONY: Portfolio Positions & Dividend Data

Looking for Alpha

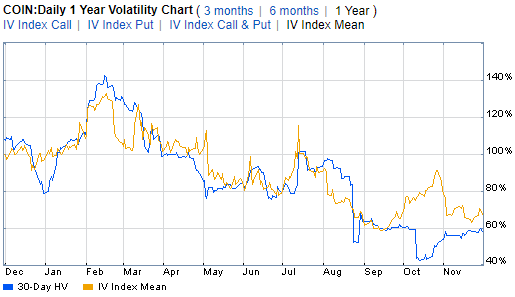

Is now time to personal CONY over COIN? I do not suppose so. Let’s element why. Discover within the chart beneath that COIN’s implied volatility share is traditionally low at 67%. Generally, you’d need to personal CONY when implied volatility is abnormally excessive so that you simply acquire extra possibility premium by way of promoting calls. With low IV at this time, there may be not as a lot to promote, merely put.

COIN: Low Implied Volatility

Constancy Investments

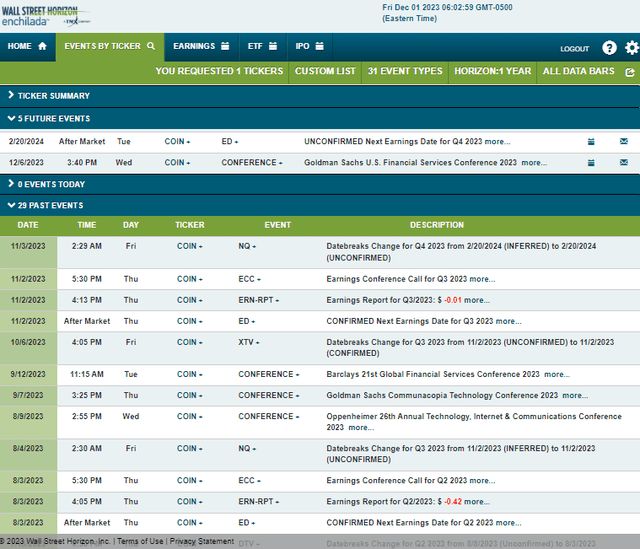

It is also vital to spotlight any volatility-inducing catalysts within the offing. In response to knowledge from Wall Avenue Horizon, Coinbase’s CFO Alesia Haas is slated to current on the Goldman Sachs U.S. Monetary Providers Convention 2023 on December 5 and 6 earlier than the corporate’s This fall 2023 earnings date of Tuesday, February 20, 2024.

Company Occasion Danger Calendar

Wall Avenue Horizon

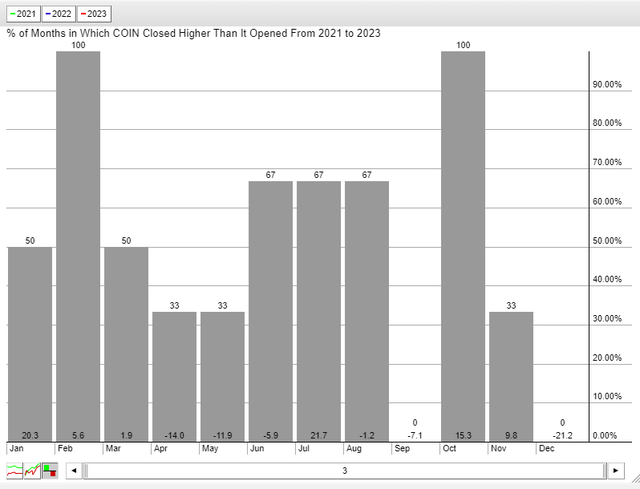

Not like long-term investments, it is key to pay very shut consideration to short-term catalysts, too. Seasonally, there may be not a lot to go off of with respect to seasonal tendencies on Coinbase shares. Nonetheless, December has been by far the inventory’s weakest month since its 2021 debut. It was down in each December 2021 and 2022, with a mean lack of greater than 20%.

COIN: 0-2 In Decembers So Far

StockCharts.com

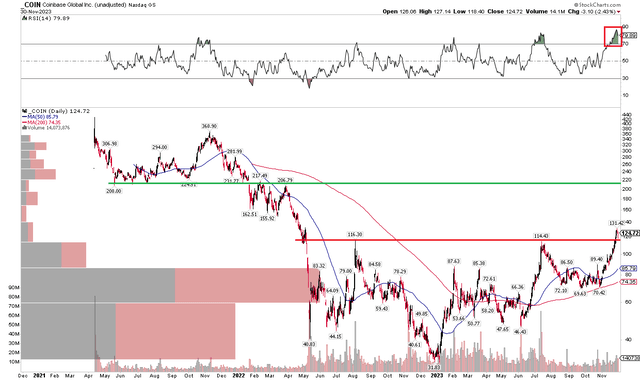

The Technical Take

Whereas there’s bearish seasonality at play with COIN proper now, worth evaluation comes earlier than making selections primarily based on the calendar. Discover within the chart beneath that the inventory broke out by means of key resistance within the mid-$110s. Shares touched above $130 lately, and I see a potential transfer as much as a earlier vital resistance mark within the $207 to $217 vary. The mid-$150s may additionally current some challenges for the bulls, however there’s a strong air pocket of sunshine quantity up about 30% from at this time’s worth in comparison with the high-volume congestion zone at $115 and beneath.

Additionally, check out the RSI momentum indicator on the high of the graph – it’s firmly in overbought territory. I usually view that as constructive – an indication of intense demand for shares. Furthermore, with a rising long-term 200-day shifting common, the bulls seem in management. So, being lengthy COIN outright over proudly owning the artificial covered-call technique ETF is the higher play at this time, for my part.

COIN: Bullish Upside Breakout, Gentle Quantity As much as $207

StockCharts.com

The Backside Line

I see a greater upside in COIN versus CONY at this time. Modest implied volatility on COIN shares, and its bullish chart, lead me to conclude that being extra aggressive by means of COIN is the higher play.