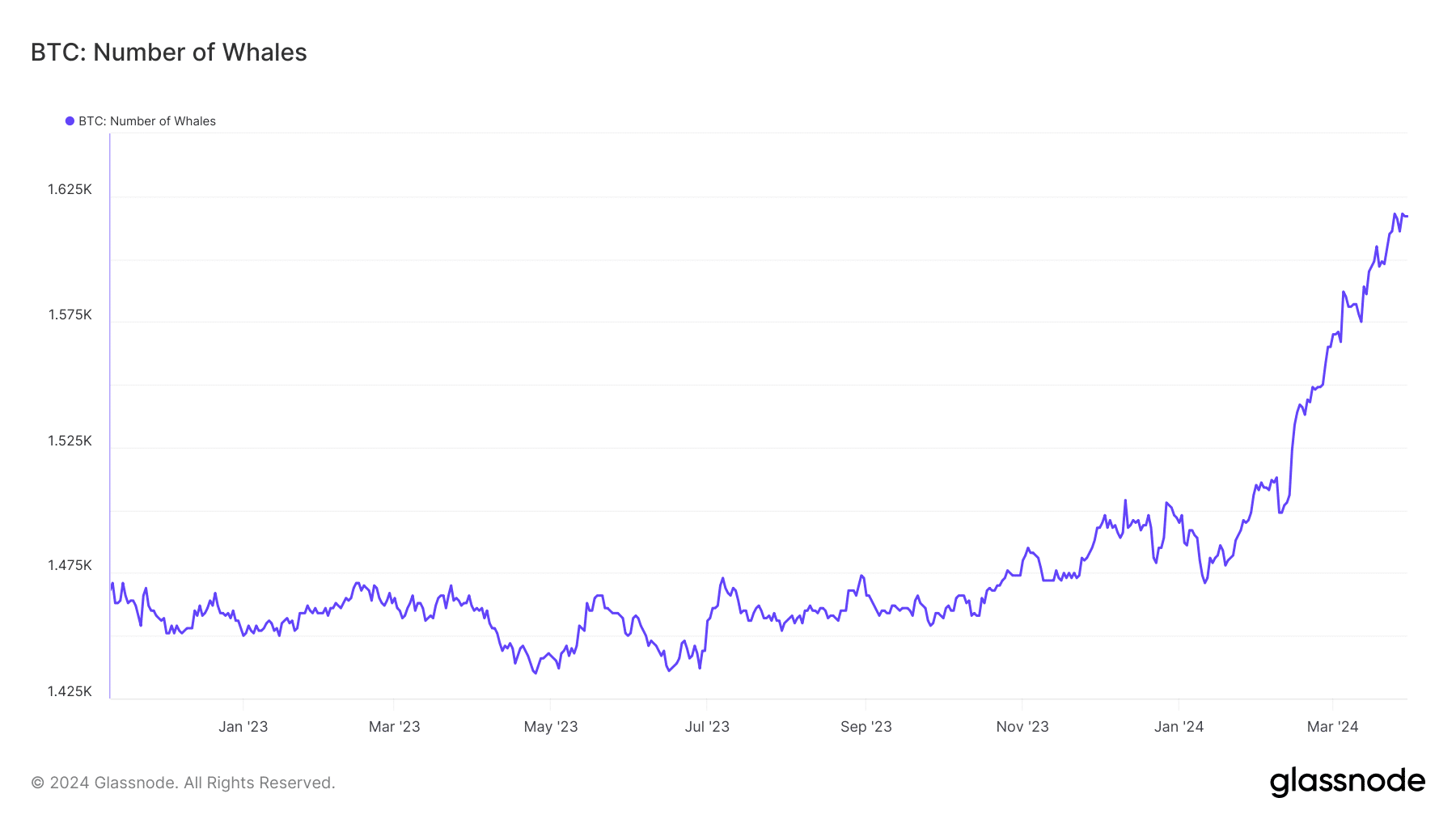

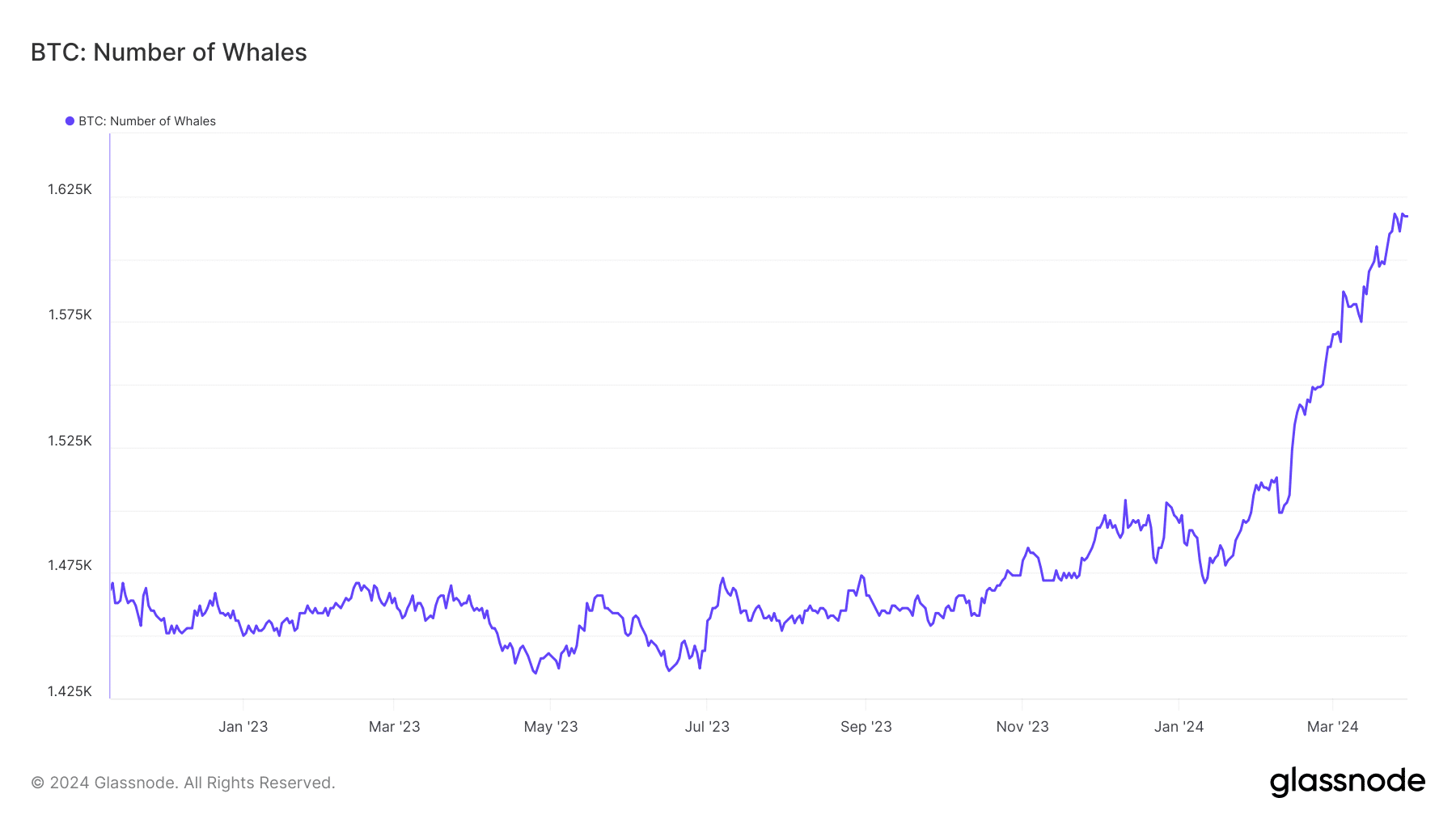

- The variety of entities having a minimum of 1k cash shot up significantly.

- The buildup banked on expectations of upper inflows into Bitcoin spot ETFs.

Bitcoin [BTC] was consolidating round previous all-time highs (ATH) as of this writing, as market contributors eagerly waited for a decisive transfer to the subsequent large goal of $75,000.

No drop in accumulation

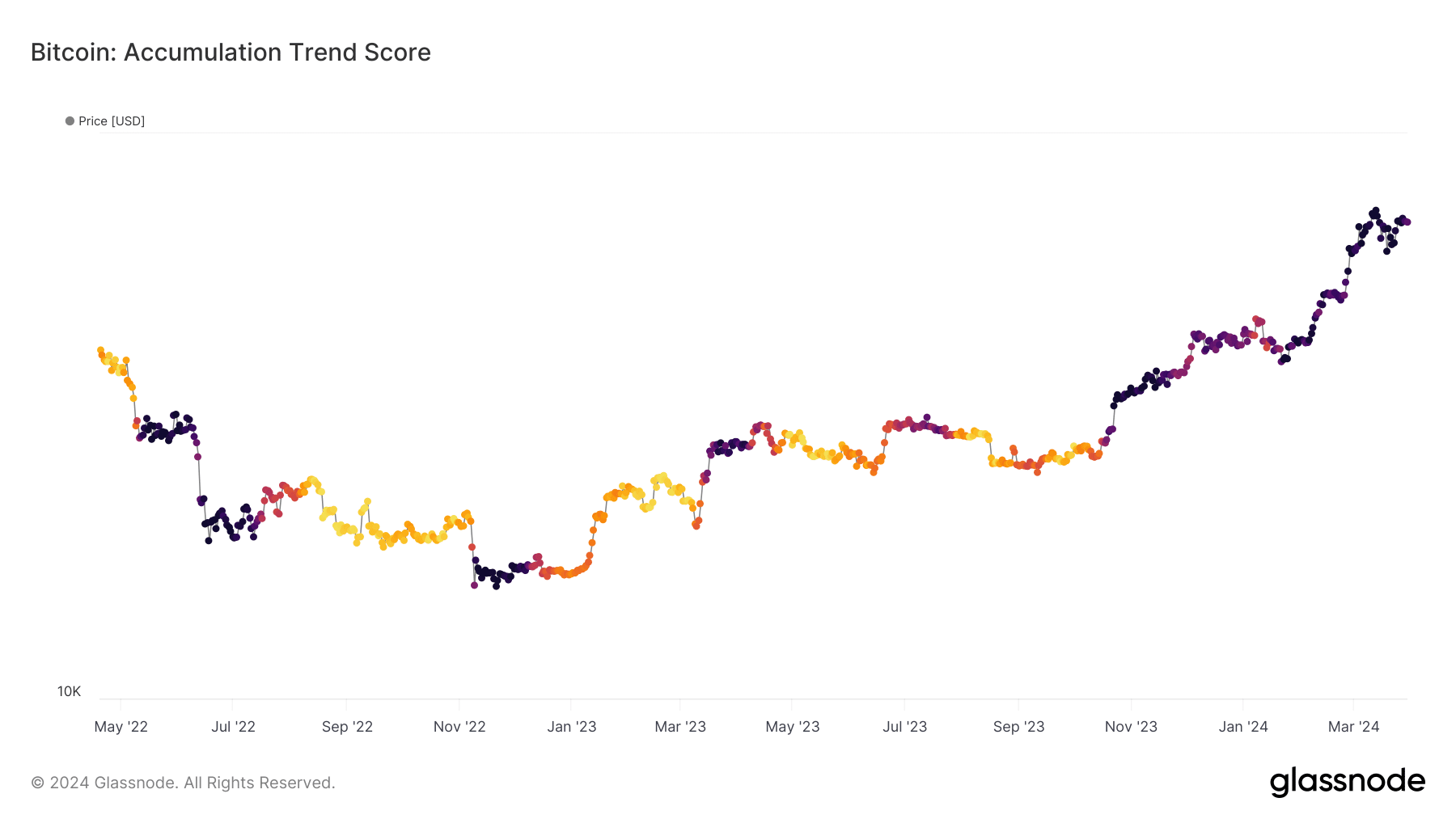

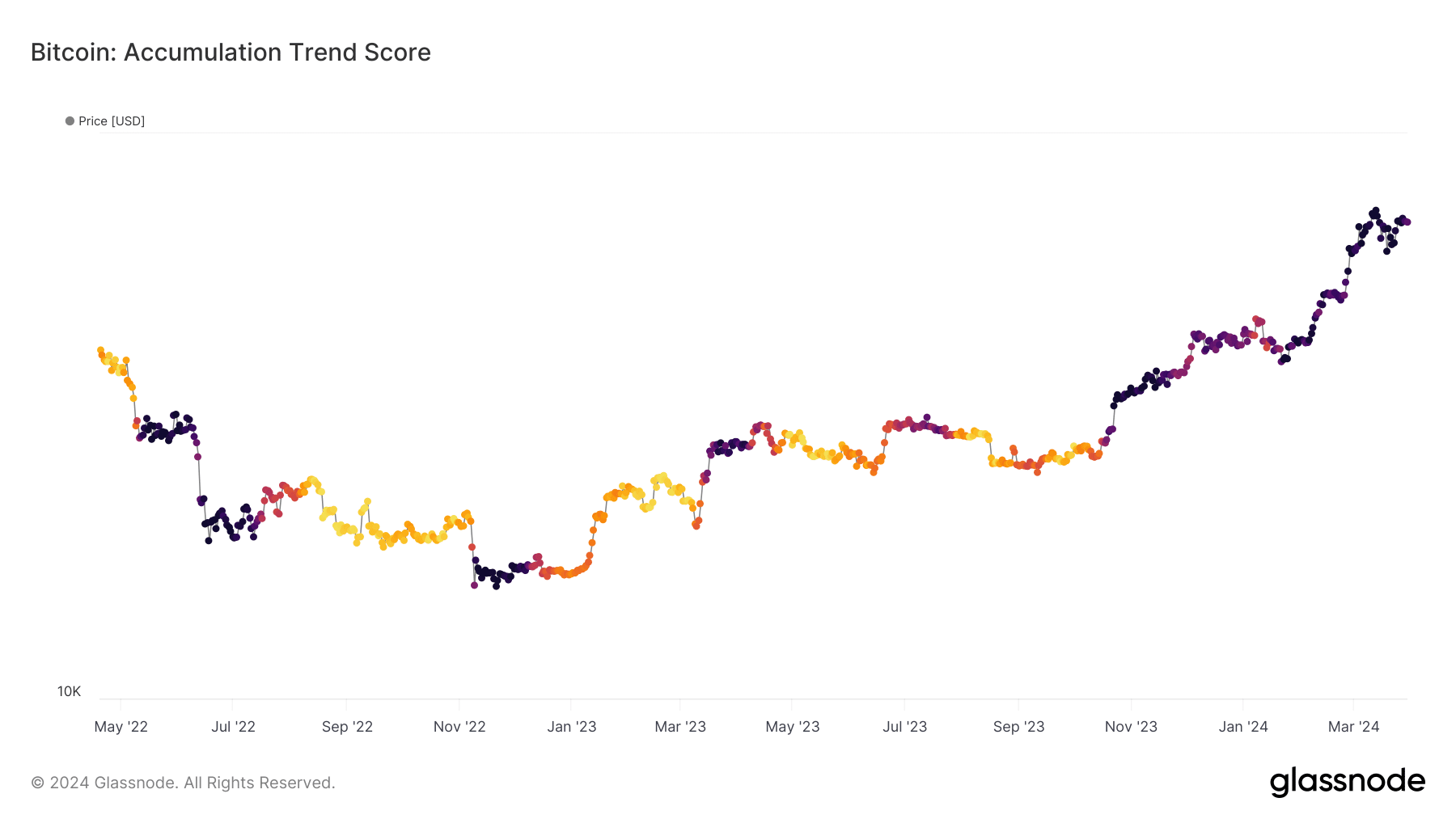

The excellent news was that purchasing exercise remained sturdy. In line with AMBCrypto’s evaluation of Santiment’s knowledge, Bitcoin’s accumulation development rating was 0.78 at press time, implying that a lot of the bigger entities have been including to their positions.

Supply: Glassnode

Regular accumulation meant that traders have been satisfied that BTC’s market was not but saturated and there was scope for additional value good points.

The bullishness was additionally mirrored within the quickly rising variety of whale addresses i.e, addresses holding a minimal of 1,000 cash. As of the thirtieth of March, the overall variety of whale entities was 1,617, up from 1,565 identical time final month.

Supply: Glassnode

The most important bullish set off

The optimism was most certainly pushed by expectations of upper inflows into Bitcoin spot ETFs. These funding autos have captured nearly all of Bitcoin’s provide since they started buying and selling early January.

The ten new spot ETFs have attracted inflows price greater than $12 billion since itemizing, in line with SoSo Value knowledge.

And demand was more likely to get stronger. Jinze, an analyst at cryptocurrency funding agency LD Capital, predicted a powerful subsequent week as giant funds may shift capital to identify ETFs because of the end-of-quarter rebalancing.

What do technical indicators inform?

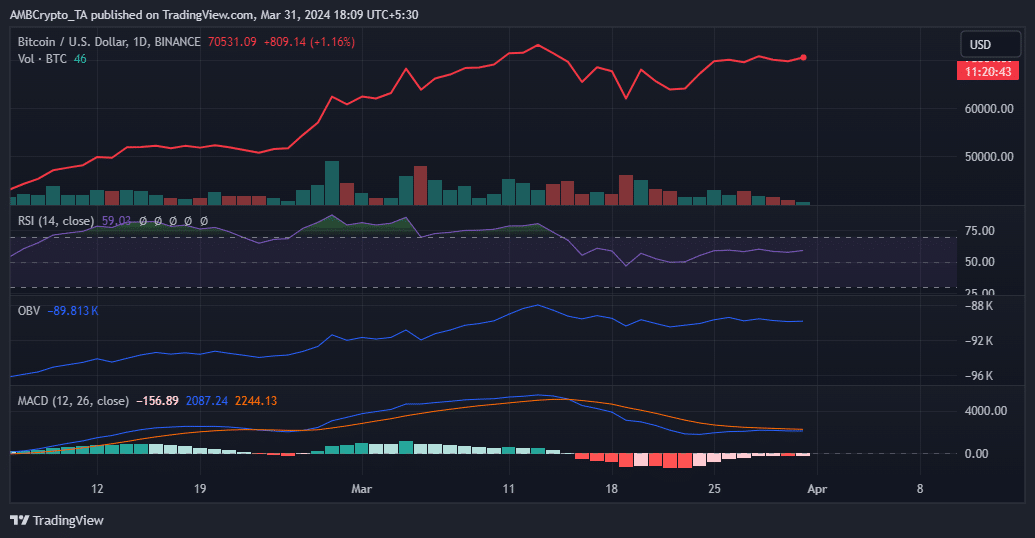

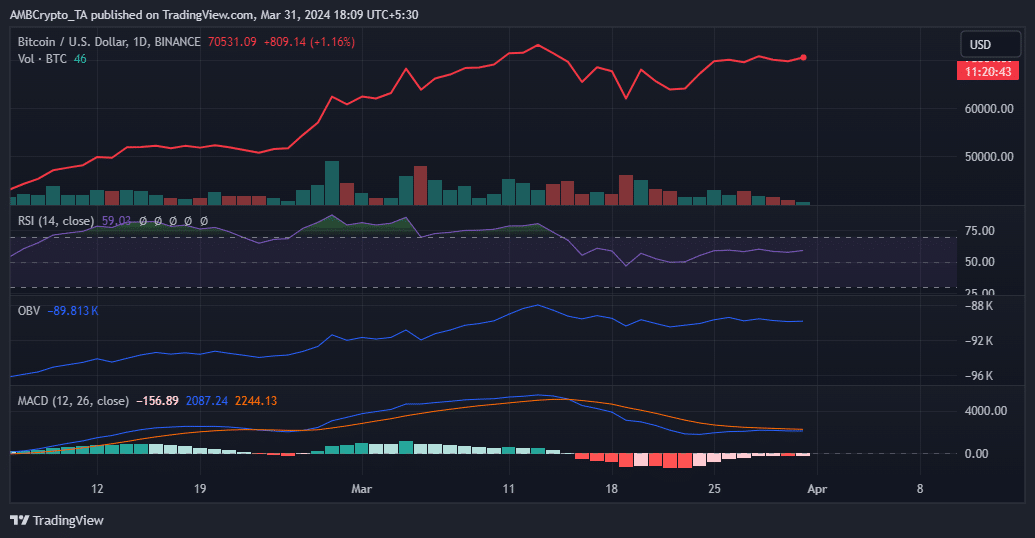

AMBCrypto analyzed a few of BTC’s key technical indicators to good points insights on its subsequent directional strikes.

The Relative Energy Index (RSI) moved nearer to 60, a breach of which may add appreciable bullish optimism.

Learn BTC’s Worth Prediction 2024-25

The On Stability Quantity (OBV) mirrored the worth motion as of this writing, suggesting a steadiness between bullish and bearish forces.

The Transferring Common Convergence Divergence (MACD) indicator appeared more likely to make a bullish crossover with the sign line. Such an occasion may enhance the possibilities of Bitcoin’s elevation within the days forward.

Supply: Buying and selling View